Bank Of England: Weighing The Pros And Cons Of A 0.5% Interest Rate Cut

Table of Contents

Potential Benefits of a 0.5% Interest Rate Cut by the Bank of England

A 0.5% interest rate cut by the Bank of England could offer several potential benefits, primarily focused on stimulating the economy and averting a potential recession.

Stimulating Economic Growth

Lower interest rates are a powerful tool for economic stimulus. A 0.5% interest rate cut would likely translate to:

- Lower mortgage rates: Making homeownership more affordable and potentially boosting the housing market.

- Increased consumer spending: Lower borrowing costs encourage individuals to spend more, driving demand and economic activity.

- Business investment boosts: Reduced borrowing costs incentivize businesses to invest in expansion and job creation.

The impact on GDP growth and employment figures could be substantial. Historically, lower interest rates have been associated with increased economic activity, although the magnitude of the effect can vary depending on other economic factors. Effective monetary policy, like this potential 0.5% interest rate cut, aims to achieve a balance between stimulating GDP growth and managing inflation.

Preventing a Recession

A proactive interest rate cut can serve as a crucial measure in recession prevention. By injecting liquidity into the market and boosting confidence, a 0.5% interest rate cut could:

- Reduce the risk of a downturn: Providing a buffer against negative economic shocks.

- Support struggling businesses: Easing their financial burden and preventing bankruptcies.

- Improve consumer sentiment: Creating a more positive outlook and encouraging spending.

Preemptive rate cuts are often employed to avoid a deeper economic crisis. The rationale is that a small, timely intervention can prevent the need for more drastic measures later. Successfully implemented, this 0.5% interest rate cut could act as a crucial safety net, securing financial stability.

Impact on the Pound Sterling

An interest rate cut by the Bank of England can have a significant impact on the pound sterling's exchange rate. The potential effects, both short-term and long-term, are complex:

- Potential devaluation: Lower interest rates can make the pound less attractive to foreign investors, potentially leading to a devaluation against other currencies.

- Impact on imports and exports: A weaker pound can make exports cheaper and imports more expensive, potentially boosting the trade balance.

- Foreign investment considerations: The attractiveness of the UK as an investment destination might diminish.

Careful analysis of currency fluctuation is crucial when assessing the overall impact of the 0.5% interest rate cut.

Potential Drawbacks of a 0.5% Interest Rate Cut by the Bank of England

While a 0.5% interest rate cut offers potential benefits, it also carries considerable risks.

Increased Inflation

A significant drawback of a rate cut is the risk of fueling inflation. If the increased borrowing and spending stimulated by lower interest rates outpace the growth in supply, it could lead to:

- Rising prices of goods and services: Eroding purchasing power for consumers.

- Reduced purchasing power: Making it harder for people to afford essential goods and services.

- Potential wage-price spiral: Where rising prices lead to demands for higher wages, further fueling inflation.

The Bank of England has an inflation target (currently 2%), and a 0.5% interest rate cut could jeopardize this target, leading to a situation where price stability is threatened.

Impact on Savers

Lower interest rates directly impact savers, leading to:

- Reduced returns on savings: Making it harder to maintain savings and build wealth.

- Erosion of savings value: Especially concerning with inflation outpacing interest rates, leading to negative real interest rates.

- Potential for negative real interest rates: Where the return on savings is less than the rate of inflation.

This has particularly harsh consequences for those reliant on savings income, such as retirees.

Risk of Asset Bubbles

Lower interest rates can inflate asset prices, particularly in the property market, potentially creating unsustainable bubbles:

- Increased housing prices: Making homeownership even less accessible for many.

- Speculative investment: Encouraging risky investments driven by the expectation of further price increases.

- Potential for a market crash: When the bubble inevitably bursts, resulting in significant economic disruption.

The risk of asset price inflation and subsequent market volatility necessitates a cautious approach to monetary policy.

Conclusion: Understanding the Bank of England's 0.5% Interest Rate Cut Decision

The decision regarding a 0.5% interest rate cut by the Bank of England is a complex one, balancing the potential benefits of stimulating economic growth and preventing a recession against the risks of increased inflation, negative impacts on savers, and the formation of asset bubbles. A balanced approach is crucial, carefully monitoring economic indicators and adapting monetary policy accordingly. The Bank of England's actions will significantly impact the UK economy.

Stay updated on the latest Bank of England announcements regarding this crucial 0.5% interest rate cut by visiting their website: [Link to Bank of England Website].

Featured Posts

-

Nc State Loses Kendrick Raphael Rising Junior Running Back Decommits

May 08, 2025

Nc State Loses Kendrick Raphael Rising Junior Running Back Decommits

May 08, 2025 -

Reakcija Pavla Grbovica Na Predloge Za Prelaznu Vladu

May 08, 2025

Reakcija Pavla Grbovica Na Predloge Za Prelaznu Vladu

May 08, 2025 -

Arsenal Proti Ps Zh Ta Barselona Proti Intera Anons Matchiv Ligi Chempioniv 2024 2025

May 08, 2025

Arsenal Proti Ps Zh Ta Barselona Proti Intera Anons Matchiv Ligi Chempioniv 2024 2025

May 08, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Report

May 08, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Report

May 08, 2025 -

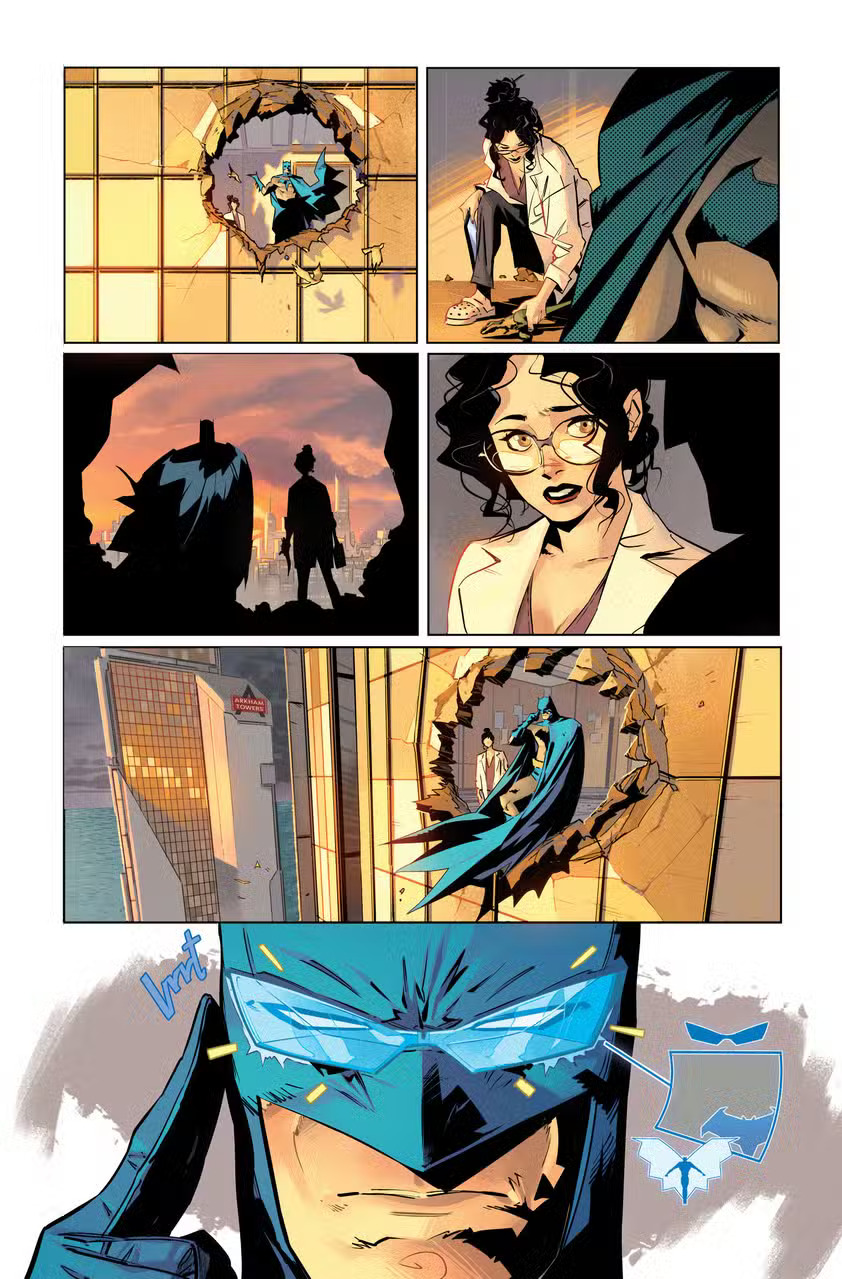

Dc Comics Batman Relaunches New 1 Issue And Costume Unveiled

May 08, 2025

Dc Comics Batman Relaunches New 1 Issue And Costume Unveiled

May 08, 2025

Latest Posts

-

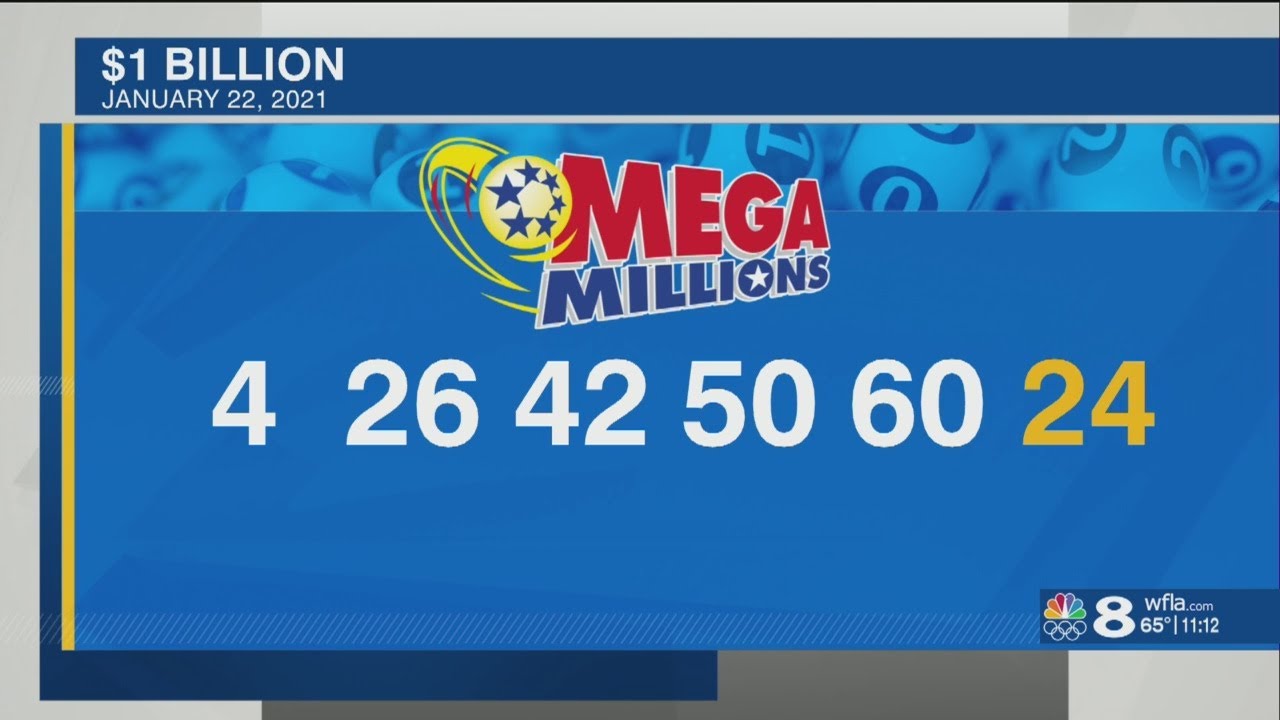

Check The April 9th Lotto Results Jackpot Numbers Here

May 08, 2025

Check The April 9th Lotto Results Jackpot Numbers Here

May 08, 2025 -

Winning Lotto Numbers For Wednesday April 16th 2025

May 08, 2025

Winning Lotto Numbers For Wednesday April 16th 2025

May 08, 2025 -

Here Are The Lotto Jackpot Numbers Wednesday April 9th Result

May 08, 2025

Here Are The Lotto Jackpot Numbers Wednesday April 9th Result

May 08, 2025 -

Understanding The Secs Stance On Xrp A Comprehensive Guide

May 08, 2025

Understanding The Secs Stance On Xrp A Comprehensive Guide

May 08, 2025 -

April 16 2025 Lottery Results

May 08, 2025

April 16 2025 Lottery Results

May 08, 2025