BofA's Rationale: Why Elevated Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Underlying Economic Assumptions

BofA's positive assessment of current stock market valuations rests on several key economic assumptions. Their analysis suggests that the current high valuations are justified by a confluence of positive factors, mitigating the risks often associated with elevated price-to-earnings (P/E) ratios.

Strong Corporate Earnings Growth

BofA projects robust corporate earnings growth for the coming years. This projection is supported by several factors, and their reports indicate a significant increase in profitability across various sectors.

- Examples of sectors driving growth: Technology, healthcare, and consumer discretionary are expected to be key drivers of earnings growth. BofA's analysts highlight the strong performance of these sectors, fueled by innovation, increased consumer spending, and a favorable regulatory environment.

- Projected growth rates: BofA's earnings projections suggest growth rates exceeding historical averages, potentially offsetting the impact of higher valuations. While specific numbers vary by sector, the overall picture painted by BofA is one of sustained, healthy growth.

- Impact on P/E ratios: While P/E ratios might appear high, BofA argues that strong earnings growth will gradually lower these ratios over time, making current valuations more sustainable. This positive earnings outlook is a central pillar in their argument regarding BofA stock market valuations.

Low Interest Rates & Abundant Liquidity

The current low interest rate environment and abundant liquidity play a significant role in supporting asset prices, according to BofA. This monetary policy has profound implications for the market.

- Impact on borrowing costs for companies: Low interest rates reduce the cost of borrowing for corporations, allowing them to invest more aggressively, expand operations, and ultimately boost earnings. This positive feedback loop contributes to higher stock valuations.

- Effects on investor behavior: Low interest rates make bonds less attractive compared to stocks, pushing investors towards equities in search of higher returns. This increased demand further supports elevated stock market valuations.

- Potential for further monetary easing: BofA's analysis considers the possibility of further monetary easing by central banks, which could potentially provide additional support to asset prices. Their forecasts suggest this as a contributing factor to the stability of the market and its seemingly high valuations.

Resilient Consumer Spending

BofA's assessment highlights the resilience of consumer spending as a key factor supporting market valuations. A healthy consumer base drives corporate revenues and profitability.

- Key consumer spending indicators: Indicators such as retail sales, consumer confidence indices, and employment data suggest sustained consumer spending power. BofA's research incorporates this data into their analysis of market valuations.

- Projected consumer confidence: BofA's projections indicate continued consumer confidence, implying sustained demand for goods and services, which directly benefits corporate earnings.

- Impact on corporate revenues: Strong consumer spending translates directly into higher corporate revenues, contributing to the strong earnings growth projections discussed earlier and ultimately impacting BofA stock market valuations.

Addressing Valuation Concerns

While acknowledging the high valuations, BofA addresses concerns by focusing on several key factors. Their perspective emphasizes the long-term, moving beyond short-term metrics.

Focus on Long-Term Growth Potential

BofA's analysis emphasizes long-term growth potential rather than solely focusing on short-term valuation metrics. This long-term perspective is crucial to their overall assessment.

- Discussion of innovative technologies: BofA points to the transformative potential of innovative technologies as a key driver of long-term growth, arguing that current valuations reflect this future potential.

- Emerging markets: Investment opportunities in emerging markets are highlighted as another significant contributor to long-term growth, exceeding the limitations of short-term market fluctuations.

- Long-term investment strategies: BofA advocates for long-term investment strategies, suggesting that investors should focus on companies with strong growth prospects rather than being overly concerned about short-term valuation fluctuations.

Sector-Specific Analysis & Diversification

BofA's approach involves evaluating valuations on a sector-by-sector basis, highlighting the importance of diversification in mitigating risk.

- Examples of undervalued sectors: BofA identifies specific sectors that might be undervalued relative to their growth potential, offering investors opportunities for strategic allocation.

- Sectors with strong growth potential: The analysis focuses on sectors with strong growth potential, offering a more nuanced picture than a broad market assessment.

- Risk mitigation strategies: BofA emphasizes the importance of diversification to mitigate risk, suggesting that a well-diversified portfolio can better withstand market volatility.

Addressing Inflationary Pressures

BofA acknowledges potential inflationary pressures and their impact on stock valuations. However, their analysis suggests that these pressures are manageable.

- BofA's inflation forecasts: BofA provides inflation forecasts, considering the potential impact on corporate profits and the broader economy.

- Potential impact on corporate profits: The analysis assesses the likely impact of inflation on corporate profits, considering factors such as pricing power and cost pressures.

- Strategies for managing inflation risk: BofA suggests strategies for managing inflation risk, such as investing in companies with strong pricing power or those with exposure to inflation-hedged assets.

Conclusion

BofA's analysis suggests that current elevated stock market valuations, while seemingly high, aren't necessarily a cause for immediate concern. Their optimistic outlook is supported by strong earnings growth projections, a low interest rate environment, resilient consumer spending, and a focus on long-term growth potential. By considering sector-specific analysis, diversification strategies, and potential inflationary pressures, BofA provides a comprehensive perspective on BofA stock market valuations.

While BofA's analysis offers a reassuring perspective, it's crucial to conduct your own thorough research and consider your individual risk tolerance before making any investment decisions regarding BofA stock market valuations. Learn more about BofA's market analysis and investment strategies to make informed decisions.

Featured Posts

-

Sander Westerveld Concerned By Mamardashvilis Form

May 29, 2025

Sander Westerveld Concerned By Mamardashvilis Form

May 29, 2025 -

Baker Park Shooting Murder Charges Filed Against Suspect

May 29, 2025

Baker Park Shooting Murder Charges Filed Against Suspect

May 29, 2025 -

Celebrating Excellence The Zoellner Family Paraeducator Award

May 29, 2025

Celebrating Excellence The Zoellner Family Paraeducator Award

May 29, 2025 -

Moradores Aprovam Criacao Da Cidade Space X Nos Eua Um Novo Marco Para A Exploracao Espacial

May 29, 2025

Moradores Aprovam Criacao Da Cidade Space X Nos Eua Um Novo Marco Para A Exploracao Espacial

May 29, 2025 -

Informasi Cuaca Akurat Sumatra Utara Prakiraan Untuk Medan Karo Nias Toba

May 29, 2025

Informasi Cuaca Akurat Sumatra Utara Prakiraan Untuk Medan Karo Nias Toba

May 29, 2025

Latest Posts

-

Analyzing Provincial Influence On Residential Construction Speed

May 31, 2025

Analyzing Provincial Influence On Residential Construction Speed

May 31, 2025 -

Faster Home Construction The Importance Of Provincial Initiatives

May 31, 2025

Faster Home Construction The Importance Of Provincial Initiatives

May 31, 2025 -

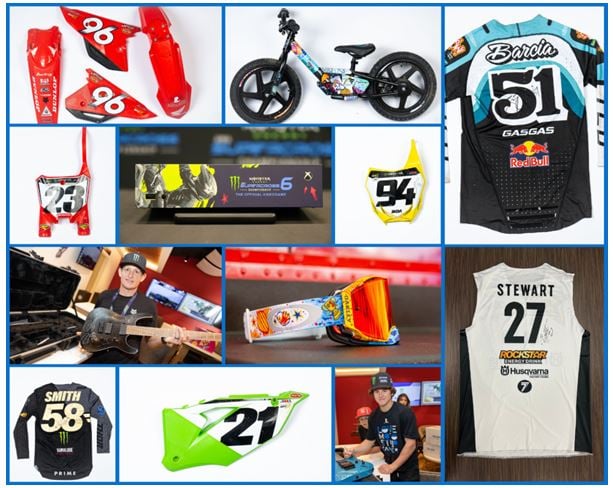

2025 Love Moto Stop Cancer Online Auction

May 31, 2025

2025 Love Moto Stop Cancer Online Auction

May 31, 2025 -

Rbcs Earnings Fall Short A Look At The Banks Loan Portfolio

May 31, 2025

Rbcs Earnings Fall Short A Look At The Banks Loan Portfolio

May 31, 2025 -

Provincial Regulations And Faster Homebuilding A Critical Analysis

May 31, 2025

Provincial Regulations And Faster Homebuilding A Critical Analysis

May 31, 2025