Billionaires' Favorite ETF: Projected 110% Growth By 2025

Table of Contents

Understanding the Billionaires' Favorite ETF's Investment Strategy

The GrowthPlus ETF (GPUS) employs a unique investment strategy designed to capitalize on long-term growth opportunities. Its core focus is on delivering strong returns while managing risk effectively. Key features of this strategy include:

-

Specific Sectors Targeted: GPUS primarily invests in rapidly expanding sectors such as technology (especially artificial intelligence and cloud computing), renewable energy (solar, wind, and green technologies), and biotechnology (innovative pharmaceuticals and medical devices).

-

Geographic Diversification: The ETF's portfolio is geographically diversified, including exposure to both developed markets (North America, Europe) and high-growth emerging markets (Asia, Latin America). This diversification helps mitigate risk associated with specific regional economic downturns.

-

Investment Approach: GPUS focuses on growth stocks with high potential for appreciation. The fund managers actively select companies exhibiting strong fundamentals, innovative products/services, and significant growth trajectories. Keywords: investment strategy, portfolio diversification, sector allocation, risk management.

Factors Driving the Projected 110% Growth by 2025

The projected 110% growth for GPUS by 2025 is underpinned by several key factors:

-

Technological Advancements: The rapid pace of technological innovation in areas like AI, cloud computing, and renewable energy is expected to drive significant growth in the companies held within the GPUS portfolio.

-

Economic Growth Projections: Positive economic growth projections in the target sectors and regions further support the ETF's growth potential. Strong GDP growth in emerging markets and continued expansion in developed economies are key drivers.

-

Government Policies and Regulations: Supportive government policies, such as tax incentives for renewable energy and investments in technological research, are expected to fuel growth in the targeted sectors.

-

Emerging Market Opportunities: GPUS's exposure to emerging markets offers significant growth potential as these economies continue to develop and their consumption patterns evolve. Keywords: market trends, economic growth, industry analysis, future projections.

Analyzing the Risk and Potential Returns of the Billionaires' ETF

While the projected growth is exciting, it's crucial to consider the potential risks associated with investing in GPUS:

-

Potential Downsides and Risks: Market volatility, sector-specific downturns (e.g., a sudden correction in the tech sector), and geopolitical events can all impact the ETF's performance.

-

Strategies for Mitigating Risks: Diversification within the portfolio, alongside a well-defined risk tolerance assessment, are crucial strategies for managing potential downsides. Understanding your personal risk profile is paramount.

-

Realistic Expectations of Returns: While the 110% projection is ambitious, it's important to remember that past performance doesn't guarantee future results. Investors should establish realistic return expectations. Keywords: risk management, return on investment, market volatility, risk assessment, investment analysis.

Comparing the Billionaires’ ETF to Similar High-Growth Investments

Several other ETFs focus on similar high-growth sectors. However, GPUS distinguishes itself through its specific blend of sector allocation, geographic diversification, and active management. A detailed comparison with other leading high-growth ETFs would require a separate analysis. However, GPUS's unique combination of factors sets it apart. Keywords: ETF comparison, investment alternatives, competitor analysis.

Conclusion: Is the Billionaires' Favorite ETF Right for You?

The GrowthPlus ETF (GPUS) presents a compelling investment opportunity with significant growth potential. The projected 110% growth by 2025 is driven by a strategic investment approach targeting high-growth sectors and leveraging favorable market trends. However, it's essential to carefully assess the associated risks. This high-growth ETF might be a suitable addition to a diversified portfolio for investors with a higher risk tolerance and a long-term investment horizon. Remember to conduct thorough research and consult with a qualified financial advisor before making any investment decisions. Learn more about the Billionaires' Favorite ETF and its potential to transform your investment portfolio. Keywords: Billionaires' ETF, high-growth investment, portfolio diversification, investment strategy.

Featured Posts

-

Who Are The Rogue Exiles In Path Of Exile 2

May 08, 2025

Who Are The Rogue Exiles In Path Of Exile 2

May 08, 2025 -

Lahwr Hayykwrt Awr Dley Edlyh Ke Jjz Ke Lye Sht Ky Bymh Shwlt Ka Aghaz

May 08, 2025

Lahwr Hayykwrt Awr Dley Edlyh Ke Jjz Ke Lye Sht Ky Bymh Shwlt Ka Aghaz

May 08, 2025 -

Psg Nin Nantes La Berabere Kaldigi Mac Oezeti

May 08, 2025

Psg Nin Nantes La Berabere Kaldigi Mac Oezeti

May 08, 2025 -

Los Angeles Wildfires The Disturbing Reality Of Disaster Gambling

May 08, 2025

Los Angeles Wildfires The Disturbing Reality Of Disaster Gambling

May 08, 2025 -

Wednesday 16 April 2025 Daily Lotto Results

May 08, 2025

Wednesday 16 April 2025 Daily Lotto Results

May 08, 2025

Latest Posts

-

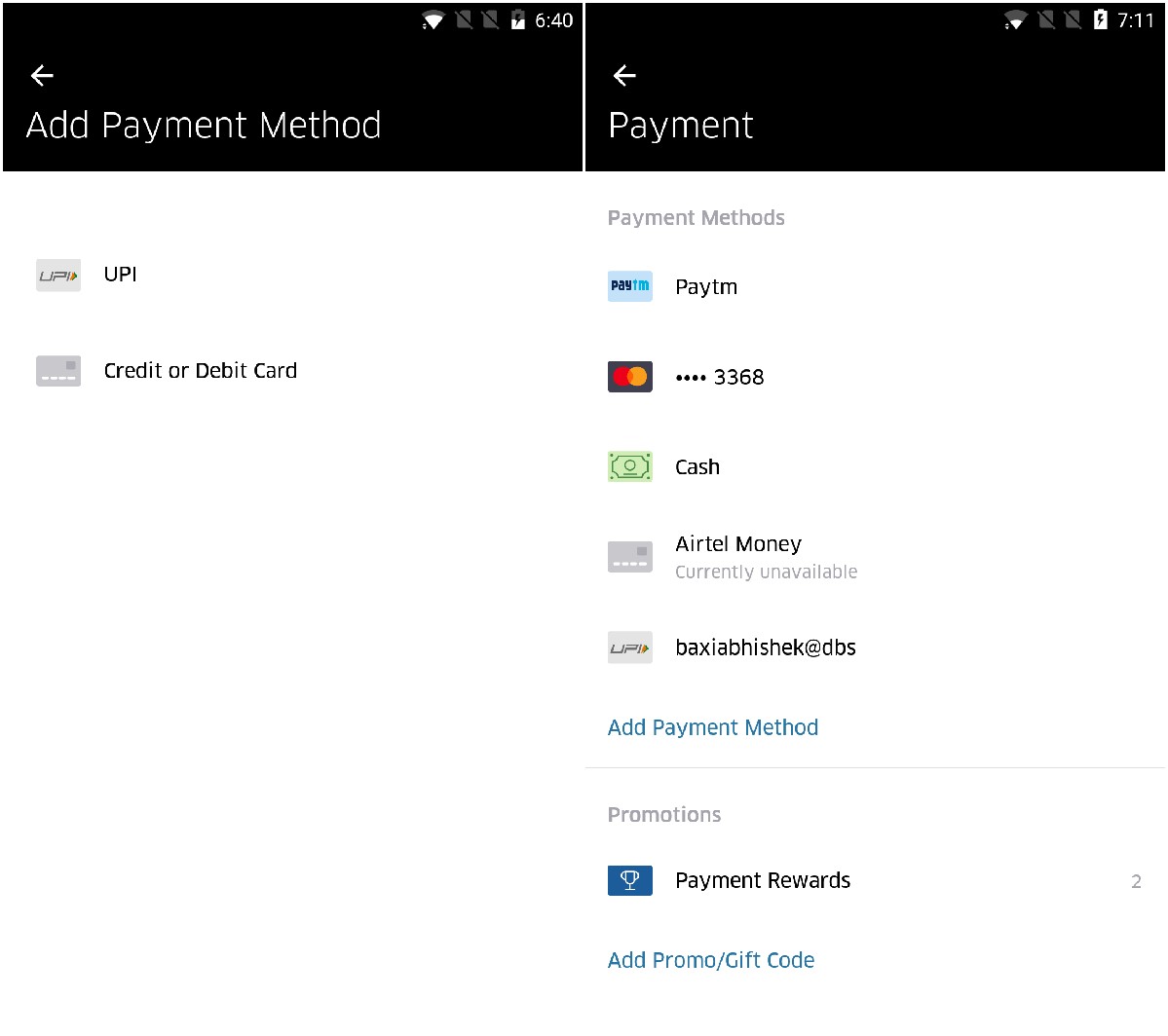

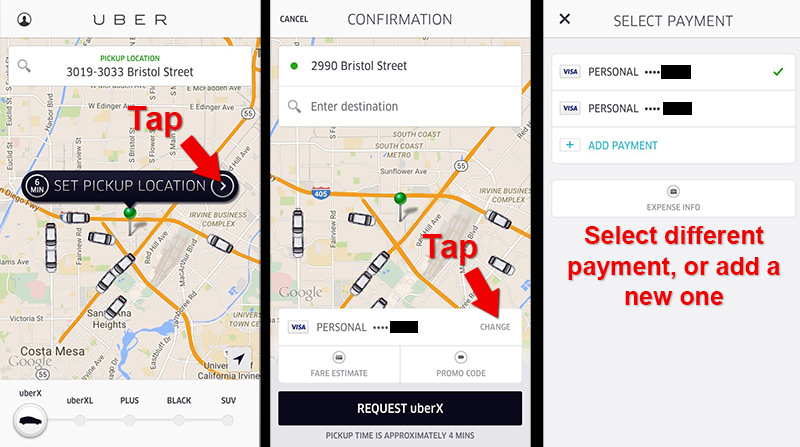

Uber Auto Payments Cash Alternatives And Upi Availability

May 08, 2025

Uber Auto Payments Cash Alternatives And Upi Availability

May 08, 2025 -

Understanding Uber Auto Payment Methods A Guide

May 08, 2025

Understanding Uber Auto Payment Methods A Guide

May 08, 2025 -

Is Upi Payment Still Available For Uber Auto Rides

May 08, 2025

Is Upi Payment Still Available For Uber Auto Rides

May 08, 2025 -

Uber Auto Payment Options Upi And Beyond

May 08, 2025

Uber Auto Payment Options Upi And Beyond

May 08, 2025 -

No More Cash On Uber Auto Upi Payments Explained

May 08, 2025

No More Cash On Uber Auto Upi Payments Explained

May 08, 2025