Bank Of Canada Rate Cuts Predicted Amidst Tariff-Driven Job Losses

Table of Contents

Rising Unemployment Due to Tariffs

The direct link between increased tariffs and job losses in Canada is becoming increasingly apparent. Higher tariffs on imported goods make Canadian products less competitive in global markets, impacting several key sectors. This reduced competitiveness directly translates into decreased demand, forcing businesses to cut costs, often through layoffs and hiring freezes.

-

Increased import costs leading to reduced competitiveness for Canadian businesses: Tariffs increase the price of imported raw materials and finished goods, making Canadian businesses less able to compete with imports from countries with lower tariffs. This price disadvantage shrinks profit margins and undermines their ability to invest and expand, ultimately leading to job cuts.

-

Layoffs and reduced hiring due to decreased consumer demand and business investment: As businesses struggle with higher costs, they reduce investment in new equipment, technology, and expansion plans. Simultaneously, decreased consumer purchasing power due to higher prices fuels a downward economic spiral. This uncertainty leads to significant decreases in hiring and often results in mass layoffs.

-

Specific examples of industries severely impacted by tariffs and job losses: The agricultural sector, particularly farmers exporting to the US, has been significantly affected, facing reduced demand and lower prices for their goods. The manufacturing sector has also felt the impact, with companies struggling to compete against cheaper imports.

-

Data on unemployment rates in relevant sectors: Recent statistics show a rise in unemployment in sectors directly exposed to the impact of tariffs. Further detailed analysis is needed to fully understand the extent of this impact, but the trend is clear. For instance, the manufacturing sector unemployment rate has shown a recent increase of X%, while the agricultural sector's unemployment has risen by Y%. (Note: Replace X and Y with actual data if available.)

Keywords: Tariff impact on jobs, Canadian unemployment, trade war job losses

Economic Slowdown and Inflation Concerns

Tariff-driven job losses significantly contribute to a broader economic slowdown in Canada. The ripple effects are widespread and deeply concerning.

-

Reduced consumer spending due to job insecurity and wage stagnation: Job losses and fears of further job losses lead to decreased consumer confidence and a reduction in discretionary spending. This dampens overall economic activity.

-

Decreased business investment due to uncertainty and higher operating costs: Businesses face uncertainty about future market conditions, leading to a hesitation in investment decisions. Coupled with higher costs due to tariffs, this further stifles economic growth.

-

Potential for deflationary pressures as consumer demand weakens: Reduced consumer spending could lead to deflationary pressures as businesses struggle to sell their goods and services. This is a significant concern, as deflationary spirals can be difficult to reverse.

-

Impact on GDP growth and economic forecasts: The overall impact of these factors is reflected in lowered GDP growth forecasts for Canada. Numerous economic institutions have revised their projections downward due to tariff-related uncertainty and slowing growth.

Keywords: Economic slowdown Canada, Inflation Canada, GDP growth forecast

The Bank of Canada's Response: Predicted Rate Cuts

In response to the looming economic slowdown, many economists predict that the Bank of Canada will lower interest rates. This monetary policy tool is aimed at stimulating economic activity.

-

Explanation of how lower interest rates stimulate economic activity: Lower interest rates make borrowing cheaper, encouraging businesses to invest and consumers to spend. This increased borrowing and spending can help to boost economic activity.

-

Discussion of the Bank of Canada's mandate and its response to economic downturns: The Bank of Canada's mandate is to maintain price stability and full employment. Historically, the Bank has responded to economic downturns by lowering interest rates.

-

Analysis of market predictions for future rate cuts: Financial markets are currently pricing in a high probability of at least one, if not multiple, rate cuts by the Bank of Canada in the coming months.

-

Potential risks and side effects of rate cuts (e.g., inflation): While rate cuts can stimulate the economy, they also carry risks. If the rate cuts are too aggressive, they could fuel inflation. The Bank of Canada must carefully balance the need to stimulate growth with the need to control inflation.

Keywords: Bank of Canada interest rates, monetary policy Canada, rate cut prediction

Impact on Canadian Consumers and Businesses

The predicted Bank of Canada rate cuts, alongside the ongoing impact of tariffs, will have a significant effect on both Canadian consumers and businesses.

-

Impact on mortgage rates and consumer borrowing: Lower interest rates will likely lead to lower mortgage rates, making it cheaper for Canadians to buy homes. It may also make other forms of consumer borrowing, such as credit card debt, less expensive.

-

Effect on business investment and expansion plans: Lower borrowing costs can encourage businesses to invest in expansion and new projects. This could help to create jobs and stimulate economic growth.

-

Potential benefits and drawbacks of lower interest rates for different economic segments: Lower interest rates benefit borrowers, but they can hurt savers who receive lower returns on their investments. The impact will vary across different economic segments.

Keywords: Mortgage rates Canada, Business investment Canada, Consumer spending Canada

Conclusion

The confluence of escalating tariffs, resulting job losses, and a predicted economic slowdown points towards the strong likelihood of Bank of Canada rate cuts. The link between increased tariffs, reduced consumer confidence, and the need for monetary policy intervention is undeniable. This will impact various aspects of the Canadian economy, from mortgage rates and consumer spending to business investment and overall GDP growth. The predicted Bank of Canada interest rate decisions will have far-reaching consequences for Canadian consumers and businesses.

Call to Action: Stay informed about the evolving economic situation and the Bank of Canada's response. Regularly check for updates on Bank of Canada interest rate decisions and their implications. Monitor news and analysis regarding the impact of tariffs on the Canadian economy and consider diversifying your investments to mitigate risk in this period of uncertainty.

Featured Posts

-

Remembering Chris Newsom Halls Crossroads Baseball Tournament Returns

May 11, 2025

Remembering Chris Newsom Halls Crossroads Baseball Tournament Returns

May 11, 2025 -

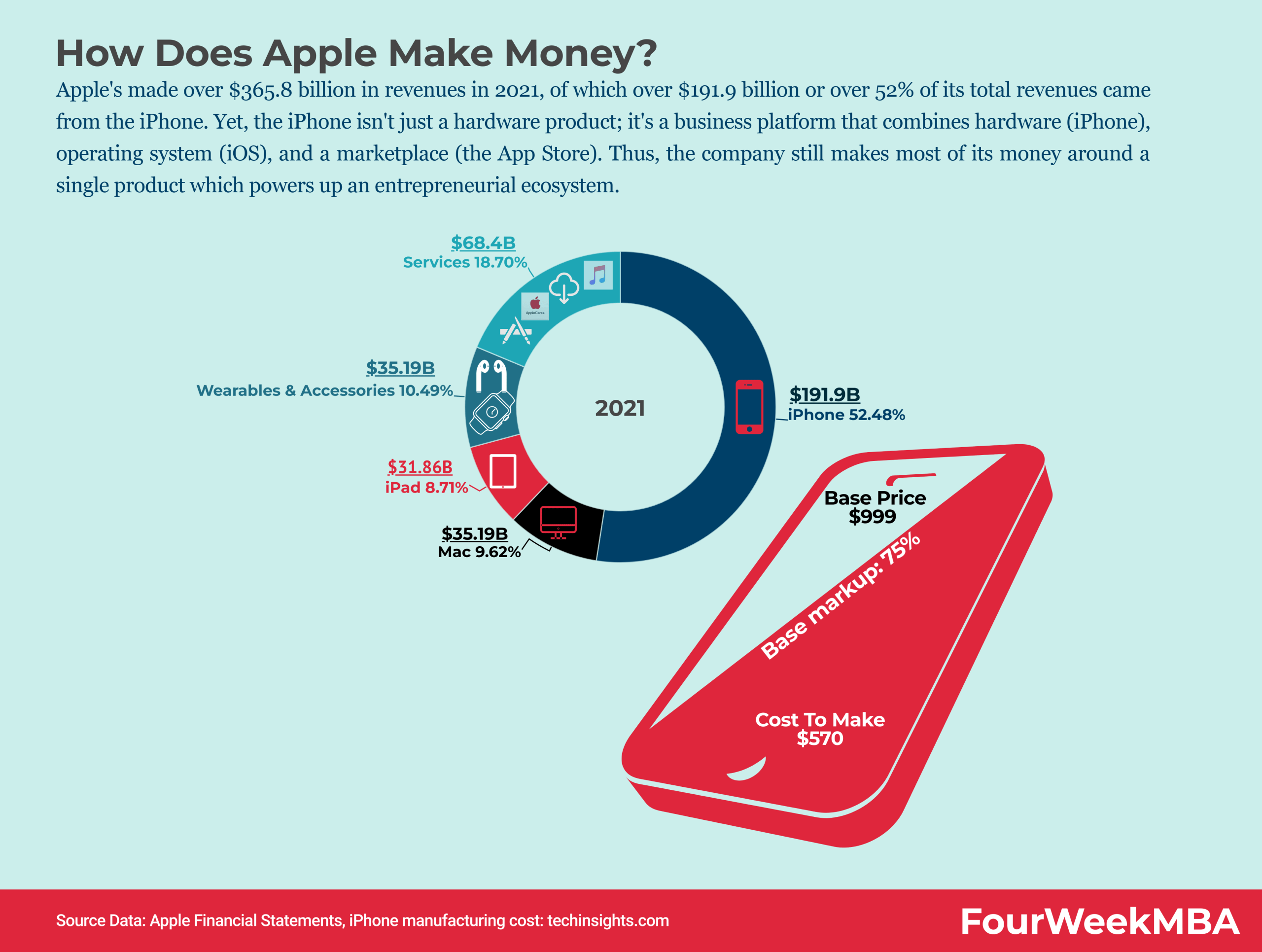

Is Apples Strategy Secretly Benefiting Google

May 11, 2025

Is Apples Strategy Secretly Benefiting Google

May 11, 2025 -

Yankees Vs Rays Series May 2 4 Key Injuries To Watch

May 11, 2025

Yankees Vs Rays Series May 2 4 Key Injuries To Watch

May 11, 2025 -

Adele Lim To Adapt Crazy Rich Asians Into A Max Series

May 11, 2025

Adele Lim To Adapt Crazy Rich Asians Into A Max Series

May 11, 2025 -

How To Watch The Grand Slam Track Kingston Live Stream

May 11, 2025

How To Watch The Grand Slam Track Kingston Live Stream

May 11, 2025

Latest Posts

-

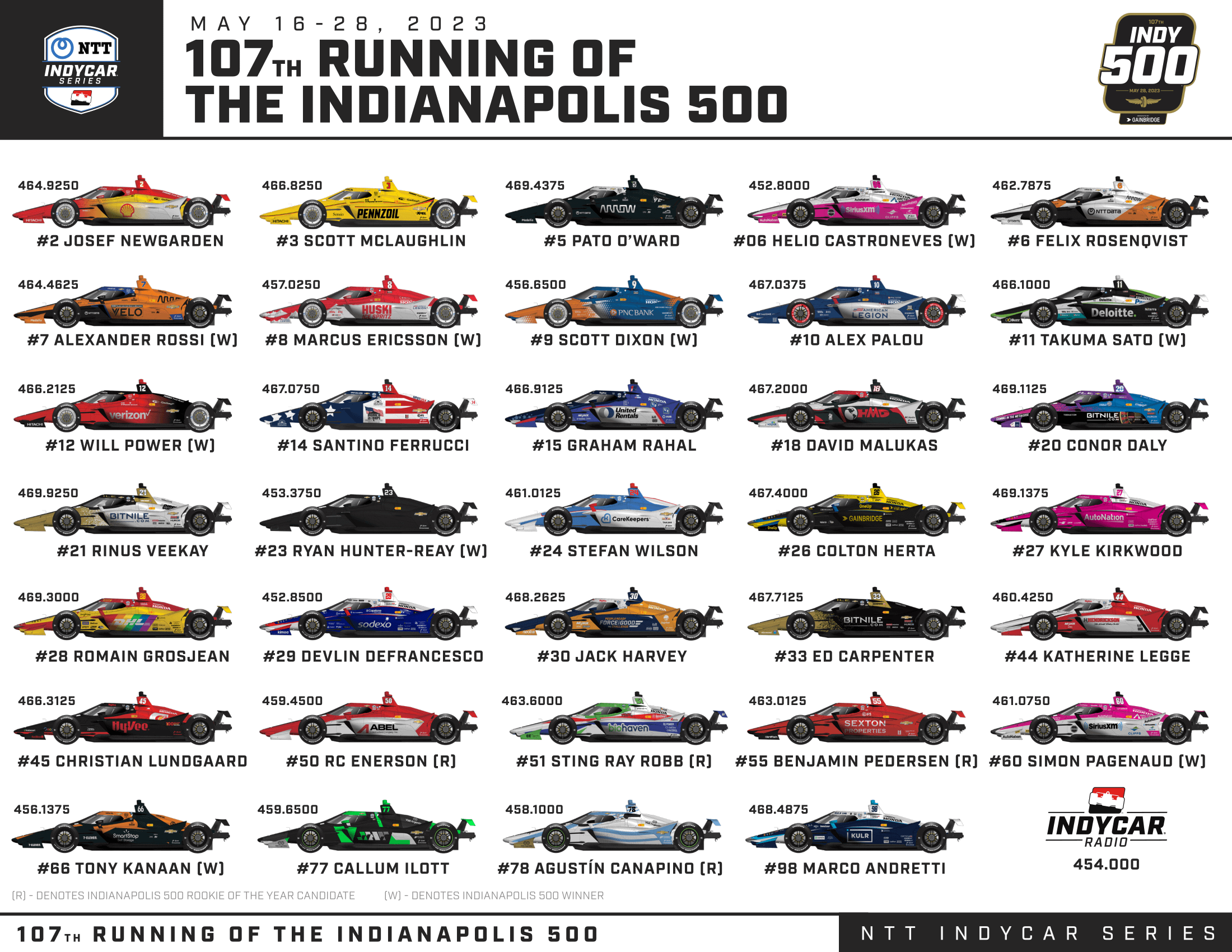

Indy 500 Palous Pole Position Highlights Andrettis Difficulties

May 11, 2025

Indy 500 Palous Pole Position Highlights Andrettis Difficulties

May 11, 2025 -

First Gen Ford Gt Restoration Lynxs Expertise On Display

May 11, 2025

First Gen Ford Gt Restoration Lynxs Expertise On Display

May 11, 2025 -

Lynx Brings First Gen Ford Gt Back To Life A Complete Restoration

May 11, 2025

Lynx Brings First Gen Ford Gt Back To Life A Complete Restoration

May 11, 2025 -

Indy 500 Qualifying Palou On Pole Andretti Drivers Struggle

May 11, 2025

Indy 500 Qualifying Palou On Pole Andretti Drivers Struggle

May 11, 2025 -

2025 Indy 500 Analyzing The Drivers At Risk Of Elimination

May 11, 2025

2025 Indy 500 Analyzing The Drivers At Risk Of Elimination

May 11, 2025