BOE Rate Cut Probabilities Fall: Pound Reacts To UK Inflation Figures

Table of Contents

H2: Persistent Inflation Defies Expectations

The latest UK inflation figures, released on October 26th, 2023, showed inflation at 6.9%, defying analysts' predictions of a decline to 6.5%. This persistent inflation, driven primarily by elevated energy prices, lingering supply chain disruptions, and robust wage growth, has forced the BOE to reconsider its previously dovish stance on interest rate cuts. The continued upward pressure on the Consumer Price Index (CPI) and Retail Price Index (RPI) underscores the complexity of the situation.

- Higher-than-expected CPI and RPI readings: The figures significantly exceeded market expectations, highlighting the persistence of inflationary pressures.

- Persistent inflationary pressures across various sectors: Inflation is not confined to a single sector; it's impacting food, energy, and transportation costs, affecting the cost of living for UK citizens.

- Limited signs of easing price pressures in the near term: There's little indication that inflationary pressures will ease significantly in the coming months, prompting the BOE to maintain a cautious approach. This means ongoing pressure on household budgets and the continued impact of the cost of living crisis.

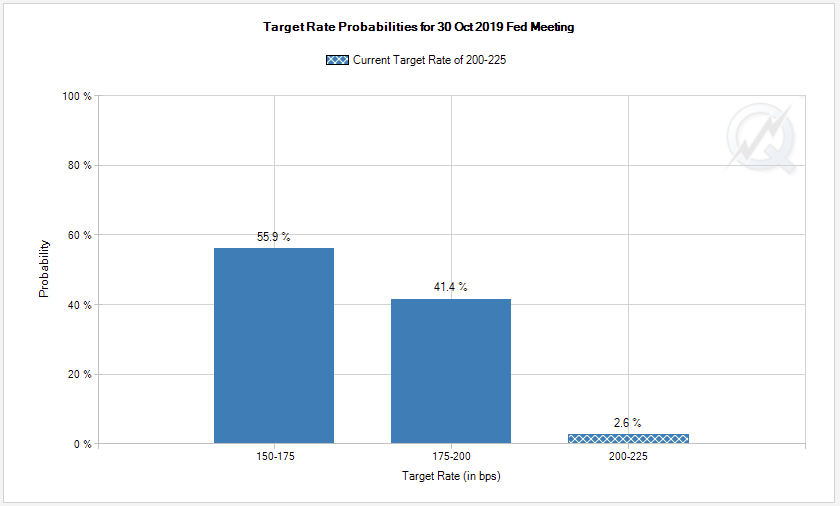

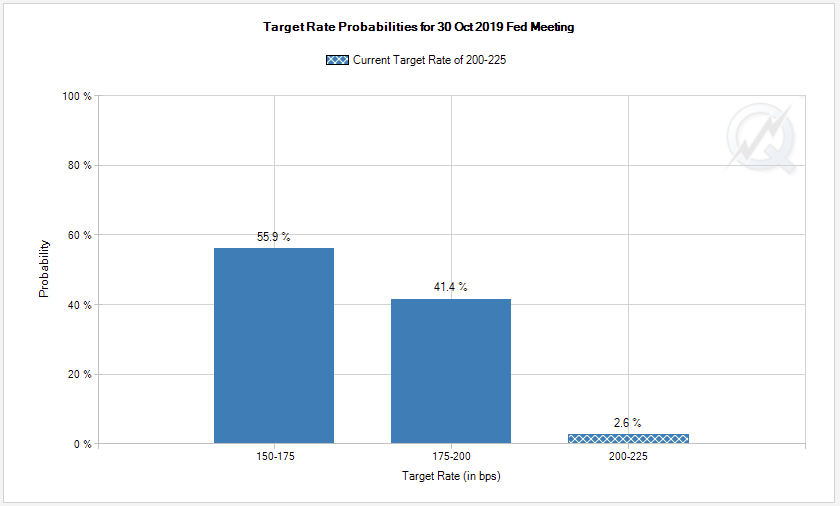

H2: BOE Rate Cut Probabilities Plummet

Following the release of the inflation data, market expectations for a BOE rate cut have plummeted. Analysts now assign a mere 15% probability to a rate cut in the next quarter, down from a 40% probability before the figures were announced. This dramatic shift reflects the BOE's unwavering commitment to its primary mandate: controlling inflation. The Monetary Policy Committee (MPC) will likely prioritize price stability over immediate economic growth considerations.

- Reduced probability of a rate cut reflected in futures markets: Financial markets are pricing in a significantly lower probability of a rate cut, indicating a shift in investor sentiment.

- Increased likelihood of the BOE maintaining or even increasing interest rates: The current inflationary environment increases the likelihood of the BOE holding interest rates steady or even implementing further hikes.

- Impact on borrowing costs for businesses and consumers: This impacts mortgages, loans, and business credit, potentially slowing down economic activity.

H2: Pound Sterling Gains Strength

The unexpected inflation figures and the reduced probability of a BOE rate cut have boosted investor confidence in the pound. The GBP has strengthened against major currencies like the USD and EUR, reflecting a more positive outlook for the UK economy – at least in the short term, from a currency perspective. This relative strength is largely due to the perceived increased strength of the UK economy compared to the expectations of more aggressive rate cuts by other central banks.

- GBP/USD exchange rate increase: The pound has appreciated against the US dollar, indicating increased demand for GBP.

- GBP/EUR exchange rate increase: Similarly, the pound has shown strength against the euro, reflecting the current market dynamics.

- Impact on UK exporters and importers: A stronger pound makes UK exports more expensive and imports cheaper, influencing trade balances and business strategies.

H3: Potential Implications for the UK Economy

The BOE's decision to likely maintain or increase interest rates will have far-reaching consequences for the UK economy. While combating inflation is crucial, this approach also risks slowing economic growth and potentially increasing the risk of a recession. Striking a balance between managing inflation and fostering sustainable economic expansion is the central challenge facing the BOE.

- Potential slowdown in economic growth: Higher interest rates can stifle economic growth by increasing borrowing costs for businesses and consumers.

- Increased borrowing costs for businesses and consumers: This will directly impact investment decisions, consumer spending, and overall economic activity.

- Impact on investment and consumer spending: Reduced investment and consumer spending can lead to a further slowdown in economic growth, potentially triggering a recession.

3. Conclusion

The unexpectedly high UK inflation figures have dramatically shifted the landscape surrounding BOE rate cut probabilities. The reduced likelihood of a rate cut, coupled with the strengthening pound, paints a complex economic outlook for the UK. Investors and businesses must carefully analyze these developments when strategizing. Maintaining awareness of upcoming BOE interest rate decisions and closely monitoring UK inflation figures is paramount for navigating this dynamic economic environment. Keep a close eye on BOE rate cut probabilities and their impact on the pound sterling to make informed financial decisions.

Featured Posts

-

Bolidul De Milioane De Euro Al Fratilor Tate O Aparitie Spectaculoasa In Centrul Bucurestiului

May 22, 2025

Bolidul De Milioane De Euro Al Fratilor Tate O Aparitie Spectaculoasa In Centrul Bucurestiului

May 22, 2025 -

Remembering Adam Ramey Dropout Kings Singer Dies At 32

May 22, 2025

Remembering Adam Ramey Dropout Kings Singer Dies At 32

May 22, 2025 -

Serious Stabbing In Lancaster City A Comprehensive Report

May 22, 2025

Serious Stabbing In Lancaster City A Comprehensive Report

May 22, 2025 -

Ai Digest Transforming Mundane Scatological Data Into A Compelling Podcast

May 22, 2025

Ai Digest Transforming Mundane Scatological Data Into A Compelling Podcast

May 22, 2025 -

Cau Ma Da Tien Do Xay Dung Va Giai Phap Khac Phuc Kho Khan

May 22, 2025

Cau Ma Da Tien Do Xay Dung Va Giai Phap Khac Phuc Kho Khan

May 22, 2025