BigBear.ai's Q1 Financial Report Causes Stock Price Drop

Table of Contents

Key Disappointments in BigBear.ai's Q1 Financial Report

BigBear.ai's Q1 financial report revealed several key disappointments that directly contributed to the subsequent stock price drop. The report significantly missed analysts' expectations across multiple key metrics, triggering a negative market reaction.

Revenue Miss: A Deeper Look at BigBear.ai Q1 Earnings

The most striking aspect of the Q1 financial report was the substantial revenue shortfall. BigBear.ai reported revenues of [Insert Actual Revenue Figure], falling significantly short of the anticipated [Insert Analyst Expectation Figure]. This missed earnings expectations can be attributed to several factors:

- Decreased government contracts: A decline in secured government contracts impacted revenue projections, indicating potential challenges in navigating the competitive landscape of government bidding.

- Delays in project implementation: Several projects experienced delays, pushing revenue recognition into later quarters and contributing to the BigBear.ai Q1 earnings miss.

- Lower-than-anticipated sales in the commercial sector: The commercial sector failed to meet projected sales targets, highlighting potential weaknesses in BigBear.ai's market penetration strategies.

This revenue shortfall directly contributed to the overall negative sentiment surrounding BigBear.ai's Q1 earnings.

Increased Expenses and Operating Losses: Analyzing BigBear.ai Profitability

Adding to the concerns, BigBear.ai reported increased expenses, resulting in significant operating losses. The rise in operating costs further exacerbated the negative impact of the revenue miss on the company's profitability. Key contributing factors include:

- Increased R&D spending: Investments in research and development, while crucial for long-term growth, put pressure on short-term profitability.

- Higher administrative costs: An increase in administrative overhead added to the overall expense burden, impacting BigBear.ai profitability.

- Potential restructuring expenses: The possibility of future restructuring activities could add further financial strain in the coming quarters.

These increased expenses, coupled with the revenue shortfall, created a perfect storm resulting in substantial operating losses for the quarter, fueling concerns about BigBear.ai's financial health.

Guidance for Future Quarters: BigBear.ai's Outlook and Revenue Projections

BigBear.ai's guidance for the remaining quarters of the year further dampened investor sentiment. The company lowered its revenue projections, signaling a continued struggle to meet expectations. Key aspects of the future outlook include:

- Lowered revenue projections: The revised projections suggest a potential for continued revenue shortfalls in the coming quarters.

- Potential for further losses: The company hinted at the possibility of further operating losses, raising serious questions about its path to profitability.

- Timeline for achieving profitability: The company provided a less optimistic timeline for achieving profitability, pushing it further into the future.

This cautious outlook contributed significantly to the negative market reaction and the subsequent BigBear.ai stock price drop.

Market Reaction and Investor Sentiment

The release of BigBear.ai's Q1 financial report triggered a swift and significant negative market reaction.

Immediate Stock Price Impact: The BigBear.ai Stock Price Plunge

The BigBear.ai stock price experienced a sharp decline immediately following the release of the Q1 report. The [Insert Percentage]% drop represented a significant loss for investors, reflecting the severity of the disappointing financial results. This stock price plunge was accompanied by:

- Sharp decline in share price: The immediate impact was a dramatic decrease in the company's share price.

- Increased trading volume: The heightened trading activity indicated significant investor anxiety and a flurry of sell-offs.

- Negative investor reaction: The overall investor sentiment turned sharply negative, leading to a considerable sell-off.

This immediate reaction highlighted the market's strong negative response to the Q1 financial report.

Analyst Reactions and Ratings Changes: BigBear.ai Stock Outlook

Following the report, several financial analysts downgraded their ratings on BigBear.ai stock and revised their price targets downward. These actions reflect the concerns among experts about the company's short-term and long-term prospects. The analyst reactions included:

- Downgrades from analysts: Several leading analysts revised their ratings, reflecting a decreased confidence in BigBear.ai's future performance.

- Revised price targets: Price targets were significantly lowered, reflecting the diminished expectations for future growth.

- Concerns about the company's future: Analysts expressed deep concerns about the company's ability to overcome its current challenges.

These actions further fueled the negative investor sentiment and contributed to the sustained decline in BigBear.ai's stock price.

Long-Term Implications for BigBear.ai: Strategic Repositioning and Long-Term Prospects

The disappointing Q1 report has significant long-term implications for BigBear.ai, potentially impacting its strategic direction and investor confidence. The challenges necessitate a proactive approach to address the underlying issues:

- Potential restructuring: The company may need to undertake a significant restructuring to improve efficiency and reduce costs.

- Changes in business strategy: A reassessment of its business strategy and market focus may be necessary to improve competitiveness.

- Impact on future funding rounds: Securing future funding rounds could become more challenging given the current financial performance.

The long-term prospects of BigBear.ai now heavily depend on its ability to implement effective changes and regain investor confidence.

Conclusion: Analyzing BigBear.ai's Q1 Financial Report and Stock Price Drop

BigBear.ai's Q1 financial report revealed significant shortcomings, resulting in a substantial stock price drop. The revenue miss, increased expenses, lowered guidance, and negative analyst reactions created a perfect storm for investor concern. The company faces significant challenges in the short-term and must address these issues effectively to restore investor confidence and improve its long-term prospects. To stay updated on BigBear.ai's Q2 financial report and monitor the BigBear.ai stock price, follow our analysis of BigBear.ai's financial performance and stay informed about future developments. Understanding the impact of the Q1 financial report on BigBear.ai's stock price is crucial for navigating the complexities of the market.

Featured Posts

-

Hamiltonin Ferrarin Siirto Miksi Se Kariutui

May 20, 2025

Hamiltonin Ferrarin Siirto Miksi Se Kariutui

May 20, 2025 -

Jasmine Paolinis Historic Rome Victory A New Era Begins

May 20, 2025

Jasmine Paolinis Historic Rome Victory A New Era Begins

May 20, 2025 -

Zakat Odnoy Ery Rassvet Drugoy Novaya Sharapova V Mire Tennisa

May 20, 2025

Zakat Odnoy Ery Rassvet Drugoy Novaya Sharapova V Mire Tennisa

May 20, 2025 -

Vtoro Dete Za Dzhenifr Lorns

May 20, 2025

Vtoro Dete Za Dzhenifr Lorns

May 20, 2025 -

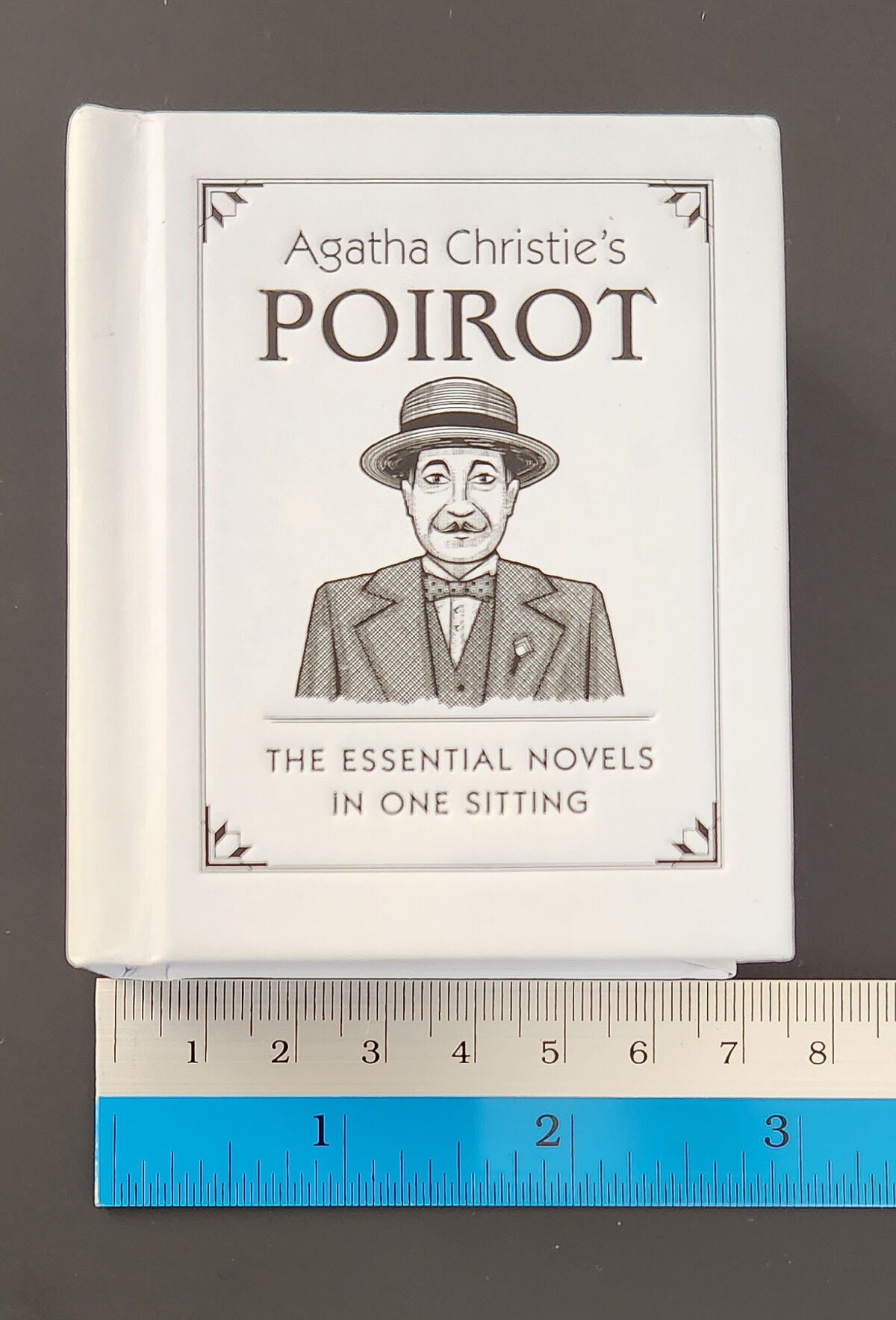

Exploring The Enduring Appeal Of Agatha Christies Poirot

May 20, 2025

Exploring The Enduring Appeal Of Agatha Christies Poirot

May 20, 2025

Latest Posts

-

Juergen Klopp Gelecegin Duenya Devi Nin Teknik Direktoerue Olabilir Mi

May 21, 2025

Juergen Klopp Gelecegin Duenya Devi Nin Teknik Direktoerue Olabilir Mi

May 21, 2025 -

Britains Got Talent The Walliams Cowell Feud Heats Up

May 21, 2025

Britains Got Talent The Walliams Cowell Feud Heats Up

May 21, 2025 -

Klopp Un Geri Doenuesue Bir Futbol Devriminin Baslangici Mi

May 21, 2025

Klopp Un Geri Doenuesue Bir Futbol Devriminin Baslangici Mi

May 21, 2025 -

Behind The Scenes The David Walliams Simon Cowell Britains Got Talent Rift

May 21, 2025

Behind The Scenes The David Walliams Simon Cowell Britains Got Talent Rift

May 21, 2025 -

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Lideri Mi

May 21, 2025

Juergen Klopp Un Doenuesue Duenya Devi Nin Yeni Lideri Mi

May 21, 2025