BofA: Understanding And Addressing Concerns About Stretched Stock Market Valuations

Table of Contents

BofA's Perspective on Current Market Valuations

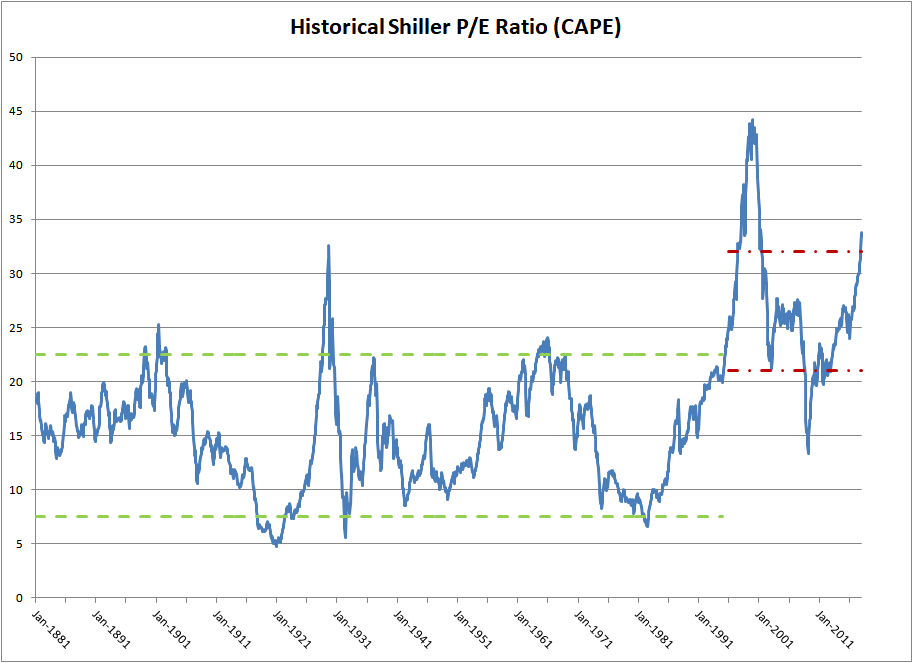

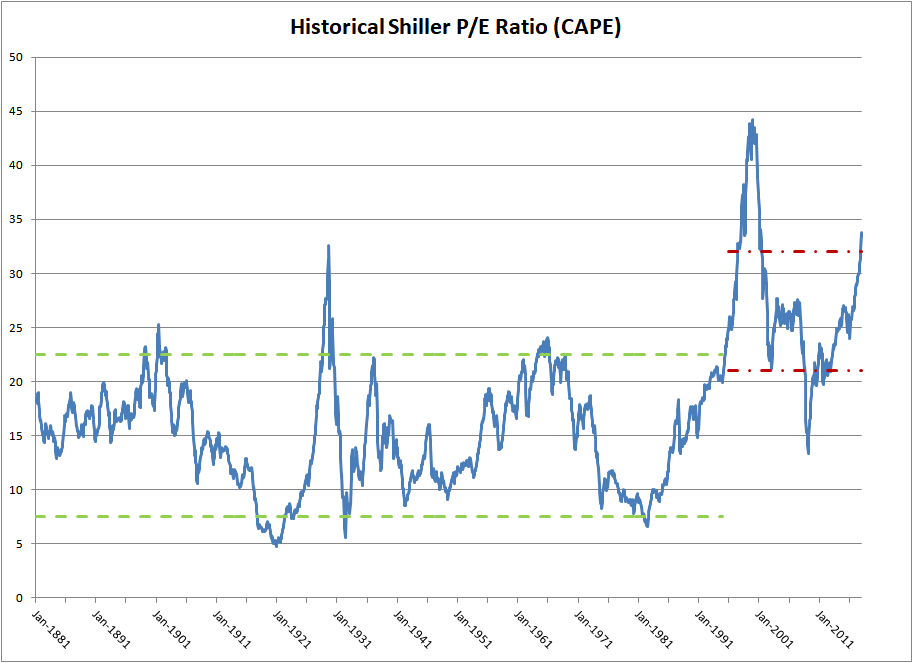

BofA's recent reports paint a cautious picture of the current market. Their analysts frequently utilize metrics like Price-to-Earnings (P/E) ratios and market capitalization to GDP ratios to gauge overall market valuation. These analyses consistently highlight the potential for overvaluation in several key sectors. The bank's research doesn't necessarily predict an immediate crash, but rather suggests a heightened risk of correction.

- Summary of BofA's key findings regarding overvaluation: BofA has flagged several instances where current valuations deviate significantly from historical averages, suggesting potential frothiness in the market. They've emphasized the need for caution and a more discerning approach to investment.

- Specific sectors or indices BofA highlights as potentially overvalued: While specific sectors cited by BofA can fluctuate, previous reports have often highlighted technology, consumer discretionary, and certain growth-oriented sectors as potentially overvalued, although this is not exhaustive. It's important to refer to the most recent BofA reports for up-to-date sector-specific assessments.

- Quote relevant experts from BofA research: (Note: Direct quotes from BofA research would need to be sourced from their official publications and reports for accuracy and ethical reasons. This section would be populated with such quotes if access were available.)

Factors Contributing to Stretched Valuations

Several macroeconomic factors have contributed to the current environment of high stock valuations. These factors, interacting in complex ways, have fueled investor enthusiasm and driven asset prices higher.

- Impact of low interest rates on investor behavior: Low interest rates make bonds less attractive, pushing investors towards riskier assets like stocks in search of higher returns. This increased demand helps inflate asset prices.

- Role of quantitative easing (QE) in inflating asset prices: QE programs, implemented by central banks to stimulate economic growth, increase the money supply. This surplus liquidity can find its way into the stock market, further pushing valuations higher.

- Influence of strong corporate earnings (even if unsustainable): Strong corporate earnings, even if temporarily inflated due to various economic factors, can justify high valuations in the eyes of some investors, leading to a further upward price trajectory. This can create a self-fulfilling prophecy until market corrections occur.

Potential Risks Associated with High Valuations

Investing in a market perceived as overvalued carries significant risks. While past performance is not indicative of future results, historical data suggests that periods of high valuations are often followed by corrections or even market downturns.

- Risk of significant market corrections: A sharp decline in market prices is a very real possibility when valuations are stretched. This correction could be triggered by various factors, such as rising interest rates, geopolitical instability, or a sudden loss of investor confidence.

- Impact of rising interest rates on valuations: As interest rates rise, bonds become more attractive, potentially drawing investment away from the stock market and putting downward pressure on valuations.

- Potential for increased volatility: A highly valued market is often characterized by increased volatility, meaning that prices can swing wildly in both directions, increasing the risk for investors. This heightened volatility can make it more challenging to manage portfolios effectively.

Strategies for Navigating a High-Valuation Market

Given BofA's assessment of the market, investors need a well-defined strategy to mitigate risks and potentially capitalize on opportunities. A cautious yet proactive approach is recommended.

- Diversification across asset classes: Spreading investments across different asset classes (stocks, bonds, real estate, etc.) can help reduce portfolio risk and limit exposure to any single market segment.

- Focus on undervalued companies or sectors: Identifying companies or sectors that are trading below their intrinsic value can provide a more attractive risk-reward profile. This requires careful fundamental analysis and a long-term perspective.

- Consider defensive investment strategies: In a potentially volatile market, defensive strategies, such as investing in dividend-paying stocks or sectors less susceptible to economic downturns, can help preserve capital and limit downside risk.

- Importance of risk management: Thorough risk assessment and risk management are crucial in navigating a high-valuation market. This includes setting realistic investment goals, understanding your risk tolerance, and regularly monitoring your portfolio.

Conclusion: Making Informed Decisions about BofA's Stretched Stock Market Valuations

BofA's analysis highlights legitimate concerns about stretched stock market valuations. Several macroeconomic factors have contributed to this environment, creating potential risks for investors. Understanding these risks is paramount. By diversifying investments, focusing on undervalued assets, adopting defensive strategies, and practicing rigorous risk management, investors can navigate this complex market landscape more effectively. Understand BofA's analysis of stretched stock market valuations and take control of your investment strategy today! (Note: A link to relevant BofA resources could be inserted here if available.)

Featured Posts

-

Trump Attorney Generals Ominous Message To Political Rivals

May 10, 2025

Trump Attorney Generals Ominous Message To Political Rivals

May 10, 2025 -

Pam Bondis Plan To Kill American Citizens A Detailed Examination

May 10, 2025

Pam Bondis Plan To Kill American Citizens A Detailed Examination

May 10, 2025 -

Edmonton School Construction 14 Projects On The Fast Track

May 10, 2025

Edmonton School Construction 14 Projects On The Fast Track

May 10, 2025 -

Apples Ai Crossroads Innovation Or Obsolescence

May 10, 2025

Apples Ai Crossroads Innovation Or Obsolescence

May 10, 2025 -

The Closure Of Anchor Brewing Company What Happened

May 10, 2025

The Closure Of Anchor Brewing Company What Happened

May 10, 2025