Bitcoin Price Rebound: Is It Time To Buy Or Sell?

Table of Contents

Keywords: Bitcoin price rebound, buy Bitcoin, sell Bitcoin, Bitcoin investment, Bitcoin price prediction, cryptocurrency market, Bitcoin volatility, Bitcoin trading, Bitcoin ETF, Lightning Network, Taproot

The recent Bitcoin price rebound has many investors wondering: is this a genuine resurgence, or a temporary reprieve before another market downturn? This crucial question is at the heart of every Bitcoin trading strategy. Let's analyze the current market conditions and help you decide whether now is the time to buy Bitcoin, sell Bitcoin, or hold your existing holdings.

Analyzing the Bitcoin Price Rebound

Examining Recent Market Trends

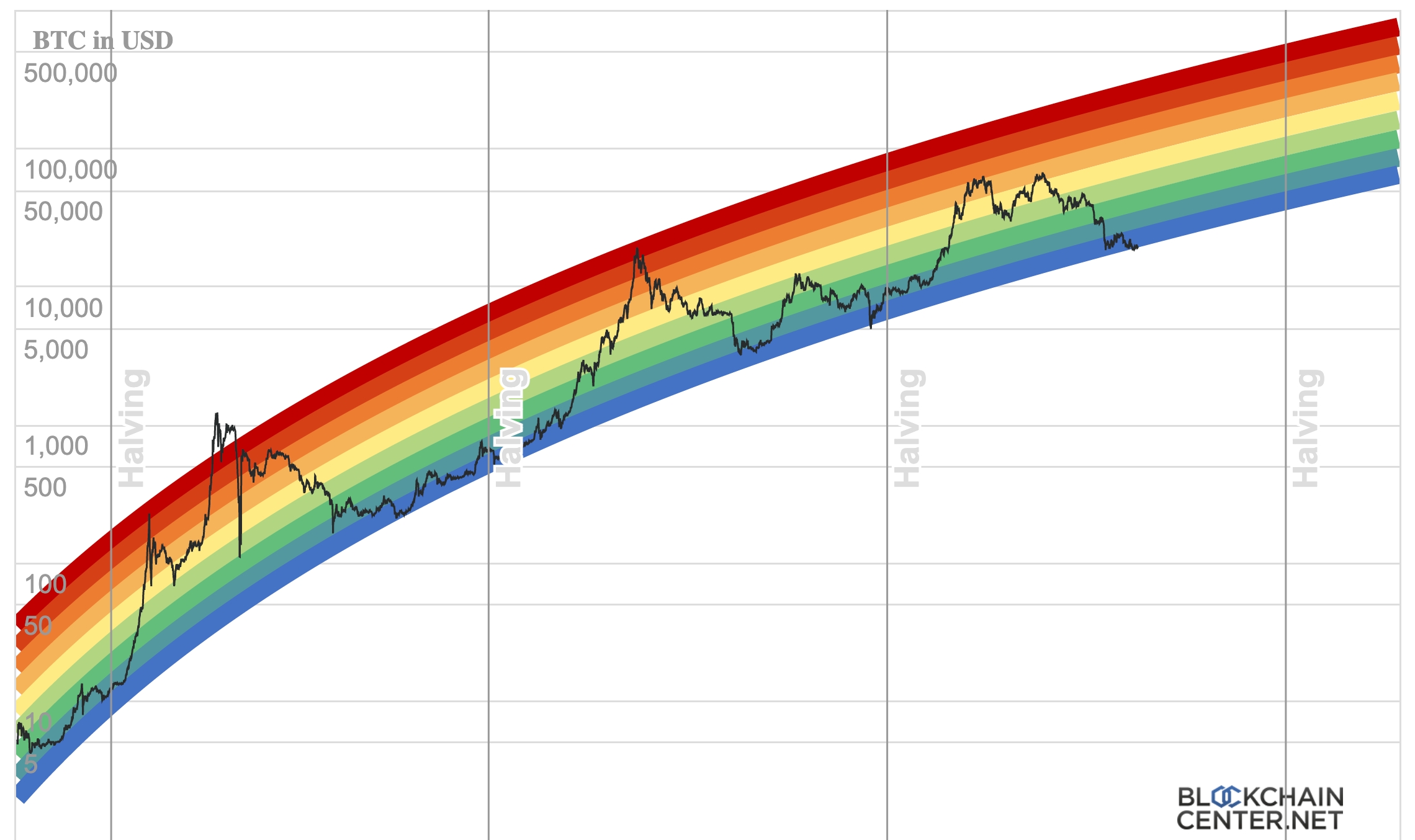

Bitcoin's price has shown significant volatility in recent months. Examining the charts reveals key trends. For instance:

- July 2024: A significant price increase of X% followed a period of relative stability.

- August 2024: A slight correction of Y% occurred, potentially indicating profit-taking by some investors.

- September 2024: The price has rebounded by Z%, exceeding the previous high. This could signify renewed investor confidence.

These price movements are visually represented in the chart below: [Insert relevant chart/graph showing Bitcoin price movements].

Several news events have influenced these price shifts:

- The announcement of a potential Bitcoin ETF application approval generated significant positive sentiment.

- Concerns over global macroeconomic instability have also impacted the cryptocurrency market.

Understanding Market Sentiment

Gauging market sentiment is crucial for Bitcoin price prediction. Currently, social media platforms show a mix of optimism and caution. While many are celebrating the recent rebound and discussing "buy Bitcoin" strategies, others remain skeptical, recalling past price crashes.

- Social Media Analysis: A surge in positive hashtags like #BitcoinRebound and #BitcoinBullRun is noticeable. Conversely, hashtags indicating skepticism remain present.

- News Coverage: Major financial news outlets are reporting on the rebound, offering a range of expert opinions. Some analysts predict further gains, while others warn of potential corrections.

- Fear and Greed Index: The Crypto Fear & Greed Index shows a shift towards "Greed" suggesting increasing optimism, but this isn't an absolute indicator.

Factors Influencing the Bitcoin Price

Macroeconomic Factors

Global economic conditions significantly influence Bitcoin's price. High inflation and rising interest rates can negatively impact risk assets like Bitcoin, while recessionary fears might drive investors towards safer havens.

- Correlation with Traditional Markets: Bitcoin's correlation with traditional markets is not consistently strong but can fluctuate based on various circumstances.

- Inflation Hedge: Some investors view Bitcoin as a hedge against inflation, believing its scarcity protects its value during periods of monetary expansion.

Technological Developments

Technological advancements within the Bitcoin network itself can greatly affect its price and adoption.

- Lightning Network: The Lightning Network, a second-layer scaling solution, enhances transaction speed and reduces fees, potentially increasing Bitcoin's usability and attractiveness.

- Taproot Upgrade: This upgrade improved Bitcoin's privacy and smart contract capabilities, contributing to its long-term potential.

- Regulatory Changes: Positive regulatory developments, such as clearer guidelines or ETF approvals, generally stimulate investor confidence and price increases.

Adoption and Institutional Investment

The growing adoption of Bitcoin by institutional investors is a significant price driver.

- Institutional Investments: Several large corporations and financial institutions have made substantial Bitcoin investments, signaling a growing acceptance of the cryptocurrency.

- ETF Approvals: Approval of Bitcoin ETFs could unlock massive amounts of institutional capital, potentially leading to a significant price surge.

Risk Assessment and Investment Strategies

Bitcoin Volatility and Risk Tolerance

Bitcoin's price is notoriously volatile. Before investing, it's vital to understand your risk tolerance.

- Risk Profiles: Conservative investors should allocate a smaller portion of their portfolio to Bitcoin, while more aggressive investors might tolerate higher risk.

- Diversification: Diversifying your investments across different asset classes is a crucial risk management strategy.

Buy, Sell, or Hold Strategies

Several investment approaches exist depending on your risk tolerance and market analysis:

- Buy-the-Dip: This strategy involves purchasing Bitcoin during price dips, anticipating a future price rebound.

- Sell-the-News: This approach involves selling Bitcoin after significant price increases driven by positive news, anticipating a potential correction.

- Hodl: This long-term strategy involves holding Bitcoin for an extended period, irrespective of short-term price fluctuations, believing in its long-term value.

- Stop-Loss Orders: Setting stop-loss orders can limit potential losses if the price unexpectedly falls.

Conclusion

The recent Bitcoin price rebound presents both opportunities and risks. While positive market sentiment and technological advancements are encouraging, inherent volatility remains. Whether you decide to buy Bitcoin, sell Bitcoin, or hold your investment, thorough research and a well-defined strategy are crucial for navigating the dynamic world of cryptocurrency. Stay informed about the Bitcoin price rebound and make calculated decisions based on your risk tolerance and financial goals.

Featured Posts

-

Stephen Kings 2024 Movie Slate The Monkey And Two More To Watch

May 09, 2025

Stephen Kings 2024 Movie Slate The Monkey And Two More To Watch

May 09, 2025 -

Dakota Johnson And Chris Martin A Look At Her Career Choices

May 09, 2025

Dakota Johnson And Chris Martin A Look At Her Career Choices

May 09, 2025 -

F1 News Montoya Reveals Pre Determined Doohan Decision

May 09, 2025

F1 News Montoya Reveals Pre Determined Doohan Decision

May 09, 2025 -

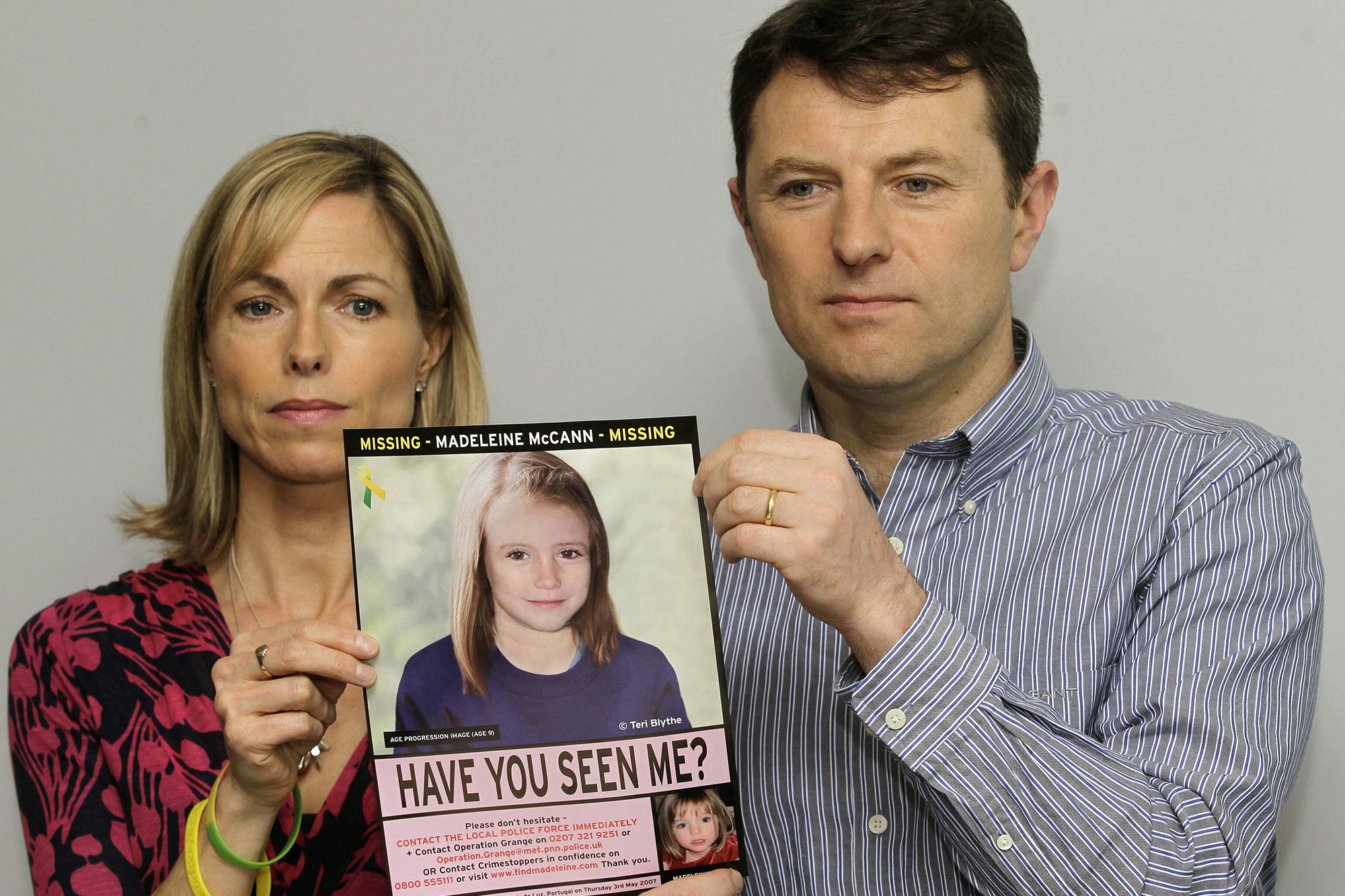

Madeleine Mc Cann Investigation Receives 108 000 Boost

May 09, 2025

Madeleine Mc Cann Investigation Receives 108 000 Boost

May 09, 2025 -

Madeleine Mc Cann Case Womans Dna Test Results Fuel Speculation

May 09, 2025

Madeleine Mc Cann Case Womans Dna Test Results Fuel Speculation

May 09, 2025