BigBear.ai, BBAI, penny stock, AI, data analytics, stock performance, and investment prospects.

BigBear.ai, BBAI, penny stock, AI, data analytics, stock performance, and investment prospects.

BBAI's stock price has demonstrated considerable volatility, characteristic of many penny stocks. Examining both short-term and long-term trends reveals a rollercoaster ride. (Insert chart or graph depicting BBAI's stock price over a relevant timeframe here).

BBAI stock price, stock chart, price volatility, trading volume, market capitalization.Analyzing BBAI's financial statements is crucial for understanding its underlying health. We need to look beyond just the stock price. (Insert relevant data from BBAI's financial reports here).

financial statements, revenue growth, earnings per share, profitability, financial ratios, BBAI financials.Understanding analyst sentiment offers valuable insight. The consensus view among financial analysts can significantly influence a stock's price.

analyst ratings, buy rating, sell rating, hold rating, price target, BBAI stock outlook.BBAI operates in a rapidly growing sector, presenting significant opportunities.

market growth, AI market, data analytics market, government contracts, strategic partnerships, BBAI growth potential.The AI and data analytics industry is fiercely competitive.

competitive landscape, market competition, competitive advantage, business model, BBAI competitors.Investing in BBAI carries inherent risks.

investment risks, financial risk, technological risk, regulatory risk, BBAI risk factors.BigBear.ai (BBAI) presents a compelling but risky investment opportunity within the dynamic AI and data analytics landscape. While its potential for growth is significant, fueled by expanding market demand and potential government contracts, the company faces challenges relating to its financial stability and competition within a rapidly evolving sector. The volatility of its stock price underlines the inherent risk involved. Remember, this analysis is not financial advice. Thorough due diligence is crucial before investing in any penny stock, including BigBear.ai (BBAI). Before making any investment decisions, consider your personal risk tolerance, financial goals, and consult with a qualified financial advisor. Further research into BBAI's financial statements, analyst reports, and industry trends is recommended. Proceed with caution and make informed decisions regarding BigBear.ai (BBAI) and similar penny stocks.

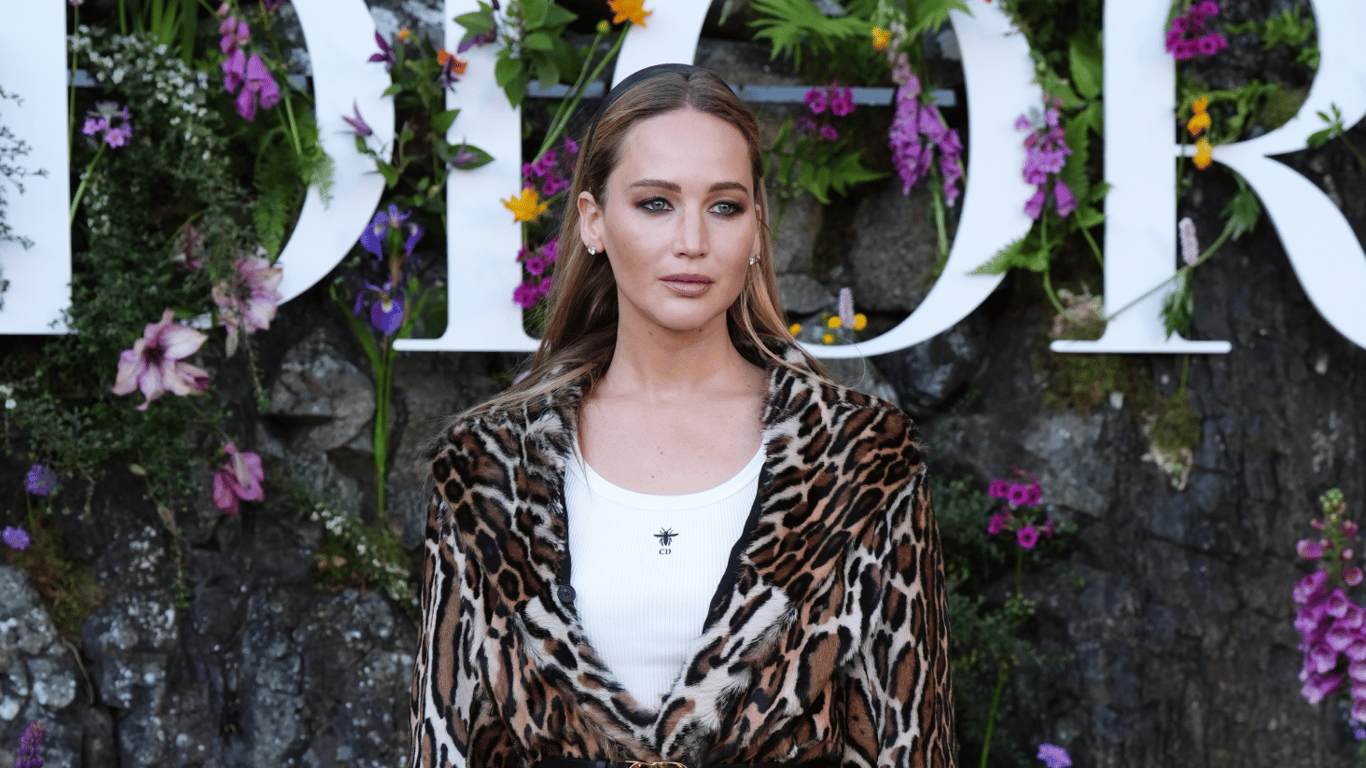

Dzhennifer Lourens Vdruge Stala Mamoyu Pidtverdzhennya Ta Podrobitsi

Dzhennifer Lourens Vdruge Stala Mamoyu Pidtverdzhennya Ta Podrobitsi

Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

Wwe Rumors Ronda Rousey Logan Paul Jey Uso And Big Es Engagement

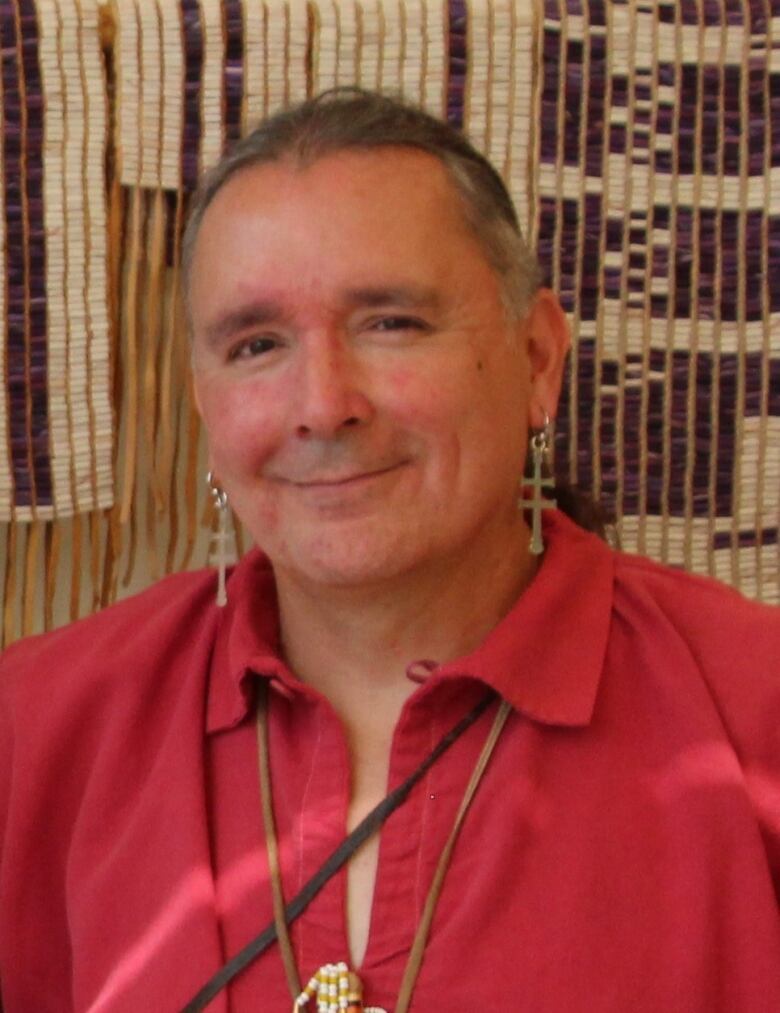

Kahnawake Casino Lawsuit 220 Million Claim Against Mohawk Council

Kahnawake Casino Lawsuit 220 Million Claim Against Mohawk Council

Hmrc Leverages Voice Recognition For Faster Call Handling

Hmrc Leverages Voice Recognition For Faster Call Handling

Seger Foer Jacob Friis I Malta Trots Tuff Match

Seger Foer Jacob Friis I Malta Trots Tuff Match

The Housemaid And Echo Valley Whats Next For Sydney Sweeney

The Housemaid And Echo Valley Whats Next For Sydney Sweeney

Sejarah Dan Statistik Juara Premier League Siapa Yang Akan Menang Selanjutnya

Sejarah Dan Statistik Juara Premier League Siapa Yang Akan Menang Selanjutnya

Liverpool Menjuarai Liga Inggris Analisis Faktor Kunci Dan Peran Pelatih

Liverpool Menjuarai Liga Inggris Analisis Faktor Kunci Dan Peran Pelatih

Sydney Sweeney Post Echo Valley And The Housemaid Projects

Sydney Sweeney Post Echo Valley And The Housemaid Projects

Analisa Peluang Liverpool Menjadi Juara Liga Inggris 2024 2025

Analisa Peluang Liverpool Menjadi Juara Liga Inggris 2024 2025