BofA Says: Don't Worry About Stretched Stock Market Valuations

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Cause for Concern

BofA's argument against immediate panic over high valuations rests on several key pillars. They contend that current market pricing, while appearing elevated, is supported by underlying economic fundamentals and shouldn't necessarily trigger a sell-off. Their analysis suggests that several factors are mitigating the risks associated with these seemingly "stretched" valuations.

-

Low Interest Rates: Persistently low interest rates continue to provide a supportive backdrop for higher valuations. Low borrowing costs encourage investment and make equities relatively more attractive compared to fixed-income alternatives. This dynamic has been a significant contributor to the current market environment.

-

Robust Corporate Earnings Growth: BofA points to strong corporate earnings growth as a crucial offset to high price-to-earnings (P/E) ratios. Healthy profits provide a justifiable basis for the current market prices, even if they seem elevated on a historical basis. Their research highlights specific sectors exhibiting particularly strong earnings growth.

-

Positive Long-Term Economic Outlook: BofA's assessment incorporates a positive long-term outlook for the economy. Projections for continued growth, albeit perhaps at a moderated pace, support their view that current valuations, while high, are not necessarily unsustainable in the longer term. Their forecasts incorporate factors such as technological advancements and global economic recovery.

-

BofA Research Data: BofA's conclusions are backed by detailed research and data analysis, which are available in their published reports. Specific data points, such as projected GDP growth and forward-looking earnings estimates, underpin their argument and add credibility to their optimistic stance.

Key Factors Supporting BofA's Positive Outlook

BofA's positive outlook is underpinned by several key economic indicators and market trends. These factors provide a framework for understanding their analysis and its implications.

-

Robust Consumer Spending: Strong consumer spending remains a cornerstone of economic growth, supporting corporate revenues and justifying high valuations. Increased consumer confidence and a robust labor market contribute to this spending power.

-

Continued Technological Innovation: Technological advancements continue to drive productivity gains and fuel economic expansion. Innovation in various sectors supports long-term growth projections and reinforces the argument for higher valuations.

-

Government Stimulus and Infrastructure Spending: (If applicable, detail specific government policies and their potential impact on valuations). Government initiatives, if relevant, can further bolster economic growth and provide a supportive environment for market valuations.

-

Geopolitical Factors: While geopolitical risks always exist, BofA's analysis likely incorporates assessments of these risks and their potential impact. Mention any specific considerations, such as trade relations or global political stability. This demonstrates a holistic approach to their valuation assessment.

Addressing Potential Risks and Counterarguments

While BofA presents a relatively optimistic outlook, it's crucial to acknowledge potential risks and counterarguments. A balanced perspective is essential when navigating stretched stock market valuations.

-

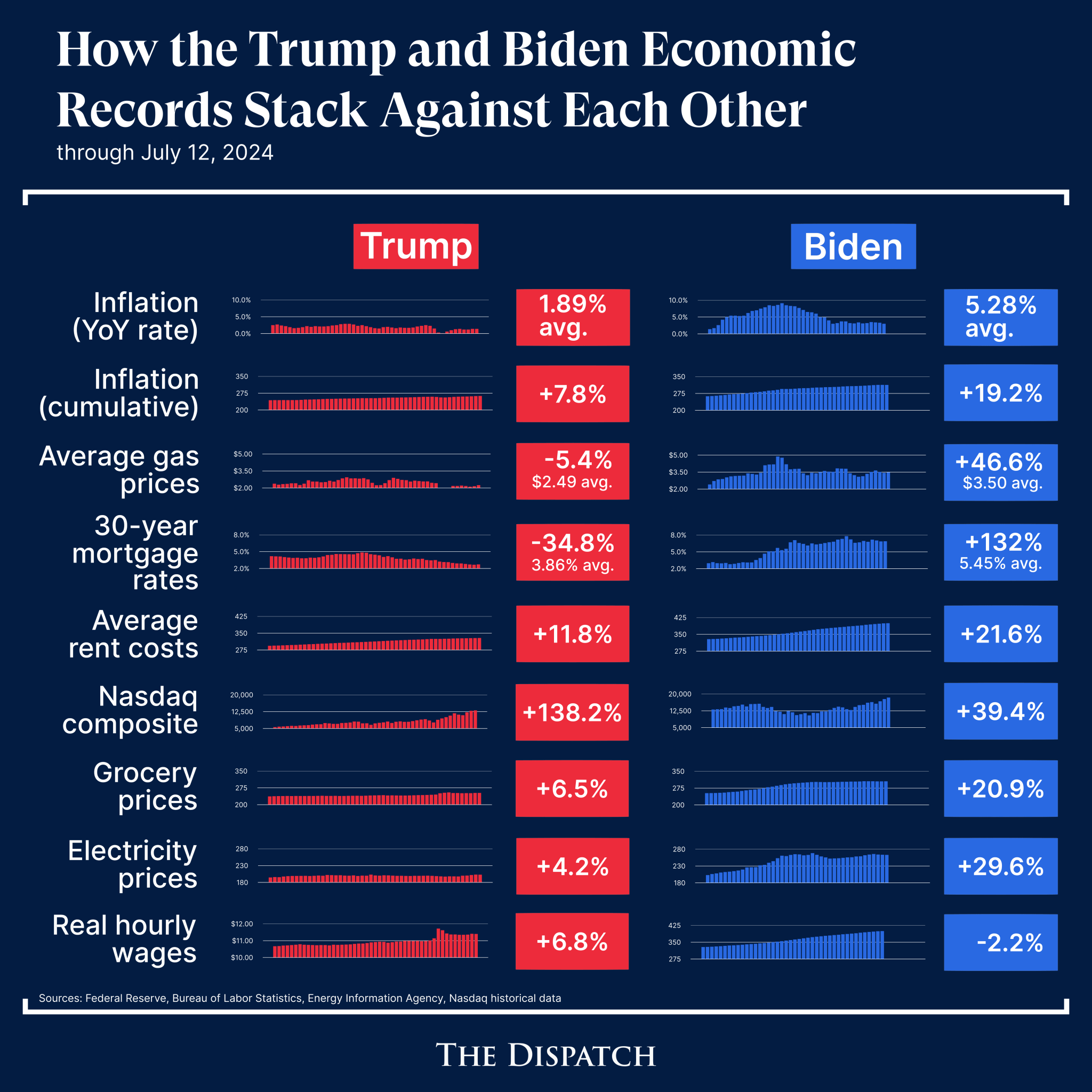

Inflationary Pressures: Rising inflation poses a significant threat. High inflation can erode corporate profits and potentially lead to interest rate hikes, impacting valuations negatively. BofA's analysis probably accounts for inflation projections and their potential impact on earnings.

-

Supply Chain Disruptions: Ongoing supply chain challenges could impact corporate profitability and increase uncertainty, potentially putting downward pressure on valuations. BofA likely addresses this risk by considering the resilience of supply chains and potential mitigation strategies.

-

Potential for Interest Rate Hikes: The prospect of future interest rate increases represents a significant risk. Higher interest rates typically reduce equity valuations as they make fixed-income instruments more attractive. BofA's assessment should incorporate their projections for interest rate changes.

-

BofA's Risk Assessment: BofA’s analysis likely incorporates a detailed assessment of these risks, quantifying their potential impact and incorporating appropriate risk factors into their valuation models. This should be highlighted to provide a comprehensive understanding of their position.

What BofA's Assessment Means for Investors

BofA's analysis carries significant implications for investors, particularly when considering market valuation concerns. The message isn't necessarily to rush into the market blindly but rather to understand the context and adopt a thoughtful approach.

-

Long-Term Investors: For long-term investors with a longer time horizon, BofA's positive outlook may reinforce a "buy and hold" strategy, focusing on quality companies with strong growth potential.

-

Risk-Averse Investors: More risk-averse investors may need a more cautious approach, considering diversification and potentially allocating more to fixed-income instruments.

-

Diversification: Regardless of risk tolerance, diversification across asset classes remains crucial to mitigate risks and manage portfolio volatility. This is paramount, even with a generally positive outlook.

-

Potential Investment Opportunities: (If BofA highlighted specific investment opportunities, mention them here). Mention any sectors or asset classes that BofA's research suggests may offer attractive opportunities within the current market environment.

Conclusion: Navigating Stretched Stock Market Valuations with Confidence

BofA's assessment on stretched stock market valuations offers a reassuring perspective, suggesting that while valuations appear high, underlying economic fundamentals provide support. Their analysis considers strong corporate earnings growth, low interest rates, and a positive long-term economic outlook as key mitigating factors. However, potential risks, including inflationary pressures and supply chain disruptions, must be acknowledged. The key takeaway is the importance of considering individual risk tolerance and diversifying investments. While BofA offers a reassuring perspective on stretched stock market valuations, remember to conduct thorough research and consult with a financial professional before making any investment decisions. Understanding the nuances of high stock market valuations is crucial for navigating the market effectively.

Featured Posts

-

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 26, 2025

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 26, 2025 -

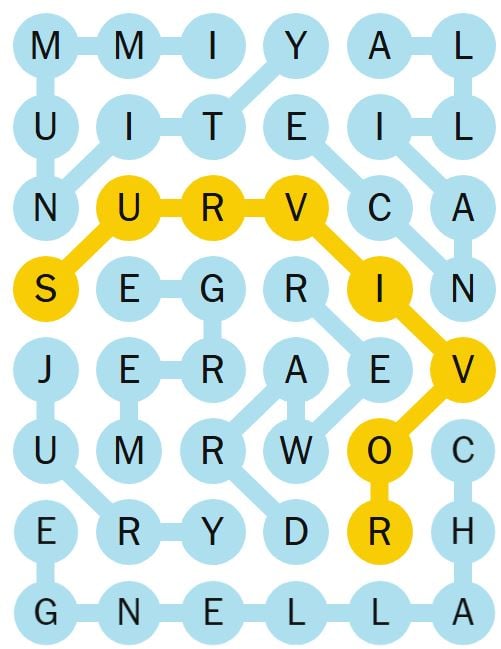

February 26th Nyt Spelling Bee Puzzle 360 Hints Answers And Strategies

Apr 26, 2025

February 26th Nyt Spelling Bee Puzzle 360 Hints Answers And Strategies

Apr 26, 2025 -

Quem E Benson Boone E Seu Caminho Para O Sucesso Antes Do Lollapalooza

Apr 26, 2025

Quem E Benson Boone E Seu Caminho Para O Sucesso Antes Do Lollapalooza

Apr 26, 2025 -

Thunderbolt Actors Honest Admission About Nepotism In Hollywood

Apr 26, 2025

Thunderbolt Actors Honest Admission About Nepotism In Hollywood

Apr 26, 2025 -

Ceos Sound Alarm Trump Tariffs And Economic Uncertainty

Apr 26, 2025

Ceos Sound Alarm Trump Tariffs And Economic Uncertainty

Apr 26, 2025

Latest Posts

-

Assessing The Economic Fallout The Canadian Travel Boycott And The Us

Apr 28, 2025

Assessing The Economic Fallout The Canadian Travel Boycott And The Us

Apr 28, 2025 -

The Us Economy Under Pressure Assessing The Impact Of The Canadian Travel Boycott

Apr 28, 2025

The Us Economy Under Pressure Assessing The Impact Of The Canadian Travel Boycott

Apr 28, 2025 -

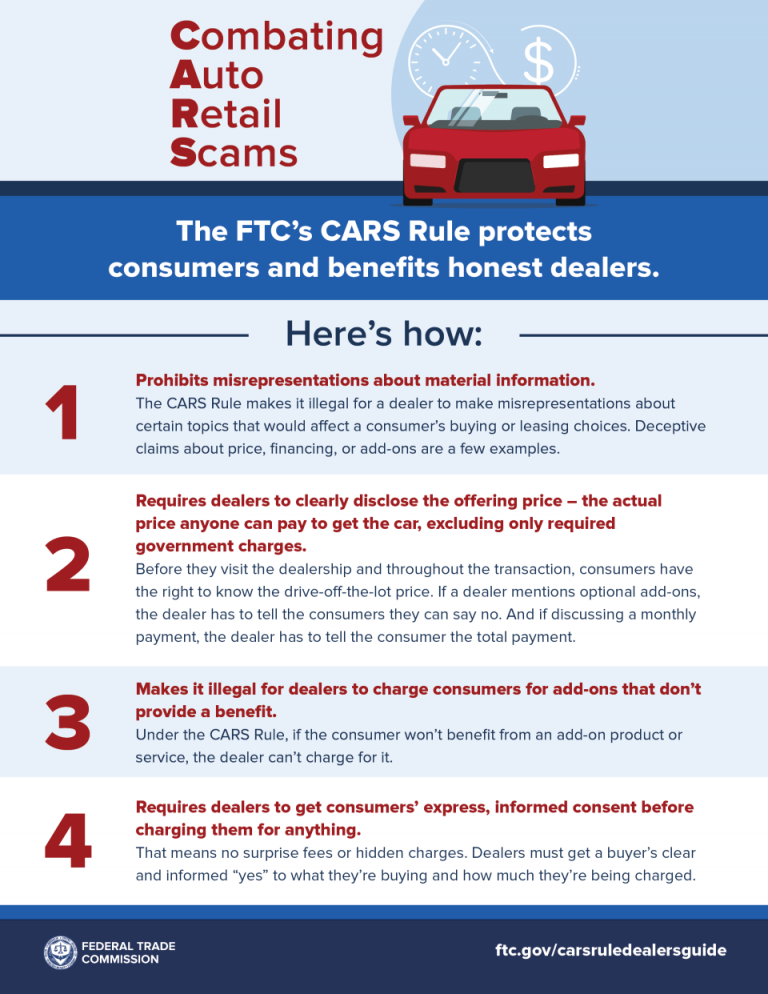

Auto Dealers Push Back Against Mandatory Ev Quotas

Apr 28, 2025

Auto Dealers Push Back Against Mandatory Ev Quotas

Apr 28, 2025 -

Cybercriminals Office365 Exploit Millions In Losses Reported

Apr 28, 2025

Cybercriminals Office365 Exploit Millions In Losses Reported

Apr 28, 2025 -

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Reveal

Apr 28, 2025

Execs Office365 Accounts Targeted Millions Made In Cybercrime Feds Reveal

Apr 28, 2025