Bitcoin Price Rebound: A Look At Potential Future Growth

Table of Contents

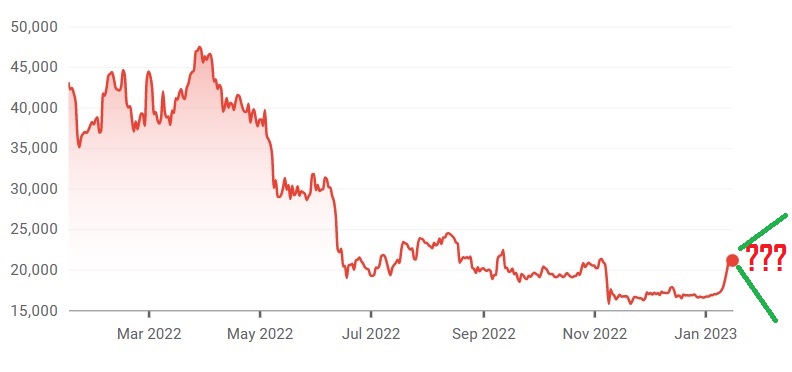

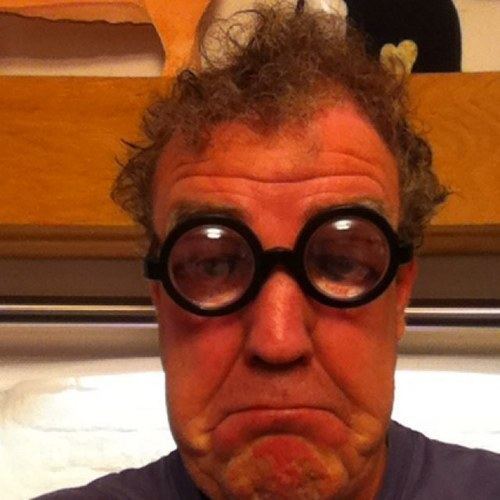

Analyzing the Current Bitcoin Price Rebound

The current Bitcoin price rebound isn't just random fluctuation; it's fueled by a confluence of factors, creating a potentially bullish environment. Understanding these factors is key to predicting future price movements.

Factors Contributing to the Rebound:

Several key elements have contributed to the recent Bitcoin price upswing. These include:

- Increased Institutional Investment: Major players like Grayscale, MicroStrategy, and other institutional investors continue to accumulate Bitcoin, demonstrating growing confidence in its long-term value. This large-scale buying pressure significantly impacts the market.

- Growing Business Adoption: More businesses are accepting Bitcoin as a form of payment, expanding its practical use cases and increasing demand. This wider adoption strengthens its position as a legitimate store of value and medium of exchange.

- Positive Regulatory Developments: While regulatory landscapes vary globally, some jurisdictions are showing increasing acceptance of cryptocurrencies, fostering a more stable and predictable environment for Bitcoin investment. This reduces uncertainty and attracts more mainstream investors.

- Bitcoin Scarcity: The inherent scarcity of Bitcoin, with a fixed supply of only 21 million coins, creates a deflationary model that many believe will drive long-term price appreciation. As more Bitcoin is lost or held long-term, the remaining supply becomes even more valuable.

- Macroeconomic Uncertainty: Global macroeconomic instability often drives investors towards safe-haven assets, and Bitcoin is increasingly viewed as a hedge against inflation and economic uncertainty. This safe-haven demand boosts prices during times of market turbulence.

Technical Analysis Indicators:

Analyzing technical indicators provides further insight into the Bitcoin price rebound. Examining key metrics helps determine the strength and sustainability of the upward trend.

- Moving Averages: The convergence and divergence of various moving averages (e.g., 50-day, 200-day) can signal potential price reversals or confirmations of trends. A bullish crossover often indicates a strengthening upward trend.

- RSI (Relative Strength Index): The RSI helps measure the momentum of price changes and identify overbought or oversold conditions. A reading above 70 often suggests an overbought market, while a reading below 30 suggests an oversold market.

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. Bullish signals arise when the MACD line crosses above the signal line.

- Support and Resistance Levels: Identifying historical support and resistance levels helps predict potential price turning points. Breaking through resistance levels often indicates a stronger upward trend.

- Trading Volume: High trading volume during price increases confirms the strength of the upward movement, while low volume can suggest a weaker trend.

Potential Drivers of Future Bitcoin Price Growth

Beyond the current rebound, several factors could propel Bitcoin to new heights. These drivers highlight both the technological innovations surrounding Bitcoin and the increasing mainstream adoption.

Technological Advancements:

Technological improvements are crucial for Bitcoin's continued growth and adoption. These advancements address scalability and efficiency issues, making Bitcoin more practical for everyday use.

- The Lightning Network: This layer-2 scaling solution dramatically increases transaction speed and reduces fees, making Bitcoin more suitable for microtransactions and everyday payments.

- Layer-2 Solutions: Various layer-2 solutions are being developed to enhance Bitcoin's scalability and transaction throughput, mitigating network congestion.

- Mining Technology Innovations: Advancements in mining technology lead to increased energy efficiency and lower operating costs, benefiting the entire Bitcoin ecosystem.

- Bitcoin ETFs: The potential approval of Bitcoin ETFs could bring significant institutional investment into the market, boosting liquidity and price.

Regulatory Clarity and Adoption:

Increased regulatory clarity and mainstream adoption are vital for the sustained growth of Bitcoin. Greater acceptance reduces risks and encourages broader participation.

- Regulatory Acceptance: As governments worldwide develop clearer regulatory frameworks for cryptocurrencies, the investment climate becomes more favorable, encouraging institutional investment.

- Institutional Adoption: Continued adoption by institutional investors and large corporations demonstrates growing confidence in Bitcoin as a viable asset class.

- DeFi Integration: The integration of Bitcoin into the decentralized finance (DeFi) ecosystem unlocks new opportunities and use cases, further boosting demand.

- Financial System Integration: Seamless integration of Bitcoin into existing financial systems will make it more accessible and user-friendly for the average person.

Risks and Challenges to a Continued Bitcoin Price Rebound

While the outlook for Bitcoin is generally positive, several risks and challenges could impact its price trajectory. Understanding these factors is crucial for informed investment decisions.

Regulatory Uncertainty and Potential Bans:

Regulatory uncertainty remains a significant risk. Governmental policies can significantly impact the price of Bitcoin.

- Governmental Regulations: Differing regulatory frameworks across jurisdictions can create uncertainty and complexity for investors. Strict regulations or outright bans can severely impact the market.

- Jurisdictional Differences: The lack of a unified global regulatory approach creates challenges for international Bitcoin transactions and investment.

Market Volatility and Price Corrections:

The cryptocurrency market is inherently volatile, and price corrections are to be expected. Risk management is crucial.

- Market Volatility: Bitcoin’s price can experience significant fluctuations in short periods, leading to substantial gains or losses for investors.

- Price Corrections: Sharp price drops, or corrections, are a normal part of the market cycle and should be anticipated.

- Risk Management: Diversification and careful risk assessment are essential for mitigating potential losses in the volatile Bitcoin market.

Competition from Other Cryptocurrencies:

Bitcoin faces competition from other cryptocurrencies offering different functionalities and advantages.

- Altcoin Competition: The emergence of alternative cryptocurrencies (altcoins) with innovative features poses a challenge to Bitcoin's dominance.

- Technological Advancements in Other Blockchains: Technological breakthroughs in competing blockchain networks can potentially disrupt Bitcoin's market share.

Conclusion

The Bitcoin price rebound presents a compelling case for potential future growth, driven by a confluence of factors including increasing institutional adoption, technological advancements, and growing global interest in cryptocurrencies. However, investors must remain aware of the inherent risks associated with this volatile market. Understanding the dynamics of the Bitcoin price rebound is crucial for informed investment decisions. Stay updated on market trends, conduct thorough research, and manage your risk effectively to navigate this exciting space. Further investigate the factors contributing to the Bitcoin price rebound and make strategic decisions based on your risk tolerance. Don't miss out on the potential of a continued Bitcoin price rebound – stay informed and invest wisely.

Featured Posts

-

Leon Draisaitl Injury Oilers Optimistic For Playoff Return After Lower Body Setback

May 09, 2025

Leon Draisaitl Injury Oilers Optimistic For Playoff Return After Lower Body Setback

May 09, 2025 -

The Trade War And Cryptocurrency Is This Coin Immune

May 09, 2025

The Trade War And Cryptocurrency Is This Coin Immune

May 09, 2025 -

Celtics Coach On Tatums Wrist Injury Update And Next Steps

May 09, 2025

Celtics Coach On Tatums Wrist Injury Update And Next Steps

May 09, 2025 -

Jeremy Clarksons Plan To Save F1 Will Ferraris Dsq Fears Materialize

May 09, 2025

Jeremy Clarksons Plan To Save F1 Will Ferraris Dsq Fears Materialize

May 09, 2025 -

March 15 Nyt Strands Puzzle 377 Solutions And Help

May 09, 2025

March 15 Nyt Strands Puzzle 377 Solutions And Help

May 09, 2025