Bank Of Canada Rate Cuts: Economists Predict Renewed Cuts Amidst Tariff Job Losses

Table of Contents

The Impact of Tariffs on Canadian Employment

The imposition of tariffs has had a significant and multifaceted impact on Canadian employment. The direct effects are most visible in sectors directly targeted by tariffs, such as manufacturing and agriculture. However, the indirect effects, through supply chain disruptions and reduced consumer spending, ripple across the entire economy.

-

Specific examples of industries affected: The automotive sector, reliant on cross-border trade, has experienced significant job losses due to retaliatory tariffs. Similarly, the agricultural sector, particularly farmers exporting to the US, has faced reduced demand and decreased profitability, impacting related jobs.

-

Data illustrating the decline in employment numbers: Statistics Canada data (cite specific reports and numbers here if available) will likely show a decline in employment figures in the affected sectors. This decline needs to be quantified for a stronger impact.

-

Analysis of the impact on GDP growth: Reduced employment and decreased consumer confidence directly impact GDP growth, potentially leading to a slowdown or even a contraction in the economy. The connection between job losses and reduced consumer spending needs to be analyzed quantitatively.

Economists' Forecasts and Predictions of Further Bank of Canada Rate Cuts

Leading economists are increasingly forecasting further Bank of Canada rate cuts in response to the weakening economic outlook. This prediction is largely driven by concerns about slowing economic growth and subdued inflation. Different economic models, such as those focusing on leading indicators and consumer sentiment, support these predictions.

-

Key predictions from different economic institutions: The Royal Bank of Canada, TD Bank, and other prominent institutions should be cited here with their predictions for future interest rate changes.

-

Reasons cited for anticipating further rate cuts: The primary reasoning revolves around mitigating the negative impact of tariff-related job losses on economic growth. Lower interest rates aim to incentivize borrowing and investment, stimulating economic activity.

-

Potential timing of future rate adjustments: Economists' predictions on the timing of future rate cuts should be included here, providing a sense of the urgency and potential impact. Mention potential timelines for further cuts.

Potential Consequences of Further Bank of Canada Rate Cuts

Further Bank of Canada rate cuts will have both positive and negative consequences. While lower interest rates can stimulate borrowing and investment, they also carry potential risks.

-

Impact on consumer spending and investment: Lower borrowing costs can incentivize consumers to increase spending and businesses to invest, boosting economic activity.

-

Effect on mortgage rates and housing market: Lower interest rates may lead to lower mortgage rates, potentially stimulating the housing market, but could also lead to increased house prices and affordability concerns.

-

Potential impact on the Canadian dollar's value: Lower interest rates can weaken the Canadian dollar, making imports more expensive and potentially fueling inflation.

-

Risks of fueling inflation: While stimulating the economy, lower interest rates risk fueling inflation if demand outpaces supply, potentially eroding purchasing power.

Alternative Monetary Policy Options for the Bank of Canada

Besides rate cuts, the Bank of Canada has other monetary policy tools at its disposal. Quantitative easing (QE), for example, involves the Bank purchasing government bonds to increase the money supply.

-

Explanation of quantitative easing and other non-conventional policies: A brief explanation of QE and other unconventional monetary policies should be provided.

-

Advantages and disadvantages of each alternative policy: Weigh the pros and cons of alternative policies, considering their potential impact on the economy.

-

Potential risks associated with different policy choices: Discuss the potential risks associated with each policy option. For example, QE can potentially lead to asset bubbles.

Conclusion: Navigating the Uncertain Future with Bank of Canada Rate Cuts

The likelihood of further Bank of Canada rate cuts in response to tariff-related job losses is significant, according to leading economists. While these cuts aim to stimulate the economy, they carry potential risks, including inflation and currency depreciation. The Canadian economy faces an uncertain future, and navigating this uncertainty requires careful monitoring of economic indicators and informed decision-making. Stay informed about future Bank of Canada announcements and follow economic news related to Bank of Canada rate cuts and their potential effects on your personal finances and investments. Consider seeking professional financial advice to navigate these challenging economic times.

Featured Posts

-

Celtics Magic Blowout Win Clinches Division Title

May 12, 2025

Celtics Magic Blowout Win Clinches Division Title

May 12, 2025 -

Why Choose Uruguay For Your Next Film Shoot

May 12, 2025

Why Choose Uruguay For Your Next Film Shoot

May 12, 2025 -

Victoria De Knicks Sobre Sixers Anunoby Destaca Con 27 Puntos

May 12, 2025

Victoria De Knicks Sobre Sixers Anunoby Destaca Con 27 Puntos

May 12, 2025 -

Interview Exclusive Thomas Mueller Bayern Munich Repond Avec Finesse

May 12, 2025

Interview Exclusive Thomas Mueller Bayern Munich Repond Avec Finesse

May 12, 2025 -

Tam Krwz Ks Adakarh Kw Dyt Kr Rhe Hyn

May 12, 2025

Tam Krwz Ks Adakarh Kw Dyt Kr Rhe Hyn

May 12, 2025

Latest Posts

-

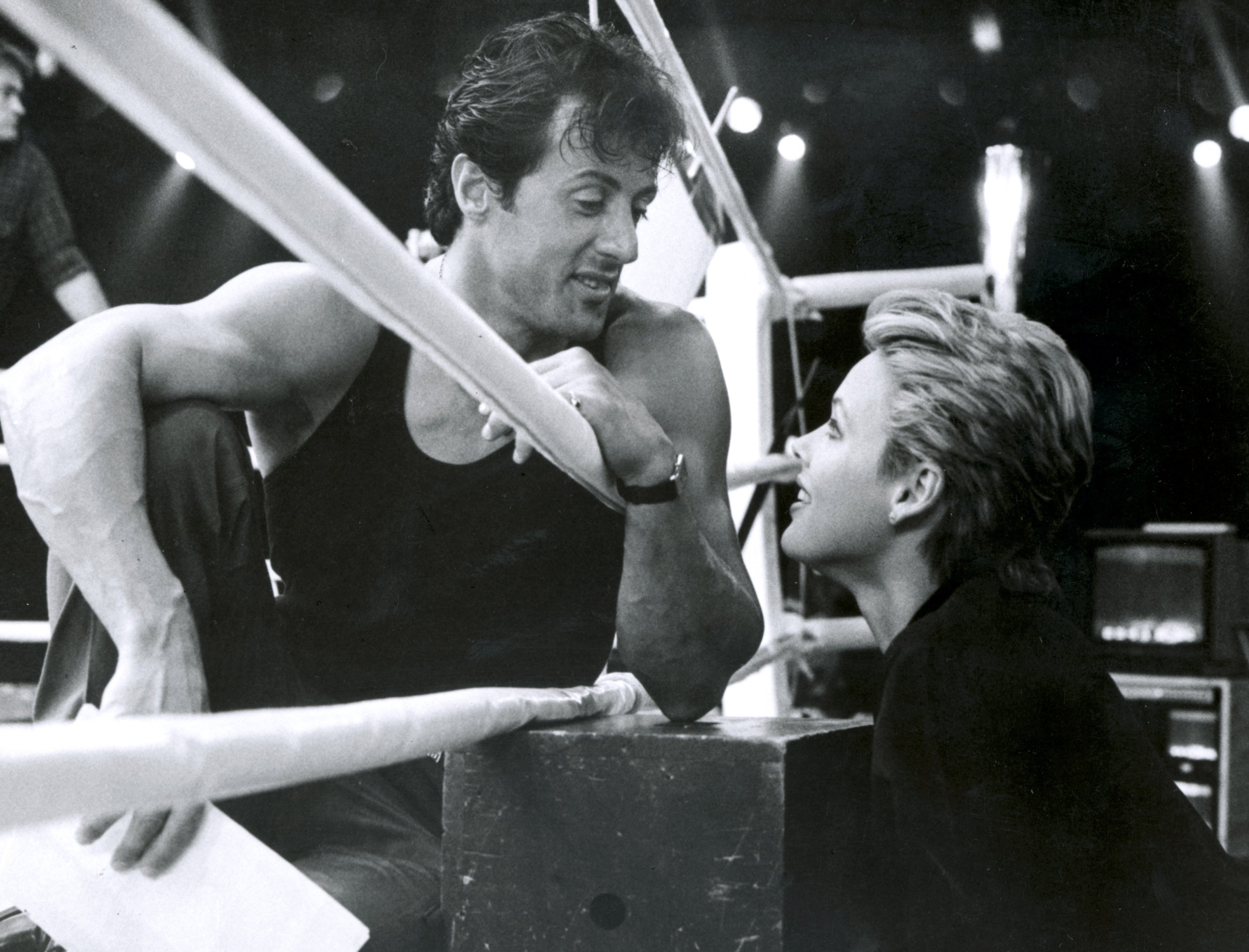

Sylvester Stallone Reveals His Favorite Rocky Film An Emotional Rollercoaster

May 12, 2025

Sylvester Stallone Reveals His Favorite Rocky Film An Emotional Rollercoaster

May 12, 2025 -

Which Rocky Movie Touches Sylvester Stallone The Most Exploring The Franchises Emotional Core

May 12, 2025

Which Rocky Movie Touches Sylvester Stallone The Most Exploring The Franchises Emotional Core

May 12, 2025 -

The Most Emotional Rocky Movie According To Sylvester Stallone A Critical Analysis

May 12, 2025

The Most Emotional Rocky Movie According To Sylvester Stallone A Critical Analysis

May 12, 2025 -

Sylvester Stallone Picks His Top Rocky Film Why This One Is So Emotional

May 12, 2025

Sylvester Stallone Picks His Top Rocky Film Why This One Is So Emotional

May 12, 2025 -

Exploring Sylvester Stallones Only Non Starring Directorial Effort

May 12, 2025

Exploring Sylvester Stallones Only Non Starring Directorial Effort

May 12, 2025