BlackRock ETF Poised For Massive Gains: Billionaire Investors Pile In

Table of Contents

Why Billionaire Investors are Betting Big on BlackRock ETFs

Billionaire investors aren't placing their bets on BlackRock ETFs blindly. Their confidence stems from a confluence of factors, making BlackRock a compelling choice in the world of ETF investing.

BlackRock's Track Record and Reputation

BlackRock, a titan in the asset management industry, boasts a long and impressive history. Their reputation for stability and strong performance is built on:

- Decades of experience: BlackRock's extensive experience in managing assets provides a level of expertise and stability that attracts high-net-worth investors.

- Proven success: Numerous BlackRock ETFs have consistently outperformed market benchmarks. For example, [cite a specific BlackRock ETF and its historical performance data with source, e.g., "the iShares Core S&P 500 ETF (IVV) has shown [percentage]% annualized return over the past [number] years, according to [source]."].

- Diverse ETF offerings: BlackRock offers a wide range of ETFs catering to various investment styles, risk tolerances, and market sectors, allowing investors to diversify and customize their portfolios effectively. This includes options spanning various asset classes, geographies, and market caps.

Market Conditions Favoring BlackRock ETFs

Current market trends significantly favor BlackRock's ETF offerings. [Insert a chart illustrating a relevant market trend, e.g., interest rates, inflation].

- Low interest rates: The current environment of low interest rates makes fixed-income investments less attractive, driving investors toward ETFs that offer potentially higher returns.

- Inflation hedging: Certain BlackRock ETFs, particularly those focused on commodities or inflation-protected securities, offer a hedge against inflation, appealing to risk-averse investors.

- Sector-specific growth: Specific sectors, such as [mention a currently thriving sector, e.g., technology or renewable energy], are experiencing significant growth, and BlackRock offers ETFs focused on these areas, allowing investors to capitalize on these trends.

Diversification and Risk Management

BlackRock ETFs are a cornerstone of effective diversification strategies.

- Asset class diversification: Investing in multiple BlackRock ETFs allows for diversification across various asset classes (e.g., stocks, bonds, real estate), mitigating overall portfolio risk.

- Passive investing benefits: Many BlackRock ETFs utilize passive investment strategies, tracking specific market indices, offering low-cost, efficient exposure to broad market segments.

- Examples: [Mention specific BlackRock ETFs that offer diversification, e.g., "The iShares Core U.S. Aggregate Bond ETF (AGG) provides broad exposure to the U.S. investment-grade bond market, complementing equity investments."].

Specific BlackRock ETFs Showing Promising Potential

Several BlackRock ETFs demonstrate strong potential for future growth, attracting significant attention from sophisticated investors.

Top Performing BlackRock ETFs

- [ETF Ticker 1]: [Brief description of ETF, investment strategy, expense ratio, AUM, and historical performance].

- [ETF Ticker 2]: [Brief description of ETF, investment strategy, expense ratio, AUM, and historical performance].

- [ETF Ticker 3]: [Brief description of ETF, investment strategy, expense ratio, AUM, and historical performance]. (Remember to replace bracketed information with actual data from reputable sources.)

Analyzing the Billionaire Investments

Reports suggest that billionaires are actively investing in [mention specific ETFs and cite reputable financial news sources]. This influx of capital can further fuel the growth of these ETFs, creating a positive feedback loop. However, it's crucial to remember that past performance is not indicative of future results.

Potential Risks and Considerations

While BlackRock ETFs offer significant potential, investors must be aware of potential risks.

Market Volatility and Economic Uncertainty

- Market downturns: Even the best ETFs are susceptible to market volatility. During economic downturns, ETF values can decline significantly.

- Underlying asset risk: The performance of a BlackRock ETF is directly tied to the performance of its underlying assets. A downturn in a specific sector can negatively impact ETFs focused on that sector.

- Due diligence: Thorough research and understanding of an ETF's investment strategy and associated risks are crucial before investing.

Expense Ratios and Fees

- Expense ratio comparison: Compare expense ratios across similar ETFs offered by different providers to minimize costs. Lower expense ratios can significantly impact long-term returns.

- Cost minimization: Choose ETFs with low expense ratios to maximize your returns.

Conclusion

Billionaire investors are increasingly choosing BlackRock ETFs due to their robust track record, diversified offerings, and alignment with current market trends. Several BlackRock ETFs show promising potential for significant gains. However, remember that all investments carry inherent risk. Explore BlackRock ETF options carefully, conduct thorough due diligence, and consider consulting a financial advisor before making any investment decisions. Investigating the potential of BlackRock ETFs is a crucial step in building a robust and diversified investment portfolio, but proceed with caution and a comprehensive understanding of the market landscape. Remember to diversify and manage your risk appropriately.

Featured Posts

-

Thailand Theater Teases 5 Minute Minecraft Superman Preview

May 08, 2025

Thailand Theater Teases 5 Minute Minecraft Superman Preview

May 08, 2025 -

Colin Cowherd And Jayson Tatum An Ongoing Disagreement And Its Implications

May 08, 2025

Colin Cowherd And Jayson Tatum An Ongoing Disagreement And Its Implications

May 08, 2025 -

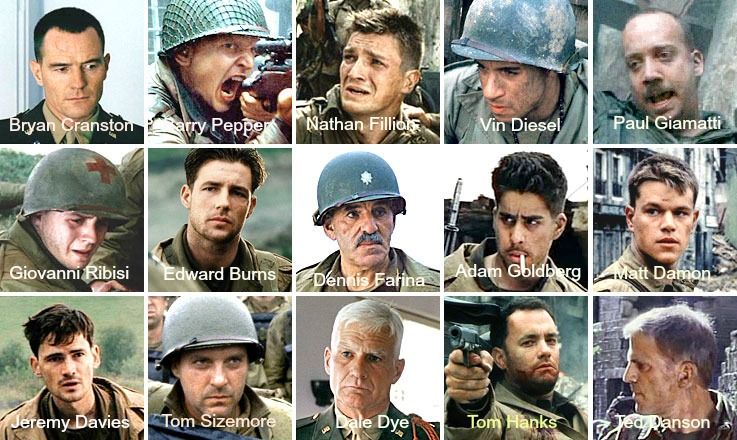

Steven Spielbergs Top 7 War Films Excluding Saving Private Ryan A Ranked List

May 08, 2025

Steven Spielbergs Top 7 War Films Excluding Saving Private Ryan A Ranked List

May 08, 2025 -

Psg Vs Arsenal Gary Nevilles Prediction And Match Analysis

May 08, 2025

Psg Vs Arsenal Gary Nevilles Prediction And Match Analysis

May 08, 2025 -

Saglik Bakanligi 37 000 Personel Alimi Basvuru Sartlar Ve Oenemli Tarihler

May 08, 2025

Saglik Bakanligi 37 000 Personel Alimi Basvuru Sartlar Ve Oenemli Tarihler

May 08, 2025

Latest Posts

-

El Emotivo Gesto De Erick Pulgar Con La Aficion Del Flamengo

May 08, 2025

El Emotivo Gesto De Erick Pulgar Con La Aficion Del Flamengo

May 08, 2025 -

Cash Only Understanding Ubers Auto Service Policy Shift

May 08, 2025

Cash Only Understanding Ubers Auto Service Policy Shift

May 08, 2025 -

El Gesto De Pulgar Que Emociono A Los Hinchas Del Flamengo

May 08, 2025

El Gesto De Pulgar Que Emociono A Los Hinchas Del Flamengo

May 08, 2025 -

Uber Auto Service Goes Cash Only Impact And Implications

May 08, 2025

Uber Auto Service Goes Cash Only Impact And Implications

May 08, 2025 -

Convocatoria De Neymar Brasil Vs Argentina En El Monumental Por Las Eliminatorias

May 08, 2025

Convocatoria De Neymar Brasil Vs Argentina En El Monumental Por Las Eliminatorias

May 08, 2025