BigBear.ai Holdings, Inc. (BBAI): Analyst Downgrade And Growth Concerns

Table of Contents

Analyst Downgrade: A Deep Dive into the Reasons

The recent negative sentiment surrounding BBAI stems largely from a downgrade issued by [Analyst Firm Name], a prominent investment research firm. They lowered their rating on BBAI from [Previous Rating] to [New Rating], and adjusted their target price from [Previous Target Price] to [New Target Price].

Specifics of the Downgrade:

- Slower-than-expected revenue growth: The analyst cited concerns about BigBear.ai's revenue growth, noting that Q[Quarter] results fell short of expectations by [Percentage]%. This was attributed to delays in several key government contract awards.

- Increased competition: The report highlighted the intensifying competition within the AI and government contracting sectors, suggesting that BigBear.ai faces challenges from larger, more established players with deeper resources.

- Execution risks: The analyst expressed concerns about BigBear.ai's ability to successfully execute its business plan, particularly regarding the integration of recent acquisitions and the management of complex government projects. "The company's track record in successfully integrating acquisitions remains a key concern," the report stated.

Market Reaction to the Downgrade:

The market reacted swiftly to the downgrade. BBAI stock experienced a [Percentage]% drop on the day of the announcement, with trading volume significantly exceeding its average. While the initial drop was sharp, subsequent price movements have been more volatile, indicating investor uncertainty. [Include a chart or graph illustrating the price movement if possible]. It's important to note that not all analysts share this pessimistic view; some maintain a more positive outlook, citing the company's long-term potential in the rapidly growing AI market.

Growth Concerns: Challenges Facing BigBear.ai

Several factors contribute to the growing concerns regarding BigBear.ai's growth trajectory.

Revenue Growth Slowdown:

- Government contract delays: BigBear.ai's revenue is heavily reliant on government contracts, and any delays in awarding these contracts directly impact revenue streams. Recent delays have been attributed to [Reasons for delays, e.g., bureaucratic processes, budgetary constraints].

- Integration challenges: Acquisitions can be disruptive, and the successful integration of acquired companies is crucial for realizing synergies and generating growth. BigBear.ai has undertaken several acquisitions recently, and their seamless integration is key to future success.

- Increased operating costs: Higher operating costs associated with expansion and R&D could also be impacting profitability and slowing down revenue growth.

Competitive Landscape:

BigBear.ai operates in a highly competitive landscape. Key competitors include [List Key Competitors], each possessing significant resources and market share. While BigBear.ai boasts specialized AI capabilities and a strong government contracting presence, it faces significant competition for contracts and talent.

- Competitor A: Holds [Percentage]% market share, known for [Strengths].

- Competitor B: Focuses on [Specific Market Segment], leveraging [Competitive Advantage].

Execution Risks:

- Project Management: Successfully managing large, complex government contracts requires robust project management capabilities. Failures in this area can lead to cost overruns, delays, and reputational damage.

- Talent Retention: Attracting and retaining skilled AI professionals in a competitive market is crucial for BigBear.ai's continued innovation and growth.

- Technological Advancements: The rapid pace of technological change requires continuous innovation to remain competitive. Failure to keep pace could lead to market share erosion.

Future Outlook for BigBear.ai (BBAI) Stock

Despite the current challenges, several potential catalysts could drive future growth for BigBear.ai.

Potential Catalysts for Growth:

- Successful contract wins: Securing significant new government contracts would significantly boost revenue and investor confidence.

- Strategic partnerships: Collaborations with other companies could unlock new market opportunities and enhance BigBear.ai's technological capabilities.

- Technological breakthroughs: Significant advancements in BigBear.ai's AI technologies could create new revenue streams and attract further investment.

Investment Considerations:

Investors should carefully weigh the risks and opportunities before investing in BBAI. The recent downgrade, coupled with the growth concerns outlined above, highlights the inherent volatility of the stock. However, the company's strong position in the growing AI market and its potential for future growth offer significant long-term possibilities.

Conclusion: Assessing the Risks and Opportunities in BigBear.ai (BBAI)

This analysis has explored the recent analyst downgrade of BigBear.ai (BBAI) stock and the underlying concerns regarding its growth prospects. While challenges exist, including slower-than-expected revenue growth, increased competition, and execution risks, potential catalysts for future growth also remain. Therefore, investors must conduct thorough due diligence before investing in BigBear.ai (BBAI) stock, carefully weighing the insights provided in this analysis of recent analyst downgrades and growth concerns. Understanding these factors is crucial for making informed investment decisions.

Featured Posts

-

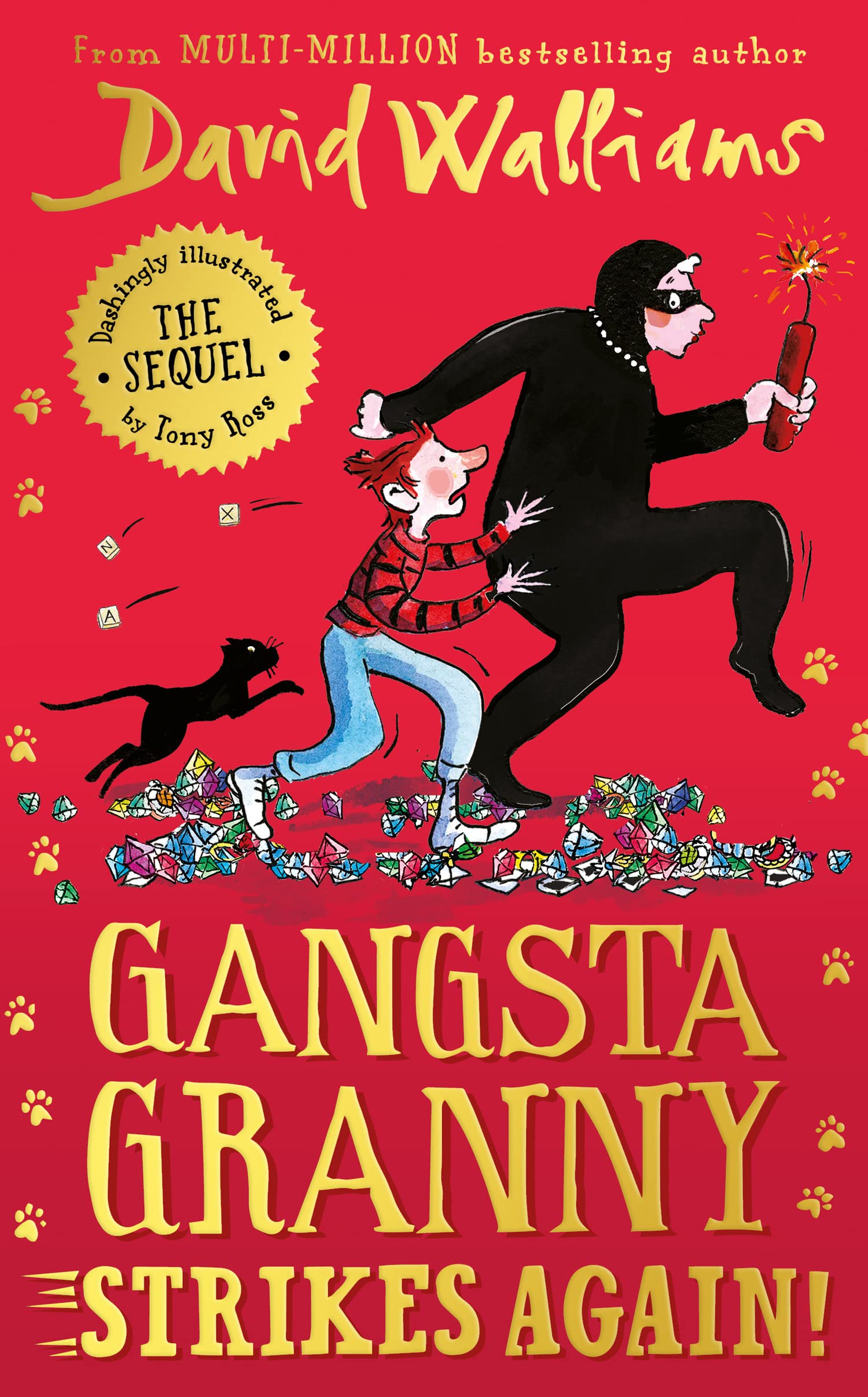

Is Gangsta Granny Suitable For Young Readers A Parents Guide

May 21, 2025

Is Gangsta Granny Suitable For Young Readers A Parents Guide

May 21, 2025 -

Le Bouillon A Clisson Un Festival De Spectacles Engages

May 21, 2025

Le Bouillon A Clisson Un Festival De Spectacles Engages

May 21, 2025 -

I Ypothesi Giakoymaki Mia Meleti Peri Bullying Vasanismon Kai Tragikis Apoleias

May 21, 2025

I Ypothesi Giakoymaki Mia Meleti Peri Bullying Vasanismon Kai Tragikis Apoleias

May 21, 2025 -

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki Programma And Eisitiria

May 21, 2025

Synaylia Kathigiton Dimotikoy Odeioy Rodoy Stin Dimokratiki Programma And Eisitiria

May 21, 2025 -

See Vybz Kartel Live In New York Details Of The Historic Show

May 21, 2025

See Vybz Kartel Live In New York Details Of The Historic Show

May 21, 2025