BofA On Stretched Stock Market Valuations: A Reason For Calm

Table of Contents

BofA's Methodology and Key Findings

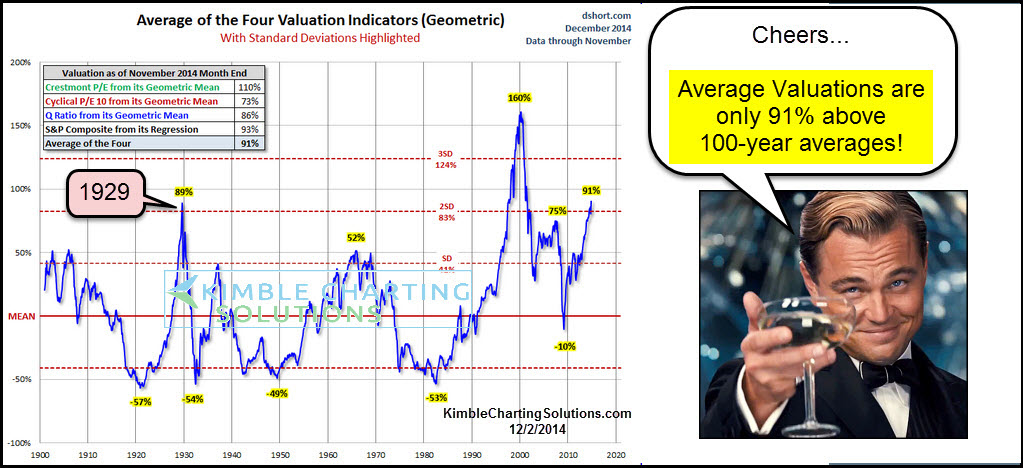

BofA's assessment of stretched stock market valuations employed a multi-faceted approach, incorporating various established metrics. Their analysis heavily relied on traditional valuation ratios like the Price-to-Earnings ratio (P/E), including the cyclically adjusted price-to-earnings ratio (Shiller P/E), which smooths out earnings fluctuations over a longer period (typically 10 years). They also considered factors like interest rates, economic growth projections, and corporate profitability forecasts.

- Key Findings:

- BofA found the current P/E ratio to be 20% above the historical average, indicating seemingly elevated valuations.

- However, their analysis also highlighted that strong earnings growth could partially justify these higher valuations.

- The report acknowledged a degree of uncertainty regarding future economic growth and interest rate movements.

It's crucial to note that BofA's analysis, like any market assessment, has limitations. Their projections are based on current economic data and assumptions, which are subject to change. Unexpected economic shocks or shifts in monetary policy could significantly impact their conclusions.

Factors Supporting BofA's Optimistic Outlook

BofA's relatively optimistic outlook is underpinned by several key factors:

Strong Corporate Earnings and Profitability

BofA's analysis points to robust corporate earnings and profitability as a key justification for the current, seemingly high valuations.

- Positive Indicators:

- Many sectors have reported significant revenue growth, exceeding expectations.

- Companies have demonstrated impressive cost management, improving profit margins.

- Forward-looking projections suggest continued strong earnings growth in the coming quarters.

This sustained earnings growth, BofA argues, can support higher price-to-earnings ratios, making the current valuations appear less alarming than initially perceived.

Low Interest Rates and Monetary Policy

The prevailing low interest rate environment plays a significant role in supporting stock valuations.

- Low interest rates make borrowing cheaper for companies, fueling investment and growth.

- They also make stocks relatively more attractive compared to bonds, pushing investors towards equities.

However, BofA acknowledges the potential impact of future monetary policy changes. A shift towards higher interest rates could dampen stock market performance and potentially lead to a market correction.

Long-Term Growth Prospects

BofA's analysis incorporates a positive outlook on long-term economic growth, particularly in specific sectors.

- Sectors with Strong Growth Potential: BofA identifies technology, healthcare, and renewable energy as sectors poised for significant long-term growth.

- This anticipated growth can justify higher valuations, as investors are willing to pay a premium for companies expected to deliver strong returns in the future.

Addressing Concerns about Overvaluation

Many investors remain rightfully concerned about the potential for a market correction or even a bear market given the apparent overvaluation. The risk of a valuation risk is always present.

- Counterarguments: BofA argues that the current valuations, while high relative to historical averages, are not necessarily unsustainable, given the factors discussed above.

- Potential Risks: However, unexpected economic downturns, geopolitical instability, or a faster-than-expected increase in interest rates could trigger a market correction, impacting even fundamentally strong companies.

Investors can mitigate risk through diversification, focusing on long-term investment strategies, and carefully selecting companies with strong fundamentals.

Conclusion: Navigating Stretched Stock Market Valuations with BofA's Insights

BofA's analysis provides a valuable perspective on navigating stretched stock market valuations. While the current P/E ratios appear elevated, their assessment suggests that strong corporate earnings, low interest rates, and promising long-term growth prospects offer a degree of justification. However, investors must acknowledge the inherent risks associated with any market, including the possibility of a market correction.

To understand the nuances of stretched stock market valuations, consider BofA's analysis alongside your own research and consult with a financial advisor. Make informed decisions about your investments, incorporating BofA's perspective into your overall investment strategy. Remember, understanding the current market landscape is critical to successfully managing your portfolio in the face of seemingly high valuations.

Featured Posts

-

62 5m Transfer Battle Man Utd Makes Contact With Arsenal And Chelsea Target

May 20, 2025

62 5m Transfer Battle Man Utd Makes Contact With Arsenal And Chelsea Target

May 20, 2025 -

Trade Wars And Brand Identity Porsches Tightrope Walk Between Ferrari And Mercedes

May 20, 2025

Trade Wars And Brand Identity Porsches Tightrope Walk Between Ferrari And Mercedes

May 20, 2025 -

Aldhkae Alastnaey Yeyd Ihyae Ajatha Krysty Thlyl Jdyd Laemalha

May 20, 2025

Aldhkae Alastnaey Yeyd Ihyae Ajatha Krysty Thlyl Jdyd Laemalha

May 20, 2025 -

Increased Military Cooperation Philippines And Us Announce Expanded Balikatan Drills

May 20, 2025

Increased Military Cooperation Philippines And Us Announce Expanded Balikatan Drills

May 20, 2025 -

Kaellman Ja Hoskonen Loppu Puola Uralle

May 20, 2025

Kaellman Ja Hoskonen Loppu Puola Uralle

May 20, 2025

Latest Posts

-

Revealed The Meaning Of Peppa Pigs New Baby Sisters Name

May 21, 2025

Revealed The Meaning Of Peppa Pigs New Baby Sisters Name

May 21, 2025 -

The Heartwarming Story Behind Peppa Pigs New Baby Sisters Name

May 21, 2025

The Heartwarming Story Behind Peppa Pigs New Baby Sisters Name

May 21, 2025 -

Cassis Condemns Pahalgam Terror Attack Swiss Ministers Strong Response

May 21, 2025

Cassis Condemns Pahalgam Terror Attack Swiss Ministers Strong Response

May 21, 2025 -

Descubre El Secreto Sin Secretos Magicos Para Un Envejecimiento Saludable Un Superalimento Superior Al Arandano

May 21, 2025

Descubre El Secreto Sin Secretos Magicos Para Un Envejecimiento Saludable Un Superalimento Superior Al Arandano

May 21, 2025 -

Combate El Envejecimiento Y Las Enfermedades Cronicas Con Este Superalimento

May 21, 2025

Combate El Envejecimiento Y Las Enfermedades Cronicas Con Este Superalimento

May 21, 2025