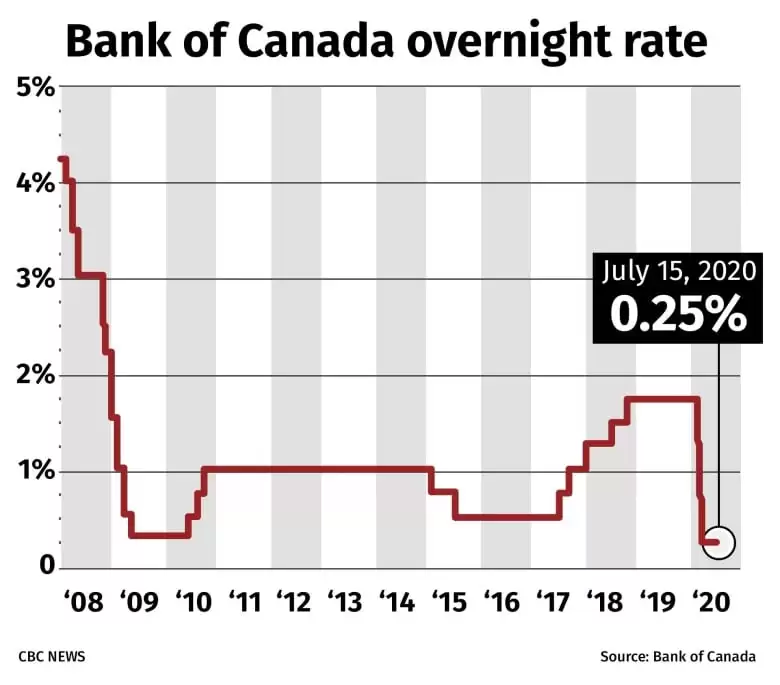

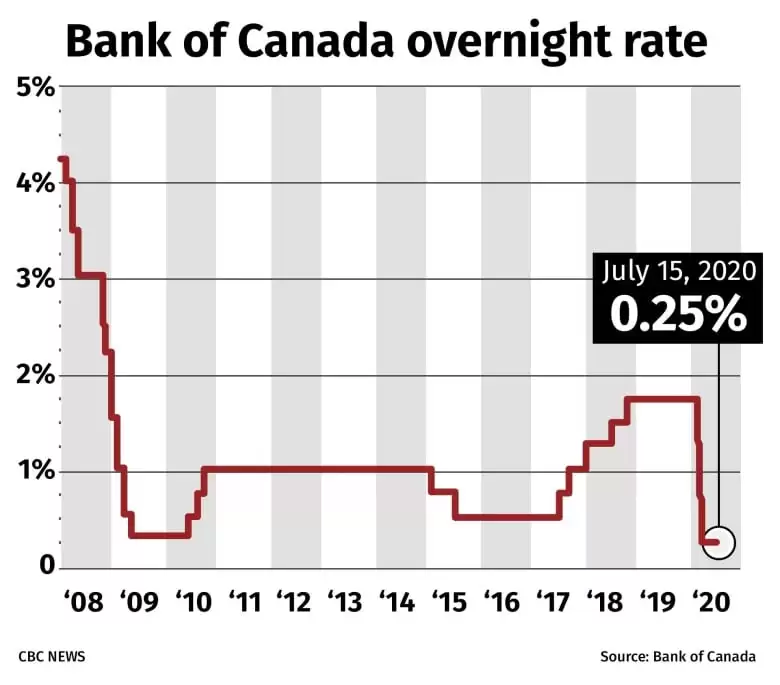

Bank Of Canada Rate Cuts: Desjardins Predicts Three More

Table of Contents

Desjardins' Rationale Behind the Prediction

Desjardins' prediction of three further Bank of Canada rate cuts is likely rooted in a careful analysis of several key economic indicators. Understanding these factors is crucial to grasping the potential implications for Canadians.

-

Current Inflation Rate and Trajectory: While inflation has cooled from its peak, it remains above the Bank of Canada's target range. Desjardins likely anticipates a continued downward trend, suggesting that further rate cuts are warranted to stimulate economic growth without reigniting inflationary pressures. The persistence of core inflation, which excludes volatile items like food and energy, will be a key factor in their assessment.

-

Unemployment Data and Economic Impact: Recent unemployment figures, while relatively stable, may signal a softening of the labour market. This, coupled with potentially slowing GDP growth, could push Desjardins towards anticipating the need for stimulus through rate cuts. A rise in unemployment claims or a decrease in job creation would strengthen this argument.

-

GDP Growth and Economic Outlook: Slowing GDP growth, or a contraction, is a strong signal that the economy needs support. Desjardins' analysis of GDP growth projections – taking into account factors like consumer spending, business investment, and government spending – likely underpins their prediction. A weaker-than-expected GDP report would certainly bolster their case.

-

Other Relevant Economic Factors: Beyond these major indicators, other factors like consumer confidence, business investment levels, and global economic conditions will all play a role in Desjardins' overall assessment. External shocks, such as geopolitical instability or significant shifts in global commodity prices, could also impact their forecast.

Potential Impact of Further Bank of Canada Rate Cuts

Three additional Bank of Canada rate cuts would have far-reaching consequences across the Canadian economy. Understanding these potential effects is crucial for both consumers and businesses.

-

Impact on Borrowing Costs: Lower interest rates will translate to cheaper borrowing for consumers. This could lead to lower mortgage payments, more affordable loans, and potentially increased consumer spending. However, this may also incentivize further borrowing, potentially increasing consumer debt levels.

-

Influence on Business Investment: Reduced borrowing costs could stimulate business investment and expansion. Lower interest rates make it cheaper for companies to borrow money for capital expenditures, leading to job creation and economic growth. However, this increased investment depends on business confidence and the broader economic outlook.

-

Effects on the Housing Market: Lower interest rates could reignite the housing market, leading to potential price increases. This could exacerbate affordability concerns for prospective homebuyers. Conversely, if economic uncertainty persists, the housing market might remain sluggish despite lower rates.

-

Implications for the Canadian Dollar: Rate cuts often weaken a country's currency. Lower interest rates relative to other major economies could decrease demand for the Canadian dollar, potentially affecting both imports and exports.

Counterarguments and Alternative Scenarios

While Desjardins' prediction is significant, it's vital to consider counterarguments and alternative scenarios. A balanced perspective acknowledges potential risks and uncertainties.

-

Risk of Inflation Resurgence: One significant risk is a resurgence of inflation. If rate cuts stimulate demand too aggressively, it could lead to renewed inflationary pressures, forcing the Bank of Canada to reverse course and raise interest rates again.

-

Differing Economic Forecasts: Not all economists share the same view. Some might argue that the current economic slowdown is temporary and that further rate cuts are unnecessary or even counterproductive. Different models and interpretations of economic data lead to diverging predictions.

-

Uncertainties and Influencing Factors: The Canadian economy is subject to numerous unpredictable factors. Global economic events, unexpected shocks to commodity markets, and changes in government policy could significantly alter the economic outlook and influence the Bank of Canada's decisions.

Strategies for Consumers and Businesses

In light of the predicted Bank of Canada rate cuts, consumers and businesses should adopt proactive strategies to manage their financial well-being.

-

Consumers: Consider refinancing mortgages to secure lower interest rates, adjust savings strategies, and explore investment options aligned with a potentially lower-interest-rate environment. Review debt levels and prioritize higher-interest debt repayment.

-

Businesses: Evaluate borrowing opportunities to fund expansion or investments, reassess pricing strategies based on potential changes in consumer spending, and develop contingency plans for managing financial risk in a dynamic economic environment. Explore hedging strategies to mitigate exchange rate risks.

-

Managing Financial Risk: Regardless of economic conditions, diversification remains key. A well-balanced financial strategy, including diversified investments and debt management, can help weather any market volatility. Seek professional financial advice to tailor a strategy to your specific circumstances.

Conclusion

Desjardins' prediction of three more Bank of Canada rate cuts presents both opportunities and challenges for the Canadian economy. Understanding the potential impacts on borrowing costs, the housing market, and the Canadian dollar is critical for both consumers and businesses. While lower rates can stimulate growth, risks such as inflation resurgence remain. Staying informed about future Bank of Canada announcements and seeking professional financial advice is crucial for navigating this changing landscape. Stay updated on the latest Bank of Canada rate cuts by following reputable financial news sources and consulting a financial advisor to understand how these changes might affect your financial planning.

Featured Posts

-

Could Jonathan Groff Win A Tony For Just In Time

May 23, 2025

Could Jonathan Groff Win A Tony For Just In Time

May 23, 2025 -

Massive V Mware Price Increase At And T On Broadcoms Proposed 1 050 Jump

May 23, 2025

Massive V Mware Price Increase At And T On Broadcoms Proposed 1 050 Jump

May 23, 2025 -

Accident Mortel A Seoul Effondrement De Chaussee Et Deces D Un Motard

May 23, 2025

Accident Mortel A Seoul Effondrement De Chaussee Et Deces D Un Motard

May 23, 2025 -

Milly Alcock And Meghann Fahy Face Toxic Workplace In New Siren Trailer

May 23, 2025

Milly Alcock And Meghann Fahy Face Toxic Workplace In New Siren Trailer

May 23, 2025 -

Karate Kid 6 A Balancing Act Ralph Macchios Return And A Potential Sequel Controversy

May 23, 2025

Karate Kid 6 A Balancing Act Ralph Macchios Return And A Potential Sequel Controversy

May 23, 2025

Latest Posts

-

Maintaining Your Ferraris Performance Key Gear And Tools

May 24, 2025

Maintaining Your Ferraris Performance Key Gear And Tools

May 24, 2025 -

Taenaeaen Tuukka Taponen Ja Mahdollinen F1 Ura Taenae Vuonna

May 24, 2025

Taenaeaen Tuukka Taponen Ja Mahdollinen F1 Ura Taenae Vuonna

May 24, 2025 -

Protecting Your Investment Essential Gear For Ferrari Owners

May 24, 2025

Protecting Your Investment Essential Gear For Ferrari Owners

May 24, 2025 -

Ferrari Opens Flagship Bangkok Facility A New Era Begins

May 24, 2025

Ferrari Opens Flagship Bangkok Facility A New Era Begins

May 24, 2025 -

Saako Tuukka Taponen F1 Paikan Taenae Vuonna Yllaetys Uutinen

May 24, 2025

Saako Tuukka Taponen F1 Paikan Taenae Vuonna Yllaetys Uutinen

May 24, 2025