BigBear.ai Holdings (BBAI): Declining Stock Performance In 2025 Explained

Table of Contents

BigBear.ai Holdings is a technology company specializing in artificial intelligence (AI) and data analytics solutions for government and commercial clients. Its focus on providing advanced analytics and AI-powered decision support systems positions it within a rapidly evolving and competitive market. However, the 2025 decline highlights the inherent risks associated with investing in growth-oriented technology companies.

Main Points: Analyzing the Factors Contributing to BBAI's Stock Performance in 2025

H2: Macroeconomic Factors Impacting BBAI Stock Price

Several macroeconomic headwinds significantly impacted BBAI's stock price in 2025. The interconnectedness of global markets means that events outside of BBAI's direct control can profoundly influence its performance.

H3: The Impact of Rising Interest Rates

Rising interest rates played a major role in the BigBear.ai Holdings (BBAI) stock decline.

- Increased borrowing costs: Higher interest rates made it more expensive for BBAI to borrow money for expansion and operations.

- Reduced investor appetite for risk: Investors shifted towards safer, fixed-income investments offering higher returns, reducing investment in riskier growth stocks like BBAI.

- Impact on valuation multiples: Rising interest rates typically lead to lower valuation multiples for growth companies, negatively impacting their stock prices. This compression of valuation is a standard response to a higher discount rate applied to future earnings.

H3: Geopolitical Instability and its Ripple Effect

Geopolitical instability in 2025 created widespread uncertainty impacting investor confidence and the overall market, including BBAI.

- Supply chain disruptions: Global events disrupted supply chains, increasing costs and potentially impacting BBAI's ability to deliver its products and services on time.

- Reduced consumer spending: Uncertainty led to decreased consumer spending, reducing demand for many products and services, indirectly affecting technology companies like BBAI.

- Decreased government investment in technology: Governments may have redirected funds towards addressing immediate geopolitical challenges, leading to reduced investment in technology projects.

H3: Overall Market Correction and its Influence on BBAI

A broader market correction in 2025 contributed to the BBAI stock decline.

- Market volatility: Increased market volatility made investors more risk-averse, leading to sell-offs across various sectors, including technology.

- Investor risk aversion: Investors moved away from riskier assets, including many growth stocks, leading to significant price declines.

- Sell-offs in the tech sector: The technology sector, as a whole, experienced substantial sell-offs during this period, impacting BBAI’s stock price.

H2: Company-Specific Challenges Facing BigBear.ai Holdings

Beyond macroeconomic factors, BBAI faced internal challenges impacting its stock performance in 2025. These company-specific issues added to the downward pressure on the stock price.

H3: Revenue Shortfalls and Missed Earnings Expectations

BBAI's failure to meet projected revenue targets and earnings expectations played a significant role in the stock decline.

- Specific examples of missed targets: [Insert specific examples of missed revenue or earnings targets, citing verifiable sources].

- Reasons for underperformance: [Explain the reasons for underperformance, such as challenges in securing new contracts, delays in project implementation, or unexpected expenses].

- Investor reaction: Investors reacted negatively to the missed expectations, leading to a sell-off in BBAI stock.

H3: Competition in the AI Market

Intense competition in the AI market added pressure to BBAI's financial performance and stock valuation.

- Key competitors: [List and briefly describe BBAI's main competitors in the AI market].

- Competitive advantages and disadvantages: [Analyze BBAI's strengths and weaknesses compared to its competitors].

- Market share dynamics: [Discuss how BBAI's market share evolved in relation to its competitors].

H3: Execution Risks and Operational Challenges

Internal operational challenges hindered BBAI’s performance and contributed to the stock decline.

- Integration issues: [Discuss any difficulties encountered in integrating acquired companies or technologies].

- Management changes: [Analyze the impact of any significant management changes or leadership transitions].

- Technological hurdles: [Explain any technical difficulties that delayed product development or deployment].

H2: Investor Sentiment and Market Reactions to BBAI News

Negative investor sentiment further exacerbated the BigBear.ai Holdings (BBAI) stock decline.

H3: Analyst Ratings and Price Target Revisions

Analyst downgrades and revised price targets reflected the deteriorating outlook for BBAI.

- Specific examples of rating downgrades: [Cite specific examples of rating downgrades from reputable financial analysts].

- Revised price targets: [Mention the revised price targets set by analysts and the reasons behind the revisions].

- Reasons for changes in sentiment: [Explain why analysts became more pessimistic about BBAI's prospects].

H3: Media Coverage and Public Perception

Negative media coverage and social media sentiment contributed to the decline in investor confidence.

- Examples of negative news coverage: [Cite examples of negative news articles or reports impacting investor sentiment].

- Social media sentiment: [Discuss the overall sentiment expressed about BBAI on social media platforms].

- Impact on investor confidence: [Explain how negative news and social media sentiment influenced investor decisions].

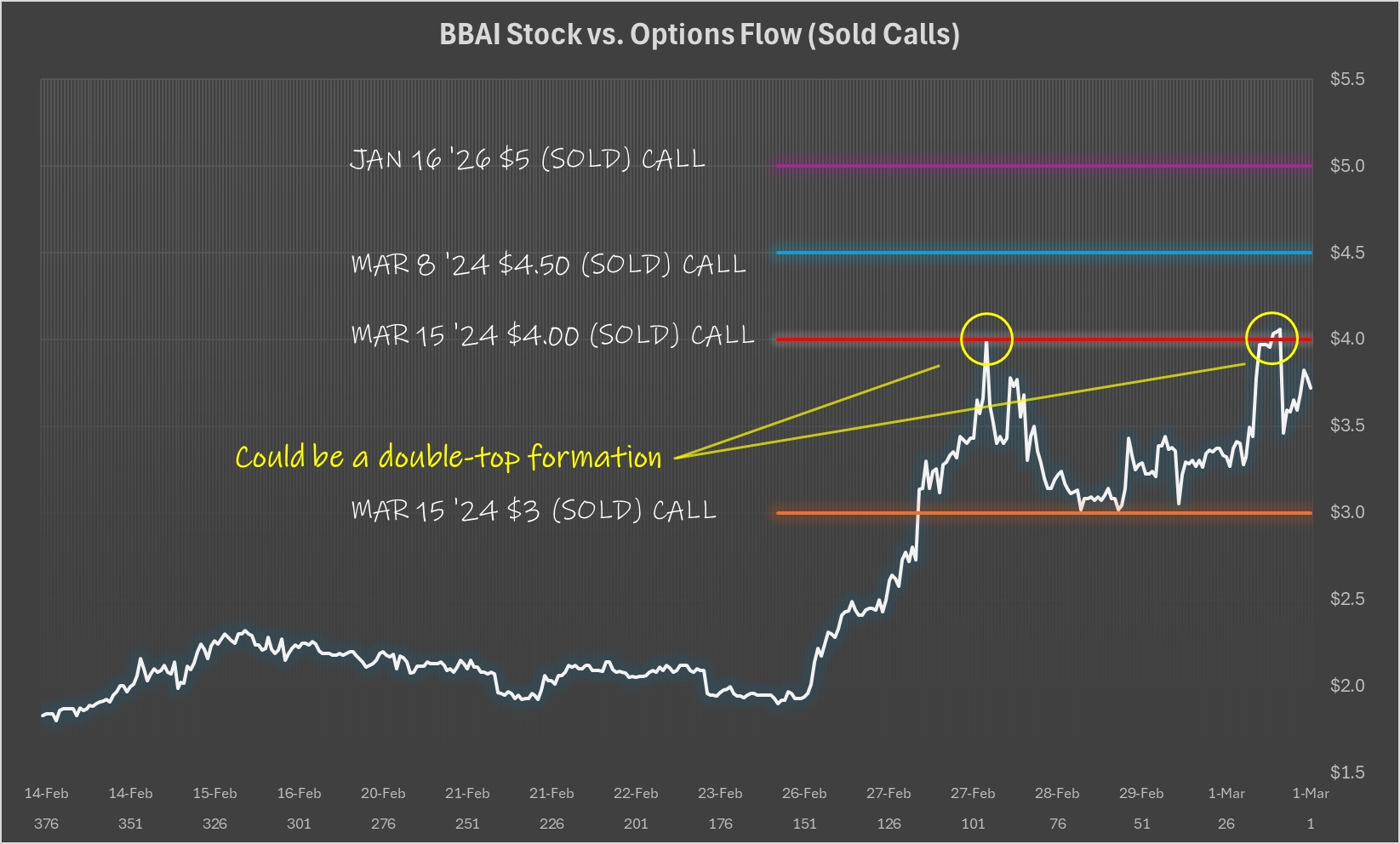

H3: Major Stock Price Movements and Their Causes

Significant stock price drops were directly linked to specific events and announcements.

- Specific dates and price movements: [List key dates and associated price movements].

- Triggering events: [Describe the events triggering each significant price movement].

- Investor reactions: [Analyze investor reactions to these events and announcements].

Conclusion: Investing in BigBear.ai Holdings (BBAI) Stock in the Future

The BigBear.ai Holdings (BBAI) stock decline in 2025 was a result of a confluence of factors, including macroeconomic headwinds, company-specific challenges, and negative investor sentiment. While the future outlook for BBAI remains uncertain, understanding these challenges is crucial for informed investment decisions. The company's performance will depend on its ability to address its internal issues, navigate the competitive AI market, and adapt to changing macroeconomic conditions.

Before making any investment decisions regarding BigBear.ai Holdings (BBAI) stock, thorough research and analysis of current market conditions and the company's performance are crucial. Understanding the risks associated with BBAI stock and its potential for future growth is paramount to making a sound investment decision. Carefully monitor BBAI stock performance and the evolving landscape of the AI market before committing your capital. Consider consulting with a financial advisor to further assess the risks and rewards of investing in BBAI stock.

Featured Posts

-

Hamilton And Leclerc Tensions Flare After Ferraris Team Order Decision

May 20, 2025

Hamilton And Leclerc Tensions Flare After Ferraris Team Order Decision

May 20, 2025 -

O Erotas I Fygi Kai I Syllipsi Pera Apo Ta Tampoy

May 20, 2025

O Erotas I Fygi Kai I Syllipsi Pera Apo Ta Tampoy

May 20, 2025 -

Kylian Jaminet Denonce Les Sommes Exorbitantes Impliquees Dans Le Transfert De Melvyn Jaminet

May 20, 2025

Kylian Jaminet Denonce Les Sommes Exorbitantes Impliquees Dans Le Transfert De Melvyn Jaminet

May 20, 2025 -

Big Bear Ai Bbai Stock Losses Legal Options For Investors

May 20, 2025

Big Bear Ai Bbai Stock Losses Legal Options For Investors

May 20, 2025 -

All The Eurovision 2025 Artists You Need To Know

May 20, 2025

All The Eurovision 2025 Artists You Need To Know

May 20, 2025

Latest Posts

-

3 1

May 21, 2025

3 1

May 21, 2025 -

Serie A Lazio Fight Back For Draw Against Juventus

May 21, 2025

Serie A Lazio Fight Back For Draw Against Juventus

May 21, 2025 -

Late Drama As Lazio And 10 Man Juventus Share Points

May 21, 2025

Late Drama As Lazio And 10 Man Juventus Share Points

May 21, 2025 -

10 Man Juventus Held To Draw By Lazio In Serie A Thriller

May 21, 2025

10 Man Juventus Held To Draw By Lazio In Serie A Thriller

May 21, 2025 -

Lazios Late Goal Secures Draw Against Reduced Juventus

May 21, 2025

Lazios Late Goal Secures Draw Against Reduced Juventus

May 21, 2025