BlackRock ETF: A Billionaire-Backed Investment With 110% Growth Potential In 2025

Table of Contents

Understanding BlackRock ETFs and Their Market Position

BlackRock's Reputation and Market Dominance

BlackRock is a global investment management corporation, a behemoth in the financial world. Their sheer size and influence significantly impact the ETF market. Their assets under management (AUM) are staggering, representing a considerable portion of the global investment landscape. This market dominance translates to extensive research capabilities, robust infrastructure, and a diverse range of ETFs catering to various investment styles and risk profiles. They boast a long and successful track record, establishing trust among investors worldwide.

- BlackRock's AUM: Trillions of dollars, showcasing their significant market share.

- Popular BlackRock ETFs: iShares Core S&P 500 ETF (IVV), iShares Core US Aggregate Bond ETF (AGG), illustrating their offerings across diverse asset classes.

- Market Expertise: Decades of experience and a vast team of analysts provide a competitive edge in market analysis and ETF development.

Types of BlackRock ETFs and Investment Strategies

BlackRock offers a plethora of ETFs, each designed for specific investment goals and risk tolerances. These include:

- Index-tracking ETFs: These passively manage investments, mirroring the performance of a specific index like the S&P 500. They are generally low-cost and provide broad market exposure.

- Sector-specific ETFs: These focus on particular sectors, such as technology, healthcare, or energy, allowing investors to target specific market trends.

- Actively managed ETFs: Unlike index trackers, these ETFs employ active portfolio management strategies, aiming to outperform a benchmark index.

Understanding your risk tolerance and investment goals is crucial for selecting the appropriate BlackRock ETF. For instance, a conservative investor might favor low-volatility index-tracking ETFs, while a more aggressive investor might consider sector-specific ETFs with higher growth potential.

Analyzing the 110% Growth Potential Prediction for 2025

Factors Contributing to Potential High Growth

The 110% growth prediction for 2025 is ambitious and subject to significant uncertainty. Several factors could contribute to substantial growth:

- Economic Growth: A robust global economy could fuel strong market performance, benefiting BlackRock ETFs across various sectors.

- Technological Innovation: Breakthroughs in technology often drive significant market growth, particularly in sectors like technology and healthcare.

- Geopolitical Stability: A relatively stable geopolitical environment reduces uncertainty and encourages investment, potentially boosting ETF performance.

However, these are just potential scenarios. Predicting market performance with such precision is inherently difficult.

Risks and Considerations

Investing in BlackRock ETFs, while potentially lucrative, carries inherent risks:

- Market Volatility: Market fluctuations can significantly impact ETF prices, leading to potential losses.

- Sector-Specific Risks: Investing in sector-specific ETFs exposes investors to the risks associated with that particular sector. A downturn in a specific industry could negatively impact the ETF’s performance.

- Personal Risk Tolerance: It's crucial to assess your own risk tolerance before investing in any ETF. High-growth potential often comes with higher risk.

Billionaire Investment Strategies and BlackRock ETFs

Why Billionaires Invest in ETFs

High-net-worth individuals often favor ETFs for several compelling reasons:

- Diversification: ETFs provide instant diversification across a wide range of assets, mitigating risk.

- Cost-Effectiveness: Expense ratios for ETFs are generally lower than those of mutual funds.

- Liquidity and Accessibility: ETFs are highly liquid, meaning they can be easily bought and sold.

Examples of Billionaire ETF Investment Approaches

While specific portfolio details of billionaires remain private, it’s widely known that many incorporate ETFs into their diversified portfolios to gain broad market exposure and manage risk effectively. They might employ a core-satellite strategy, combining low-cost index ETFs with more specialized ETFs targeting specific growth sectors.

Conclusion

BlackRock ETFs offer a compelling investment opportunity, particularly for those seeking exposure to a broad range of markets. The potential for significant growth, as suggested by the 110% prediction for 2025, is fueled by factors like economic growth and technological innovation. However, it's crucial to understand the inherent risks involved, including market volatility and sector-specific downturns. Before investing in BlackRock ETFs or any other investment vehicle, conduct thorough research and consider consulting a qualified financial advisor to develop a personalized investment strategy aligned with your financial goals and risk tolerance. Start exploring the potential of BlackRock ETF investment today and build your portfolio for a potentially successful future! Learn more about BlackRock ETF options through reputable financial resources.

Featured Posts

-

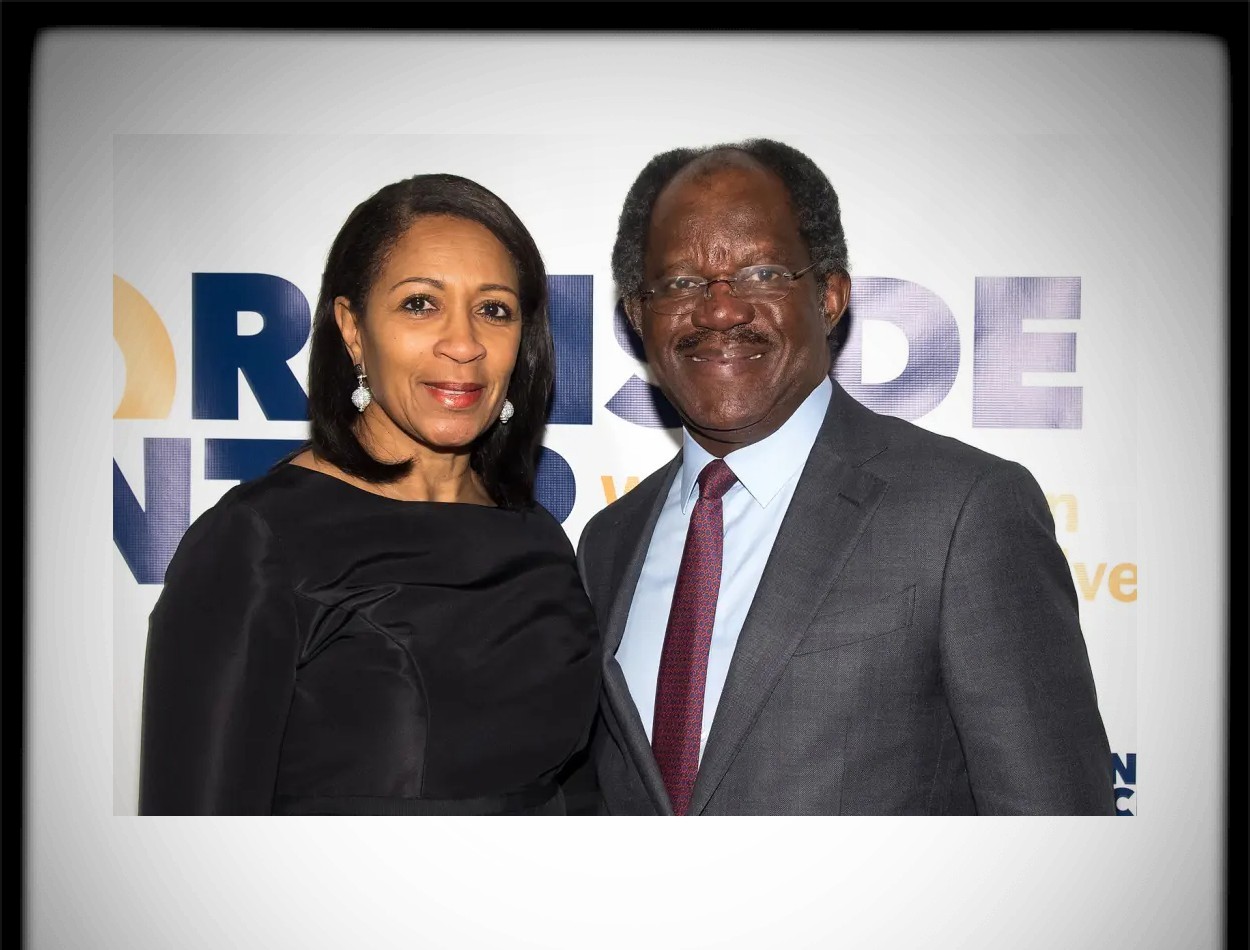

Strategies For Expediting Crime Control Measures A Practical Approach

May 08, 2025

Strategies For Expediting Crime Control Measures A Practical Approach

May 08, 2025 -

Essential Krypto Stories Every Fan Needs To Know

May 08, 2025

Essential Krypto Stories Every Fan Needs To Know

May 08, 2025 -

Poor Performance Angels Minor League System Receives Low Ranking

May 08, 2025

Poor Performance Angels Minor League System Receives Low Ranking

May 08, 2025 -

Exploring The Possibility Of Xrp Reaching 5 In 2025

May 08, 2025

Exploring The Possibility Of Xrp Reaching 5 In 2025

May 08, 2025 -

Why Is Xrp Ripple Up Today A Potential Link To President Trump

May 08, 2025

Why Is Xrp Ripple Up Today A Potential Link To President Trump

May 08, 2025

Latest Posts

-

Andor Season 1 Where To Watch Episodes Online Hulu And You Tube

May 08, 2025

Andor Season 1 Where To Watch Episodes Online Hulu And You Tube

May 08, 2025 -

Stream All Andor Season 1 Episodes Hulu And You Tube Availability

May 08, 2025

Stream All Andor Season 1 Episodes Hulu And You Tube Availability

May 08, 2025 -

Watch Andor Season 1 Episodes On Hulu And You Tube Before Season Two

May 08, 2025

Watch Andor Season 1 Episodes On Hulu And You Tube Before Season Two

May 08, 2025 -

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025

Andor Season One Stream Episodes Now On Hulu And You Tube

May 08, 2025 -

Yavin 4s Resurgence Exploring The Delay In Its Star Wars Reappearance

May 08, 2025

Yavin 4s Resurgence Exploring The Delay In Its Star Wars Reappearance

May 08, 2025