BigBear.ai Stock: A Detailed Investment Assessment

Table of Contents

Company Overview and Business Model

BigBear.ai provides advanced AI-driven solutions to government and commercial clients. Its core business centers around leveraging cutting-edge technology to solve complex problems across various sectors. BigBear.ai's services are primarily focused on delivering mission-critical applications, data analytics, and national security solutions.

- AI-Driven Solutions: BigBear.ai employs sophisticated AI algorithms and machine learning models to analyze large datasets, predict outcomes, and automate processes. These solutions are tailored to specific client needs, offering substantial improvements in efficiency and accuracy.

- Government Contracts: A significant portion of BigBear.ai's revenue stems from government contracts, particularly within the defense and intelligence communities. This reliance on government spending presents both opportunities and risks, depending on government budget cycles and policy shifts.

- Commercial Applications: BigBear.ai is also expanding its commercial client base, targeting industries like finance, healthcare, and energy where its advanced analytics can offer significant value. This diversification is crucial for mitigating reliance on a single client sector.

- Strategic Acquisitions and Partnerships: BigBear.ai’s growth strategy involves strategic acquisitions and partnerships to expand its capabilities and market reach. These acquisitions often bring new technologies, talent, and client relationships, contributing to overall business growth. The success of this strategy is a key factor in evaluating BigBear.ai's long-term prospects.

Keywords: BigBear.ai services, BigBear.ai clients, BigBear.ai technology, AI solutions, government contracts, commercial applications.

Financial Performance and Valuation

Evaluating BigBear.ai's financial health requires a thorough examination of its recent financial reports. While revenue growth might be impressive, assessing profitability and debt levels is crucial for understanding the company's long-term sustainability.

- Revenue Growth and Profitability: Analyzing BigBear.ai's revenue growth rate alongside its net income (or loss) provides insights into its operational efficiency and ability to translate revenue into profits. Consistent growth and improving profitability are positive signs for investors.

- Key Financial Ratios: Investors should analyze key financial ratios like the Price-to-Earnings (P/E) ratio to assess valuation relative to its earnings, and consider the revenue growth rate in context with industry peers. A high P/E ratio might suggest the stock is overvalued, whereas a low P/E ratio might indicate undervaluation or potential risks.

- Debt Levels and Cash Flow: High levels of debt can be a significant risk factor. Examining BigBear.ai's debt-to-equity ratio and its cash flow from operations is essential to understanding its financial stability and ability to meet its obligations. Positive cash flow indicates financial health and the ability to fund future growth.

- Comparison to Industry Peers: Comparing BigBear.ai's financial performance to its competitors in the AI sector is essential for determining its relative strengths and weaknesses. This comparison provides context and helps assess its competitiveness within the market.

Keywords: BigBear.ai financials, BigBear.ai revenue, BigBear.ai earnings, BigBear.ai valuation, financial analysis, stock valuation.

Market Analysis and Competitive Landscape

The market for AI-driven solutions is experiencing rapid expansion, creating both opportunities and challenges for BigBear.ai. Understanding its market share and competitive positioning is critical for assessing its investment potential.

- AI Market Potential: The global market for AI is vast and growing at a significant rate. BigBear.ai's ability to capitalize on this growth depends on its ability to innovate, adapt, and compete effectively.

- BigBear.ai's Market Share: Determining BigBear.ai's market share, both within the broader AI sector and its niche segments, helps gauge its competitive standing and potential for future growth.

- Key Competitors: Identifying and analyzing BigBear.ai's main competitors – including both large established players and smaller, innovative startups – is vital. Understanding their strengths and weaknesses is crucial for assessing BigBear.ai’s competitive advantages.

- Market Trends and Disruptions: Keeping abreast of emerging trends and potential disruptions within the AI industry is crucial. Technological advancements, regulatory changes, and shifts in market demand can significantly impact BigBear.ai's future prospects.

Keywords: AI market, BigBear.ai competitors, competitive analysis, market share, market growth, industry trends.

Risks and Challenges

Investing in BigBear.ai stock involves inherent risks. A thorough understanding of these potential challenges is essential for responsible investment decision-making.

- Regulatory Risks: Government regulations concerning data privacy, national security, and the use of AI can significantly impact BigBear.ai's operations and growth.

- Competition: The AI sector is highly competitive, with both established players and new entrants vying for market share. BigBear.ai’s ability to maintain a competitive edge is crucial for its long-term success.

- Financial Risks: Financial risks include the possibility of lower-than-expected revenue, losses, and debt accumulation. A careful analysis of its financial statements is crucial in mitigating these risks.

- Technological Risks: Rapid technological advancements could render BigBear.ai's existing technologies obsolete, requiring substantial investments in research and development to maintain competitiveness.

Keywords: BigBear.ai risks, investment risks, market risks, financial risks, competitive risks.

Future Outlook and Growth Potential

BigBear.ai's future outlook hinges on its ability to execute its strategic plans and adapt to the ever-changing AI landscape. Assessing its growth potential requires analyzing both internal and external factors.

- Growth Catalysts: Potential catalysts for growth include the launch of new products and services, strategic partnerships, expansion into new markets, and successful acquisitions.

- Market Conditions: Favorable macroeconomic conditions and continued growth in the AI sector will positively influence BigBear.ai's prospects. Conversely, economic downturns or shifts in market demand could negatively impact its performance.

- Strategic Execution: The company's ability to successfully execute its strategic plan, including its acquisition strategy and product development roadmap, is crucial for achieving its stated growth goals.

Keywords: BigBear.ai future, growth prospects, investment outlook, market outlook, future growth.

Conclusion

This BigBear.ai stock analysis reveals a company operating in a high-growth sector with significant potential but also considerable risks. While BigBear.ai's innovative AI solutions and strategic acquisitions show promise, the company’s reliance on government contracts, competitive landscape, and financial performance warrant close scrutiny. The assessment leans towards a cautiously optimistic view, but further due diligence is crucial.

Call to Action: Before investing in BigBear.ai stock, conduct your own thorough research, analyzing financial statements, industry reports, and competitive analyses. Consider your personal risk tolerance and investment goals. Explore additional resources such as SEC filings, analyst reports, and financial news outlets to perform a comprehensive BigBear.ai stock analysis. Remember, BigBear.ai investment opportunities come with inherent risks, and careful due diligence is paramount to making informed decisions. Consider exploring BigBear.ai stock prospects alongside other promising AI investments for diversification.

Featured Posts

-

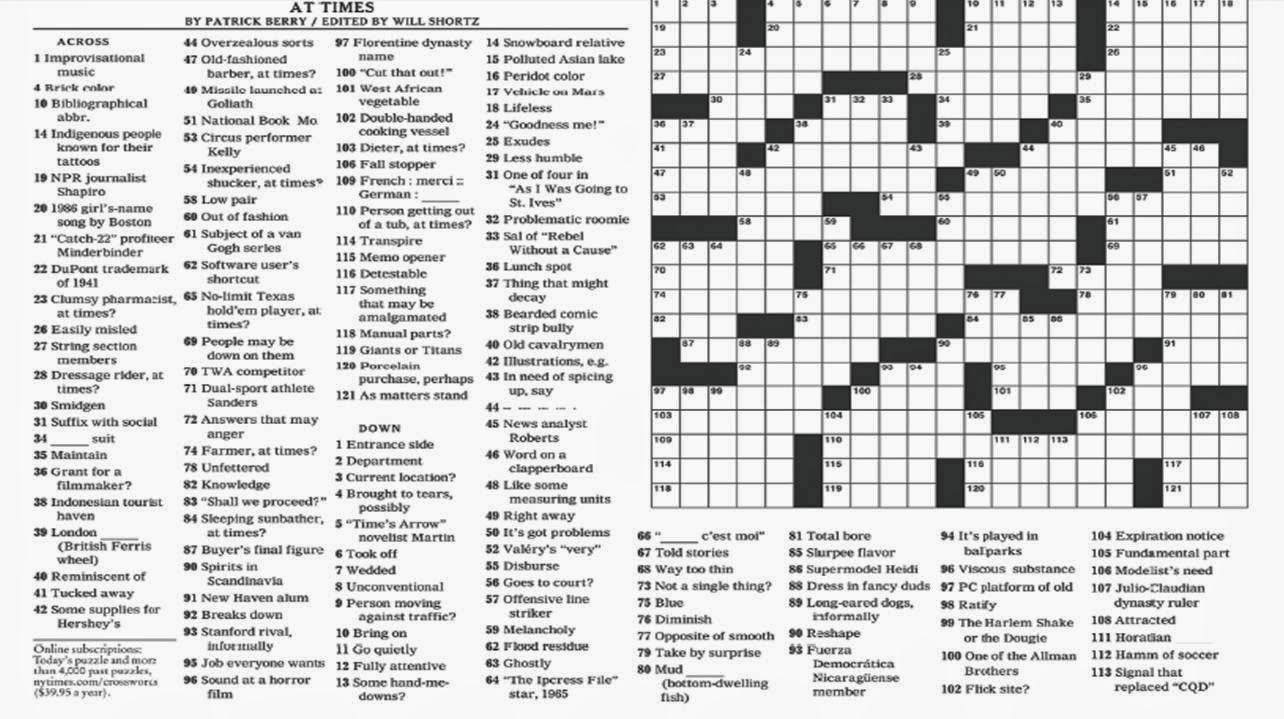

Nyt Mini Crossword May 1 Solving The Marvel Avengers Clue

May 20, 2025

Nyt Mini Crossword May 1 Solving The Marvel Avengers Clue

May 20, 2025 -

Joint Us Australia Missile Test Sparks Chinese Ire

May 20, 2025

Joint Us Australia Missile Test Sparks Chinese Ire

May 20, 2025 -

Stade Toulousain Et Jaminet Trouvent Un Accord Sur Le Remboursement

May 20, 2025

Stade Toulousain Et Jaminet Trouvent Un Accord Sur Le Remboursement

May 20, 2025 -

Parcours De Femmes A Biarritz Colloques Et Debats Pour La Journee Internationale Des Droits Des Femmes

May 20, 2025

Parcours De Femmes A Biarritz Colloques Et Debats Pour La Journee Internationale Des Droits Des Femmes

May 20, 2025 -

Risparmia Hercule Poirot Per Ps 5 A Prezzo Bomba Su Amazon Sotto I 10 E

May 20, 2025

Risparmia Hercule Poirot Per Ps 5 A Prezzo Bomba Su Amazon Sotto I 10 E

May 20, 2025

Latest Posts

-

Interview Barry Ward On Playing Cops And Casting

May 21, 2025

Interview Barry Ward On Playing Cops And Casting

May 21, 2025 -

Barry Ward Discusses His Career From Cop Roles To Diverse Characters

May 21, 2025

Barry Ward Discusses His Career From Cop Roles To Diverse Characters

May 21, 2025 -

Barry Ward Interview I Look Like A Cop

May 21, 2025

Barry Ward Interview I Look Like A Cop

May 21, 2025 -

Espn Insider Deciphering The Bruins Crucial Offseason Moves

May 21, 2025

Espn Insider Deciphering The Bruins Crucial Offseason Moves

May 21, 2025 -

Bruins Offseason Espn Highlights Key Decisions And Franchise Impact

May 21, 2025

Bruins Offseason Espn Highlights Key Decisions And Franchise Impact

May 21, 2025