Bitcoin's 10-Week High Broken: Could $100,000 Be Next?

Table of Contents

Analyzing the Recent Bitcoin Price Surge

Technical Analysis

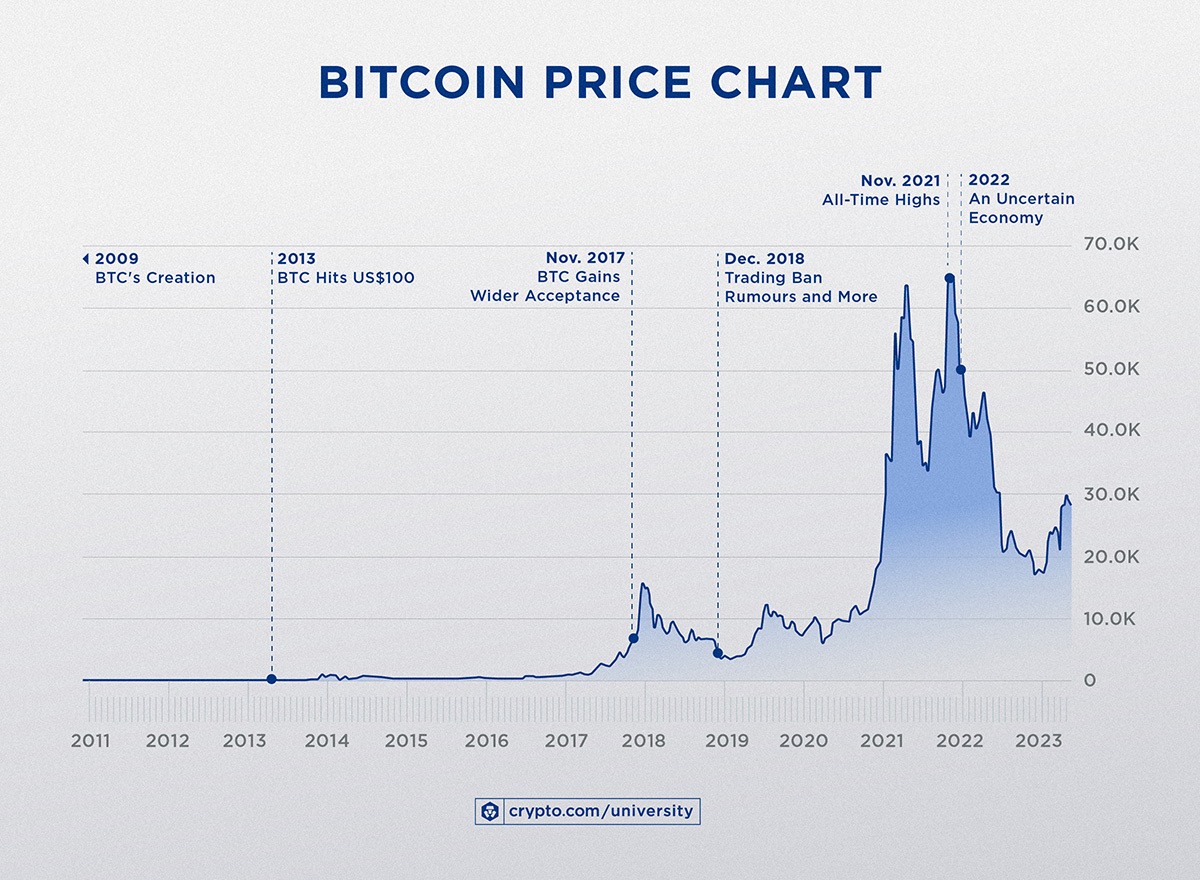

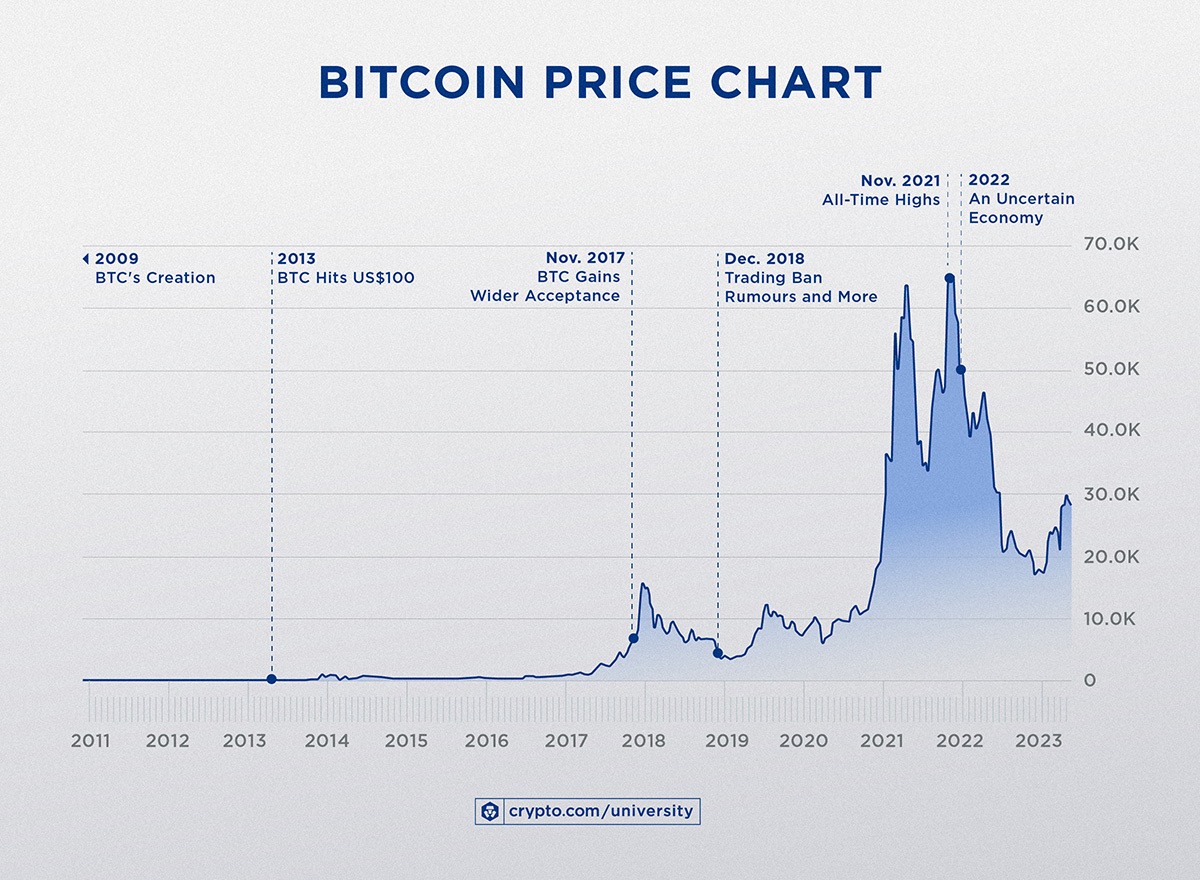

Bitcoin price prediction models often rely heavily on technical analysis. Charts are meticulously scrutinized for clues about future price movements. Examining support and resistance levels, along with key technical indicators, can provide valuable insights.

- Moving Averages: The 50-day and 200-day moving averages are currently trending upwards, a strong bullish signal for Bitcoin.

- RSI (Relative Strength Index): While the RSI might be above 70, indicating an overbought condition, the sustained upward momentum suggests the bullish trend could continue for some time.

- MACD (Moving Average Convergence Divergence): A bullish MACD crossover recently occurred, further strengthening the positive outlook for Bitcoin's price. Chart analysis shows a clear upward trajectory.

This confluence of positive technical indicators points towards a sustained period of bullish momentum for Bitcoin. However, it's crucial to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis.

Fundamental Factors

Beyond the technical charts, several fundamental factors are driving the Bitcoin price increase. These include:

- Increased Institutional Investment: Major financial institutions, like BlackRock, are increasingly showing interest in Bitcoin, filing applications for Bitcoin ETFs. This institutional adoption brings legitimacy and significant capital to the Bitcoin market.

- Positive Regulatory Developments: While regulatory uncertainty remains a concern, some jurisdictions are becoming more receptive to cryptocurrencies, fostering a more favorable environment for Bitcoin's growth.

- Growing Adoption by Businesses: More businesses are starting to accept Bitcoin as a form of payment, further increasing its utility and driving demand.

- Bitcoin Halving: The upcoming Bitcoin halving event, which reduces the rate of new Bitcoin creation, is anticipated to contribute to scarcity and potentially drive the price higher. The market capitalization continues to grow, reflecting increased demand.

These fundamental factors, coupled with the positive technical signals, paint a picture of a robust and potentially explosive Bitcoin market.

The Path to $100,000 Bitcoin

Overcoming Challenges

Reaching $100,000 Bitcoin is not without its challenges. Significant hurdles include:

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains volatile and uncertain, potentially causing price fluctuations.

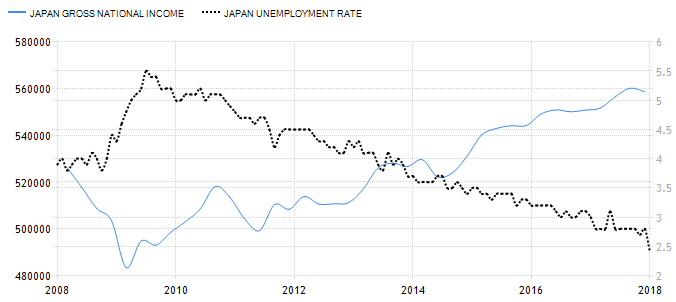

- Macroeconomic Factors: Global macroeconomic conditions, such as inflation and potential recessions, can significantly impact the price of Bitcoin. Managing risk is crucial.

- Market Corrections: Bitcoin is known for its volatility, and significant price corrections are possible, even within a bullish trend.

Investors must develop a robust Bitcoin investment strategy that accounts for these risks. Diversification and responsible risk management are paramount.

Factors Supporting a $100,000 Price Target

Despite the challenges, several factors could propel Bitcoin to the $100,000 mark:

- Bitcoin Scarcity: The limited supply of 21 million Bitcoins makes it a deflationary asset, potentially attractive during periods of inflation.

- Inflation Hedge: Many investors view Bitcoin as a potential hedge against inflation, driving demand during periods of economic uncertainty.

- Store of Value: Bitcoin's decentralized nature and inherent security features make it an increasingly attractive store of value.

- Long-Term Investment: Bitcoin's long-term potential as a digital gold continues to attract long-term investors.

The inherent scarcity of Bitcoin and its growing acceptance as a valuable asset are key drivers of its potential for further growth.

Conclusion

The recent Bitcoin price surge, driven by positive technical indicators and strong fundamental factors, has reignited the conversation about a potential $100,000 Bitcoin. While challenges remain, the increasing institutional adoption, positive regulatory developments, and Bitcoin's inherent scarcity suggest a strong case for continued growth. However, investors should approach Bitcoin investment with caution, conducting thorough research and carefully considering their risk tolerance. Stay informed about the latest Bitcoin news and trends to make informed investment decisions. The future of Bitcoin remains bright, and its potential for growth is undeniable. Learn more about Bitcoin investing and its potential – the journey to $100,000 Bitcoin might be closer than you think.

Featured Posts

-

Is Sumitomo Mitsui Financial Group Smfg Buying Into Yes Bank

May 07, 2025

Is Sumitomo Mitsui Financial Group Smfg Buying Into Yes Bank

May 07, 2025 -

How The Timberwolves Unlocked Julius Randles Potential A Knicks Comparison

May 07, 2025

How The Timberwolves Unlocked Julius Randles Potential A Knicks Comparison

May 07, 2025 -

Steph Currys All Star Championship A Dud Format

May 07, 2025

Steph Currys All Star Championship A Dud Format

May 07, 2025 -

Oracle Park Injury Victor Robles Diving Catch Costs Him The Game

May 07, 2025

Oracle Park Injury Victor Robles Diving Catch Costs Him The Game

May 07, 2025 -

Did Skype Get It Right An Examination Of Its Predictions

May 07, 2025

Did Skype Get It Right An Examination Of Its Predictions

May 07, 2025

Latest Posts

-

Jenna Ortegas Rise The Making Of A Horror Icon

May 07, 2025

Jenna Ortegas Rise The Making Of A Horror Icon

May 07, 2025 -

Egy Szineszno Aki Befolyasolta Jenna Ortegat

May 07, 2025

Egy Szineszno Aki Befolyasolta Jenna Ortegat

May 07, 2025 -

Why Jenna Ortega Is Poised To Become Horrors Next Scream Queen

May 07, 2025

Why Jenna Ortega Is Poised To Become Horrors Next Scream Queen

May 07, 2025 -

Ki Inspiralta Jenna Ortegat Egy Meglepo Szineszno

May 07, 2025

Ki Inspiralta Jenna Ortegat Egy Meglepo Szineszno

May 07, 2025 -

Jenna Ortega And Marvel The Forgotten Performance That Will Astound You

May 07, 2025

Jenna Ortega And Marvel The Forgotten Performance That Will Astound You

May 07, 2025