BigBear.ai Stock: Is It A Good Investment Right Now?

Table of Contents

BigBear.ai's Business Model and Growth Potential

BigBear.ai delivers cutting-edge AI-driven solutions primarily to the defense and intelligence sectors. Its business model hinges on securing substantial government contracts and capitalizing on the escalating demand for sophisticated big data analytics and intelligence solutions.

Revenue Streams and Market Opportunity

BigBear.ai's revenue streams are largely derived from government contracts, specifically within the defense and intelligence communities. This dependence presents both opportunity and risk. The potential for growth is significant due to the continuously expanding AI market and the increasing reliance on AI-powered solutions for national security.

- Specific Contracts: BigBear.ai has secured contracts related to various projects including advanced analytics, predictive modeling, and cyber security. (Specific details would require further research and referencing of public filings).

- Market Expansion: The company aims to expand its reach into adjacent markets, such as commercial applications of its AI technology, potentially diversifying revenue streams and reducing reliance on government contracts.

- Key Market Segments: BigBear.ai focuses on high-value market segments characterized by complex data challenges and the need for specialized AI expertise. This strategy allows them to command premium pricing for their services.

Competitive Landscape and Market Share

BigBear.ai operates in a fiercely competitive landscape populated by established technology giants and innovative startups. While it faces stiff competition from companies with extensive resources, BigBear.ai holds specific competitive advantages.

- Key Competitors: (List and analyze key competitors in the AI market, comparing market share and strengths/weaknesses).

- Competitive Advantages: BigBear.ai's expertise in delivering AI solutions tailored to the unique requirements of the defense and intelligence sectors provides a strong competitive edge. Their specialized knowledge and established relationships are difficult to replicate.

- Technological Advantage: The company continuously invests in research and development to maintain a technological edge, focusing on innovative AI algorithms and analytical techniques.

Financial Performance and Valuation

Assessing BigBear.ai's investment potential requires a thorough examination of its financial performance and current stock valuation.

Recent Financial Results

(This section needs to be updated with current financial data obtained from reliable sources like financial news websites or BigBear.ai's financial reports. Include charts and graphs illustrating revenue growth, profitability, and key financial ratios).

- Key Financial Metrics: Analyze revenue growth, earnings per share (EPS), debt-to-equity ratio, and other relevant metrics to understand the company's financial health. Compare these metrics to industry benchmarks to assess relative performance.

- Profitability: Analyze gross profit margins and net profit margins to determine the company's ability to generate profits.

- Debt Levels: Evaluate the level of debt and the company's ability to manage it.

Stock Valuation and Future Projections

The valuation of BigBear.ai stock requires consideration of multiple metrics and a projection of future performance.

- Valuation Metrics: Analyze the Price-to-Earnings (P/E) ratio, Price-to-Sales (P/S) ratio, and other valuation metrics to gauge whether the current stock price is fairly valued.

- Future Projections: Based on the company's financial performance, market outlook, and competitive landscape, formulate a reasoned projection of future stock price movements. (Note: This section should include a disclaimer stating that these are projections and not financial advice).

- Risk Assessment: Clearly define the potential risks associated with investing in BigBear.ai stock, including the possibility of price volatility and the impact of unforeseen circumstances.

Risks and Considerations

Investing in BigBear.ai stock presents various risks that must be carefully considered.

Geopolitical Risks and Government Spending

BigBear.ai's reliance on government contracts exposes it to potential risks associated with shifts in geopolitical situations and changes in government spending priorities.

- Government Budget Cuts: Reductions in defense budgets could significantly impact the company's revenue streams.

- International Relations: Changes in international relations can affect the demand for the company's services and its ability to secure contracts.

- Contract Risk: The nature of government contracting involves complexities and uncertainties that can affect timely payment and project completion.

Technological Disruption and Competition

The rapid pace of technological innovation in the AI industry creates risks associated with technological disruption and intense competition.

- Disruptive Technologies: Emerging technologies could render BigBear.ai's current offerings obsolete, requiring significant investment in adapting to new market demands.

- Competitive Pressure: Competition from larger technology companies with greater resources could impact BigBear.ai's market share.

- Innovation Pace: Failure to maintain apace with the rapidly evolving AI landscape poses a significant threat to the company's future success.

Conclusion

Determining whether BigBear.ai stock is a good investment at present requires a nuanced assessment of its growth potential, financial performance, and associated risks. While the company operates in a promising sector with significant long-term potential, its heavy reliance on government contracts and the competitive landscape introduce substantial uncertainties. Based on the analysis presented above, (insert your conclusion here: state whether you believe it's a good investment or not, justifying your decision with reference to the previous sections).

Call to Action: Before investing in BigBear.ai stock or any other security, conduct thorough due diligence, consult with a qualified financial advisor, and carefully consider your own risk tolerance. This analysis provides valuable information, but it is not a substitute for professional investment advice. Remember to independently research BigBear.ai stock and related market conditions before making any investment decisions.

Featured Posts

-

Beyond The Screen Exploring The Romances Of Twilight Stars

May 20, 2025

Beyond The Screen Exploring The Romances Of Twilight Stars

May 20, 2025 -

Zivot Gina Marie Schumacher Kceri Michaela Schumachera

May 20, 2025

Zivot Gina Marie Schumacher Kceri Michaela Schumachera

May 20, 2025 -

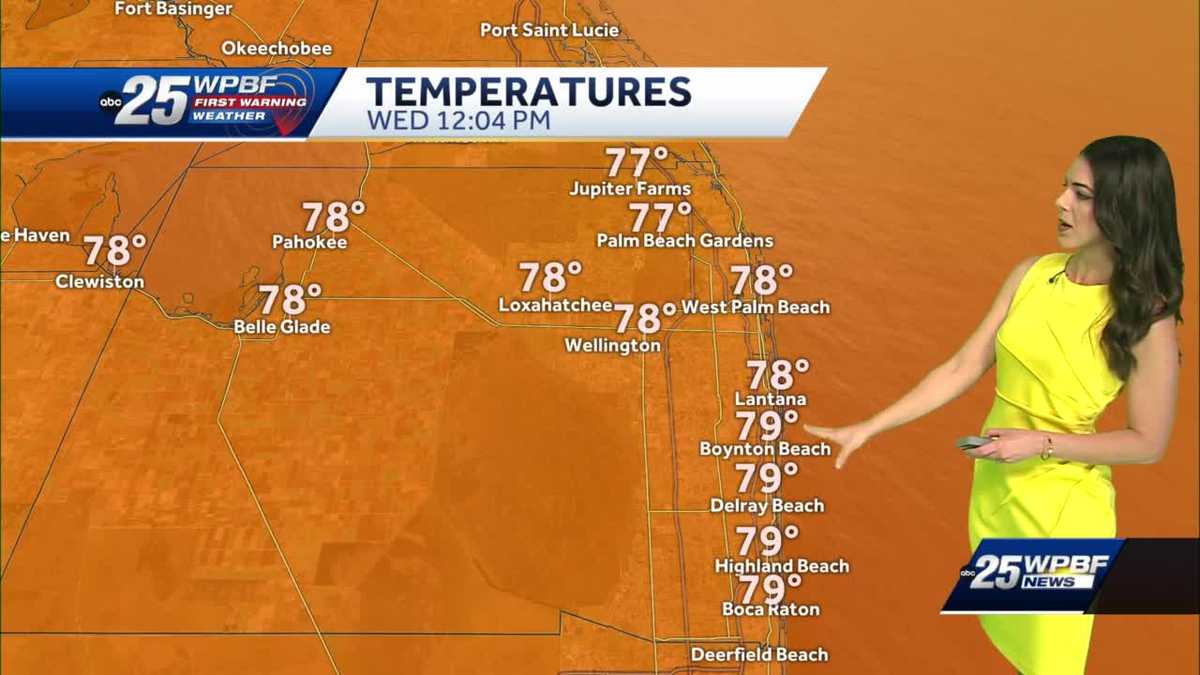

Where To Find Breezy And Mild Weather Year Round

May 20, 2025

Where To Find Breezy And Mild Weather Year Round

May 20, 2025 -

Ankuendigung Endgueltige Form Der Bauplaene Durch Architektin Bestaetigt

May 20, 2025

Ankuendigung Endgueltige Form Der Bauplaene Durch Architektin Bestaetigt

May 20, 2025 -

Millions In Hmrc Refunds Unclaimed Act Now And Check Your Payslip

May 20, 2025

Millions In Hmrc Refunds Unclaimed Act Now And Check Your Payslip

May 20, 2025

Latest Posts

-

Klopp Mu Ancelotti Mi Teknik Direktoer Secimi Analizi

May 21, 2025

Klopp Mu Ancelotti Mi Teknik Direktoer Secimi Analizi

May 21, 2025 -

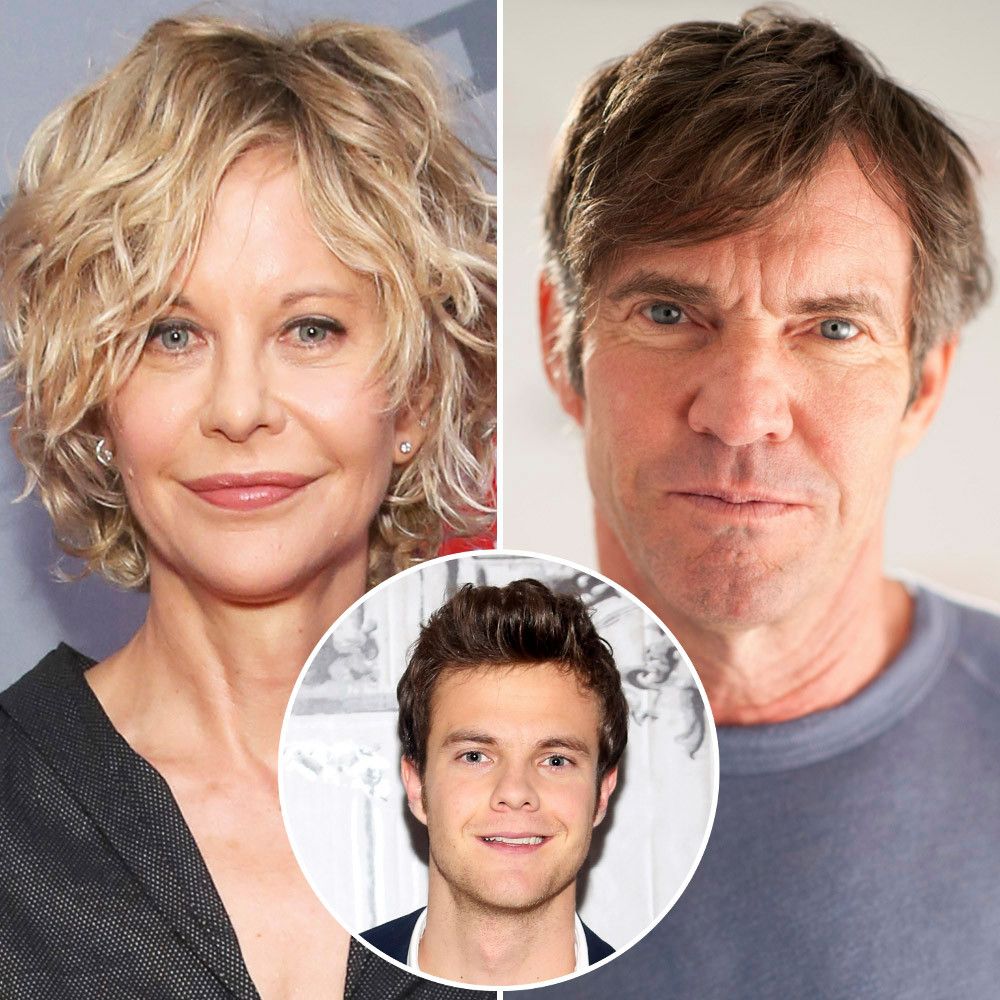

Dennis Quaid Meg Ryan And James Caan An Overlooked Western Neo Noir

May 21, 2025

Dennis Quaid Meg Ryan And James Caan An Overlooked Western Neo Noir

May 21, 2025 -

Real Madrid De Ancelotti Nin Yerine Klopp Olasi Bir Senaryo

May 21, 2025

Real Madrid De Ancelotti Nin Yerine Klopp Olasi Bir Senaryo

May 21, 2025 -

Ancelotti Nin Yerine Klopp Avantajlar Ve Dezavantajlar

May 21, 2025

Ancelotti Nin Yerine Klopp Avantajlar Ve Dezavantajlar

May 21, 2025 -

Juergen Klopp Carlo Ancelotti Nin Yerine Uygun Bir Secenek Mi

May 21, 2025

Juergen Klopp Carlo Ancelotti Nin Yerine Uygun Bir Secenek Mi

May 21, 2025