BigBear.ai (BBAI): Analyzing The Significant Stock Decline And Its Implications

Table of Contents

Analyzing the Factors Contributing to the BBAI Stock Decline

Disappointing Financial Performance

BigBear.ai's recent financial reports have revealed a concerning trend of missed earnings expectations and revenue shortfalls. This disappointing financial performance has significantly impacted investor confidence and contributed to the BBAI stock decline.

- Revenue Growth: A slowdown in revenue growth, potentially indicating challenges in securing new contracts or scaling existing operations, has been observed.

- Net Income: Negative net income or significantly reduced profitability compared to previous periods signals underlying financial pressures within the company.

- EPS (Earnings Per Share): A decrease or negative EPS further reinforces the negative financial picture, leading to decreased investor confidence and selling pressure.

- Analyst Downgrades: Several financial analysts have downgraded their ratings for BBAI stock, citing concerns about the company's financial outlook and future growth prospects. This negative sentiment has undoubtedly contributed to the stock's decline.

Market Sentiment and Investor Confidence

The overall market sentiment towards AI stocks, while generally positive in the long term, has experienced periods of volatility. BigBear.ai, unfortunately, has been particularly affected by negative market sentiment.

- Negative Press Coverage: Any negative press, whether related to financial performance, operational issues, or controversies, can significantly impact investor confidence and lead to selling pressure.

- Broader Macroeconomic Factors: Inflation, rising interest rates, and overall economic uncertainty have impacted investor sentiment across the tech sector, disproportionately affecting companies like BigBear.ai that rely on investor funding for growth.

- Investor Flight to Safety: During periods of economic uncertainty, investors often shift their investments towards safer assets, leading to selling pressure on more volatile stocks such as BBAI.

Competition and Market Dynamics

BigBear.ai operates in a highly competitive AI industry, facing stiff competition from established players and emerging startups. Its position within this competitive landscape has significantly influenced its recent performance.

- Key Competitors: Identifying and analyzing the strengths and market share of BigBear.ai's competitors is crucial to understand the challenges it faces. These competitors may offer similar services or solutions, putting pressure on BBAI's pricing and market share.

- Competitive Advantages/Disadvantages: A thorough assessment of BBAI's competitive advantages (e.g., unique technology, strong partnerships) and disadvantages (e.g., limited market reach, high operating costs) is necessary to determine its long-term viability.

- Market Saturation: The degree of market saturation in BigBear.ai's target market segments influences the potential for future growth and revenue generation.

Evaluating the Implications of the BBAI Stock Decline

Short-Term and Long-Term Impact on Investors

The BBAI stock decline presents both short-term and long-term implications for investors.

- Potential for Further Price Drops: The risk of further price drops remains, especially given the ongoing uncertainties surrounding the company's financial performance and the broader market conditions.

- Potential for Recovery: A recovery is possible, but it hinges on BigBear.ai's ability to address the underlying issues contributing to the decline and restore investor confidence. This requires strong strategic initiatives and demonstrable improvements in financial performance.

- Risks and Rewards: Investing in BBAI currently carries significant risk, but the potential rewards could be substantial if the company manages to turn its fortunes around. This necessitates careful assessment of risk tolerance and investment goals.

Strategic Responses from BigBear.ai

BigBear.ai has likely implemented or is considering implementing strategic initiatives to address the stock decline.

- Cost-Cutting Measures: Reducing operational costs and streamlining processes can improve profitability and boost investor confidence.

- Restructuring Efforts: Restructuring the company, potentially through layoffs or divestitures, might be necessary to improve efficiency and focus on core competencies.

- New Product Development: Investing in research and development to develop innovative AI solutions could attract new customers and drive future growth.

- Strategic Partnerships: Forming strategic alliances with larger companies in the industry can provide access to new markets and resources. The effectiveness of these initiatives in restoring investor confidence remains to be seen.

Future Outlook and Potential for Recovery

The future outlook for BBAI depends on several factors, including the success of its strategic initiatives, the overall market sentiment towards AI stocks, and the company's ability to demonstrate sustainable growth.

- Conditions for Recovery: A recovery is possible if BigBear.ai can show significant improvement in its financial performance, address investor concerns, and demonstrate a clear path towards profitability and sustainable growth.

- Long-term Potential: The long-term potential for BigBear.ai is dependent on its ability to innovate and compete effectively in the rapidly evolving AI industry.

Conclusion: Investing in BigBear.ai (BBAI) – A Cautious Approach?

The significant decline in BigBear.ai (BBAI) stock is attributable to a combination of disappointing financial performance, negative market sentiment, intense competition, and broader macroeconomic factors. The implications for investors are substantial, involving both the risk of further price drops and the potential for future recovery. While the company's long-term potential in the AI sector remains, its current situation necessitates a cautious approach. Before making any investment decisions related to BigBear.ai (BBAI) stock, thorough research and a comprehensive understanding of the risks involved are crucial. Consider consulting with a financial advisor before investing in BBAI or other volatile AI stocks. Investing in BBAI requires careful consideration of the risks and potential rewards, demanding due diligence before committing capital.

Featured Posts

-

Tampoy Mia Deyteri Eykairia Gia Ti Martha Kai Ton Gamo Tis

May 20, 2025

Tampoy Mia Deyteri Eykairia Gia Ti Martha Kai Ton Gamo Tis

May 20, 2025 -

Zirka Gollivudu Dzhennifer Lourens Stala Mamoyu Vdruge

May 20, 2025

Zirka Gollivudu Dzhennifer Lourens Stala Mamoyu Vdruge

May 20, 2025 -

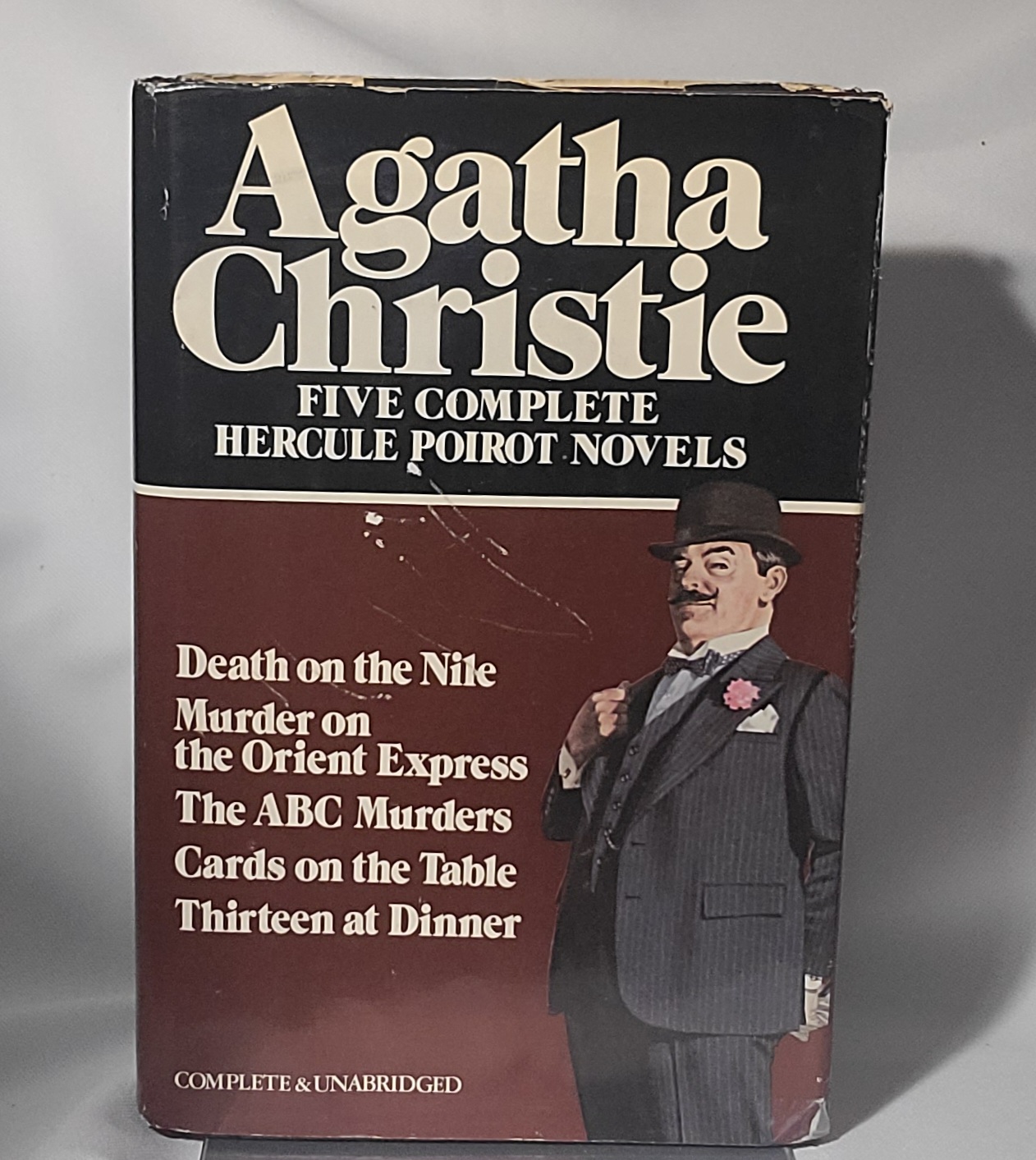

Exploring The World Of Agatha Christies Poirot From Novels To Adaptations

May 20, 2025

Exploring The World Of Agatha Christies Poirot From Novels To Adaptations

May 20, 2025 -

Actor Mark Rylance Speaks Out Against Music Festival Impact On London Green Spaces

May 20, 2025

Actor Mark Rylance Speaks Out Against Music Festival Impact On London Green Spaces

May 20, 2025 -

Nyt Mini Crossword Clues April 26 2025

May 20, 2025

Nyt Mini Crossword Clues April 26 2025

May 20, 2025

Latest Posts

-

Huuhkajien Uusi Valmennus Ja Tie Mm Karsintoihin

May 20, 2025

Huuhkajien Uusi Valmennus Ja Tie Mm Karsintoihin

May 20, 2025 -

Huuhkajat Mm Karsintoihin Uusi Valmennusstrategia

May 20, 2025

Huuhkajat Mm Karsintoihin Uusi Valmennusstrategia

May 20, 2025 -

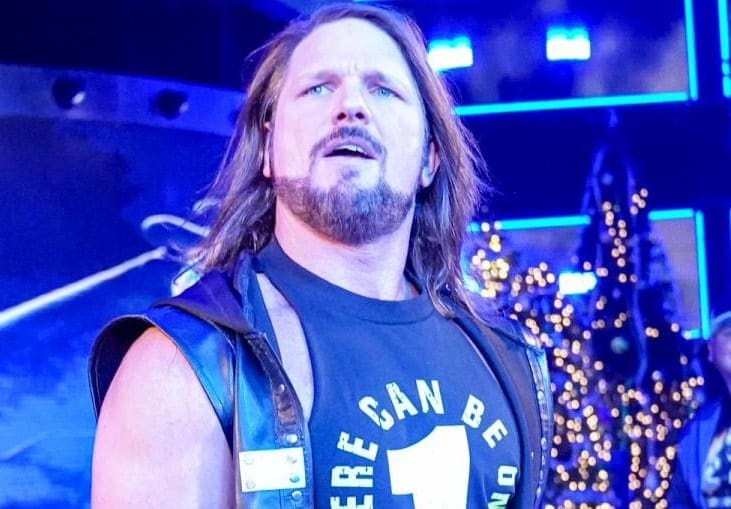

Wwes Aj Styles Contract Status And Future Plans

May 20, 2025

Wwes Aj Styles Contract Status And Future Plans

May 20, 2025 -

Aj Styles Wwe Contract Latest Backstage Updates

May 20, 2025

Aj Styles Wwe Contract Latest Backstage Updates

May 20, 2025 -

Wwe Raw Zoey Stark Suffers Injury Match Cut Short

May 20, 2025

Wwe Raw Zoey Stark Suffers Injury Match Cut Short

May 20, 2025