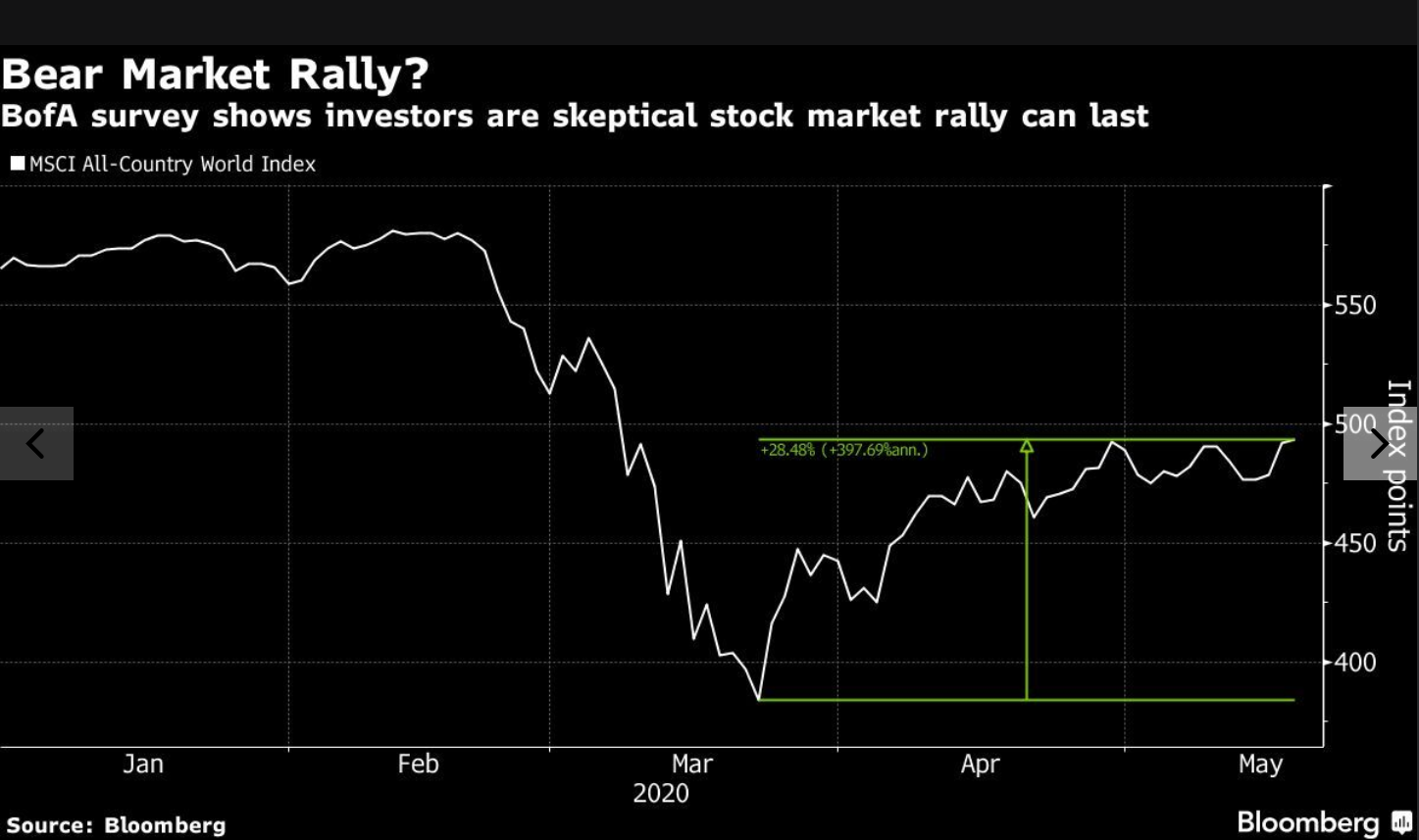

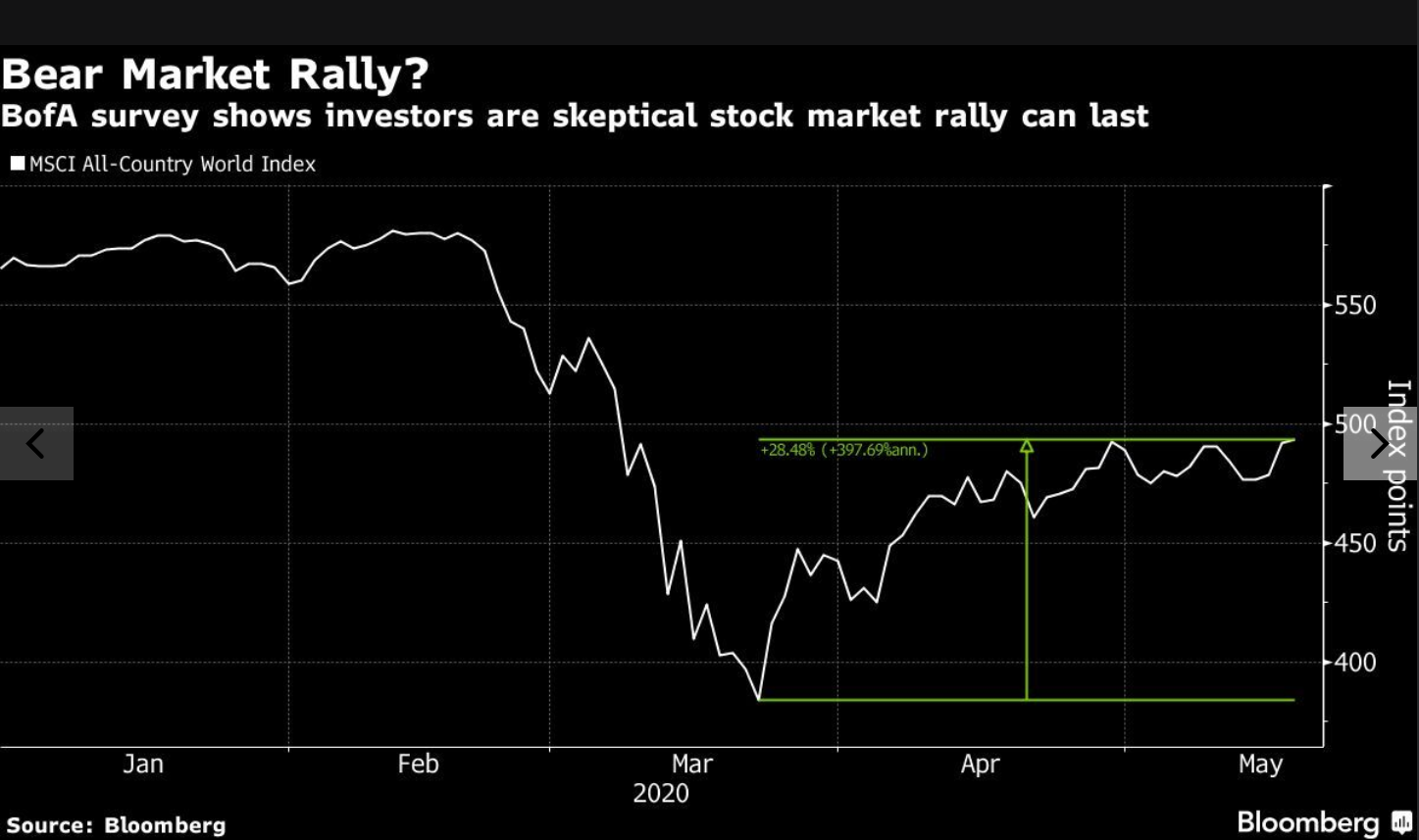

BofA On Stock Market Valuations: A Rationale For Investors

Table of Contents

BofA's Current Assessment of Stock Market Valuations

BofA's current stance on stock market valuations is nuanced and often depends on the specific sector. While their overall outlook might be described as cautiously optimistic, or perhaps even slightly bearish in certain areas, it’s crucial to examine their reasoning. Their analysis typically incorporates a range of valuation metrics to paint a comprehensive picture.

-

Specific valuation metrics used by BofA: BofA likely employs a combination of metrics including the Price-to-Earnings ratio (P/E), the Shiller PE ratio (CAPE), and various discounted cash flow models to assess the intrinsic value of stocks and the overall market. They may also consider other factors like price-to-book ratios and dividend yields.

-

Key sectors BofA highlights as overvalued or undervalued: Recent BofA reports might identify specific sectors like technology or energy as potentially overvalued, reflecting high P/E ratios relative to historical averages or projected future earnings. Conversely, other sectors, such as consumer staples or certain areas of healthcare, could be deemed undervalued based on their analysis. These assessments are dynamic and change based on various market and economic conditions.

-

Any significant changes in BofA's outlook compared to previous reports: It’s important to track shifts in BofA’s overall market sentiment. For example, if they've recently become more cautious due to rising inflation or geopolitical uncertainty, this would significantly affect their valuation analysis and subsequent investment recommendations. Regularly reviewing BofA's publicly available research is critical to staying up-to-date.

Factors Influencing BofA's Valuation Analysis

BofA's valuation analysis isn't conducted in a vacuum. Several macroeconomic factors significantly impact their assessments:

-

Impact of interest rate hikes on stock valuations: Increased interest rates typically lead to higher borrowing costs for companies, reducing profitability and potentially lowering stock valuations, especially for growth stocks reliant on future earnings. BofA closely monitors central bank policies to anticipate their influence on the equity market.

-

Influence of inflation on corporate earnings and investor confidence: High inflation erodes purchasing power and can squeeze corporate profit margins. BofA examines inflation data and its impact on earnings growth when evaluating stock prices. Reduced investor confidence can further depress valuations.

-

Role of geopolitical events in shaping market sentiment: Global events such as wars, trade disputes, or political instability can significantly influence investor sentiment and market volatility, impacting stock valuations across the board. BofA carefully assesses these risks and their potential consequences.

-

The effect of economic growth projections on valuations: BofA's assessment includes considerations for economic growth forecasts. Stronger growth typically supports higher valuations, while weaker projections lead to more cautious assessments and potential downward revisions.

BofA's Investment Recommendations Based on Valuations

Based on their valuation analysis, BofA provides investment recommendations, typically categorized into buy, sell, or hold ratings. These recommendations shape their suggested investment strategies:

-

Specific sectors or asset classes BofA recommends: Depending on their assessment, BofA might advise investors to overweight certain sectors like healthcare or infrastructure and underweight others like technology, reflecting their valuation analysis.

-

Advice on risk management in the current market environment: Given market uncertainties, BofA usually advises prudent risk management, which may involve diversifying investments across different asset classes and sectors to mitigate potential losses.

-

Strategies for diversification based on BofA's assessment: BofA's recommendations often include diversification strategies aligning with their valuation insights. For instance, they might suggest a balanced portfolio considering the relative valuations of different asset classes and sectors.

Understanding the Limitations of BofA's Analysis

While BofA's analysis is valuable, it's crucial to understand its limitations:

-

Potential for unexpected market events to impact valuations: Unforeseen events, like a sudden global pandemic or unexpected geopolitical crisis, can significantly alter market dynamics and render even the most sophisticated valuation models inaccurate.

-

The importance of individual investor risk tolerance: BofA's recommendations are general guidelines. Individual investors should consider their own risk tolerance and investment objectives when making decisions.

-

The need for independent research and due diligence: BofA's analysis should be seen as one input in your decision-making process. Conducting independent research and due diligence is crucial before making any investment choices.

Conclusion

BofA's analysis of stock market valuations offers a valuable perspective, considering various macroeconomic factors and valuation metrics. However, investors should remember that market forecasts are inherently uncertain. Their recommendations, while insightful, are just one piece of the puzzle. By combining BofA's insights with independent research and careful consideration of your own risk tolerance, you can build a well-informed investment strategy. Stay informed about BofA's ongoing analysis of stock market valuations and adjust your investment strategy accordingly. Develop a comprehensive understanding of market dynamics to make sound investment decisions.

Featured Posts

-

Tuerkiye Nin Avrupa Ile Is Birligi Vizyonu

May 03, 2025

Tuerkiye Nin Avrupa Ile Is Birligi Vizyonu

May 03, 2025 -

Chinese Naval Activity Off Sydney What Australians Need To Know

May 03, 2025

Chinese Naval Activity Off Sydney What Australians Need To Know

May 03, 2025 -

Play Station Christmas Voucher Glitch Sony Offers Free Credit To Affected Players

May 03, 2025

Play Station Christmas Voucher Glitch Sony Offers Free Credit To Affected Players

May 03, 2025 -

Fortnite Community Outraged Over Recent Music Change Details Inside

May 03, 2025

Fortnite Community Outraged Over Recent Music Change Details Inside

May 03, 2025 -

Macron Defend Un Patriotisme Economique Europeen Pour L Intelligence Artificielle

May 03, 2025

Macron Defend Un Patriotisme Economique Europeen Pour L Intelligence Artificielle

May 03, 2025

Latest Posts

-

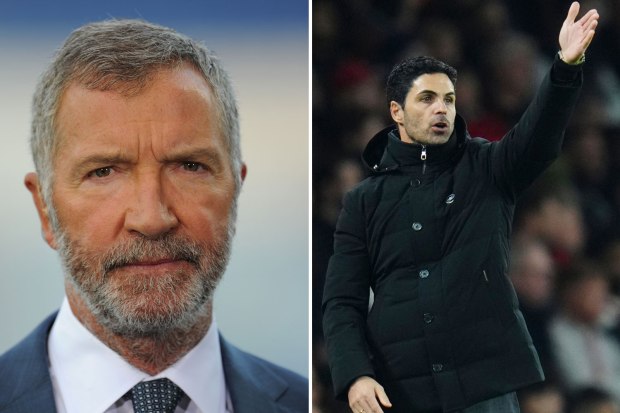

Is Havertz The Right Fit Sounesss Epl Verdict On Arsenal Signing

May 03, 2025

Is Havertz The Right Fit Sounesss Epl Verdict On Arsenal Signing

May 03, 2025 -

Epl Analysis Souness Slams Havertzs Arsenal Transfer

May 03, 2025

Epl Analysis Souness Slams Havertzs Arsenal Transfer

May 03, 2025 -

Havertzs Arsenal Performance Souness Questions Epl Impact

May 03, 2025

Havertzs Arsenal Performance Souness Questions Epl Impact

May 03, 2025 -

Rupert Lowe On X Examining The Effectiveness Of His Messaging For Uk Reform

May 03, 2025

Rupert Lowe On X Examining The Effectiveness Of His Messaging For Uk Reform

May 03, 2025 -

Souness Identifies The Missing Piece In Arsenals Title Challenge

May 03, 2025

Souness Identifies The Missing Piece In Arsenals Title Challenge

May 03, 2025