Bitcoin's Recovery: A Deeper Look At The Market Trend

Table of Contents

Analyzing the Current Bitcoin Price Action

Understanding the current price action is crucial for assessing Bitcoin's recovery. We can gain valuable insights through both technical and on-chain analysis.

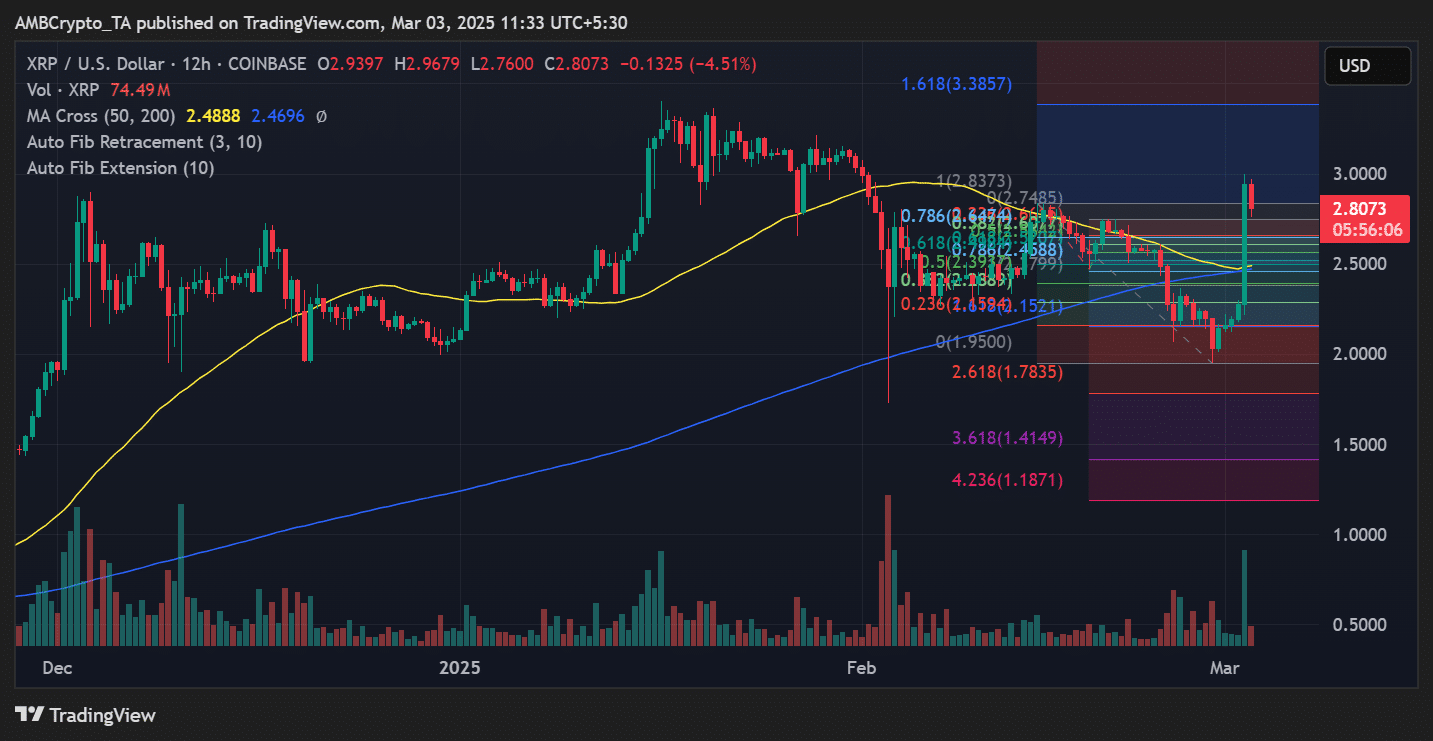

Technical Analysis Indicators

Technical analysis provides a framework for predicting future price movements based on historical data. Several key indicators suggest a potential Bitcoin recovery.

- Moving Averages: The 50-day and 200-day moving averages are often used to identify trends. A bullish crossover (50-day crossing above the 200-day) can signal a potential uptrend, a key factor in Bitcoin's recovery.

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 50 generally suggests bullish momentum. For example, the recent break above 50 in [mention specific date] signaled a shift from oversold to overbought territory, a positive sign for Bitcoin's recovery.

- Moving Average Convergence Divergence (MACD): The MACD identifies changes in momentum by comparing two moving averages. A bullish MACD crossover can be a confirmation of a price trend reversal.

- Chart Patterns: Reversal patterns like head and shoulders (a bearish reversal pattern that, when broken upwards, can signal bullish price movement) can offer strong insights into potential price movements. A successful break above the neckline of an inverse head and shoulders pattern can signal a significant price increase, driving Bitcoin's recovery further.

- Support and Resistance Levels: Identifying key support and resistance levels helps predict price reactions. Successful breakouts above resistance levels often lead to further upward price movements. For example, the recent breakout above the $[price] resistance level suggests strengthening bullish momentum in Bitcoin's recovery.

On-Chain Metrics and Their Significance

On-chain data provides a more fundamental perspective on Bitcoin's network activity and can hint at its future price trajectory.

- Transaction Volume: Increasing transaction volume signifies rising activity and interest in the Bitcoin network, supporting a positive narrative for Bitcoin's recovery.

- Network Hash Rate: A higher hash rate indicates a more secure and robust network, suggesting growing confidence and participation. A sustained increase in the network hash rate can indicate a healthy network and support Bitcoin's recovery.

- Miner Behavior: Analyzing miner behavior, such as the proportion of miners holding onto their Bitcoin, can offer valuable insights into their confidence in the future price. Miners holding onto their Bitcoin suggests faith in future price increases, which is essential to Bitcoin's recovery.

Macroeconomic Factors Influencing Bitcoin's Recovery

Macroeconomic conditions significantly impact Bitcoin's price.

Inflation and Safe-Haven Assets

High inflation often drives investors towards alternative assets perceived as inflation hedges.

- Bitcoin as an Inflation Hedge: Bitcoin's fixed supply of 21 million coins makes it a potential hedge against inflation, as its value may rise in response to fiat currency devaluation. However, the correlation between Bitcoin's price and inflation remains debated.

- Competing Safe-Havens: Gold and government bonds are traditional safe-haven assets. Their performance relative to Bitcoin can influence investor allocation. For example, if investors move away from bonds towards Bitcoin, this contributes to Bitcoin's recovery.

Regulatory Developments and Their Impact

Regulatory clarity and acceptance are vital for Bitcoin's long-term growth.

- Positive Regulatory Developments: Clear regulatory frameworks in major jurisdictions can increase institutional participation and investor confidence, driving Bitcoin's recovery.

- Negative Regulatory Developments: Conversely, overly restrictive or unclear regulations can negatively impact market sentiment and hinder Bitcoin's price appreciation.

Institutional Adoption and Investor Sentiment

Institutional adoption and changing public perception significantly influence Bitcoin's recovery.

Growing Institutional Interest

Large financial institutions are increasingly incorporating Bitcoin into their portfolios.

- Portfolio Diversification: Institutions are seeking diversification beyond traditional assets, seeing Bitcoin as a valuable addition.

- Exposure to a New Asset Class: The potential for high returns attracts institutional interest. This influx of institutional investment directly increases demand and can drive Bitcoin's recovery.

Shifting Public Perception and Media Coverage

Positive media coverage and increased public awareness contribute to greater adoption.

- Positive News Stories: Favorable news stories about Bitcoin's technology, use cases, and potential can improve market sentiment, leading to increased investment.

- Increased Media Attention: Greater media attention, whether positive or negative, often correlates with increased price volatility and can either hinder or support Bitcoin's recovery.

Conclusion

The current indications, encompassing improving technical indicators, positive on-chain data, favorable macroeconomic conditions, and growing institutional adoption, suggest a potential Bitcoin's recovery is underway. While volatility remains inherent in the cryptocurrency market, understanding these underlying trends is crucial for navigating the path forward. For further insights into Bitcoin's recovery and to stay informed on the latest market developments, continue researching and monitoring relevant news and analysis regarding Bitcoin's recovery. Stay informed and make well-considered investment decisions based on your own risk tolerance. Understanding the factors driving Bitcoin's recovery is key to successful cryptocurrency investing.

Featured Posts

-

Mike Trouts Knee Soreness Sidelines Him As Angels Lose Fifth Straight

May 08, 2025

Mike Trouts Knee Soreness Sidelines Him As Angels Lose Fifth Straight

May 08, 2025 -

Analyzing Counting Crows Slip Into The Shadows From The Aurora Album A Track By Track Look

May 08, 2025

Analyzing Counting Crows Slip Into The Shadows From The Aurora Album A Track By Track Look

May 08, 2025 -

Kyren Paris Late Homer Powers Angels To Rain Soaked Victory Over White Sox

May 08, 2025

Kyren Paris Late Homer Powers Angels To Rain Soaked Victory Over White Sox

May 08, 2025 -

Cemetery Corruption In Ukraine The Profiting From Fallen Soldiers

May 08, 2025

Cemetery Corruption In Ukraine The Profiting From Fallen Soldiers

May 08, 2025 -

Etf

May 08, 2025

Etf

May 08, 2025

Latest Posts

-

Analysis Trump Media Crypto Com Etf Partnership And Cros Future

May 08, 2025

Analysis Trump Media Crypto Com Etf Partnership And Cros Future

May 08, 2025 -

New Crypto Etf From Trump Media And Crypto Com Cro Price Analysis

May 08, 2025

New Crypto Etf From Trump Media And Crypto Com Cro Price Analysis

May 08, 2025 -

Cro Skyrockets Trump Medias Crypto Etf Partnership With Crypto Com

May 08, 2025

Cro Skyrockets Trump Medias Crypto Etf Partnership With Crypto Com

May 08, 2025 -

Crypto Com And Trump Media Team Up For New Etf Boosting Cro

May 08, 2025

Crypto Com And Trump Media Team Up For New Etf Boosting Cro

May 08, 2025 -

Anlik Bitcoin Fiyati Son Dakika Degerleri Ve Piyasa Hareketleri

May 08, 2025

Anlik Bitcoin Fiyati Son Dakika Degerleri Ve Piyasa Hareketleri

May 08, 2025