BofA On Stock Market Valuations: Addressing Investor Concerns And Providing Reassurance

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's overall view on current stock market valuations often incorporates a nuanced perspective, acknowledging both potential risks and opportunities. While specific reports and data points fluctuate, a common thread in their analyses is a cautious optimism, leaning towards a belief that markets are not drastically overvalued, but rather reflect a complex interplay of economic factors. Their assessment isn't simply a blanket statement of "overvalued" or "undervalued," but rather a detailed evaluation considering several key metrics and macroeconomic factors.

Relevant macroeconomic factors significantly influence BofA's assessment. For example, persistently high inflation, though showing signs of cooling, continues to be a key consideration. Rising interest rates, designed to combat inflation, impact corporate borrowing costs and investor sentiment. Geopolitical instability, including the ongoing war in Ukraine and other global tensions, adds another layer of uncertainty to the market outlook. These factors are intricately interwoven, influencing the overall valuation picture.

- Key indicators used by BofA to determine valuations: BofA utilizes a range of indicators including the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), dividend yields, and various other fundamental and technical analyses. They don't rely on a single metric but instead consider a basket of indicators to paint a holistic picture.

- Specific sectors BofA views as attractive or less attractive: BofA's assessments often highlight sectors with strong fundamentals and sustainable growth potential as more attractive, even in a volatile market. Conversely, sectors heavily reliant on consumer discretionary spending might be viewed with more caution during periods of economic uncertainty. Specific recommendations vary based on their ongoing analysis.

- Comparison to historical valuations: BofA regularly compares current valuations to historical averages, adjusting for inflation and economic cycles. This historical context provides perspective on whether current levels are unusually high or low relative to the past.

Addressing Key Investor Concerns Regarding Stock Market Valuations

Many investors harbor concerns about current valuations, primarily driven by fears of high inflation, a potential recession, and continuously rising interest rates. These anxieties are valid, given the current macroeconomic climate. However, BofA's analysis typically addresses these concerns by presenting a balanced view, acknowledging the risks while also highlighting potential opportunities.

BofA's reports often strive to mitigate these concerns through detailed analysis and data-driven insights. For instance, they may point to specific sectors that are relatively resilient to inflationary pressures or present attractive valuations despite rising interest rates.

- Rebuttal of common bearish arguments: BofA often counters pessimistic predictions by examining underlying economic data and providing a context that offers a more nuanced perspective. They'll highlight specific instances where historical trends contradict excessively bearish forecasts.

- Highlighting potential opportunities: Even in uncertain times, BofA typically identifies opportunities within the market. These may involve specific sectors or investment strategies poised to benefit from changing economic conditions.

- Addressing concerns about specific sectors or asset classes: BofA's analysis often dives into sector-specific valuations, providing investors with a clearer understanding of the risks and rewards associated with investing in particular areas.

BofA's Recommendations and Investment Strategies

BofA's suggested investment strategies are dynamic and depend on their current assessment of market conditions and valuations. Their recommendations are rarely purely bullish or bearish but rather a blend of approaches tailored to different risk tolerances. A core principle in their advice is almost always risk management and diversification.

The rationale behind their recommendations emphasizes a long-term perspective, urging investors to avoid short-term market fluctuations and focus on building a diversified portfolio aligned with their individual financial goals.

- Specific asset classes BofA recommends: BofA's recommendations may include a mix of equities, bonds, and other asset classes like real estate, depending on the overall market outlook and risk appetite.

- Investment strategies to consider: BofA may suggest various investment strategies such as value investing (focus on undervalued assets), growth investing (focus on high-growth companies), and income investing (focus on dividend-paying stocks). The choice depends on an investor's risk profile and financial objectives.

- Risk tolerance considerations: BofA consistently stresses the importance of understanding one's own risk tolerance. Their recommendations are designed to be adaptable to various levels of risk, from conservative to more aggressive approaches.

Conclusion: Gaining Reassurance from BofA's Stock Market Valuation Analysis

BofA's analysis of stock market valuations provides investors with a valuable framework for navigating market uncertainty. While acknowledging the inherent risks associated with investing, their perspective typically emphasizes a balanced approach, highlighting both potential challenges and opportunities. Their recommendations emphasize diversification and a long-term perspective, crucial for mitigating risks and achieving long-term financial goals. Key takeaways include the importance of understanding macroeconomic factors influencing valuations, considering various investment strategies, and aligning investment choices with your personal risk tolerance.

Stay informed about BofA's ongoing analysis of stock market valuations to make well-informed investment decisions. Contact a financial advisor to discuss how you can implement BofA's insights into your portfolio and develop a personalized investment strategy that aligns with your financial objectives and risk tolerance. Remember, understanding stock market valuations is key to effective investment management.

Featured Posts

-

Prediksi Klasemen Moto Gp 2025 Bisakah Marc Marquez Menang

May 26, 2025

Prediksi Klasemen Moto Gp 2025 Bisakah Marc Marquez Menang

May 26, 2025 -

Fp 1 Monaco Gp Leclerc Fastest Verstappen Hot On His Heels

May 26, 2025

Fp 1 Monaco Gp Leclerc Fastest Verstappen Hot On His Heels

May 26, 2025 -

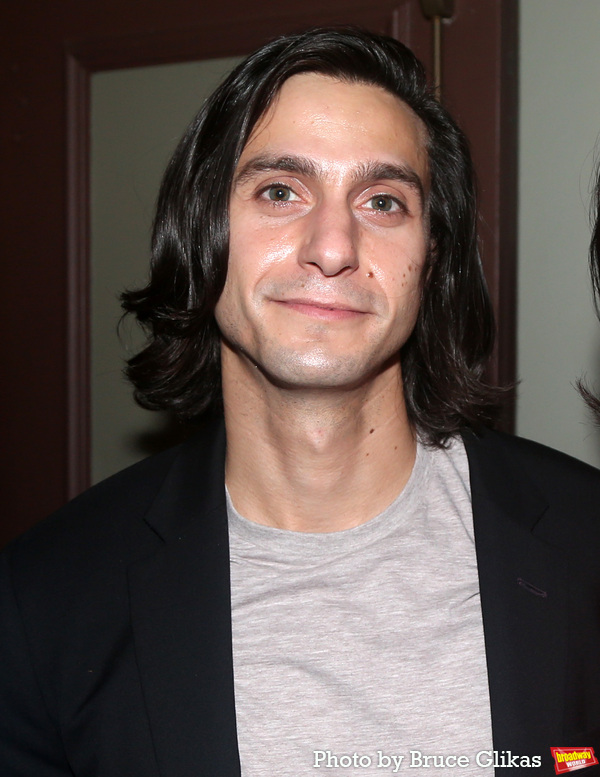

Gideon Glick Shines In Amazon Primes Etoile

May 26, 2025

Gideon Glick Shines In Amazon Primes Etoile

May 26, 2025 -

Nonton Balapan Moto Gp Argentina 2025 Link Live Streaming Dini Hari

May 26, 2025

Nonton Balapan Moto Gp Argentina 2025 Link Live Streaming Dini Hari

May 26, 2025 -

Atletico Madrid In 3 Maclik Hasreti Sona Erdi Analiz Ve Sonuclar

May 26, 2025

Atletico Madrid In 3 Maclik Hasreti Sona Erdi Analiz Ve Sonuclar

May 26, 2025