Belgium: Financial Strategies For A 270MWh Battery Energy Storage System

Table of Contents

Securing Project Financing for a Belgian BESS

Securing sufficient funding is paramount for any large-scale BESS project. The 270MWh system requires a multi-faceted approach to financing, leveraging both public and private sector resources.

Exploring Public Funding Opportunities

Belgium offers various avenues for public funding to support renewable energy projects, including BESS.

- Regional Grants and Subsidies: The Flemish, Walloon, and Brussels regions each have specific programs supporting renewable energy initiatives. Thorough research into these programs is crucial, as eligibility criteria and funding amounts vary.

- European Union Funding: The EU provides substantial funding through programs like the Connecting Europe Facility (CEF) and Horizon Europe. These programs often prioritize projects with significant environmental and economic benefits. Applications require detailed project proposals highlighting the project's contribution to the EU's energy and climate goals.

- Tax Incentives and Exemptions: Belgium offers various tax incentives for renewable energy investments. These can significantly reduce the overall project cost and improve the financial viability of the BESS. Tax advisors specializing in renewable energy projects are invaluable in navigating these complexities.

- Public-Private Partnerships: Partnering with local governments or municipalities can unlock access to their funding channels and facilitate project approvals. This collaboration can also enhance community acceptance and support for the BESS project.

Private Investment and Equity Financing

Attracting private investment is crucial for supplementing public funding.

- Identifying Investors: Venture capital and private equity firms specializing in renewable energy are key targets. A strong investment prospectus demonstrating the project's financial viability is crucial. This should highlight the BESS's potential for return on investment (ROI), emphasizing both financial returns and the positive environmental impact.

- Equity Structure: The equity structure should be carefully designed to attract investors with different risk profiles and capital requirements. This might involve offering different classes of shares with varying levels of risk and reward.

- Blended Finance: A blended finance approach, combining public and private investment, can reduce the financial burden on any single investor and broaden the project's funding base. This mitigates risks and attracts a wider range of investors.

Debt Financing Options

Debt financing provides another crucial source of capital.

- Green Finance Banks: Several Belgian and international banks specialize in providing loans for renewable energy projects, offering competitive interest rates and favorable repayment terms.

- Green Bonds: Issuing green bonds can attract investors seeking environmentally responsible investments. These bonds specifically target projects contributing to environmental sustainability, like BESS projects.

- Loan Terms Negotiation: Negotiating favorable loan terms is essential, including securing competitive interest rates, flexible repayment schedules, and potentially including grace periods.

- Credit Enhancement: Securing credit enhancement or guarantees from government agencies or other institutions can significantly reduce the lending risk for banks, leading to better loan terms.

Revenue Streams and Market Analysis for BESS in Belgium

A thorough market analysis is key to understanding the potential revenue streams for a Belgian BESS.

Frequency Regulation and Grid Services

The Belgian electricity grid requires frequency regulation and ancillary services to maintain stability.

- Market Analysis: A detailed analysis of the Belgian electricity market's need for these services is vital. This involves understanding the existing capacity, current pricing, and future demand projections.

- Revenue Forecasting: Accurately forecasting revenue from frequency regulation and ancillary services requires considering market volatility and competition from other BESS providers and traditional generation sources.

- Grid Operator Partnerships: Collaborating with grid operators allows for better understanding of their requirements and bidding processes, maximizing revenue opportunities.

Peak Shaving and Arbitrage Opportunities

BESS can provide peak shaving and energy arbitrage services.

- Market Assessment: Analyze the potential for peak shaving and arbitrage in the Belgian energy market, considering the price differentials between peak and off-peak hours.

- Profitability Modeling: Develop a robust model to simulate energy trading strategies and assess profit potential based on different electricity price scenarios. This requires sophisticated modeling techniques to accurately predict market fluctuations.

- Sophisticated Trading Strategies: Employing advanced energy trading strategies is critical for maximizing returns in the dynamic Belgian electricity market.

Capacity Market Participation

Belgium's capacity market provides another potential revenue stream.

- Eligibility Assessment: Determine the BESS project's eligibility for participation in the Belgian capacity market. This involves understanding the specific regulations and requirements.

- Revenue Estimation: Accurately estimate potential revenue from providing capacity to the grid, considering market prices and the project's capacity.

- Regulatory Compliance: Ensure complete compliance with the rules and regulations governing capacity market participation to avoid penalties. This includes understanding the obligations and penalties for non-performance.

Risk Management and Financial Modeling for Belgian BESS Projects

Effective risk management is crucial for the financial success of any BESS project.

Regulatory and Policy Risks

Changes in Belgian energy policy can significantly impact the project.

- Policy Monitoring: Continuously monitor changes in Belgian energy policy and regulations related to renewable energy support schemes, grid connection policies, and capacity market rules.

- Risk Mitigation: Develop robust strategies to mitigate these risks, including adapting project design or business plans as necessary.

- Policy Engagement: Engage with policymakers to ensure the project aligns with future energy policies and secure long-term regulatory certainty.

Technological and Operational Risks

Technological failures and operational challenges can impact profitability.

- Technology Assessment: Thoroughly assess the technological risks associated with the chosen battery technology, including its lifespan, degradation rates, and potential for failure.

- Operational Management: Implement robust operational management strategies to minimize risks associated with system failures, maintenance needs, and unforeseen downtime.

- Monitoring and Control Systems: Invest in high-quality monitoring and control systems to ensure optimal performance and early detection of potential problems.

Financial Risk Management

A comprehensive financial model is essential.

- Financial Modeling: Develop a detailed financial model that incorporates all revenue streams, costs, and risks. This model should consider various scenarios and sensitivities.

- Sensitivity Analysis: Perform a thorough sensitivity analysis to assess the impact of different variables (e.g., electricity prices, battery lifespan, interest rates) on project profitability.

- Hedging Strategies: Employ hedging strategies to mitigate the risks associated with price volatility in the electricity market.

- Insurance Coverage: Secure comprehensive insurance coverage to protect against unforeseen events, including equipment failures, natural disasters, and regulatory changes.

Conclusion

Developing a 270MWh Battery Energy Storage System in Belgium offers substantial financial opportunities, but careful planning and strategic financial management are crucial. By securing diverse funding sources, analyzing revenue streams, and managing risks effectively, investors can maximize the return on investment and contribute to Belgium's transition to a sustainable energy future. To learn more about optimizing your financial strategies for a Battery Energy Storage System (BESS) project in Belgium, contact our experts today! Successful BESS projects require careful consideration of the specific financial landscape in Belgium.

Featured Posts

-

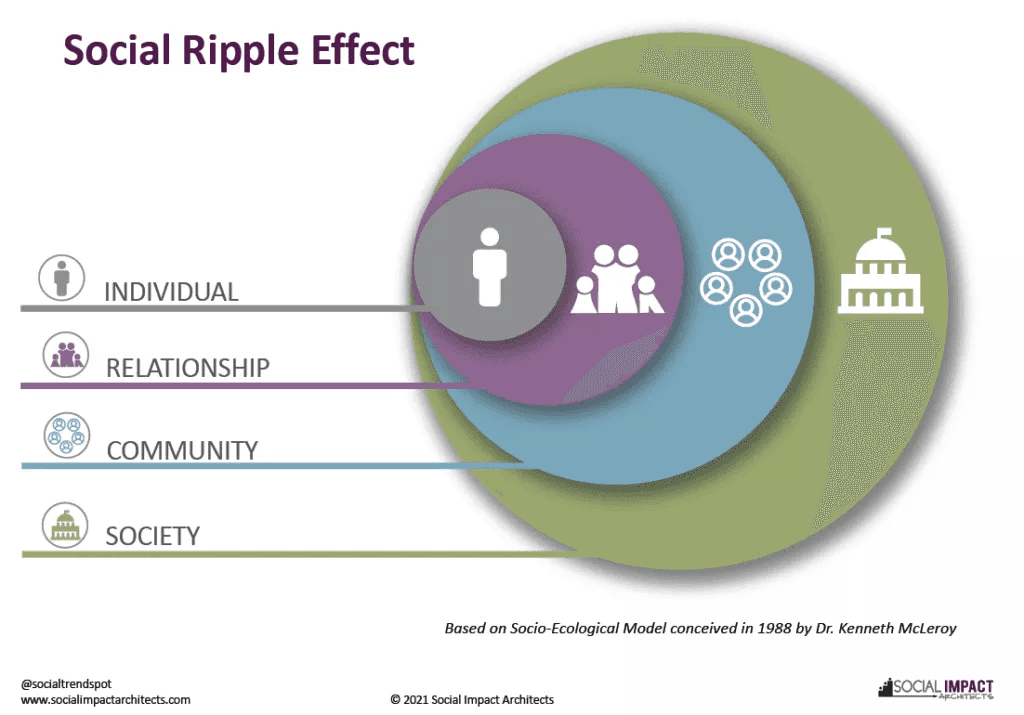

School Desegregation Order Terminated The Ripple Effect Across The Nation

May 03, 2025

School Desegregation Order Terminated The Ripple Effect Across The Nation

May 03, 2025 -

Epic Games Fortnite A Legal Battle Over In Game Store Practices

May 03, 2025

Epic Games Fortnite A Legal Battle Over In Game Store Practices

May 03, 2025 -

Fortnite Down Update 34 20 Server Status And Downtime Check

May 03, 2025

Fortnite Down Update 34 20 Server Status And Downtime Check

May 03, 2025 -

Is Riot Platforms Stock Riot A Good Investment A Current Analysis

May 03, 2025

Is Riot Platforms Stock Riot A Good Investment A Current Analysis

May 03, 2025 -

Reform Uk And Farming A Detailed Examination Of Their Policies

May 03, 2025

Reform Uk And Farming A Detailed Examination Of Their Policies

May 03, 2025

Latest Posts

-

1bn Funding Cut Forces Bbc To Confront Unprecedented Challenges

May 03, 2025

1bn Funding Cut Forces Bbc To Confront Unprecedented Challenges

May 03, 2025 -

This Country Culture Cuisine And Customs

May 03, 2025

This Country Culture Cuisine And Customs

May 03, 2025 -

Bbc Funding Crisis 1bn Loss Sparks Concerns Over Future Programming

May 03, 2025

Bbc Funding Crisis 1bn Loss Sparks Concerns Over Future Programming

May 03, 2025 -

The Best Of This Country Top Destinations And Activities

May 03, 2025

The Best Of This Country Top Destinations And Activities

May 03, 2025 -

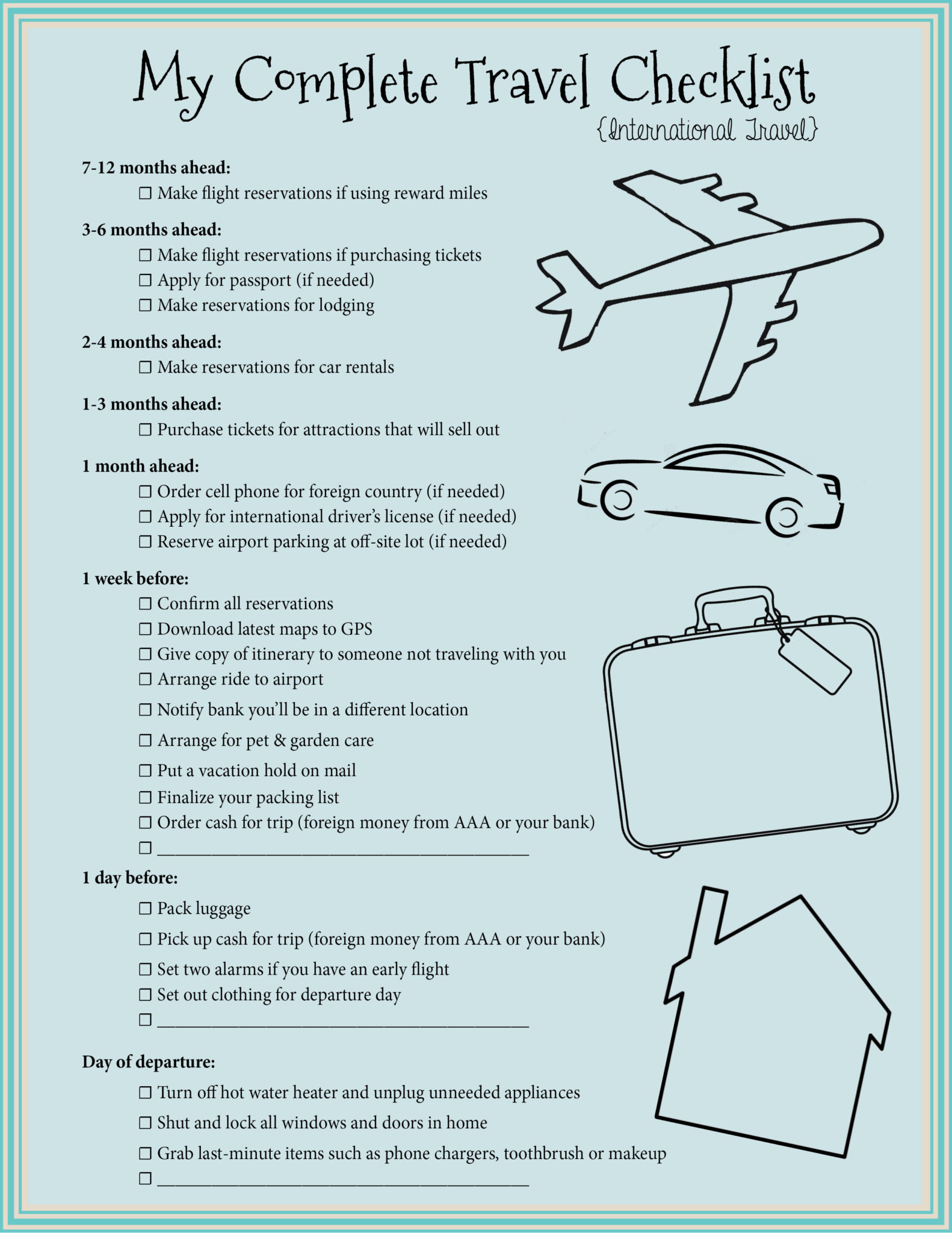

Planning Your Trip To This Country Practical Advice And Tips

May 03, 2025

Planning Your Trip To This Country Practical Advice And Tips

May 03, 2025