BigBear.ai (BBAI): Evaluating This AI Penny Stock Using Key Indicators

Table of Contents

Understanding BigBear.ai (BBAI) and its Business Model

BigBear.ai (BBAI) is a technology company specializing in providing AI-powered solutions and services, primarily targeting the defense, intelligence, and commercial sectors. Their core business revolves around leveraging advanced analytics and AI to solve complex problems for their clients.

- AI-driven solutions and services: BBAI offers a range of AI solutions, including predictive analytics, machine learning, and data visualization tools. These services help organizations analyze large datasets, identify patterns, and make data-driven decisions.

- Key clients and contracts: BigBear.ai has secured several significant contracts with government agencies and private sector companies. These contracts demonstrate the company's ability to deliver high-value AI solutions. Specific contract details are typically found in their SEC filings.

- Strategic partnerships: BBAI actively seeks strategic partnerships to expand its reach and enhance its technology offerings. These partnerships can provide access to new markets and technologies, furthering their growth potential.

Analyzing BigBear.ai's Financial Performance

Assessing BBAI's financial health requires a close look at several key performance indicators. While past performance doesn't guarantee future success, analyzing historical data offers valuable insights. It's crucial to consult BBAI's official financial reports for the most up-to-date information.

- Review of recent quarterly and annual reports: Regularly examine BBAI's 10-K and 10-Q filings with the Securities and Exchange Commission (SEC) to track revenue growth, expenses, and profitability.

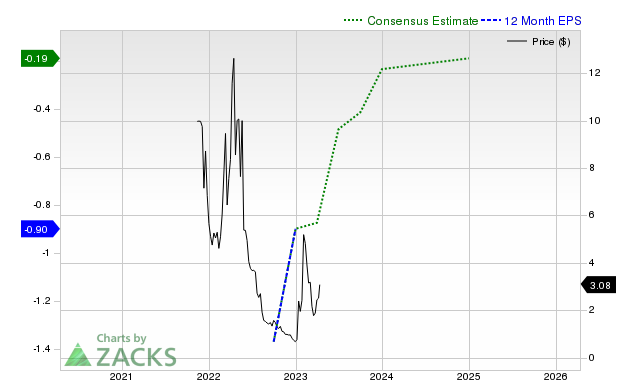

- Earnings per share (EPS) and price-to-earnings ratio (P/E): Analyze EPS trends to understand the profitability per share. The P/E ratio helps determine if the stock is overvalued or undervalued relative to its earnings.

- Debt-to-equity ratio: A high debt-to-equity ratio indicates higher financial risk. Analyze this ratio to assess BBAI's financial leverage and potential vulnerability to economic downturns.

- Cash flow from operations: Positive cash flow from operations is crucial for sustained growth and long-term viability. Track this indicator to understand BBAI's ability to generate cash from its core business activities.

Evaluating BBAI's Market Position and Competitive Landscape

BigBear.ai operates in a highly competitive landscape. Understanding its market position and competitive advantages is critical for assessing its investment potential.

- Key competitors and market share: Identify BBAI's main competitors within the AI and government contracting sectors. Assess their respective market shares to understand BBAI's relative standing.

- Competitive advantages: Evaluate BBAI's unique selling propositions, such as specialized technology, strong client relationships, or a focus on specific niche markets.

- Market trends and their impact on BBAI: Analyze prevailing trends within the AI industry, including advancements in AI technologies, changing government regulations, and evolving client demands. Consider how these trends might affect BBAI's future growth.

Assessing Risk Factors Associated with Investing in BBAI

Investing in BBAI, like any penny stock, carries significant risks. Understanding these risks is essential before making any investment decisions.

- High volatility: Penny stocks are inherently volatile, meaning their prices can fluctuate dramatically in short periods.

- Potential for significant losses: The high risk associated with penny stocks increases the potential for substantial financial losses.

- Dependence on government contracts: BBAI's revenue significantly relies on government contracts. Changes in government spending or contract awards could significantly impact its financial performance.

- Competition from established players: BBAI faces competition from larger, more established companies with greater resources and market recognition.

Predicting Future Growth and Potential Return on Investment (ROI) for BBAI

Predicting the future performance of any stock is inherently speculative. However, based on the preceding analysis, a cautious outlook can be formed.

- Potential catalysts for growth: Identify potential factors that could drive BBAI's future growth, such as securing new contracts, launching innovative products, or expanding into new markets.

- Potential for increased market share: Assess BBAI's potential to gain market share by leveraging its competitive advantages and adapting to evolving market trends.

- Uncertainties and potential downsides: Acknowledge the uncertainties and potential downsides associated with investing in BBAI. These could include slower-than-expected revenue growth, increased competition, or challenges in securing new contracts.

Conclusion

This analysis of BigBear.ai (BBAI) provides a comprehensive overview of its financial health, market position, and associated risks. The AI sector presents significant opportunities, but investing in penny stocks like BBAI involves substantial volatility. Before investing in BigBear.ai (BBAI) or any AI penny stock, conduct thorough due diligence, carefully assess your risk tolerance, and consult with a qualified financial advisor. This article is for informational purposes only and does not constitute financial advice. Further research into BigBear.ai (BBAI) is crucial before making any investment decisions.

Featured Posts

-

Tampoy I Marilena Thyma Epithesis Me Maxairi Sto Epomeno Epeisodio

May 20, 2025

Tampoy I Marilena Thyma Epithesis Me Maxairi Sto Epomeno Epeisodio

May 20, 2025 -

Impact Of The Wintry Mix Rain And Snow Advisory

May 20, 2025

Impact Of The Wintry Mix Rain And Snow Advisory

May 20, 2025 -

Apples Llm Siri A Comeback Strategy

May 20, 2025

Apples Llm Siri A Comeback Strategy

May 20, 2025 -

Persa Kai Ektoras I Floga Tis Diafonias Sto Tampoy Mega

May 20, 2025

Persa Kai Ektoras I Floga Tis Diafonias Sto Tampoy Mega

May 20, 2025 -

Novini Zi Svitu Kino Dzhennifer Lourens Znovu Mama

May 20, 2025

Novini Zi Svitu Kino Dzhennifer Lourens Znovu Mama

May 20, 2025

Latest Posts

-

Zoey Stark Injured During Wwe Raw Match Details And Updates

May 20, 2025

Zoey Stark Injured During Wwe Raw Match Details And Updates

May 20, 2025 -

Huuhkajien Alkukokoonpano Naein Se Muuttui

May 20, 2025

Huuhkajien Alkukokoonpano Naein Se Muuttui

May 20, 2025 -

Roxanne Perez And Rhea Ripley Qualify For The 2025 Money In The Bank Ladder Match

May 20, 2025

Roxanne Perez And Rhea Ripley Qualify For The 2025 Money In The Bank Ladder Match

May 20, 2025 -

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025 -

2025 Money In The Bank Perez And Ripley Earn Their Place In The Ladder Match

May 20, 2025

2025 Money In The Bank Perez And Ripley Earn Their Place In The Ladder Match

May 20, 2025