BigBear.ai Stock Evaluation: A Current Market Perspective

Table of Contents

BigBear.ai (BBAI) operates in the burgeoning artificial intelligence market, offering a diverse portfolio of AI-powered solutions. This comprehensive evaluation analyzes BigBear.ai's current market standing, financial performance, growth potential, and competitive landscape to help determine whether it represents a sound investment opportunity. We'll delve into the key factors impacting its stock price and offer a balanced perspective for potential investors considering a BigBear.ai investment.

BigBear.ai's Business Model and Competitive Landscape

Core Services and Offerings

BigBear.ai provides cutting-edge AI-powered solutions across various sectors. Its core offerings target critical needs in both the public and private sectors. Key services include:

- Advanced analytics for government agencies: BigBear.ai leverages AI and machine learning to process vast datasets, providing actionable intelligence for national security, defense, and other governmental functions. This includes predictive analytics and anomaly detection capabilities.

- Cybersecurity solutions for critical infrastructure: The company develops AI-driven cybersecurity tools to protect essential infrastructure from cyber threats. This involves threat detection, vulnerability assessment, and incident response solutions.

- AI-driven geospatial intelligence for defense applications: BigBear.ai utilizes geospatial data and AI to provide critical intelligence for defense and national security applications. This includes image analysis, target identification, and situation awareness capabilities.

- Data analytics solutions for commercial enterprises: BigBear.ai offers AI-powered data analytics solutions to help commercial clients improve efficiency, make better decisions, and gain a competitive edge. This includes predictive maintenance, fraud detection, and customer insights.

Competitive Analysis

BigBear.ai competes with a range of companies in the AI and technology sectors, including larger tech giants offering similar AI services. While facing competition from established players with significant resources, BigBear.ai differentiates itself through its focus on niche markets, particularly within government and defense sectors. Its specialized expertise in geospatial intelligence and cybersecurity gives it a competitive edge. However, challenges remain in terms of scaling operations and competing with the massive resources of larger competitors. A key area of focus for BigBear.ai's future success will be securing and retaining major government contracts and expanding its commercial client base.

Market Growth Potential

The global artificial intelligence market is experiencing exponential growth. Market research forecasts predict significant expansion over the next decade, driven by increased adoption of AI across various industries. BigBear.ai is strategically positioned to capitalize on this growth, particularly within the government and defense sectors, which are showing increasing investment in AI-powered solutions. However, success depends on its ability to navigate the competitive landscape and successfully execute its growth strategy. Staying at the forefront of AI advancements and maintaining a strong pipeline of innovative solutions will be critical for continued success in this rapidly evolving market.

Financial Performance and Valuation

Revenue and Earnings Analysis

BigBear.ai's financial performance should be analyzed using recent quarterly and annual reports. Investors should focus on revenue growth, profitability (or lack thereof), and key metrics like earnings per share (EPS) and revenue per share. Analyzing trends in these metrics provides insights into the company's financial health and growth trajectory. Looking at revenue streams from different sectors can offer a better understanding of the business's reliance on specific markets. Visual aids, like charts and graphs illustrating revenue and earnings over time, greatly enhance understanding.

Debt and Liquidity

A crucial aspect of evaluating BigBear.ai's financial health involves examining its debt levels, cash flow, and overall liquidity position. High debt levels can pose risks, especially during economic downturns. Assessing the company's ability to manage its debt and maintain sufficient liquidity to fund operations and future growth is vital. Examining the company’s cash flow statement will reveal insights into the efficiency of its operations and its ability to generate cash.

Valuation Metrics

Several valuation metrics, including the Price-to-Earnings ratio (P/E) and Price-to-Sales ratio (P/S), can help assess whether BigBear.ai stock is fairly valued. Comparing these metrics to industry benchmarks and competitors provides valuable context. A thorough analysis of these metrics, along with other relevant valuation tools, will help investors determine if the current stock price accurately reflects the company's intrinsic value and growth potential. It is crucial to compare these figures to similar companies in the AI and technology sectors to gain a comprehensive perspective.

Risk Factors and Opportunities

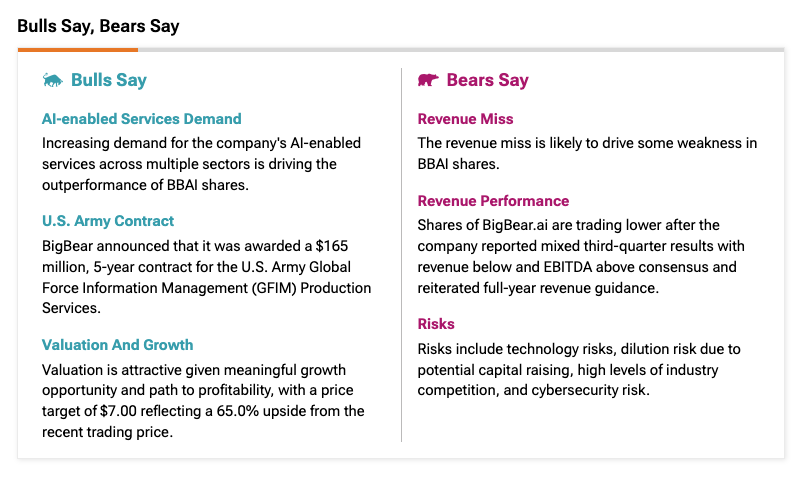

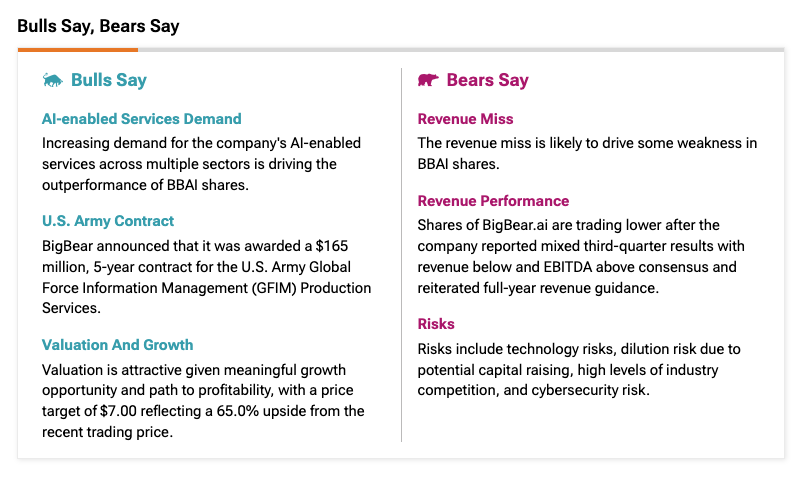

Potential Risks

Investing in BigBear.ai stock carries several risks:

- Intense competition: The AI market is highly competitive, with established players and new entrants vying for market share.

- Regulatory changes: Government regulations can significantly impact the AI industry, creating uncertainty.

- Technological disruptions: Rapid technological advancements could render BigBear.ai's technology obsolete.

- Economic conditions: Economic downturns can reduce demand for AI solutions, impacting revenue and profitability.

- Dependence on government contracts: BigBear.ai's reliance on government contracts makes it vulnerable to changes in government spending.

Growth Opportunities

Despite the risks, BigBear.ai has several growth opportunities:

- Expansion into new markets: Exploring new market segments and geographies can drive revenue growth.

- Strategic partnerships: Collaborating with other technology companies can expand its reach and capabilities.

- Technological advancements: Investing in research and development to stay at the forefront of AI innovation is vital for long-term success.

- Acquisition of complementary businesses: Acquiring companies with complementary technologies or market presence can accelerate growth.

Conclusion

This BigBear.ai stock evaluation reveals a company operating in a high-growth market with significant potential. However, investors must carefully consider the competitive landscape, financial performance, and inherent risks. While BigBear.ai possesses strengths in niche markets and possesses promising technological capabilities, the challenges posed by larger competitors and the inherent risks associated with the AI sector necessitate a thorough assessment. Whether a buy, sell, or hold strategy is appropriate depends largely on individual risk tolerance and investment goals. Further research is highly recommended.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice.

Call to Action: Before making any investment decisions regarding BigBear.ai stock, conduct your own thorough due diligence and consult with a qualified financial advisor.

Featured Posts

-

Vackert Var Det Inte Men Jacob Friis Era Inleddes Med Bortaseger Mot Malta En Lang Kamp

May 20, 2025

Vackert Var Det Inte Men Jacob Friis Era Inleddes Med Bortaseger Mot Malta En Lang Kamp

May 20, 2025 -

Bournemouth Vs Fulham Free Live Stream Details Tv Channel And Time 14 04 25

May 20, 2025

Bournemouth Vs Fulham Free Live Stream Details Tv Channel And Time 14 04 25

May 20, 2025 -

Wolves Matheus Cunha Arsenals New Director Eyes January Move

May 20, 2025

Wolves Matheus Cunha Arsenals New Director Eyes January Move

May 20, 2025 -

Efimereyontes Iatroi Stin Patra Savvatokyriako And Kyriaki

May 20, 2025

Efimereyontes Iatroi Stin Patra Savvatokyriako And Kyriaki

May 20, 2025 -

Dusan Tadic Sueper Lig De 100 Macina Cikti

May 20, 2025

Dusan Tadic Sueper Lig De 100 Macina Cikti

May 20, 2025

Latest Posts

-

The Housemaid And Echo Valley Whats Next For Sydney Sweeney

May 21, 2025

The Housemaid And Echo Valley Whats Next For Sydney Sweeney

May 21, 2025 -

Sejarah Dan Statistik Juara Premier League Siapa Yang Akan Menang Selanjutnya

May 21, 2025

Sejarah Dan Statistik Juara Premier League Siapa Yang Akan Menang Selanjutnya

May 21, 2025 -

Liverpool Menjuarai Liga Inggris Analisis Faktor Kunci Dan Peran Pelatih

May 21, 2025

Liverpool Menjuarai Liga Inggris Analisis Faktor Kunci Dan Peran Pelatih

May 21, 2025 -

Sydney Sweeney Post Echo Valley And The Housemaid Projects

May 21, 2025

Sydney Sweeney Post Echo Valley And The Housemaid Projects

May 21, 2025 -

Analisa Peluang Liverpool Menjadi Juara Liga Inggris 2024 2025

May 21, 2025

Analisa Peluang Liverpool Menjadi Juara Liga Inggris 2024 2025

May 21, 2025