BOE Rate Cut Odds Fall Following UK Inflation Figures: Pound Gains

Table of Contents

UK Inflation Figures Exceed Expectations

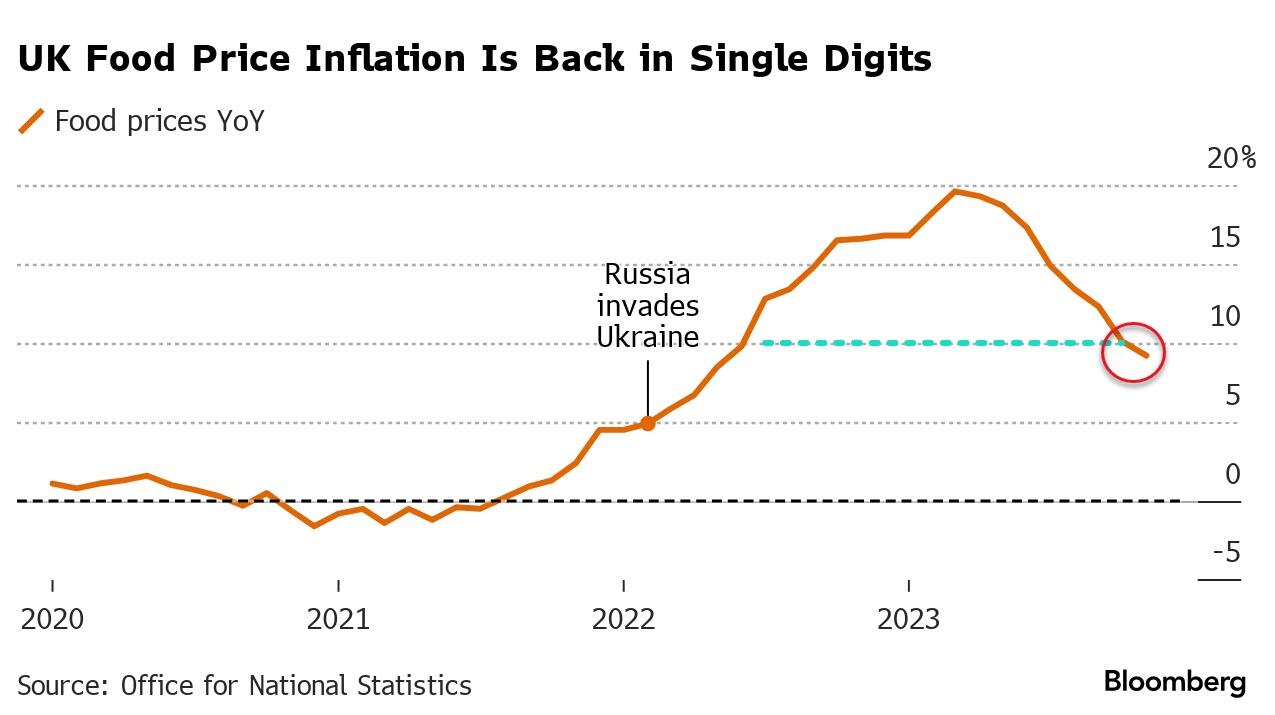

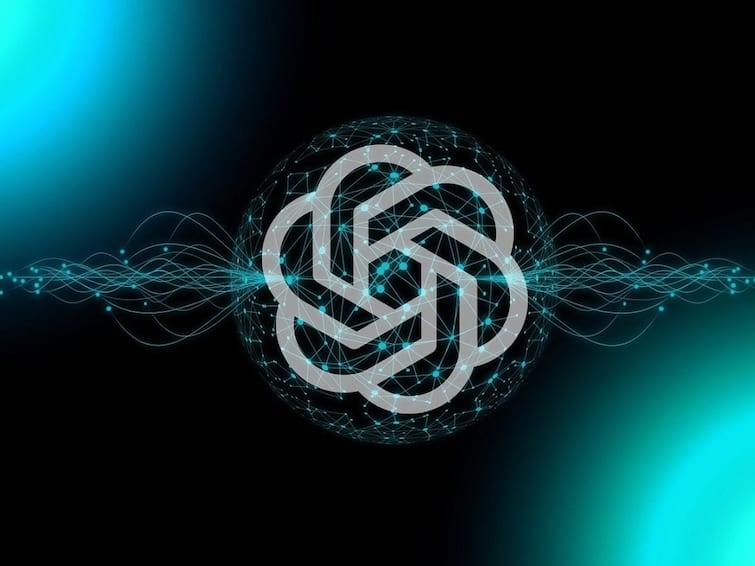

The latest UK inflation figures released significantly exceeded market forecasts, dampening expectations of an imminent BOE rate cut. The Office for National Statistics (ONS) reported a [Insert Specific Inflation Rate Percentage]% inflation rate for [Insert Month, Year], compared to the anticipated [Insert Forecasted Inflation Rate Percentage]%. This higher-than-predicted figure indicates that inflationary pressures within the UK economy remain stubbornly persistent.

- Inflation Rate: [Insert Specific Inflation Rate Percentage]% for [Insert Month, Year].

- Key Contributing Factors: Rising energy prices continue to play a major role, alongside persistent wage growth and supply chain bottlenecks.

- Comparison to Previous Months: This represents an [increase/decrease] compared to the [Insert Percentage]% inflation rate reported in [Insert Previous Month, Year].

The implications of this higher-than-expected inflation are significant for the BOE's monetary policy. The central bank's primary mandate is to maintain price stability, and persistent high inflation pressures increase the likelihood of further interest rate hikes, rather than cuts.

Market Reaction and Pound Sterling's Surge

The immediate market response to the inflation data was a sharp appreciation of the pound sterling. Investors, anticipating a less dovish stance from the BOE, rushed to buy the pound, driving its value higher against other major currencies. This demonstrates the strong correlation between inflation data, interest rate expectations, and currency valuations.

- Pound's Percentage Gain: The pound gained [Insert Percentage]% against the US dollar (USD) and [Insert Percentage]% against the Euro (EUR) in the hours following the release of the inflation figures.

- Trading Volumes and Volatility: Trading volumes surged, reflecting heightened market activity and volatility in the foreign exchange market.

- Market Analyst Quotes: "[Insert Quote from a reputable market analyst regarding the pound's strength and the BOE's likely response]."

This significant strengthening of the pound underscores the market's reassessment of the BOE's monetary policy trajectory.

Impact on BOE Rate Cut Probabilities

The unexpected inflation figures have dramatically reduced the probability of a near-term BOE rate cut. Before the data release, market analysts were assigning a [Insert Percentage]% probability of a rate cut at the next BOE meeting. Following the release, that probability has fallen to approximately [Insert Percentage]%, according to [Source]. This signifies a significant shift in market expectations.

- Before and After Probabilities: [Insert Percentage]% probability before the inflation data, [Insert Percentage]% probability after.

- Future BOE Meetings: The next BOE Monetary Policy Committee (MPC) meeting is scheduled for [Insert Date], and this decision will be crucial in shaping the future interest rate trajectory.

- Potential Future Interest Rate Changes: While a rate cut now seems less likely, further rate hikes remain a possibility depending on future economic data and inflation trends.

Economic Implications and Outlook for the UK Economy

Persistent inflation poses significant challenges to the UK economy. High inflation erodes purchasing power, dampening consumer spending and potentially impacting economic growth. It can also lead to increased wage demands, further fueling inflationary pressures. The government's response will be crucial in navigating this challenging economic landscape.

- Potential Risks and Opportunities: Risks include a prolonged period of high inflation, slower economic growth, and potential social unrest. Opportunities lie in addressing the underlying causes of inflation and implementing policies to promote sustainable economic growth.

- Government's Response to Inflation: The government's fiscal policy and its interaction with the BOE's monetary policy will be vital in determining the overall economic outcome.

- Impact on Various Economic Sectors: Different sectors of the UK economy will be affected differently by persistent inflation and potential policy responses.

Conclusion: Understanding the Shift in BOE Rate Cut Odds

In summary, the higher-than-expected UK inflation figures have significantly reduced the likelihood of a BOE rate cut in the near future. This unexpected shift has resulted in a considerable strengthening of the pound sterling against major currencies. The implications for the UK economy are significant, with persistent inflation posing challenges to economic growth, consumer spending, and overall economic stability. The government’s response, coupled with future BOE interest rate decisions, will determine the long-term economic outlook.

To stay informed about the evolving situation regarding BOE rate cut odds and the pound’s performance, monitor upcoming BOE announcements and consult reputable economic analysis from sources such as [Suggest reputable sources, e.g., financial news outlets]. Understanding BOE monetary policy and its impact on the UK economy is crucial for navigating the current economic climate.

Featured Posts

-

Record Highs Near Frankfurt Equities Opening And Dax Performance

May 25, 2025

Record Highs Near Frankfurt Equities Opening And Dax Performance

May 25, 2025 -

Inside Ferraris First Bengaluru Service Centre A Detailed Look

May 25, 2025

Inside Ferraris First Bengaluru Service Centre A Detailed Look

May 25, 2025 -

Open Ai And Chat Gpt An Ftc Probe

May 25, 2025

Open Ai And Chat Gpt An Ftc Probe

May 25, 2025 -

How To Get Bbc Radio 1 Big Weekend 2025 Tickets Full Line Up And Tips

May 25, 2025

How To Get Bbc Radio 1 Big Weekend 2025 Tickets Full Line Up And Tips

May 25, 2025 -

Avrupa Borsalarinda Karisik Bir Kapanis

May 25, 2025

Avrupa Borsalarinda Karisik Bir Kapanis

May 25, 2025

Latest Posts

-

Flash Flood Warning Cayuga County Under Alert Until Tuesday Night

May 25, 2025

Flash Flood Warning Cayuga County Under Alert Until Tuesday Night

May 25, 2025 -

North Myrtle Beachs Water Crisis Understanding The Public Safety Implications

May 25, 2025

North Myrtle Beachs Water Crisis Understanding The Public Safety Implications

May 25, 2025 -

Public Safety Issues In North Myrtle Beach Due To Excess Water Consumption

May 25, 2025

Public Safety Issues In North Myrtle Beach Due To Excess Water Consumption

May 25, 2025 -

North Myrtle Beach Excessive Water Use A Public Safety Risk

May 25, 2025

North Myrtle Beach Excessive Water Use A Public Safety Risk

May 25, 2025 -

Flash Flood Emergency What To Know And How To Respond

May 25, 2025

Flash Flood Emergency What To Know And How To Respond

May 25, 2025