BigBear.ai Holdings Inc. (BBAI): Growth Concerns Following Analyst Downgrade

Table of Contents

The Analyst Downgrade: Reasons and Implications

The downgrade of BigBear.ai (BBAI) stock came from [Name of Analyst Firm], a reputable firm with a [brief description of their focus and history]. Their decision was primarily based on concerns regarding the company's growth trajectory. Key concerns raised include:

-

Slowing Revenue Growth: The analyst firm expressed doubts about BigBear.ai's ability to maintain its current revenue growth rate, projecting a slowdown in the coming quarters. This concern stems from [specific examples or data mentioned in the analyst report, e.g., reduced contract wins, delays in project completion].

-

Challenges in Securing New Contracts: Competition in the AI and government contracting sectors is fierce. The analyst report highlighted difficulties BigBear.ai faces in securing new contracts, citing [specific examples or data]. This could significantly impact future revenue streams.

-

Intense Competition: The AI and government contracting space is becoming increasingly crowded, with established players and new entrants vying for limited resources. BigBear.ai's ability to compete effectively in this environment is a key factor influencing investor sentiment.

-

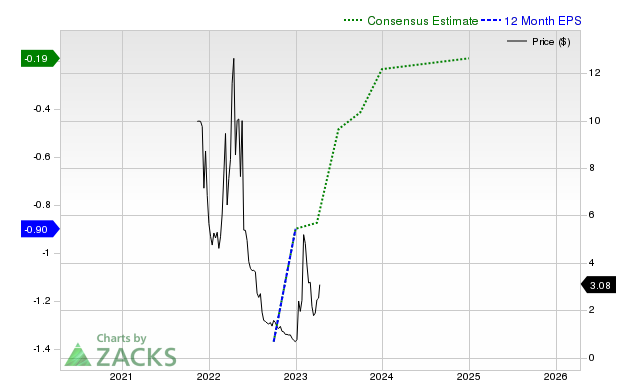

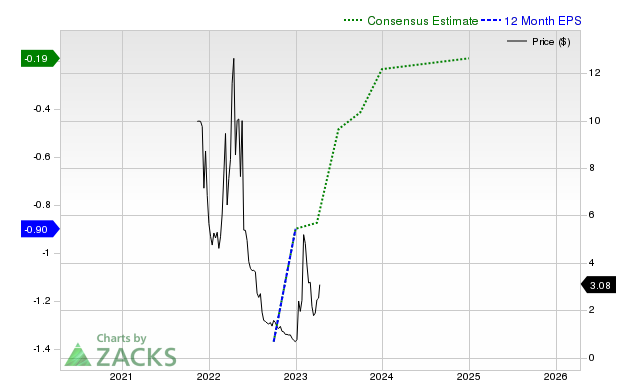

Negative Impact on BBAI Stock Price: Unsurprisingly, the downgrade immediately impacted the BBAI stock price, leading to a [percentage] drop. This highlights the market's sensitivity to analyst opinions and the importance of understanding the underlying reasons behind such assessments.

[Name of Analyst Firm]'s track record shows a [description of their accuracy and reliability, referencing specific past predictions if possible]. This should be considered when evaluating the weight of their assessment.

BigBear.ai's (BBAI) Business Model and Recent Performance

BigBear.ai's (BBAI) core business model revolves around providing AI-driven solutions to both government and commercial clients. These solutions range from [briefly list examples of their offerings, e.g., data analytics, cybersecurity, and AI-powered decision support systems].

Recent financial performance has been [describe recent financial performance using concrete numbers from financial reports - revenue, earnings, profit margins etc.]. Key achievements and setbacks include:

-

Recent Contract Wins/Losses: [List significant contract wins and losses, quantifying their impact if possible].

-

Product Launches/Failures: [Describe the success or failure of recent product launches, again with quantifiable data if available].

-

Progress in Strategic Initiatives: [Discuss the progress made on key strategic initiatives, highlighting successes and challenges].

Overall, BigBear.ai's financial health and stability appear [positive, negative, or mixed – justify with specific data and context].

Assessing the Long-Term Growth Potential of BBAI Stock

Despite the analyst downgrade, BigBear.ai's long-term growth potential remains a subject of debate. While concerns are valid, several factors could contribute to future growth:

-

Government Spending on AI: Increased government spending on AI and related technologies presents a significant opportunity for BigBear.ai to secure new contracts.

-

AI Product Innovation: BigBear.ai's ability to innovate and develop new, competitive AI products and services will be crucial for its long-term success.

-

Strategic Partnerships and Acquisitions: Strategic collaborations and acquisitions could accelerate BigBear.ai's growth and expand its market reach.

-

Market Share Expansion: Capturing a larger market share in both the government and commercial sectors is essential for achieving sustained growth.

However, risks remain. Investing in BBAI stock carries inherent uncertainties, including competition, technological disruption, and the potential for further negative analyst reports.

Comparing BBAI to Competitors

BigBear.ai competes with several established players in the AI and government contracting space, including [list key competitors with brief descriptions of their strengths and weaknesses]. BigBear.ai's competitive advantages include [list advantages, e.g., specialized expertise, proprietary technology, strong client relationships], while its disadvantages may include [list disadvantages, e.g., smaller market share, limited resources compared to larger competitors].

Investor Sentiment and Market Reaction

The market reacted negatively to the analyst downgrade, with the BBAI stock price experiencing a [percentage] drop. Trading volume [increased/decreased] significantly, indicating [interpret the significance of the trading volume change]. Analyst ratings have also [summarize changes in analyst ratings, if available]. Investor sentiment is currently [describe the overall investor sentiment – cautious, pessimistic, or a mix].

Conclusion

The analyst downgrade of BigBear.ai (BBAI) stock raises serious concerns regarding its short-term growth prospects. While the company possesses potential for long-term growth fueled by increasing government AI spending and its own innovations, investors must carefully weigh the risks and opportunities before investing. Thorough due diligence, including analysis of financial statements and competitive landscape, is crucial. Before making any investment decisions regarding BigBear.ai (BBAI) stock, consider the information presented here and continue monitoring the stock's performance, news releases, and further analyst reports. Stay informed to make well-informed decisions about this evolving investment opportunity.

Featured Posts

-

O Giakoymakis Kai I Kroyz Azoyl Ston Teliko Toy Champions League Mia Istoriki Prokrisi

May 21, 2025

O Giakoymakis Kai I Kroyz Azoyl Ston Teliko Toy Champions League Mia Istoriki Prokrisi

May 21, 2025 -

Mia Wasikowska Joins Taika Waititis New Family Film

May 21, 2025

Mia Wasikowska Joins Taika Waititis New Family Film

May 21, 2025 -

D Wave Quantum Qbts Stock Plunge Understanding Mondays Decline

May 21, 2025

D Wave Quantum Qbts Stock Plunge Understanding Mondays Decline

May 21, 2025 -

Understanding The Friday Rise In D Wave Quantum Qbts Stock

May 21, 2025

Understanding The Friday Rise In D Wave Quantum Qbts Stock

May 21, 2025 -

Abn Amro Aex Stijging Analyse Van De Kwartaalresultaten

May 21, 2025

Abn Amro Aex Stijging Analyse Van De Kwartaalresultaten

May 21, 2025