Billions Added To Elon Musk's Net Worth: Tesla's Rise And Dogecoin's Fall

Table of Contents

Tesla's Stellar Performance and its Impact on Elon Musk's Net Worth

Tesla's remarkable growth has been the primary driver of the increase in Elon Musk's net worth. This success stems from a combination of record-breaking sales, groundbreaking innovation, and overwhelmingly positive market sentiment.

Record-Breaking Sales and Production

- Record Sales Figures: Tesla consistently surpasses sales expectations, achieving record deliveries quarter after quarter. For example, in [Insert Quarter and Year], Tesla delivered [Insert Number] vehicles, a significant increase of [Percentage]% compared to the same period last year. This success is spread across multiple models, including the Model 3, Model Y, Model S, and Model X.

- Increased Production Capacity: Tesla's expansion of its Gigafactories globally has significantly boosted its production capacity, enabling it to meet the growing demand for its electric vehicles (EVs). This increased production directly translates into higher revenue and profits.

- Market Share Growth: Tesla continues to dominate the premium EV segment and is making significant inroads into the mass-market EV sector. Its increasing market share signifies its strong competitive position and future growth potential.

- Impact on Net Worth: As Elon Musk holds a substantial stake in Tesla, the company's soaring market capitalization directly impacts his net worth. A rise in Tesla's stock price translates to a corresponding increase in Elon Musk's personal wealth. For instance, a [Percentage]% increase in Tesla's stock price can add billions to Elon Musk's net worth.

Innovation and Technological Advancements

- Battery Technology: Tesla's continuous advancements in battery technology, including improvements in range, charging speed, and battery life, have significantly enhanced the appeal of its EVs.

- Autonomous Driving: Tesla's Autopilot and Full Self-Driving capabilities, though still under development, represent a significant technological leap and a key differentiator in the EV market. This advanced technology attracts investors and boosts investor confidence.

- New Product Lines: Tesla's expansion into new product lines, such as energy storage solutions (Powerwall and Powerpack), further diversifies its revenue streams and strengthens its position as a leader in sustainable energy.

- Impact on Net Worth: These innovations drive investor confidence, leading to a higher stock valuation and subsequently increasing Elon Musk's net worth. Technological breakthroughs translate to increased profitability, fueling further stock price appreciation.

Positive Market Sentiment and Investor Confidence

- Positive Media Coverage: Tesla consistently receives substantial positive media coverage, highlighting its technological advancements, growth trajectory, and innovative leadership. This positive media attention reinforces investor confidence.

- Favorable Analyst Reports: Numerous financial analysts maintain a positive outlook on Tesla's future performance, contributing to the positive market sentiment surrounding the company.

- Strong Investor Demand: The high demand for Tesla shares reflects the strong investor confidence in the company's long-term prospects.

- Elon Musk's Influence: Elon Musk's public persona and pronouncements, while sometimes controversial, significantly impact investor sentiment and, consequently, Tesla's stock price and Elon Musk's net worth. For example, [mention a specific example of a positive statement or action that boosted Tesla's stock].

Dogecoin's Volatility and its Effect on Elon Musk's Net Worth

While Tesla's success has significantly boosted Elon Musk's net worth, his involvement with Dogecoin has led to considerable volatility.

The Rise and Fall of Dogecoin

- Price History: Dogecoin, initially created as a joke cryptocurrency, experienced remarkable price surges, largely attributed to social media hype and Elon Musk's endorsements. However, it has also experienced significant price crashes, demonstrating the inherent volatility of cryptocurrencies.

- Speculative Nature: Dogecoin's value is heavily influenced by speculation and market sentiment, making it highly susceptible to price swings. Unlike traditional assets with underlying value, Dogecoin's value is largely based on perception and belief.

- Regulatory Uncertainty: The lack of clear regulatory frameworks surrounding cryptocurrencies adds to their inherent volatility and increases the risk for investors, impacting the value of Dogecoin and thus Elon Musk's net worth tied to it.

Musk's Influence and the Dogecoin Community

- Public Statements and Actions: Elon Musk's tweets and public statements regarding Dogecoin have significantly influenced its price, demonstrating the considerable power of influential figures on cryptocurrency markets.

- Social Media's Role: Social media platforms have played a crucial role in amplifying the price fluctuations of Dogecoin, with online communities driving both upward and downward trends.

- Impact on Investor Confidence: Elon Musk's endorsement (or lack thereof) has directly impacted investor confidence in Dogecoin, affecting its price and consequently, Elon Musk's holdings in the cryptocurrency.

The Risks of Cryptocurrency Investment

- Volatility: Cryptocurrencies are notoriously volatile assets, subject to unpredictable price swings driven by various factors, including market sentiment, regulatory changes, and technological advancements.

- Lack of Regulation: The relatively unregulated nature of the cryptocurrency market increases the risk of fraud, manipulation, and substantial losses for investors.

- Diversification and Risk Management: Investors should always diversify their portfolios and employ appropriate risk management strategies to mitigate the significant risks associated with cryptocurrency investments.

Conclusion

The dramatic shifts in Elon Musk's net worth underscore the interconnectedness of his business ventures and the volatile nature of the stock market and cryptocurrency investments. While Tesla's success has undeniably contributed billions to his wealth, the fluctuating value of Dogecoin serves as a potent reminder of the inherent risks involved in speculative investments. Understanding the factors influencing Elon Musk's net worth provides crucial insight into the complex interplay of innovation, market sentiment, and the impact of influential figures on investment trends. To stay informed about the ongoing fluctuations in Elon Musk's net worth and the market forces affecting his wealth, continue to follow reliable financial news sources and stay updated on Tesla's performance and the cryptocurrency market.

Featured Posts

-

Elon Musk And Dogecoin A Risky Investment Analyzing Teslas Stock Performance

May 09, 2025

Elon Musk And Dogecoin A Risky Investment Analyzing Teslas Stock Performance

May 09, 2025 -

Prediction 2 Stocks Outperforming Palantir In 3 Years

May 09, 2025

Prediction 2 Stocks Outperforming Palantir In 3 Years

May 09, 2025 -

Young Thug Addresses Infidelity In Upcoming Track

May 09, 2025

Young Thug Addresses Infidelity In Upcoming Track

May 09, 2025 -

Fox News Jeanine Pirro Appointed Dc Prosecutor By Trump

May 09, 2025

Fox News Jeanine Pirro Appointed Dc Prosecutor By Trump

May 09, 2025 -

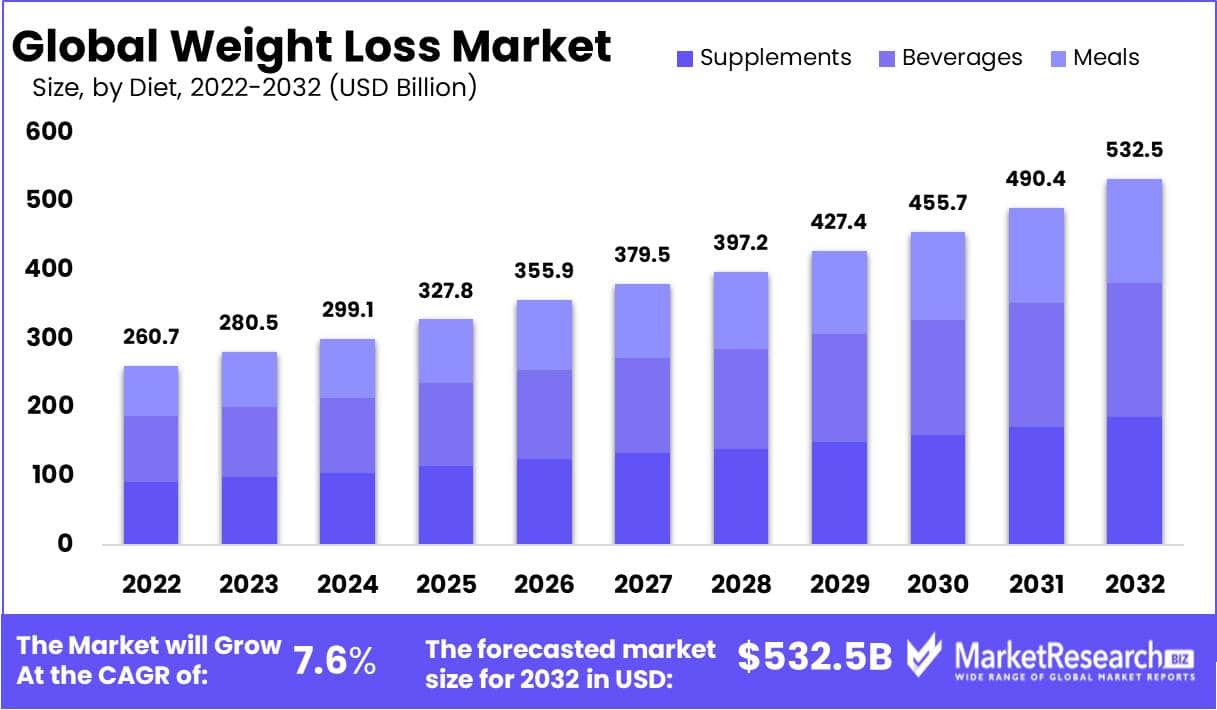

Weight Watchers Bankruptcy A Consequence Of The Weight Loss Drug Market

May 09, 2025

Weight Watchers Bankruptcy A Consequence Of The Weight Loss Drug Market

May 09, 2025