Belgium's Energy Market: Financing A 270MWh BESS Project

Table of Contents

The Belgian Energy Market and the Need for BESS

Belgium's energy policy actively promotes renewable energy sources to meet its climate commitments. The country aims to significantly increase its renewable energy capacity, targeting a substantial percentage of its electricity generation from solar and wind power. However, the intermittent nature of these sources poses a significant challenge. Solar and wind power generation fluctuates based on weather conditions, leading to instability within the electricity grid.

This is where Battery Energy Storage Systems (BESS) become indispensable. BESS projects offer a solution by storing excess renewable energy during periods of high generation and releasing it during periods of low generation or peak demand. This significantly improves grid stability, enhances the reliability of renewable energy supply, and reduces reliance on fossil fuel-based power plants. Furthermore, BESS contributes to frequency regulation, ensuring the smooth operation of the national power grid.

Belgium's government recognizes the importance of BESS and has implemented various incentives to encourage investment in energy storage projects. These include:

- Current renewable energy capacity in Belgium: [Insert current data on Belgium's renewable energy capacity from a reliable source].

- Government targets for renewable energy integration: [Insert data on Belgium's renewable energy targets from a reliable source].

- Examples of existing BESS projects in Belgium: [Insert examples of existing BESS projects, if available, with links to relevant sources].

- Key challenges facing the integration of renewable energy: Grid integration challenges, balancing supply and demand, managing intermittency.

Financing Options for a 270MWh BESS Project in Belgium

Securing financing for a large-scale 270MWh BESS project requires a multifaceted approach. Several financing models are available, each with its advantages and disadvantages:

-

Equity Financing: Attracting private investors or venture capital is a viable option. This can provide significant upfront capital but may involve relinquishing some ownership and control.

-

Debt Financing: Bank loans and green bonds are traditional sources of debt financing. These offer a more predictable cash flow but require regular interest payments and repayment of the principal. The availability of green bonds specifically designed for renewable energy projects is increasing.

-

Public Funding: Belgian government grants, subsidies, and tax credits can significantly reduce the project's overall cost. However, these often come with specific eligibility criteria and application processes.

-

Power Purchase Agreements (PPAs): Entering into long-term contracts with off-takers for the energy storage services provided by the BESS can guarantee a stable revenue stream. This reduces reliance on upfront capital and provides a more predictable financial model.

-

Hybrid Financing: A combination of the above methods allows for a balanced approach, mitigating the risks associated with relying solely on one type of financing.

Consideration should be given to:

- Interest rates for green bonds in Belgium: [Insert data on interest rates for green bonds in Belgium from a reliable source].

- Availability of government subsidies for BESS projects: [Insert details about government subsidies for BESS projects in Belgium from a reliable source].

- Examples of successful BESS financing projects in similar markets: [Provide examples of successful BESS financing from similar markets with details and links to reliable sources].

Regulatory Landscape and Permitting Process in Belgium

Navigating the regulatory landscape is crucial for successful project implementation. The permitting process for a 270MWh BESS project in Belgium involves several steps and requires detailed documentation:

- Key regulations relevant to BESS projects: [List relevant regulations and their sources].

- Timeline for obtaining necessary permits: [Provide an estimated timeline based on available information].

- Potential environmental impact assessments: A comprehensive environmental impact assessment is likely required, which might involve additional time and cost.

- Grid connection requirements: Securing grid connection approval is essential and may involve technical specifications and negotiations with the grid operator. The process may require significant coordination with Elia, the Belgian transmission system operator.

Case Studies and Best Practices

Analyzing successful BESS projects globally provides valuable insights into best practices and potential pitfalls. [Insert case studies from various countries, highlighting successful financing strategies and operational aspects]. This includes examining aspects such as:

- Key success factors of comparable projects: Strong partnerships, efficient project management, securing long-term contracts.

- Lessons learned from project failures: Inadequate due diligence, insufficient risk management, unrealistic financial projections.

- Best practices for risk mitigation: Thorough risk assessment, insurance coverage, robust financial modeling.

Conclusion: Securing the Future of Energy in Belgium: Investing in a 270MWh BESS Project

Financing a 270MWh BESS project in Belgium presents both challenges and significant opportunities. This article highlighted various financing models, the regulatory landscape, and the critical role of BESS in Belgium's energy transition. By carefully considering the available options, conducting thorough due diligence, and employing best practices, investors can successfully contribute to a more sustainable and reliable energy future for Belgium. The potential returns on investment, combined with the environmental benefits, make BESS projects an attractive proposition. Are you interested in investing in Belgium's sustainable energy future? Contact us today to learn more about financing options for your own BESS project, or to discuss the opportunities presented by the 270MWh market.

Featured Posts

-

Are Expensive Offshore Wind Farms Losing Their Appeal

May 03, 2025

Are Expensive Offshore Wind Farms Losing Their Appeal

May 03, 2025 -

Daily Lotto Draw Results Wednesday 16 April 2025

May 03, 2025

Daily Lotto Draw Results Wednesday 16 April 2025

May 03, 2025 -

Hans Resignation Paving The Way For A South Korean Presidential Run

May 03, 2025

Hans Resignation Paving The Way For A South Korean Presidential Run

May 03, 2025 -

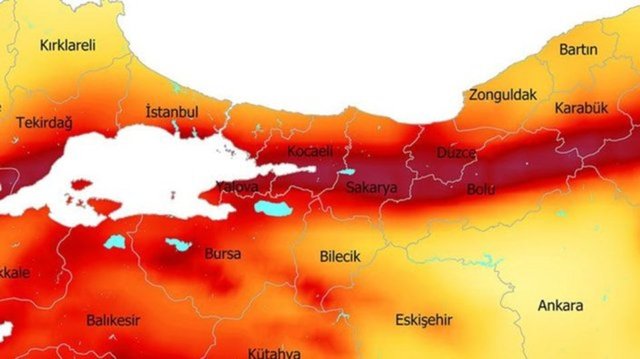

1 Mayis Kocaeli Arbede Olaylarin Ayrintili Analizi

May 03, 2025

1 Mayis Kocaeli Arbede Olaylarin Ayrintili Analizi

May 03, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

May 03, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Say

May 03, 2025

Latest Posts

-

X

May 03, 2025

X

May 03, 2025 -

Loyle Carner Announces 3 Arena Gig Westmeath Fans Rejoice

May 03, 2025

Loyle Carner Announces 3 Arena Gig Westmeath Fans Rejoice

May 03, 2025 -

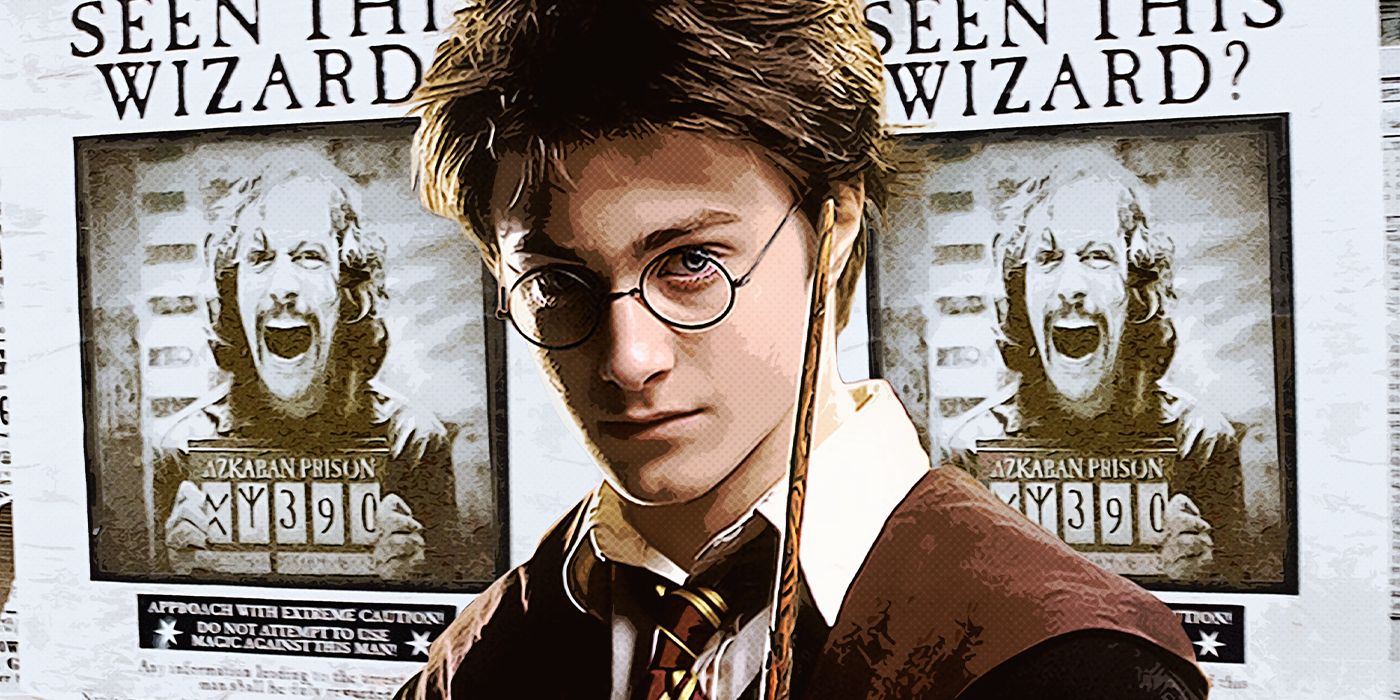

Alfonso Cuarons Vision Why He Replaced Chris Columbus In Harry Potter 3

May 03, 2025

Alfonso Cuarons Vision Why He Replaced Chris Columbus In Harry Potter 3

May 03, 2025 -

Harry Potter And The Prisoner Of Azkaban Exploring The Directorial Transition

May 03, 2025

Harry Potter And The Prisoner Of Azkaban Exploring The Directorial Transition

May 03, 2025 -

The Prisoner Of Azkaban Why A New Director Took The Helm

May 03, 2025

The Prisoner Of Azkaban Why A New Director Took The Helm

May 03, 2025