Bitcoin Mining Profits Soar: Understanding The Recent Increase

Table of Contents

The Rising Price of Bitcoin

The most direct driver of increased Bitcoin mining profits is the rising price of Bitcoin itself. A higher Bitcoin price translates directly into higher revenue for miners for each Bitcoin they successfully mine. The relationship is almost linear: if the price of Bitcoin doubles, all else being equal, mining revenue also roughly doubles.

[Insert graph showing Bitcoin price trend correlated with mining revenue].

- Higher Bitcoin price = higher revenue per mined Bitcoin: This is the fundamental principle behind Bitcoin mining profitability. The more valuable each Bitcoin becomes, the more profitable the mining operation.

- Price volatility affects profitability: While a rising price is positive, Bitcoin's inherent volatility presents both upside and downside risks. Sharp price drops can significantly reduce profitability, even leading to losses.

- Market sentiment and news impact Bitcoin's price: Positive news, regulatory developments, and overall market sentiment heavily influence Bitcoin's price, consequently impacting Bitcoin mining profits.

Bitcoin Mining Difficulty Adjustment and its Impact

Bitcoin's ingenious design includes a difficulty adjustment mechanism that regulates the rate at which new Bitcoins are created. This adjustment occurs approximately every two weeks and aims to maintain a consistent block generation time of around 10 minutes. An increase in the total network hash rate (the combined computing power of all miners) leads to a difficulty adjustment, making it harder to mine Bitcoin.

- Difficulty adjustment balances the rate of Bitcoin creation: This mechanism ensures the long-term stability and predictability of Bitcoin's issuance.

- Hash rate growth and difficulty adjustment: A higher hash rate requires a difficulty adjustment to maintain the target block generation time. This can sometimes temporarily reduce individual miner profitability, especially for those with less efficient hardware.

- Difficulty adjustments and profit impact: While difficulty adjustments can temporarily impact profitability, a consistently high hash rate, driven by factors like increased institutional interest, generally reflects a healthy and growing network, ultimately benefiting long-term Bitcoin mining profitability.

Decreasing Energy Costs and Their Role

Energy costs are a significant operational expense in Bitcoin mining. The cost of electricity directly impacts the profitability of mining operations. Regions with lower energy costs, like certain parts of the US, Canada, and some countries in Central Asia, become more attractive for Bitcoin miners.

- Energy prices directly affect operating costs: High energy prices can quickly erode profit margins, making mining unprofitable in certain locations.

- Renewable energy sources reduce mining costs: Miners increasingly utilize renewable energy sources like hydro, solar, and wind power to lower their operational costs and improve their environmental footprint, boosting their Bitcoin mining profits.

- Government policies on energy prices: Government regulations and policies related to energy pricing and subsidies significantly affect the cost of electricity for Bitcoin miners, impacting their overall profitability.

Advancements in Mining Hardware

Advancements in Application-Specific Integrated Circuit (ASIC) technology are crucial to increased Bitcoin mining efficiency and profitability. Newer ASIC miners boast significantly higher hash rates and improved power efficiency compared to their predecessors. Improved cooling systems and power management techniques further contribute to cost reduction and profitability increases.

- New mining hardware and performance improvements: The continuous development of more efficient ASIC miners allows miners to generate more Bitcoin with less energy, enhancing their profitability.

- Hash rate and its relationship to mining profitability: A higher hash rate enables miners to solve more cryptographic puzzles and earn more Bitcoin, directly translating to higher profitability.

- Cost-benefit analysis of upgrading mining hardware: While investing in new hardware requires upfront costs, the long-term benefits of increased efficiency and potential for higher Bitcoin mining profits often justify the expense.

Increased Institutional Investment and its Influence

The entrance of large institutional investors into the Bitcoin mining space has significantly shaped the landscape. These large-scale operations can leverage economies of scale, securing cheaper energy contracts and accessing advanced technologies.

- Economies of scale for large mining farms: Large mining farms can negotiate better deals for equipment and energy, resulting in significantly lower operating costs per unit of Bitcoin mined, significantly increasing Bitcoin mining profits.

- Impact on hash rate: Increased institutional investment significantly boosts the overall network hash rate, creating a more robust and secure network.

- Potential for increased competition to lower profit margins: While institutional involvement contributes to a growing ecosystem, increased competition can sometimes lead to compressed profit margins for individual miners.

Conclusion: Bitcoin Mining Profits – A Look Ahead

The recent surge in Bitcoin mining profits is a result of a combination of factors: the rising price of Bitcoin, difficulty adjustments, decreasing energy costs, advancements in mining hardware, and the increased involvement of institutional investors. Understanding these interconnected dynamics is crucial for anyone involved in or considering Bitcoin mining.

While the current outlook seems positive, it is crucial to remember that the cryptocurrency market remains inherently volatile. Sharp price swings and changes in regulatory environments can significantly impact Bitcoin mining profits.

To stay ahead, continuous research is vital. Further exploration into Bitcoin mining hardware, software, investment strategies, and market analysis will be crucial in navigating this dynamic industry. Stay informed about the fluctuations in Bitcoin mining profits and make informed decisions about your involvement in this dynamic industry.

Featured Posts

-

How Saturday Night Live Launched Counting Crows To Fame

May 08, 2025

How Saturday Night Live Launched Counting Crows To Fame

May 08, 2025 -

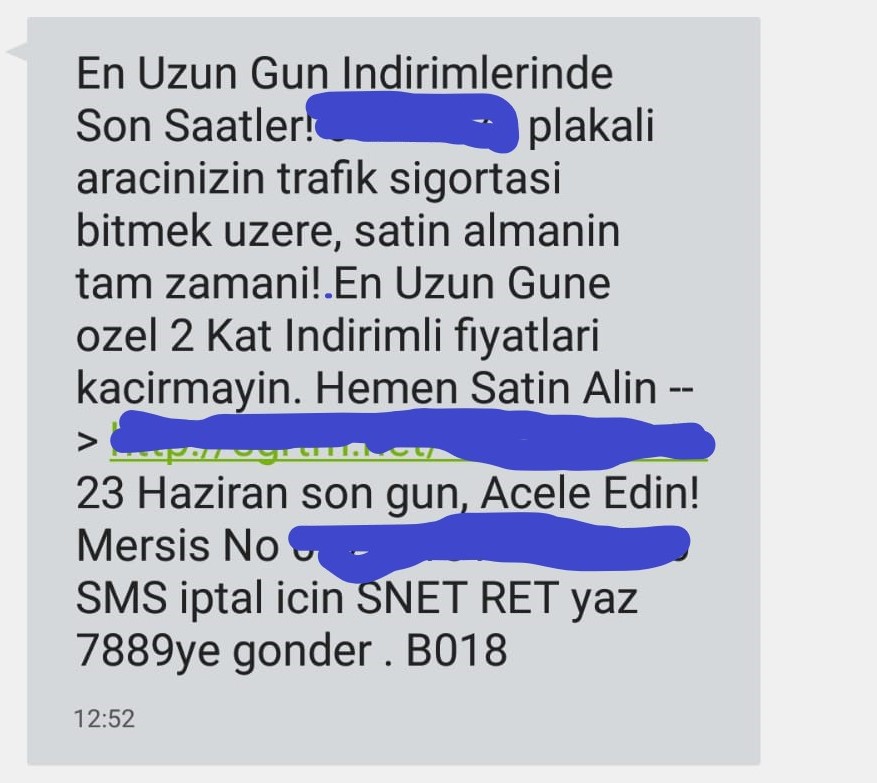

Tuerkiye Deki Sms Dolandiriciligi Sorunu Ve Artan Sikayetler

May 08, 2025

Tuerkiye Deki Sms Dolandiriciligi Sorunu Ve Artan Sikayetler

May 08, 2025 -

Nantes Psg Yi Evinden Puanla Geri Goenderdi 0 0

May 08, 2025

Nantes Psg Yi Evinden Puanla Geri Goenderdi 0 0

May 08, 2025 -

Thunder Players Respond To National Media Criticism

May 08, 2025

Thunder Players Respond To National Media Criticism

May 08, 2025 -

Is Rogue The Right Leader For The X Men

May 08, 2025

Is Rogue The Right Leader For The X Men

May 08, 2025

Latest Posts

-

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025

Celtics Vs Nets Latest Injury Report And Tatums Playing Status

May 08, 2025 -

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025

Is Jayson Tatum Out Tonight Celtics Nets Injury News

May 08, 2025 -

Celtics Vs Nets Jayson Tatums Game Status And Injury Report

May 08, 2025

Celtics Vs Nets Jayson Tatums Game Status And Injury Report

May 08, 2025 -

Jayson Tatum Injury Update Will He Play Celtics Vs Nets

May 08, 2025

Jayson Tatum Injury Update Will He Play Celtics Vs Nets

May 08, 2025 -

Abc Promo Tnt Announcers Hilarious Take On Jayson Tatum And The Lakers Celtics Matchup

May 08, 2025

Abc Promo Tnt Announcers Hilarious Take On Jayson Tatum And The Lakers Celtics Matchup

May 08, 2025