Bitcoin Price Prediction: Analyzing The Impact Of Trump's 100-Day Speech On BTC

Table of Contents

Trump's 100-Day Speech: Key Economic Policies and Their Relevance to Bitcoin

Trump's 100-day speech outlined several key economic policies with potential ramifications for Bitcoin. These policies included significant tax cuts, a focus on infrastructure spending, and deregulation across various sectors. Let's examine how these initiatives could influence Bitcoin's value.

The proposed tax cuts, for instance, could lead to increased inflation if not carefully managed. High inflation typically weakens a currency's value. A weaker US dollar could, in theory, boost the demand for Bitcoin as investors seek alternative stores of value. Conversely, increased government spending on infrastructure could stimulate economic growth, potentially strengthening the dollar and dampening Bitcoin's appeal.

- Tax Cuts: Potential for short-term inflation, weakening the dollar, potentially increasing BTC demand. Long-term effects depend on economic growth and inflation control.

- Infrastructure Spending: Could boost economic growth and strengthen the dollar, potentially reducing BTC demand in the short term. Long-term effects are uncertain.

- Deregulation: Reduced regulatory uncertainty could create a more favorable environment for cryptocurrency investment, potentially driving up BTC prices. However, this is highly dependent on the specifics of the regulations.

Keywords: Economic policy, US dollar, inflation, investor confidence, regulatory uncertainty, Bitcoin volatility.

Historical Data: Analyzing Bitcoin's Reaction to Previous Political Events

Examining Bitcoin's historical response to significant political events provides valuable insight. Past instances reveal correlations between political uncertainty and Bitcoin price fluctuations.

For example, [cite specific example of a political event and its impact on Bitcoin price, including chart/data link]. This event highlights the sensitivity of Bitcoin to geopolitical risk. Similarly, [cite another example, including chart/data link].

- Brexit (2016): [Explain the impact of Brexit on Bitcoin's price with data.]

- US Presidential Elections (2016 & 2020): [Explain the impact of these elections on Bitcoin's price with data.]

- Other Major Geopolitical Events: [Mention other events and their impact, citing sources.]

Keywords: Bitcoin historical data, political risk, market sentiment analysis, price correlation.

Sentiment Analysis: Gauging Market Reaction to Trump's Speech

Analyzing social media conversations and news coverage immediately following Trump's speech reveals the market's initial sentiment towards Bitcoin. A prevailing sentiment of optimism (bullish) would likely lead to price increases, while pessimism (bearish) could cause declines.

Post-speech, social media platforms like Twitter and Reddit showed [describe the dominant sentiment, e.g., a mix of cautious optimism and uncertainty]. News outlets reported [summarize news coverage, highlighting positive and negative viewpoints]. Trading volume [increased/decreased], indicating [explain the significance of the change in volume].

- Social Media Sentiment: [Specific examples of tweets or Reddit posts reflecting market sentiment.]

- News Media Coverage: [Specific examples of news articles and their tone towards Bitcoin.]

- Trading Volume: [Data showing changes in trading volume before, during, and after the speech.]

Keywords: Market sentiment, social media analysis, news sentiment, Bitcoin community reaction, trading volume.

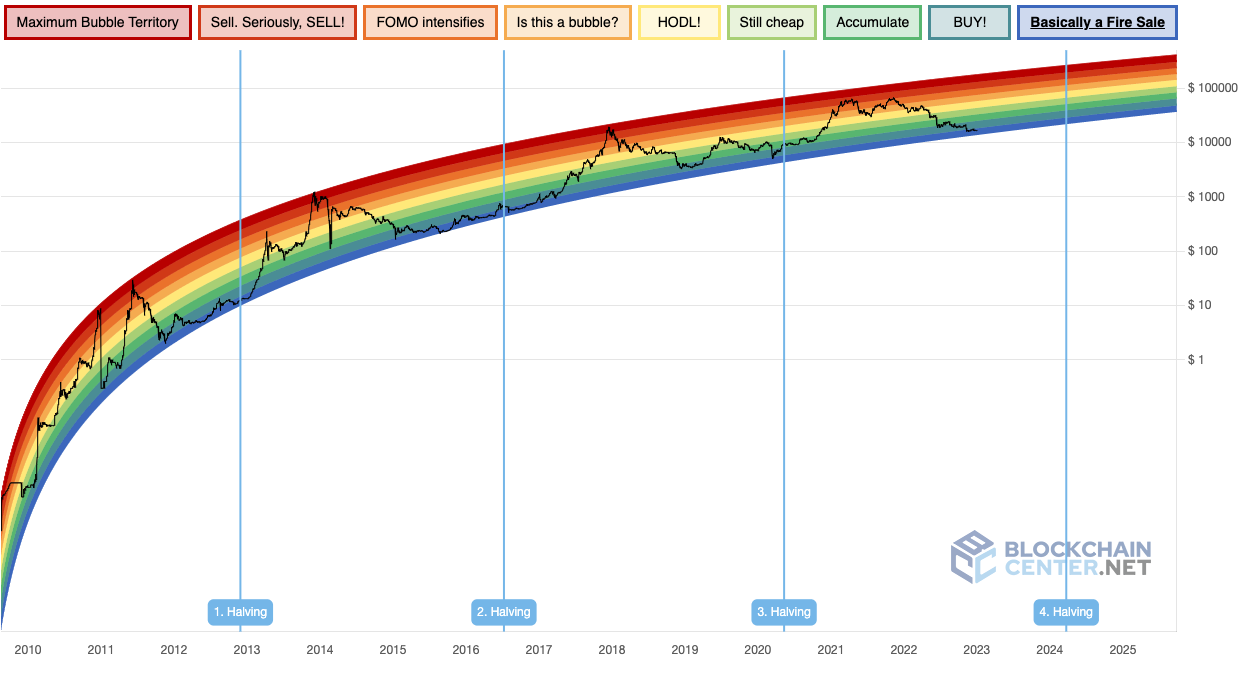

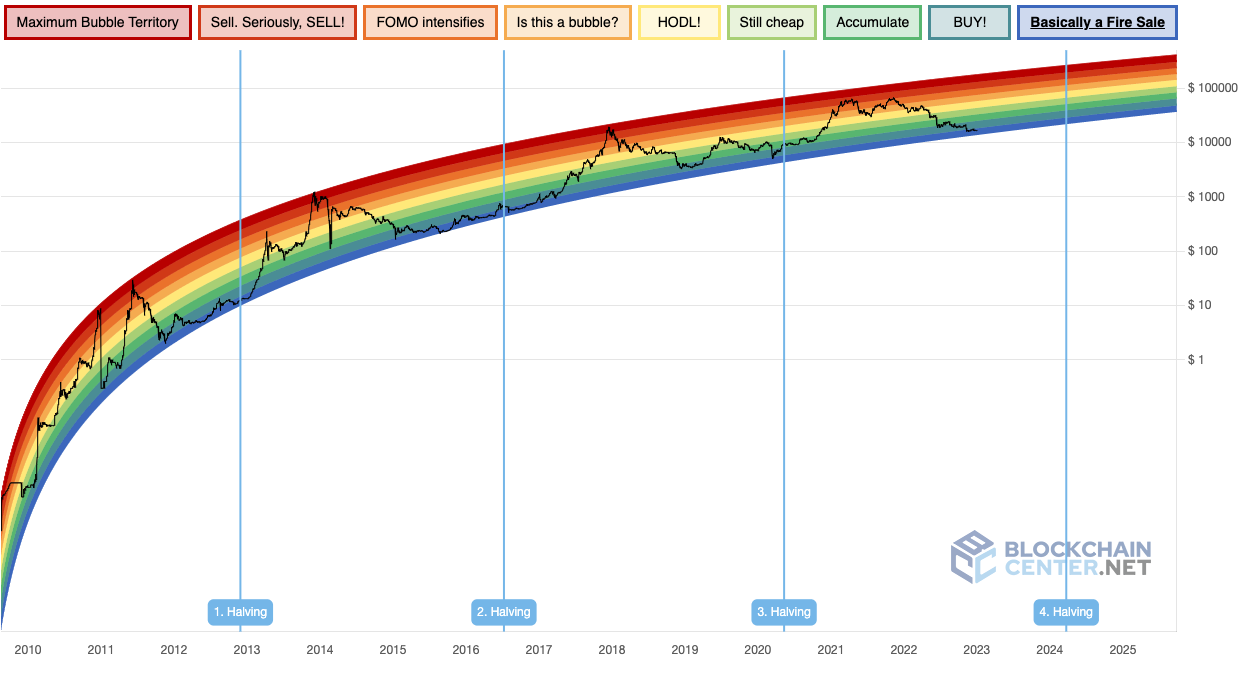

Technical Analysis: Chart Patterns and Indicators Post-Speech

Technical analysis of Bitcoin's price charts after Trump's speech provides further insights. Examining indicators like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help identify potential support and resistance levels.

[Describe specific chart patterns observed after the speech, e.g., a head and shoulders pattern, a breakout above a resistance level]. The RSI [was above/below] 70, suggesting [overbought/oversold] conditions. The MACD [crossed above/below] the signal line, indicating a [bullish/bearish] signal.

- Moving Averages: [Explain the significance of moving averages and their positions relative to the price.]

- RSI: [Explain the RSI and its interpretation in the context of the post-speech price action.]

- MACD: [Explain the MACD and its interpretation in the context of the post-speech price action.]

Keywords: Technical analysis, chart patterns, support and resistance, trading indicators, Bitcoin charts.

Predicting Future Bitcoin Price Movements Based on the Analysis

Based on the analysis of economic policies, historical data, market sentiment, and technical indicators, a reasoned Bitcoin price prediction can be offered.

Considering the potential for increased inflation due to tax cuts and the uncertain impact of infrastructure spending, a short-term [bullish/bearish/neutral] outlook seems plausible. However, the long-term outlook hinges on [explain factors influencing long-term predictions].

- Short-term Prediction (Next 3 months): [Provide a price range and justify it based on the analysis.]

- Long-term Prediction (Next 12 months): [Provide a price range and justify it based on the analysis.]

- Probability of Scenarios: [Assign probabilities to different price scenarios, e.g., 60% chance of price range X, 30% chance of range Y, 10% chance of range Z.]

Keywords: Bitcoin price forecast, future predictions, short-term outlook, long-term outlook, market outlook.

Conclusion: Bitcoin Price Prediction and Future Outlook

Trump's 100-day speech undoubtedly had ripple effects across global markets, including the cryptocurrency sector. While the direct impact on Bitcoin is complex and multifaceted, our analysis suggests a [reiterate short-term and long-term price prediction]. This prediction is based on the interplay of economic policies, historical precedent, market sentiment, and technical analysis. However, it’s crucial to remember that this is just a prediction, and the actual price movement of Bitcoin can be influenced by unforeseen events.

The Bitcoin market remains dynamic and unpredictable. Staying informed about global economic trends, political developments, and market sentiment is crucial for navigating the world of cryptocurrency investment. Continue researching and monitoring the Bitcoin market closely to make informed investment decisions. Accurate Bitcoin price prediction requires constant vigilance and a multifaceted approach.

Keywords: Bitcoin price prediction, BTC future, cryptocurrency investment, market analysis, stay informed.

Featured Posts

-

Unexpected Views A Rogue One Star On Fan Favorite Characters

May 08, 2025

Unexpected Views A Rogue One Star On Fan Favorite Characters

May 08, 2025 -

Seri Ata Na Vesprem Prodolzhuva Pobeda Nad Ps Zh Za Desetta Triumf

May 08, 2025

Seri Ata Na Vesprem Prodolzhuva Pobeda Nad Ps Zh Za Desetta Triumf

May 08, 2025 -

50 Years Of Tension Indias Bold Military Action Against Pakistan

May 08, 2025

50 Years Of Tension Indias Bold Military Action Against Pakistan

May 08, 2025 -

Productivity The Key To Economic Success Says Dodge Regarding Carney

May 08, 2025

Productivity The Key To Economic Success Says Dodge Regarding Carney

May 08, 2025 -

Stocks Can T Wish Away Liberation Day Tariffs Economic Impact And Market Reactions

May 08, 2025

Stocks Can T Wish Away Liberation Day Tariffs Economic Impact And Market Reactions

May 08, 2025

Latest Posts

-

Ekonomi Bakani Ndan Kripto Para Birimlerine Iliskin Yeni Uyari

May 08, 2025

Ekonomi Bakani Ndan Kripto Para Birimlerine Iliskin Yeni Uyari

May 08, 2025 -

Kripto Varlik Yatirimcilarina Bakan Simsek Ten Oenemli Uyari

May 08, 2025

Kripto Varlik Yatirimcilarina Bakan Simsek Ten Oenemli Uyari

May 08, 2025 -

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Son Dakika Gelismeleri

May 08, 2025

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Son Dakika Gelismeleri

May 08, 2025 -

Bakan Simsek Ten Kripto Para Piyasasina Uyari Riskler Ve Oeneriler

May 08, 2025

Bakan Simsek Ten Kripto Para Piyasasina Uyari Riskler Ve Oeneriler

May 08, 2025 -

Brezilya Bitcoin Yasal Maas Oedeme Yoentemi Olarak Kabul Edildi

May 08, 2025

Brezilya Bitcoin Yasal Maas Oedeme Yoentemi Olarak Kabul Edildi

May 08, 2025