Bitcoin's Record High: Fueled By U.S. Regulatory Optimism

Table of Contents

Positive Shifts in the U.S. Regulatory Landscape

The evolving stance of U.S. regulatory bodies, such as the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), towards cryptocurrencies has played a crucial role in boosting Bitcoin's price.

Gradual Acceptance by Regulatory Bodies

The previously ambiguous regulatory environment surrounding Bitcoin is gradually shifting towards greater clarity and acceptance.

- Recent SEC statements have shown a more nuanced understanding of the cryptocurrency market, moving beyond outright condemnation towards a more measured approach focusing on investor protection and market integrity.

- The CFTC's increased engagement with cryptocurrency exchanges and derivatives markets signals a growing comfort level with regulating this asset class.

- Proposed regulatory bills, though still under debate, demonstrate a willingness within Congress to address the specific needs of the cryptocurrency industry, fostering a sense of stability and encouraging investment.

- This evolving regulatory framework contributes to increased investor confidence, stabilizing the market and reducing fear of unpredictable government crackdowns.

Increased Clarity and Reduced Uncertainty

Recent regulatory actions have significantly clarified the legal status of Bitcoin in the U.S., reducing the uncertainty that previously deterred many institutional investors.

- Clearer guidelines on digital asset classification offer a more predictable legal environment for businesses operating within the crypto space.

- Enhanced anti-money laundering (AML) and know-your-customer (KYC) regulations help to instill confidence among investors concerned about the risks associated with illicit activities in the cryptocurrency market.

- This regulatory clarity has directly influenced institutional investment, attracting investors seeking stable and legally compliant investment opportunities.

- The reduced risk profile associated with increased clarity encourages larger-scale institutional participation, driving up Bitcoin's price.

The Surge in Institutional Investment

The growing interest of institutional investors, such as hedge funds, pension funds, and corporations, in Bitcoin is a major catalyst behind its recent price surge.

Increased Institutional Adoption of Bitcoin

Institutional investors are increasingly recognizing Bitcoin's potential as a valuable asset.

- Several large corporations have added Bitcoin to their treasury reserves, demonstrating a long-term strategic investment outlook.

- Hedge funds are increasingly allocating a significant portion of their portfolios to Bitcoin, recognizing its potential for diversification and returns.

- The reasons behind this surge include Bitcoin's potential as a hedge against inflation, its scarcity, and its decentralized nature, providing protection against geopolitical risks.

- The significant influx of institutional capital directly impacts Bitcoin's price and market capitalization, contributing to the recent record high.

The Role of Bitcoin ETFs

The potential approval of Bitcoin exchange-traded funds (ETFs) is another significant factor driving regulatory optimism and, consequently, Bitcoin's price.

- Bitcoin ETFs would offer institutional investors easier access to Bitcoin, increasing liquidity and potentially lowering the barriers to entry for larger players.

- Increased liquidity through ETFs could lead to more efficient price discovery, making Bitcoin's price more reflective of its underlying value.

- However, regulatory hurdles remain, with ongoing debates surrounding the approval of spot Bitcoin ETFs in the U.S. The potential approval is a powerful driver of anticipation and positive market sentiment.

Impact of Market Sentiment and Media Coverage

Positive media attention and overall public perception play a significant role in shaping Bitcoin's price trajectory.

Positive Media Attention and Public Perception

Positive news coverage, focusing on Bitcoin's potential as a store of value and its increasing adoption, has fueled positive market sentiment.

- Numerous mainstream media outlets have published articles highlighting Bitcoin's price increases and its growing acceptance within the financial world.

- This positive media coverage influences retail investor participation, driving demand and further contributing to price increases.

- Improved public perception reduces the stigma surrounding Bitcoin, encouraging broader adoption and increasing demand.

The Network Effect and Growing Adoption

The network effect, where increased adoption leads to further adoption, is a key driver of Bitcoin's price appreciation.

- Growing adoption in various sectors, including payments, investments, and decentralized finance (DeFi), strengthens Bitcoin's network and increases its value proposition.

- As more people and businesses use Bitcoin, its utility and value increase, creating a positive feedback loop that fuels further price appreciation.

- The network effect is a self-reinforcing mechanism, making Bitcoin's price increasingly sensitive to positive news and increased adoption.

Conclusion: Bitcoin's Future and the Impact of Regulatory Optimism

Bitcoin's recent record high is a testament to the significant impact of positive U.S. regulatory developments. Regulatory clarity, increased institutional investment, and positive market sentiment have converged to create a powerful upward force on Bitcoin's price. The potential approval of Bitcoin ETFs further amplifies this trend. While the future of Bitcoin remains subject to market volatility and ongoing regulatory changes, the current climate of regulatory optimism paints a promising picture.

To stay informed about Bitcoin's price and the evolving U.S. regulatory landscape, subscribe to relevant newsletters, follow reputable news sources, and conduct your own thorough research. Understanding the intricate relationship between Bitcoin's price and U.S. regulatory optimism is crucial for navigating this dynamic market. The interplay between Bitcoin price and regulatory actions will continue to shape the future of this cryptocurrency.

Featured Posts

-

The Impact Of Industry Contraction On Game Accessibility

May 23, 2025

The Impact Of Industry Contraction On Game Accessibility

May 23, 2025 -

Piastri Beats Norris Mc Larens Miami Grand Prix Win

May 23, 2025

Piastri Beats Norris Mc Larens Miami Grand Prix Win

May 23, 2025 -

Museum Funding Under Trump Examining The Consequences

May 23, 2025

Museum Funding Under Trump Examining The Consequences

May 23, 2025 -

Caesar Flickerman Casting Kieran Culkin Joins Sunrise On The Reaping

May 23, 2025

Caesar Flickerman Casting Kieran Culkin Joins Sunrise On The Reaping

May 23, 2025 -

The Official England And Wales Cricket Board Website

May 23, 2025

The Official England And Wales Cricket Board Website

May 23, 2025

Latest Posts

-

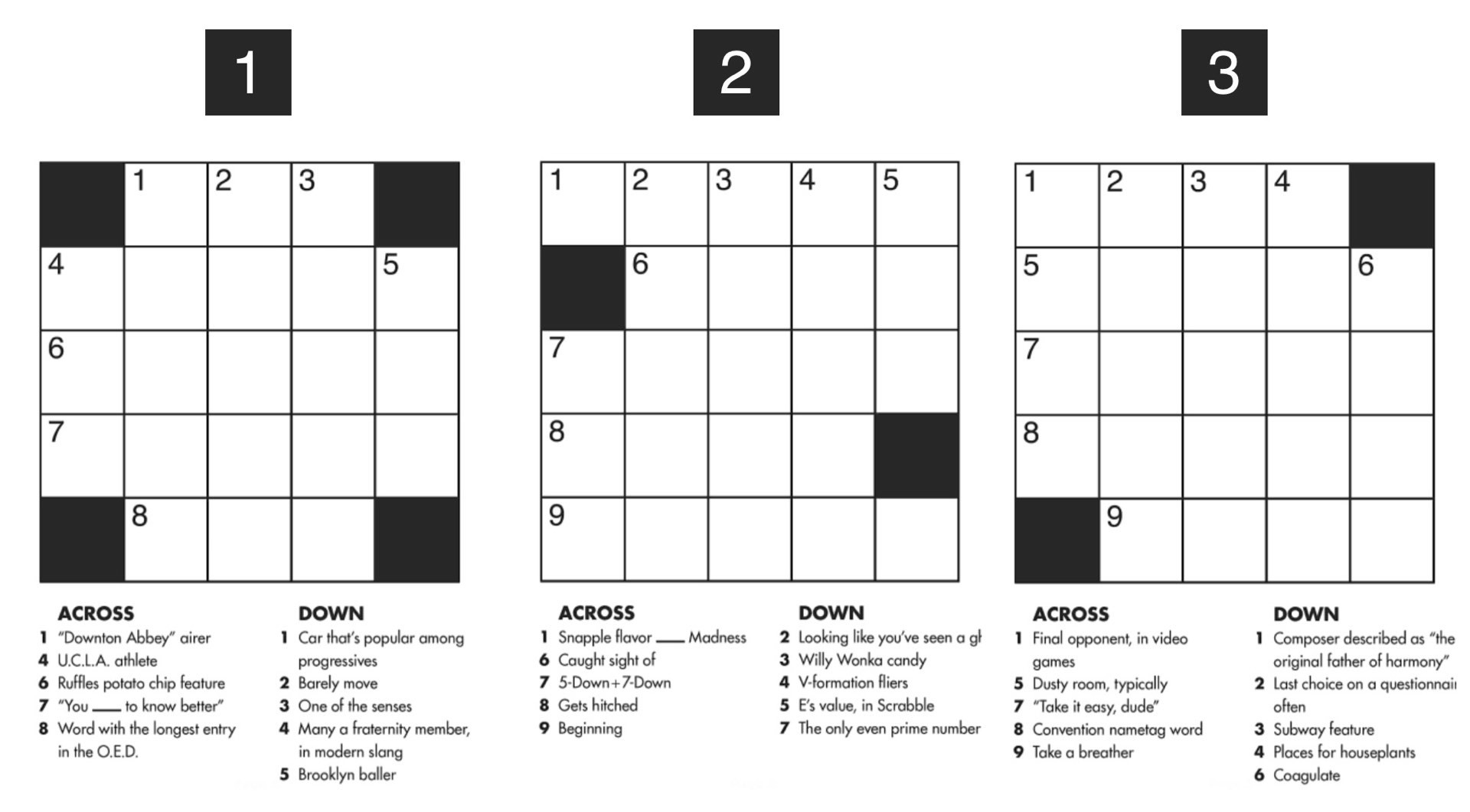

March 13 Nyt Mini Crossword Answers Hints And Solving Tips

May 23, 2025

March 13 Nyt Mini Crossword Answers Hints And Solving Tips

May 23, 2025 -

Nyt Mini Crossword Solution March 13 Hints And Complete Answers

May 23, 2025

Nyt Mini Crossword Solution March 13 Hints And Complete Answers

May 23, 2025 -

Solve The Nyt Mini Crossword March 13 Answers And Expert Strategies

May 23, 2025

Solve The Nyt Mini Crossword March 13 Answers And Expert Strategies

May 23, 2025 -

Jonathan Groff Eyes Tony Award Glory With Just In Time

May 23, 2025

Jonathan Groff Eyes Tony Award Glory With Just In Time

May 23, 2025 -

Is Jonathan Groffs Just In Time Performance Tony Worthy

May 23, 2025

Is Jonathan Groffs Just In Time Performance Tony Worthy

May 23, 2025