BlackRock ETF: Billionaire Investment Poised For 110% Growth In 2025?

Table of Contents

Understanding BlackRock ETFs and Their Market Dominance

BlackRock ETFs are investment funds that trade on stock exchanges like individual stocks. They offer diversified exposure to a basket of assets, ranging from stocks and bonds to commodities and real estate. BlackRock, the world's largest asset manager, boasts a massive market share in the ETF industry, making its offerings some of the most widely traded and liquid in the world. Their reputation for strong performance and low expense ratios contributes to their popularity. Successful examples include the iShares Core S&P 500 ETF (IVV), tracking the S&P 500 index, and the iShares Core U.S. Aggregate Bond ETF (AGG), providing broad exposure to the U.S. investment-grade bond market.

- Market capitalization of BlackRock's ETF assets: Trillions of dollars.

- Number of ETFs offered by BlackRock: Hundreds, covering a diverse range of asset classes and investment strategies.

- Key advantages of investing in BlackRock ETFs: Diversification, low expense ratios, ease of trading, and transparency.

Factors Contributing to Potential 110% Growth in 2025 (Speculative)

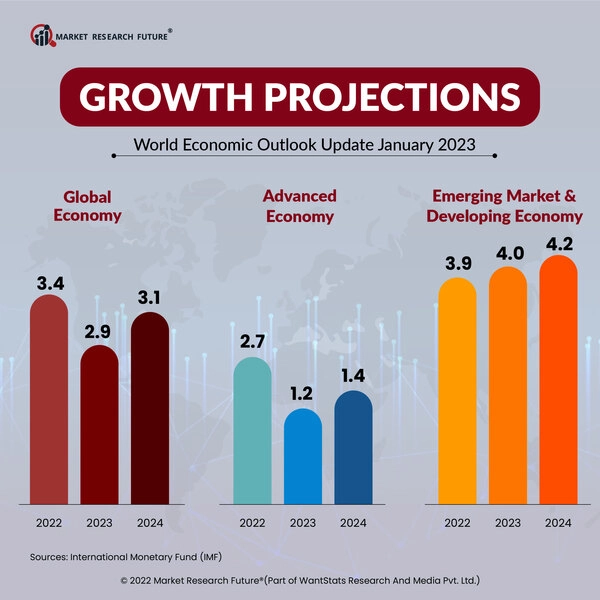

A 110% return in any investment is highly speculative and not guaranteed. However, certain market trends could contribute to significant growth in specific BlackRock ETFs. This section explores potential, not promises. A robust economic recovery, for example, could significantly boost the performance of ETFs focused on growth sectors like technology. Technological advancements themselves are a major driver of future growth, creating opportunities in areas such as artificial intelligence, renewable energy, and biotechnology. Geopolitical events, while unpredictable, can also create both opportunities and challenges, impacting various sectors differently.

- Potential economic recovery and its impact on specific market sectors: A strong recovery could benefit ETFs focused on cyclical sectors like consumer discretionary and industrials.

- Technological advancements and their influence on growth sectors: Investment in technology-focused ETFs could see substantial gains as innovation continues.

- Geopolitical factors and their potential impact: Political stability and international relations can significantly influence market performance.

Analyzing Risk and Potential Drawbacks

Investing in ETFs, even those managed by BlackRock, carries inherent risks. Market volatility is inevitable, and significant losses are possible, especially during market corrections. While diversification helps mitigate risk, it doesn't eliminate it entirely. Remember, past performance is not indicative of future results. Thorough due diligence is crucial before investing.

- Potential market corrections and their impact on ETF values: Market downturns can significantly reduce ETF values, regardless of their underlying assets.

- Risk associated with specific sectors or asset classes: Concentrated exposure to a particular sector increases the risk of significant losses if that sector underperforms.

- Importance of conducting thorough due diligence before investing: Researching an ETF's holdings, expense ratio, and historical performance is essential.

Specific BlackRock ETFs with High Growth Potential (Examples)

While predicting specific ETF performance is impossible, certain BlackRock ETFs, based on market analysis and their investment strategies, might demonstrate high growth potential. (Disclaimer: This is not financial advice. Conduct your own thorough research before investing.) For example, ETFs focused on emerging markets or specific technological advancements could offer higher growth potential but with correspondingly higher risk. Analyzing their historical performance across different timeframes is crucial, comparing their expense ratios to similar ETFs.

- Analysis of chosen ETFs' performance over different time frames: Studying performance during bull and bear markets is essential to understanding risk tolerance.

- Explanation of why these ETFs might have high growth potential: Identify the drivers of growth within their specific sectors or strategies.

- Comparison of expense ratios with similar ETFs: Lower expense ratios improve long-term returns.

Conclusion: Investing Wisely in BlackRock ETFs for Potential Growth

Investing in BlackRock ETFs offers potential for significant growth, but a 110% return by 2025 is highly speculative. Careful analysis of market trends, thorough due diligence, and a well-diversified portfolio are crucial. Remember, understanding and managing risk is as important as identifying potential opportunities. While BlackRock ETFs offer many advantages, such as diversification and low expense ratios, it's vital to consult with a financial advisor before making any investment decisions. While a 110% return on BlackRock ETFs by 2025 is speculative, careful analysis of market trends and diligent research could lead to significant gains. Learn more about BlackRock ETFs and start planning your investment strategy today!

Featured Posts

-

Analyzing The Growth Of New Business Hot Spots A National Perspective

May 08, 2025

Analyzing The Growth Of New Business Hot Spots A National Perspective

May 08, 2025 -

March 29th Nba Game Thunder Vs Pacers Injury News

May 08, 2025

March 29th Nba Game Thunder Vs Pacers Injury News

May 08, 2025 -

Mick Jagger E O Oscar Supersticao Brasileira E A Preocupacao Com O Pe Frio

May 08, 2025

Mick Jagger E O Oscar Supersticao Brasileira E A Preocupacao Com O Pe Frio

May 08, 2025 -

Largimi I Pese Yjeve Te Psg Reagimi I Luis Enriques

May 08, 2025

Largimi I Pese Yjeve Te Psg Reagimi I Luis Enriques

May 08, 2025 -

Andor Season 2 The Absence Of A Trailer Sparks Intense Fan Debate

May 08, 2025

Andor Season 2 The Absence Of A Trailer Sparks Intense Fan Debate

May 08, 2025

Latest Posts

-

Uber Pet Service Now Available In Delhi And Mumbai

May 08, 2025

Uber Pet Service Now Available In Delhi And Mumbai

May 08, 2025 -

New Uber Kenya Program Cashback For Customers Increased Opportunities For Drivers And Couriers

May 08, 2025

New Uber Kenya Program Cashback For Customers Increased Opportunities For Drivers And Couriers

May 08, 2025 -

Uber Kenya Improves Earnings For Drivers And Couriers While Offering Customers Cashback

May 08, 2025

Uber Kenya Improves Earnings For Drivers And Couriers While Offering Customers Cashback

May 08, 2025 -

Zhurnalist O Kontrakte Zenita S Zhersonom Summa E500 000 I Vozmozhnye Posledstviya

May 08, 2025

Zhurnalist O Kontrakte Zenita S Zhersonom Summa E500 000 I Vozmozhnye Posledstviya

May 08, 2025 -

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 08, 2025

Uber Kenya Boosts Customer Loyalty With Cashback Increases Driver And Courier Earnings

May 08, 2025