BofA Reassures Investors: High Stock Market Valuations Are Not A Threat

Table of Contents

BofA's Rationale Behind the Reassurance

BofA's confidence stems from a multifaceted analysis of current economic conditions and market fundamentals. Their assessment rests on three key pillars: strong corporate earnings and profitability, sustained low interest rates, and the potential for long-term growth.

Strong Corporate Earnings and Profitability

BofA's analysis points to robust corporate earnings and projected growth as a key factor supporting current valuations. The bank highlights several sectors demonstrating exceptional performance, fueled by positive economic indicators.

- Examples of strong-performing sectors: Technology, healthcare, and consumer staples are cited as exhibiting particularly strong earnings growth.

- Positive economic indicators: Factors such as low unemployment rates, increasing consumer spending, and robust global trade are contributing to this positive earnings environment.

- Specific company examples (hypothetical): BofA's report may have cited companies like XYZ Tech (showing impressive revenue growth) and ABC Pharmaceuticals (reporting strong drug sales) as examples of companies exceeding expectations. This demonstrates strong profitability, justifying higher stock prices.

These positive trends suggest that current high valuations are, at least in part, justified by the underlying strength of corporate profitability and earnings growth.

Sustained Low Interest Rates

Low interest rates are another crucial component of BofA's argument. While often associated with increased risk, BofA contends that in the current environment, they actually contribute to higher valuations without necessarily indicating an impending market downturn.

- Impact on borrowing costs: Low interest rates reduce borrowing costs for companies, allowing them to invest more and potentially increase their earnings. This positive impact on corporate profitability helps to support higher stock prices.

- Effect on investor behavior: Low interest rates often push investors towards higher-yielding assets, such as stocks, further driving up valuations.

- Comparison to historical interest rate environments: BofA likely contextualized the current low-interest-rate environment by comparing it to previous periods of low rates, demonstrating that high valuations aren't always followed by immediate market corrections.

This nuanced perspective highlights the complex interplay between monetary policy, interest rate environments and stock market valuations.

Long-Term Growth Potential

Looking beyond the short-term fluctuations, BofA emphasizes the significant long-term growth potential of the market. This perspective is crucial in understanding why high valuations aren't necessarily a cause for immediate concern.

- Technological advancements driving growth: BofA likely points to sectors like artificial intelligence, renewable energy, and biotechnology as key drivers of future economic expansion.

- Emerging markets potential: Growth opportunities in developing economies are another factor contributing to long-term optimism.

- Long-term investment strategies: BofA likely advocates for long-term investment strategies, emphasizing the importance of patience and a focus on fundamental value over short-term market movements.

This focus on long-term growth offers a compelling counterargument to concerns solely focused on current high stock market valuations.

Addressing Investor Concerns About Market Corrections

Despite BofA's positive outlook, acknowledging the potential for market corrections is crucial. Addressing investor concerns directly builds trust and provides a balanced perspective.

BofA's View on Market Volatility

Market volatility is expected. BofA's analysis likely includes an assessment of the current level of volatility and its potential impact.

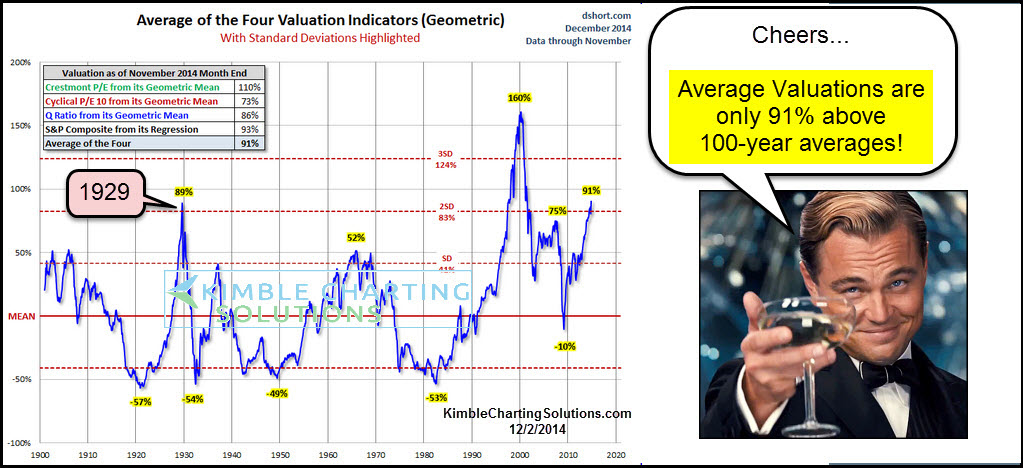

- Historical comparisons of market corrections: BofA likely referenced historical data on market corrections to demonstrate that periods of high valuations have not always been immediately followed by sharp declines.

- Risk management strategies for investors: The bank likely offered advice on risk management strategies, such as diversification and careful asset allocation, to mitigate potential losses during periods of increased volatility.

- BofA's predictions for future volatility: While not offering specific predictions, BofA likely communicated a range of potential scenarios to show a balanced understanding of market dynamics and risks.

Understanding the cyclical nature of markets and implementing appropriate risk management strategies are essential for navigating periods of uncertainty.

Opportunities Within a High-Valuation Market

Even in a high-valuation market, opportunities exist for discerning investors. BofA likely provided guidance on identifying these opportunities.

- Specific sectors with potential for growth: Sectors showing resilience even during periods of market uncertainty are likely highlighted, offering attractive investment opportunities.

- Strategies for identifying undervalued assets: BofA likely stressed the importance of fundamental analysis to identify companies whose stock prices don't fully reflect their underlying value.

- Importance of diversification: Diversifying a portfolio across various asset classes and sectors helps to mitigate risk and potentially enhance returns.

Careful stock selection and strategic portfolio diversification remain vital investment strategies regardless of overall market valuations.

Alternative Perspectives and Counterarguments

It's important to acknowledge that not all financial analysts share BofA's optimistic view. Presenting alternative perspectives demonstrates objectivity and a thorough understanding of the market.

- Mentioning alternative analyses: Some analysts may argue that high valuations are unsustainable and predict a significant market correction.

- Acknowledging risks associated with high valuations: Even with BofA's reassurance, the inherent risks associated with high valuations should be acknowledged. These risks include the potential for increased volatility and the possibility of a more significant market downturn.

- Presenting a balanced view: By acknowledging both the optimistic and cautious perspectives, this article presents a more balanced and comprehensive view of the current market. This balanced view is essential for making informed investment decisions.

Conclusion

BofA's reassurances regarding high stock market valuations are based on a combination of strong corporate earnings, sustained low interest rates, and a focus on long-term growth potential. While market volatility is inherent, and risks always exist, BofA's analysis suggests that current high valuations don't automatically signal an impending crash. Remember to conduct your own thorough research and consider diverse perspectives. Develop a sound investment strategy aligned with your risk tolerance and financial goals, keeping BofA's analysis of high stock market valuations in mind. Remember, responsible investing considers both the potential rewards and inherent risks.

Featured Posts

-

Finance Loans Explained A Comprehensive Guide For Borrowers

May 28, 2025

Finance Loans Explained A Comprehensive Guide For Borrowers

May 28, 2025 -

How To Watch The 2025 American Music Awards For Free Online

May 28, 2025

How To Watch The 2025 American Music Awards For Free Online

May 28, 2025 -

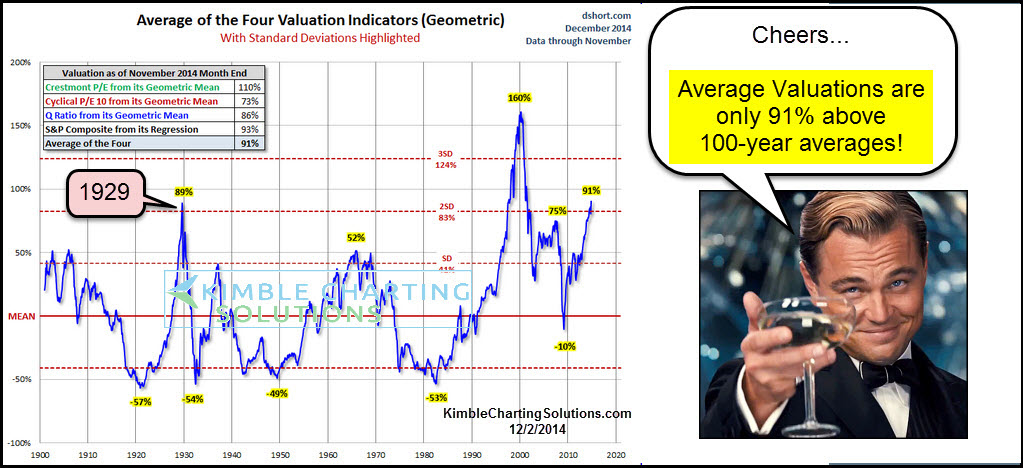

Understanding The Rise In Rainfall Climate Change In Western Massachusetts

May 28, 2025

Understanding The Rise In Rainfall Climate Change In Western Massachusetts

May 28, 2025 -

Update On Rayan Cherki From A German Source

May 28, 2025

Update On Rayan Cherki From A German Source

May 28, 2025 -

Seven Game Win Streak Jackson Merrills Impact On Padres Success

May 28, 2025

Seven Game Win Streak Jackson Merrills Impact On Padres Success

May 28, 2025