BBVA's Investment Banking Expansion: A Long-Term Strategy Explained

Table of Contents

BBVA, a leading global financial services group, is aggressively expanding its investment banking capabilities. This isn't a short-term initiative; it's a carefully crafted long-term strategy designed to solidify its position in key markets and capitalize on emerging opportunities within the dynamic global financial landscape. This article delves into the key drivers and components of BBVA's ambitious investment banking expansion plan, examining how this strategy positions them for sustained success in the competitive world of global finance.

Geographic Expansion and Market Penetration

BBVA's investment banking expansion strategy isn't confined to a single region; it's a global undertaking focused on both penetrating new markets and strengthening its presence in existing ones.

Targeting High-Growth Markets

BBVA is strategically focusing its investment banking expansion efforts on high-growth regions. Latin America, with its burgeoning economies and increasing demand for financial services, is a prime target. Similarly, the rapidly developing Asian markets present significant opportunities. Even within established markets in Europe, selective expansion into specific sectors offers significant potential. This targeted approach allows BBVA to focus resources where the greatest returns are expected.

- Increased investment in local talent and expertise: BBVA recognizes the importance of understanding local nuances and regulations. They are actively recruiting and developing local talent to build strong teams deeply rooted in their respective markets.

- Strategic partnerships with local firms: Collaborating with established local players provides immediate access to networks and expertise, accelerating market penetration and minimizing initial risks.

- Leveraging existing retail banking network: BBVA's extensive retail banking network provides a built-in customer base for cross-selling investment banking services, creating a synergistic advantage.

Strengthening Existing Market Positions

While expansion into new markets is key, BBVA simultaneously focuses on strengthening its existing positions in mature markets. This involves enhancing service offerings, improving client relationships, and increasing market share.

- Investing in cutting-edge technology and data analytics: Modernizing technology and leveraging data analytics are crucial for improving service delivery, enhancing efficiency, and providing superior client experiences.

- Expanding service offerings to cater to diverse client needs: BBVA aims to become a one-stop shop for its clients' investment banking needs, providing comprehensive services across various financial instruments and strategies.

- Recruiting top-tier investment banking professionals: Attracting and retaining top talent is vital for maintaining a competitive edge and providing clients with expert advice and execution.

Strategic Service Diversification

BBVA's expansion isn't limited to geographical reach; it also involves diversification of its service offerings within the investment banking sector.

Focus on M&A Advisory

Mergers and acquisitions (M&A) are a key focus for BBVA's investment banking expansion. The advisory services offered here are expected to be a significant driver of growth.

- Building a specialized M&A team: Assembling a team with extensive experience in various industries allows BBVA to provide tailored advice and expertise to a diverse clientele.

- Developing strong relationships with private equity firms: Strong relationships with key players in the M&A landscape are essential for access to deals and opportunities.

- Marketing its M&A expertise: Proactive marketing and targeted outreach are vital for attracting new clients and showcasing BBVA's capabilities in this lucrative area.

Expanding Capital Markets Activities

BBVA is actively expanding its capital markets activities, encompassing equity and debt underwriting, as well as other financing solutions.

- Investing in advanced trading technologies: Advanced technology is critical for efficient execution and access to a wider range of opportunities in the capital markets.

- Building strong relationships with institutional investors: These relationships are vital for successful placements and accessing capital for clients.

- Developing innovative financing products: Creating tailored and innovative financial products allows BBVA to offer competitive advantages to its clients.

Growth in Corporate Finance

Corporate finance is another significant area of focus for BBVA's investment banking expansion. They aim to offer comprehensive financial solutions tailored to the specific needs of businesses.

- Offering tailored financial solutions: Providing bespoke financial solutions ensures that clients receive services that directly address their individual needs.

- Developing industry-specific expertise: Deep industry knowledge allows BBVA to provide more relevant and insightful advice.

- Building a strong reputation for exceptional client service: Client satisfaction is crucial for building long-term relationships and driving referrals.

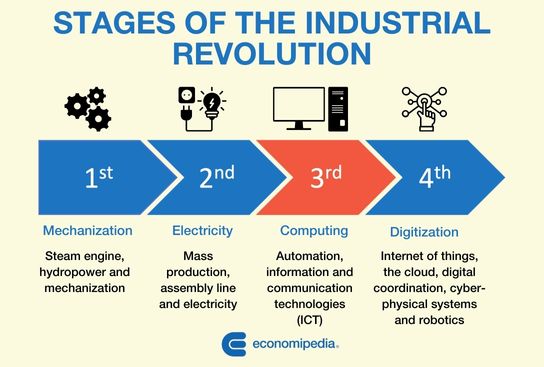

Technological Advancements and Digital Transformation

BBVA recognizes the critical role of technology in its investment banking expansion strategy.

Investment in Fintech and Technology

Investment in fintech and innovative technologies is essential for streamlining operations, improving efficiency, and enhancing the client experience.

- Adopting advanced analytics and artificial intelligence: AI and advanced analytics enhance risk management, improve decision-making, and optimize investment strategies.

- Developing user-friendly digital platforms: Modern digital platforms provide clients with seamless access to services and information.

- Improving cybersecurity measures: Robust cybersecurity is paramount for protecting sensitive client data and maintaining trust.

Data-Driven Decision Making

Data analytics is a cornerstone of BBVA's investment banking strategy, driving informed decisions and optimizing resource allocation.

- Developing sophisticated algorithms for market forecasting: Sophisticated algorithms provide insights into market trends and potential risks.

- Utilizing data to personalize client interactions: Personalized service enhances client satisfaction and builds stronger relationships.

- Optimizing investment strategies based on data-driven insights: Data-driven insights lead to more effective investment strategies and improved returns.

Conclusion

BBVA's investment banking expansion is a bold, long-term strategic initiative designed to cement its position as a leading global financial institution. Through geographic diversification, service diversification, technological advancements, and a data-driven approach, BBVA is well-positioned to capitalize on emerging opportunities and achieve sustainable growth in the investment banking sector. To stay informed about the progress of BBVA's investment banking expansion, regularly review their investor relations materials and follow their announcements regarding strategic initiatives. Understanding BBVA's investment banking expansion is crucial for anyone interested in the future of this significant global player in financial services.

Featured Posts

-

March Concerts In Okc Big Name Artists Dates And Ticket Information

Apr 25, 2025

March Concerts In Okc Big Name Artists Dates And Ticket Information

Apr 25, 2025 -

Ryujinx Emulator Project Halted Official Statement Following Nintendo Contact

Apr 25, 2025

Ryujinx Emulator Project Halted Official Statement Following Nintendo Contact

Apr 25, 2025 -

2025 Nfl Draft Chicago Bears Eyeing A Top Playmaker

Apr 25, 2025

2025 Nfl Draft Chicago Bears Eyeing A Top Playmaker

Apr 25, 2025 -

9 Billion Mgm Casino Project In Japan Groundbreaking After Delays

Apr 25, 2025

9 Billion Mgm Casino Project In Japan Groundbreaking After Delays

Apr 25, 2025 -

Ankara Emniyet Mueduerluegue Nuen Yeni Yerleskesi Hizmete Acildi

Apr 25, 2025

Ankara Emniyet Mueduerluegue Nuen Yeni Yerleskesi Hizmete Acildi

Apr 25, 2025

Latest Posts

-

Three Years Of Data Breaches Cost T Mobile 16 Million In Fines

Apr 30, 2025

Three Years Of Data Breaches Cost T Mobile 16 Million In Fines

Apr 30, 2025 -

16 Million Fine For T Mobile Details Of Three Years Of Data Security Lapses

Apr 30, 2025

16 Million Fine For T Mobile Details Of Three Years Of Data Security Lapses

Apr 30, 2025 -

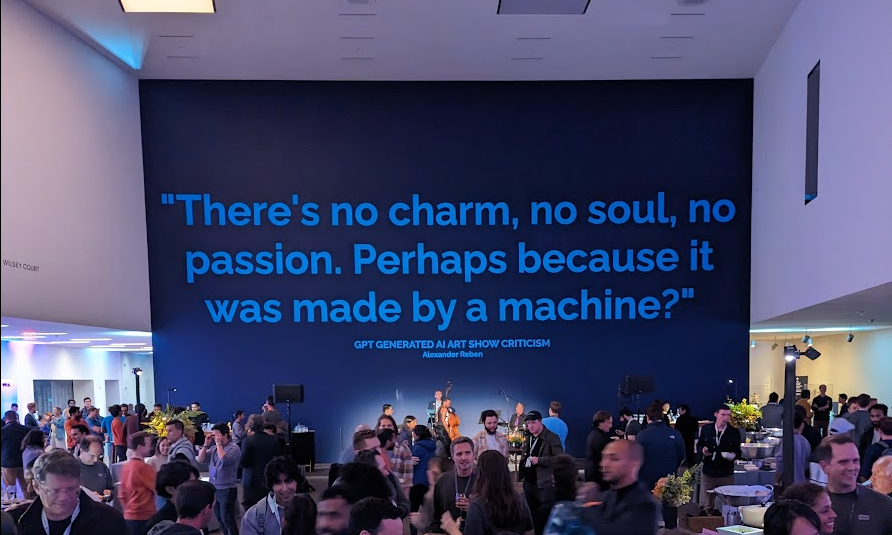

2024 Open Ai Developer Event New Tools For Voice Assistant Creation

Apr 30, 2025

2024 Open Ai Developer Event New Tools For Voice Assistant Creation

Apr 30, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Developer Showcase

Apr 30, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Showcase

Apr 30, 2025 -

Podcast Production Revolution Ais Power To Process Repetitive Scatological Documents

Apr 30, 2025

Podcast Production Revolution Ais Power To Process Repetitive Scatological Documents

Apr 30, 2025