BofA's Reassurance: Why Current Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Bullish Outlook and its Underlying Rationale

BofA maintains a bullish outlook on the stock market, driven by several key factors. Their positive market forecast isn't blind optimism; it's underpinned by a robust analysis of the current economic climate.

-

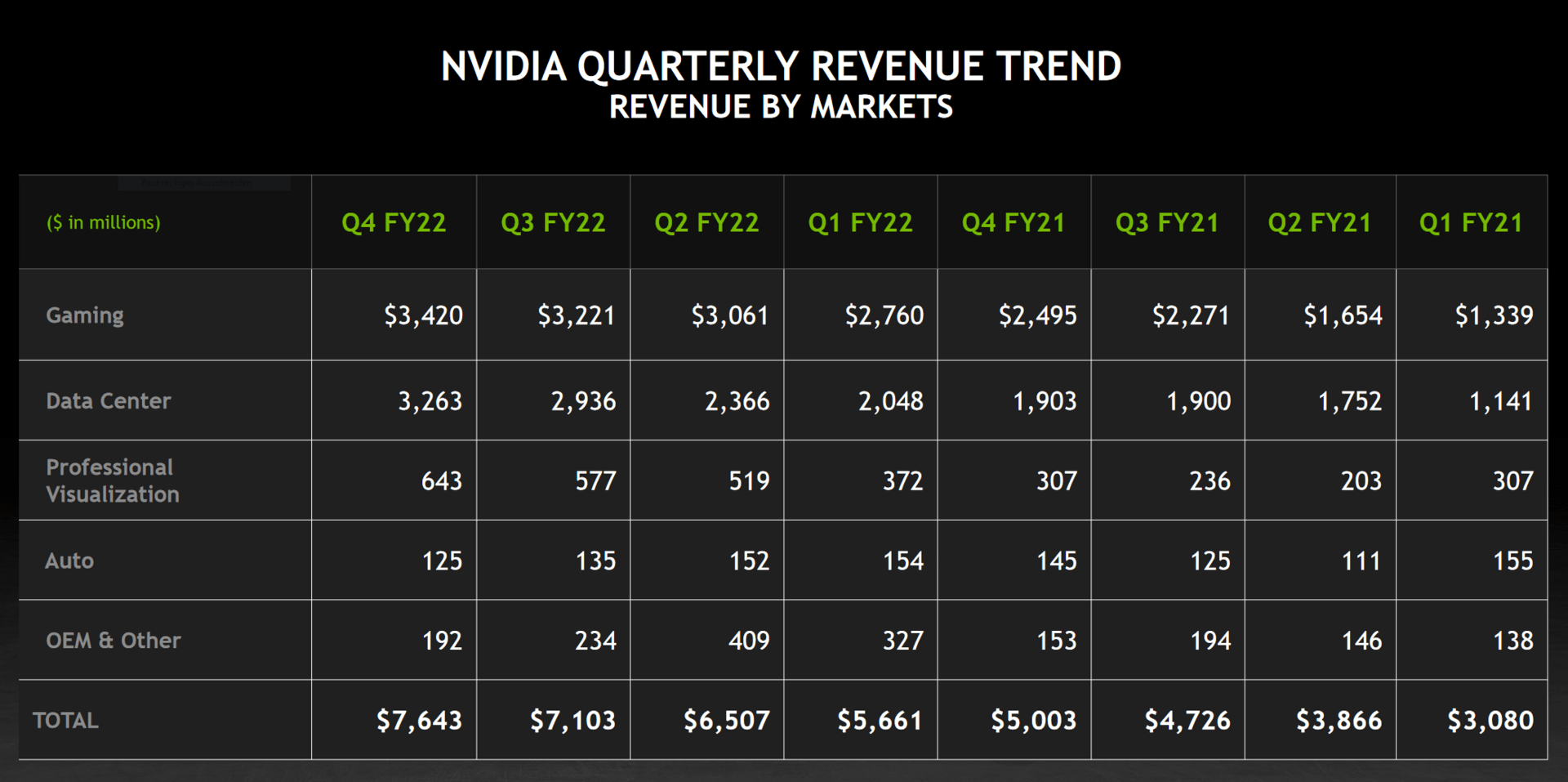

Strong corporate earnings despite economic headwinds: Despite persistent inflation and economic uncertainty, many corporations have demonstrated resilience, reporting strong earnings. This suggests a degree of underlying strength within the economy that transcends short-term challenges. BofA's analysis likely incorporates data from various sectors, focusing on revenue growth and profit margins.

-

Resilience of the consumer sector: Consumer spending remains a significant driver of economic growth. While inflation has impacted purchasing power, consumer resilience, albeit somewhat tempered, continues to support market performance. BofA's assessment likely includes data on consumer confidence indices and retail sales figures.

-

Positive long-term growth projections for specific sectors: BofA's analysis likely pinpoints specific sectors poised for significant growth, even amidst broader economic uncertainties. These sectors may represent attractive investment opportunities. Examples could include technology, renewable energy, or healthcare, depending on BofA's specific findings.

-

Effective management of inflation by central banks (potential caveat): While central banks are actively combating inflation, the effectiveness of their measures remains a key uncertainty. BofA's analysis likely accounts for various scenarios, acknowledging the potential impact of inflation on market valuations. The success of inflation control significantly impacts the long-term accuracy of their forecast.

BofA's methodology likely involves analyzing key economic indicators and financial metrics, such as the S&P 500 index, GDP growth rates, inflation rates (CPI and PCE), and corporate earnings reports. Their conclusions are based on a comprehensive assessment of these data points.

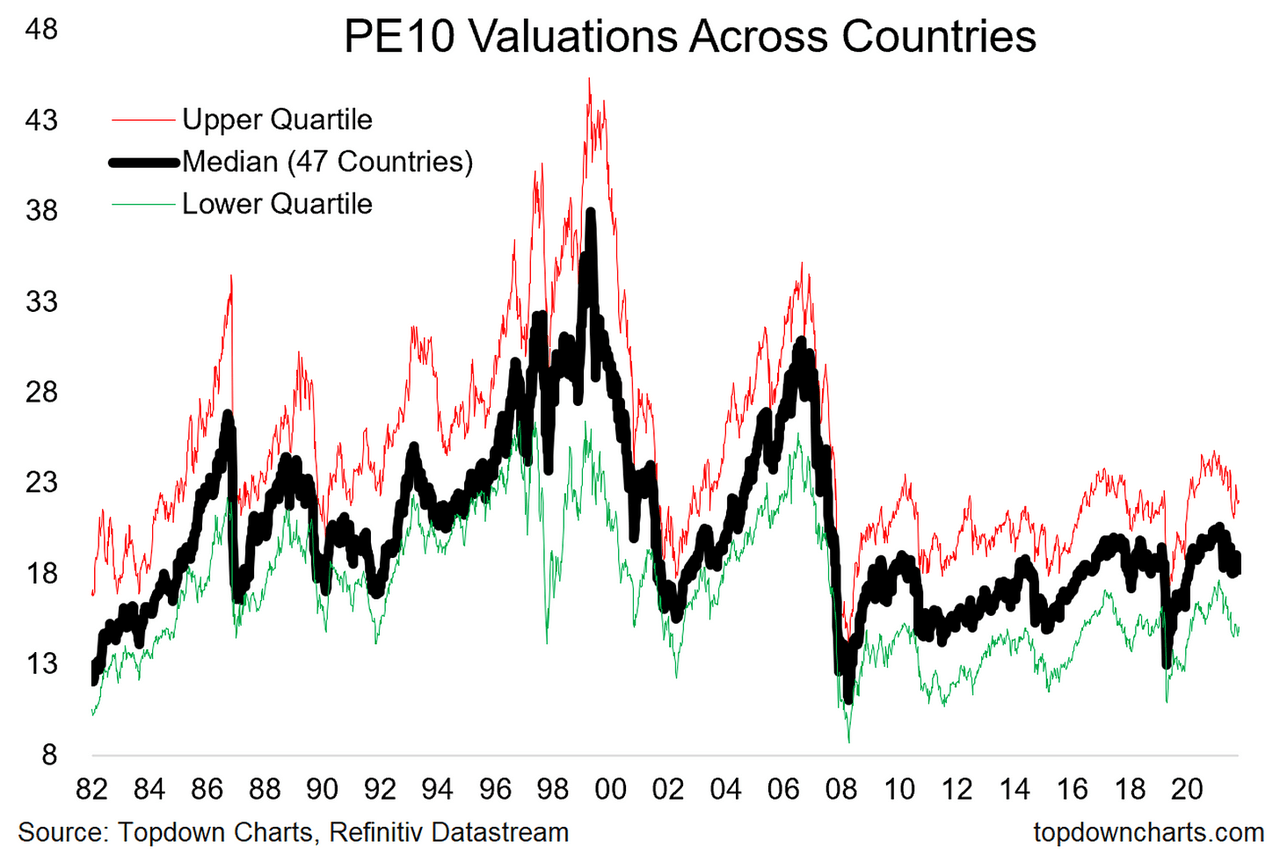

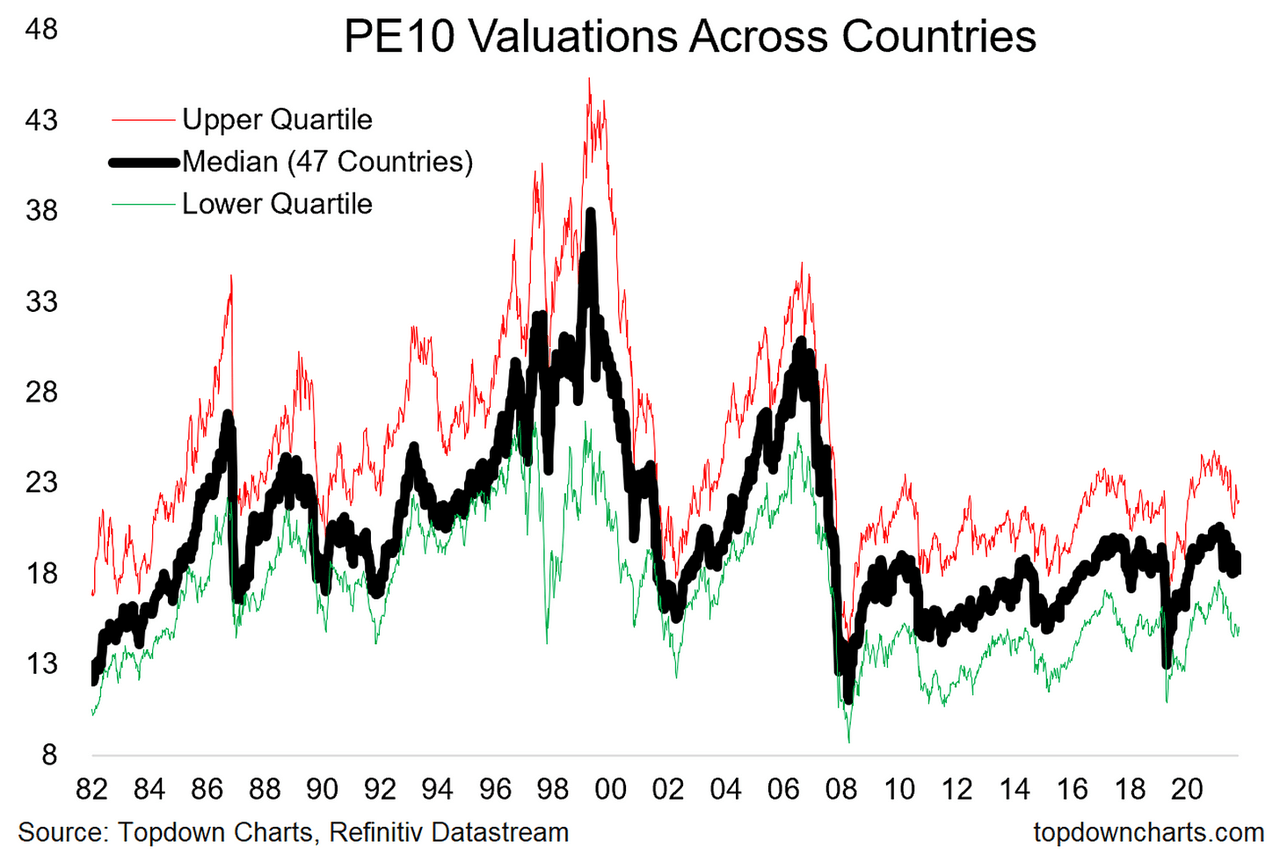

Addressing Concerns about High Valuation Ratios

It's undeniable that current Price-to-Earnings (P/E) ratios and other valuation metrics appear high compared to historical averages. However, simply comparing current valuations to historical averages without considering the context of today’s economic environment is an oversimplification.

-

Historically low interest rates justify higher valuations: Lower interest rates reduce the cost of borrowing for companies, leading to increased investment and higher earnings potential, which can support higher valuations. BofA likely factored this key element into their analysis.

-

Impact of technological advancements and innovative business models on valuation: Disruptive technologies and innovative business models often justify higher valuations, reflecting the potential for significant future growth. These companies may exhibit high growth rates, even if their current earnings aren't proportionally high.

-

Role of specific sectors (e.g., technology) in driving overall market valuations: Certain high-growth sectors, like technology, often command higher valuations due to their growth potential. BofA's analysis would likely break down the contribution of different sectors to overall market valuations.

-

Comparing current valuations with historical averages, adjusting for relevant economic factors: A direct comparison to historical averages is insufficient. Adjustments must be made to account for differences in interest rates, inflation, and economic growth rates between different periods. BofA's analysis likely employs sophisticated valuation models that account for these differences.

BofA’s argument likely centers on the notion that current valuations, while elevated, are justified given the present economic context and future growth expectations. They may provide data points demonstrating that valuations are not excessively high compared to historical averages when adjusted for relevant economic factors.

Strategic Investment Opportunities in a High-Valuation Market

Even in a market with seemingly high valuations, strategic investment opportunities exist. BofA’s recommendations likely emphasize a selective approach, focusing on specific sectors and strategies.

-

Focus on companies demonstrating strong growth potential despite high valuations: Investing in companies exhibiting robust revenue growth and earnings potential can mitigate the risk associated with higher valuations. BofA may have identified specific companies fitting this profile.

-

Consider investing in undervalued sectors or companies with strong fundamentals: While many sectors may appear overvalued, some may remain relatively undervalued, presenting attractive investment opportunities. These companies would typically demonstrate strong fundamentals, despite a lower market valuation.

-

Explore alternative investment strategies (e.g., dividend-paying stocks): Dividend-paying stocks can provide a steady income stream, mitigating the volatility associated with growth stocks. This strategy is particularly relevant in a high-valuation market.

-

Highlight the importance of diversification to mitigate risk: Diversification remains crucial, reducing the impact of any single investment's underperformance. BofA would likely recommend a diversified portfolio to reduce overall risk.

Remember, risk management is paramount. Investors should carefully consider their personal risk tolerance and financial goals before making any investment decisions.

Conclusion

BofA's reassurances regarding current stock market valuations provide a compelling argument for maintaining a cautiously optimistic outlook. By considering the factors driving market performance and focusing on strategic investment opportunities highlighted by BofA's analysis, investors can navigate this environment effectively. Don't let anxieties about high stock market valuations deter you from exploring well-researched investment strategies. Remember to consult with a qualified financial advisor before implementing any investment plan based on BofA's stock market valuations analysis or any other market analysis.

Featured Posts

-

Rihannas Engagement Ring And Footwear A Style Statement In Red

May 06, 2025

Rihannas Engagement Ring And Footwear A Style Statement In Red

May 06, 2025 -

Affordable Products You Will Love

May 06, 2025

Affordable Products You Will Love

May 06, 2025 -

Nikes Q Quarter Earnings A Five Year Revenue Low Predicted

May 06, 2025

Nikes Q Quarter Earnings A Five Year Revenue Low Predicted

May 06, 2025 -

Romania Elections 2024 Far Right Challenger Faces Centrist In Runoff

May 06, 2025

Romania Elections 2024 Far Right Challenger Faces Centrist In Runoff

May 06, 2025 -

Stephen Kings 2025 Will The Monkey Be A Low Point Or A High Year

May 06, 2025

Stephen Kings 2025 Will The Monkey Be A Low Point Or A High Year

May 06, 2025