BigBear.ai (BBAI): Understanding The Recent Analyst Downgrade And Future Outlook

Table of Contents

Understanding the Analyst Downgrade

A prominent analyst firm, [Insert Analyst Firm Name Here], recently downgraded BigBear.ai (BBAI) from [Previous Rating] to [New Rating]. The rationale cited several key concerns contributing to a more bearish outlook on the company's short-term prospects. These concerns primarily revolve around revenue growth, profitability challenges, competitive pressures, and the inherent risks associated with government contract acquisition and fulfillment.

- Revenue Growth Concerns: The analyst firm expressed concerns about the slowing pace of revenue growth compared to previous projections and market expectations. This suggests potential challenges in securing new contracts or expanding existing ones.

- Profitability Issues: High operating costs and relatively low profit margins were highlighted as significant issues. This indicates a need for increased operational efficiency and cost-cutting measures to improve profitability.

- Competitive Landscape: The analyst report acknowledged the increasing competition within the AI and government contracting sectors. BigBear.ai faces pressure from established players and emerging startups vying for the same contracts.

- Contract Risk: The inherent risk associated with government contracts, including potential delays, cancellations, or budget cuts, was another major factor influencing the downgrade. The dependence on government funding creates volatility.

While the [Insert Analyst Firm Name Here] report painted a cautious picture, some analysts maintain a more optimistic outlook, pointing to BBAI's long-term potential and strategic initiatives. These dissenting opinions highlight the need for a nuanced understanding of the situation.

Evaluating BigBear.ai's Strengths and Weaknesses

BigBear.ai boasts several key strengths, despite the recent challenges. Its core competencies lie in advanced AI technologies and its established relationships within the government sector.

- Strengths:

- Strong AI Capabilities: BBAI possesses cutting-edge AI and data analytics expertise, offering sophisticated solutions.

- Established Government Presence: Years of experience working with government agencies provides a strong foundation and credibility.

- Proprietary Technologies: Unique technology offerings can provide a competitive edge and create barriers to entry.

However, the company also faces notable weaknesses:

- Weaknesses:

- Reliance on Government Contracts: Heavy dependence on government contracts creates revenue volatility and vulnerability to budget cuts.

- Scaling Challenges: Scaling operations to meet growing demand while maintaining profitability can be challenging.

- Potential for Execution Risks: Successfully delivering complex government projects requires flawless execution, and any delays or failures can have significant consequences.

Assessing the Impact on BBAI's Stock Price

The analyst downgrade immediately impacted BBAI's stock price, causing a [Percentage]% drop. The short-term effects are likely to include continued volatility and investor uncertainty. Long-term implications depend on BBAI's ability to address the concerns raised in the report. Market sentiment and broader economic trends also play a role, influencing investor confidence and overall valuation.

BigBear.ai's Future Outlook and Growth Potential

Despite the recent challenges, BigBear.ai possesses significant growth potential. The company's strategic initiatives, such as expanding into new markets and verticals, developing innovative AI solutions, and pursuing strategic acquisitions, offer pathways to future success.

- Growth Potential:

- Market Expansion: Entering new markets and industry verticals can diversify revenue streams and reduce reliance on government contracts.

- AI Innovation: Investing in research and development to create cutting-edge AI solutions can strengthen its competitive advantage.

- Strategic Acquisitions: Acquiring complementary businesses can enhance capabilities and accelerate growth.

- Contract Success: Successful execution of existing contracts and securing new ones will be crucial for revenue generation.

Macroeconomic factors and industry trends will inevitably influence BBAI's performance. However, a balanced perspective acknowledges both the significant risks and the considerable opportunities that exist for this company.

Conclusion: The Future of BigBear.ai (BBAI) Investment

This analysis reveals that while the recent analyst downgrade raises legitimate concerns regarding BigBear.ai's (BBAI) short-term prospects, the company possesses significant long-term potential. Its strengths in AI and government relationships offer a solid foundation, but its reliance on government contracts and operational challenges require careful consideration. Before making any investment decisions related to BigBear.ai (BBAI), thorough due diligence and independent research are paramount. Consult financial advisors and examine additional resources to gain a complete understanding of the risks and rewards associated with investing in BBAI stock. Informed investment choices regarding BBAI stock and BigBear.ai's future are crucial for navigating the complexities of this dynamic market.

Featured Posts

-

Novelistes A L Espace Julien Avant Le Hellfest Une Immersion

May 21, 2025

Novelistes A L Espace Julien Avant Le Hellfest Une Immersion

May 21, 2025 -

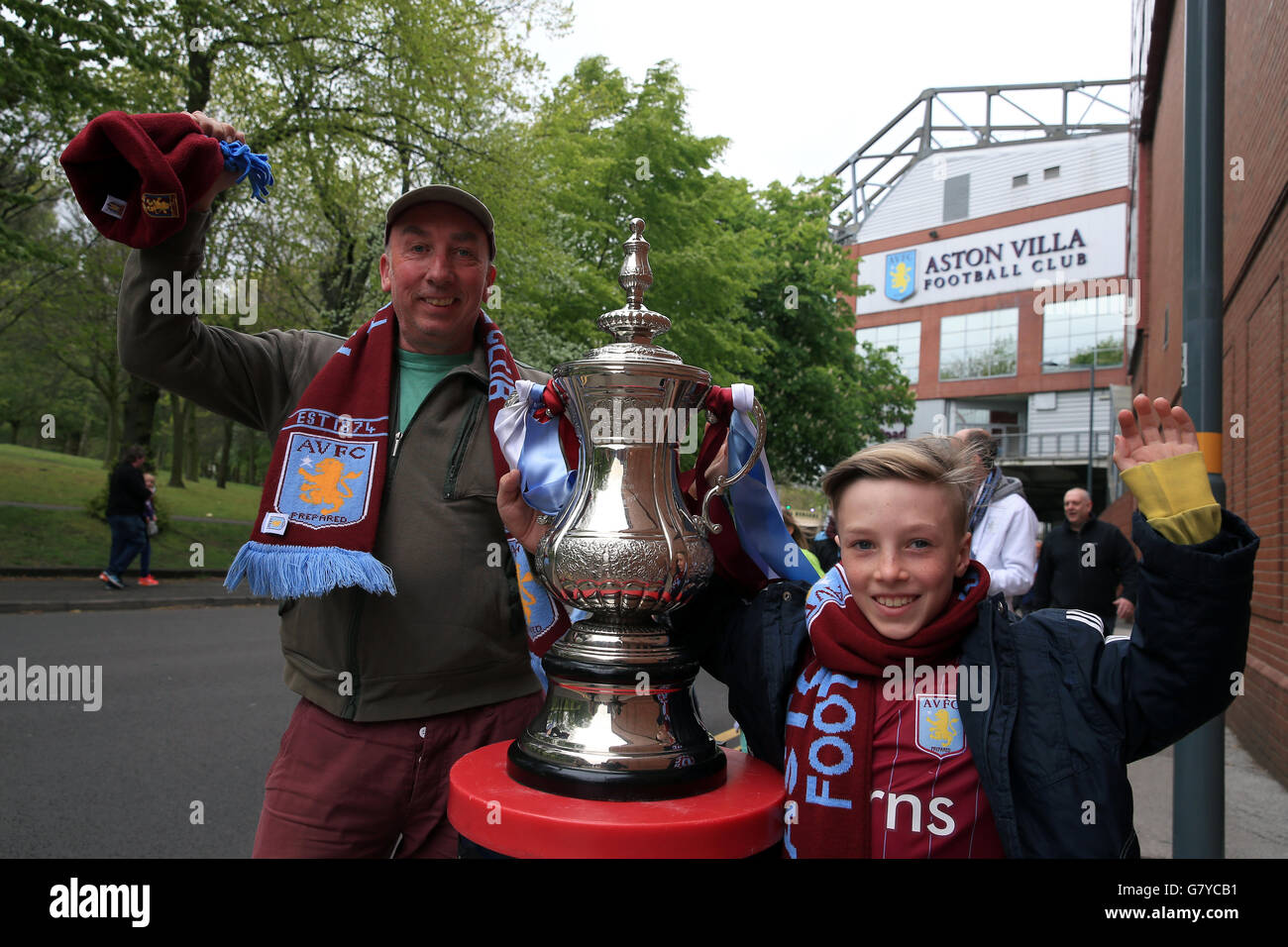

Aston Villa Cruise Past Preston In Fa Cup Thanks To Rashford

May 21, 2025

Aston Villa Cruise Past Preston In Fa Cup Thanks To Rashford

May 21, 2025 -

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 21, 2025

Huuhkajien Avauskokoonpanossa Kolme Muutosta Kaellman Penkille

May 21, 2025 -

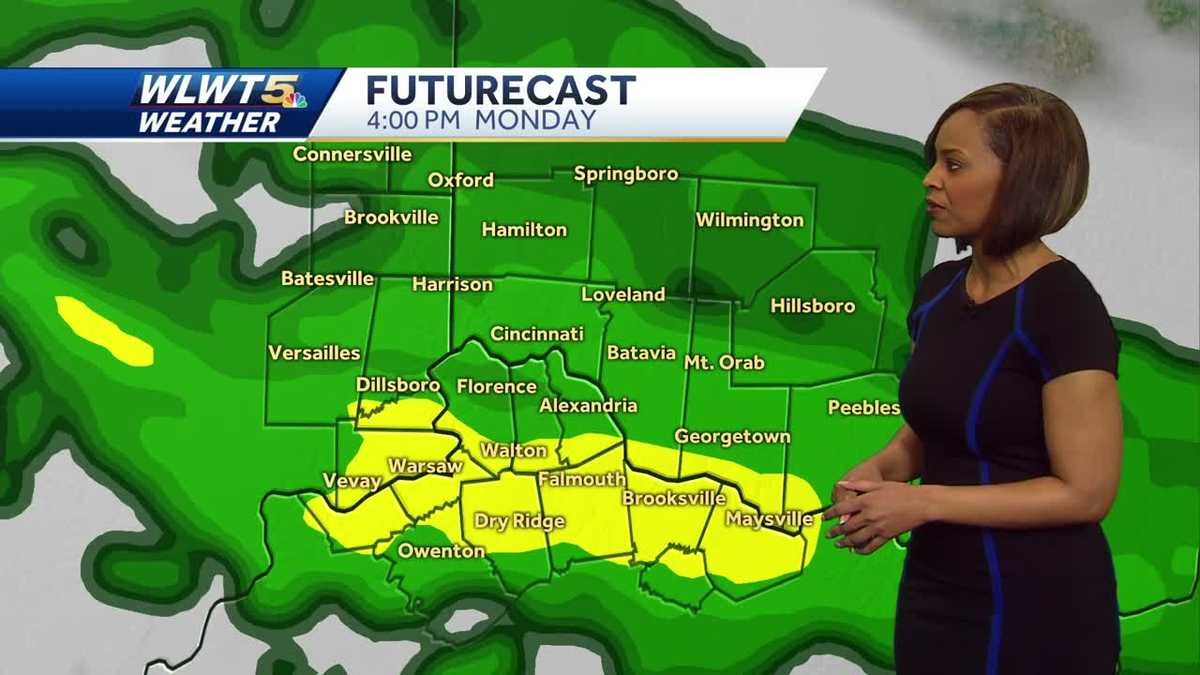

Expect Mild Temperatures And Little Rain This Week

May 21, 2025

Expect Mild Temperatures And Little Rain This Week

May 21, 2025 -

T Hanatos Apo Bullying I Sygklonistiki Istoria Toy Baggeli Giakoymaki

May 21, 2025

T Hanatos Apo Bullying I Sygklonistiki Istoria Toy Baggeli Giakoymaki

May 21, 2025