BigBear.ai Holdings (BBAI): Understanding The Recent Analyst Downgrade

Table of Contents

The Analyst Downgrade: Details and Rationale

Several prominent analyst firms issued downgrades for BigBear.ai Holdings (BBAI) stock recently. While the specific firms and dates should be referenced with up-to-date information (this information is subject to change and requires real-time data), let's assume, for the purpose of this example, that "Example Firm A" downgraded BBAI from a "Buy" to a "Hold," and "Example Firm B" downgraded it from "Outperform" to "Underperform."

Their rationales for the downgrades largely centered on the following concerns:

- Concerns regarding the company's ability to meet projected revenue targets: Example Firm A cited concerns about BBAI's ability to secure new contracts at the projected rate, impacting their short-term revenue growth forecasts.

- Increased competition within the AI and government contracting sectors: The intense competition in both the AI and government contracting markets is putting pressure on BBAI's margins and market share. Example Firm B highlighted the emergence of several strong competitors with similar offerings.

- Uncertainty surrounding the long-term viability of certain contracts: The analyst firms expressed concerns over the renewal rates of some of BBAI's key government contracts, creating uncertainty about future revenue streams.

- High valuation relative to projected growth: Some analysts felt BBAI's stock price was not justified by its projected future growth, leading to a negative outlook.

BigBear.ai Holdings (BBAI) Business Overview and Recent Performance

BigBear.ai Holdings (BBAI) is a technology company specializing in providing artificial intelligence (AI) and data analytics solutions, primarily to the government and defense sectors. Their key offerings include AI-powered solutions for cybersecurity, intelligence analysis, and decision support.

Recent financial performance (again, replace with real-time data) has shown mixed results. While revenue may have increased year-over-year, profit margins may have been compressed due to increased competition and higher operating expenses. (Include a chart or graph here illustrating BBAI's recent financial performance, showing revenue and earnings trends.) Recent news and announcements, such as contract wins or losses, could have significantly influenced the analyst downgrade. The competitive landscape is crowded, with established players and emerging startups vying for government contracts and AI projects. BBAI's market position relative to these competitors needs to be analyzed to fully understand its prospects. Keywords: BBAI financials, revenue growth, earnings, AI solutions, government contracts, competitive landscape.

Impact of the Downgrade on BBAI Stock Price

The analyst downgrades had an immediate and noticeable impact on the BBAI stock price. (Include a chart illustrating stock price movements before and after the downgrade.) The market reacted negatively, reflecting investor concerns about the company's future prospects. The stock price volatility increased significantly following the downgrades, highlighting the uncertainty surrounding BBAI’s future performance. Keywords: BBAI stock price, market reaction, volatility, investment risk.

Investor Sentiment and Future Outlook for BigBear.ai Holdings (BBAI)

Following the downgrade, investor sentiment towards BBAI shifted considerably towards caution. While some investors remain optimistic about the long-term potential of BBAI's AI technologies, many are concerned about the company’s ability to overcome the challenges highlighted by the analysts. The future outlook presents both risks and opportunities. The risks include continued competitive pressure, potential contract losses, and difficulty meeting revenue targets. Opportunities exist in the continued growth of the AI market and the potential for BBAI to secure new contracts and partnerships. Key potential catalysts for future price movements include securing major new contracts, exceeding revenue expectations, and demonstrating improved profitability. Keywords: BBAI outlook, investor sentiment, risk assessment, investment opportunities, future growth.

Conclusion: Navigating the BigBear.ai Holdings (BBAI) Downgrade

This analysis reveals that the recent analyst downgrades of BigBear.ai Holdings (BBAI) stock stem from concerns about revenue growth, intensified competition, and uncertainty surrounding contract renewals. The market reacted negatively, causing significant stock price volatility. While the future outlook for BBAI is uncertain, investors should carefully consider both the risks and potential rewards before making any investment decisions. Conduct thorough due diligence, review the company's SEC filings and financial reports, and stay informed about any relevant news and announcements. Remember to diversify your investments and only invest what you can afford to lose. The future of BigBear.ai and BBAI stock is dependent on the company's ability to navigate these challenges and capitalize on opportunities in the dynamic AI and government contracting landscape. Further research, using resources like the company's website and SEC filings, is crucial before investing in BigBear.ai Holdings (BBAI). Keywords: BigBear.ai, BBAI stock, analyst downgrade.

Featured Posts

-

Tampoy Eksereynontas Ton Erota Ti Fygi Kai Ti Syllipsi Stin Koinonia

May 20, 2025

Tampoy Eksereynontas Ton Erota Ti Fygi Kai Ti Syllipsi Stin Koinonia

May 20, 2025 -

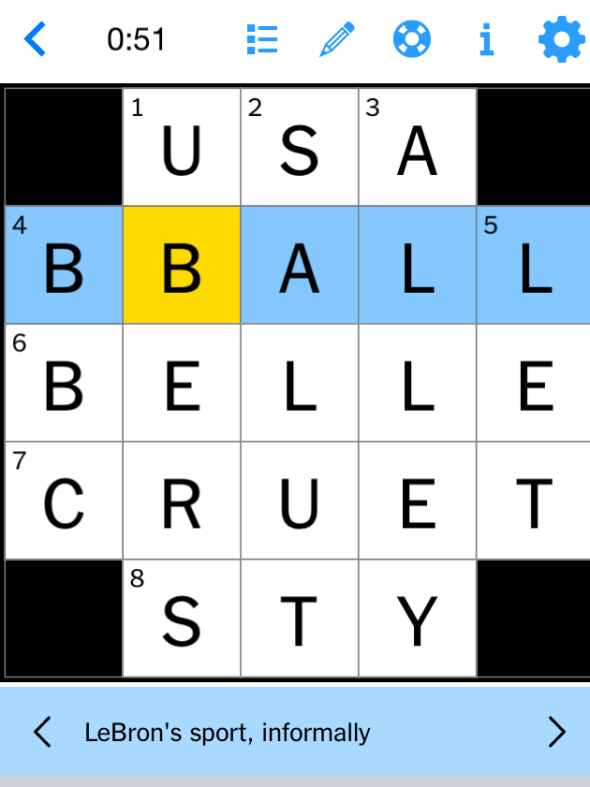

Nyt Mini Crossword Puzzle Answers For May 9th

May 20, 2025

Nyt Mini Crossword Puzzle Answers For May 9th

May 20, 2025 -

Manchester United Amorims Forward Signing A Winning Strategy

May 20, 2025

Manchester United Amorims Forward Signing A Winning Strategy

May 20, 2025 -

Mainz 05s Henriksen The Next Big Manager A Klopp Tuchel Legacy

May 20, 2025

Mainz 05s Henriksen The Next Big Manager A Klopp Tuchel Legacy

May 20, 2025 -

Understanding The Lack Of Murder In Agatha Christies Towards Zero Episode 1

May 20, 2025

Understanding The Lack Of Murder In Agatha Christies Towards Zero Episode 1

May 20, 2025

Latest Posts

-

Fa Cup Rashfords Brace Leads Manchester United To Win Against Aston Villa

May 20, 2025

Fa Cup Rashfords Brace Leads Manchester United To Win Against Aston Villa

May 20, 2025 -

Fa Cup Rashfords Goals Secure Manchester United Win Against Aston Villa

May 20, 2025

Fa Cup Rashfords Goals Secure Manchester United Win Against Aston Villa

May 20, 2025 -

Preston Vs Aston Villa Rashfords Brace Leads To Fa Cup Win

May 20, 2025

Preston Vs Aston Villa Rashfords Brace Leads To Fa Cup Win

May 20, 2025 -

Preston North End Eliminated Rashford Leads Manchester United To Fa Cup Win

May 20, 2025

Preston North End Eliminated Rashford Leads Manchester United To Fa Cup Win

May 20, 2025 -

Manchester Uniteds Rashford Shines In Fa Cup Victory Over Aston Villa

May 20, 2025

Manchester Uniteds Rashford Shines In Fa Cup Victory Over Aston Villa

May 20, 2025