BofA's Reassuring Message: Why Current Stock Market Valuations Aren't A Threat

Table of Contents

BofA's Rationale: Focusing on Fundamentals, Not Just Price-to-Earnings Ratios

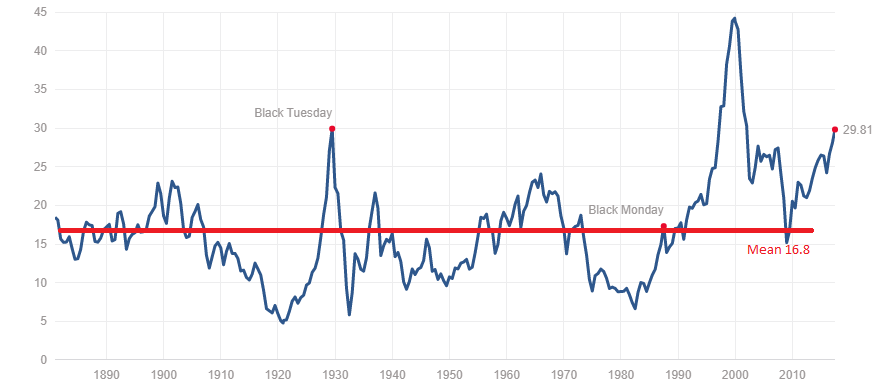

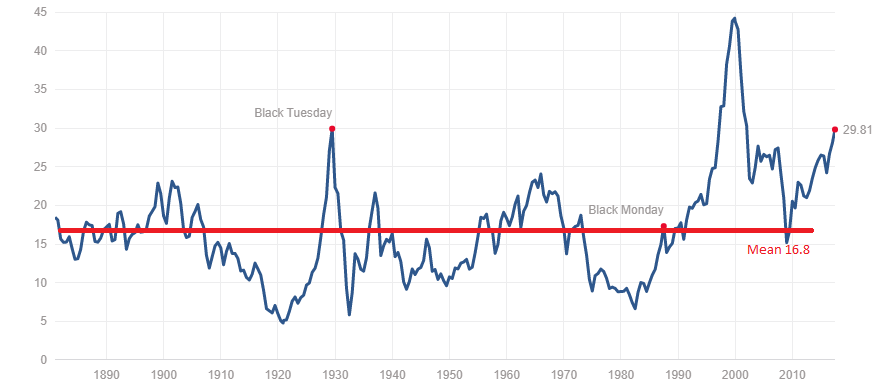

BofA's approach to stock valuation analysis goes beyond simply looking at price-to-earnings (P/E) ratios. They emphasize a holistic, fundamental analysis, considering a broader range of factors to paint a more complete picture. This nuanced perspective offers a more reassuring outlook on the current market.

-

Strong Corporate Earnings Growth Projections: BofA's research points to robust corporate earnings growth projections for the coming quarters. This suggests that underlying company performance justifies, at least partially, the current market valuations. Strong earnings are a cornerstone of sustainable stock prices.

-

Resilience of Major Sectors Despite Economic Uncertainty: While economic uncertainty persists, BofA notes that many major sectors have demonstrated remarkable resilience. This resilience counters concerns that high valuations are solely based on speculative growth. Their sector performance analysis offers a granular view, highlighting strengths in various sectors.

-

Emphasis on Long-Term Growth Potential: BofA’s analysis emphasizes the long-term growth potential of many companies. Focusing on long-term investment strategy, rather than short-term fluctuations, helps to contextualize current valuations within a larger growth narrative. This long-term perspective is crucial for mitigating short-term market anxieties.

-

Analysis of Specific Sectors and Their Valuations: The report doesn't offer a blanket assessment. BofA provides a detailed analysis of specific sectors, examining their individual valuations in relation to their growth prospects and inherent risks. This granular approach provides a more nuanced and informed perspective on stock valuation analysis.

The Role of Interest Rates in Supporting Current Valuations

Low interest rates play a significant role in supporting current stock market valuations. BofA's analysis highlights how these low rates influence investor behavior and investment decisions.

-

Comparison of Current Interest Rates to Historical Averages: Current interest rates are historically low, making bonds less attractive compared to stocks. This shift in attractiveness drives investment capital towards equities.

-

Impact on Bond Yields and Their Relationship with Stock Valuations: Low interest rates suppress bond yields, making stocks a more compelling investment option for those seeking higher returns. This dynamic contributes to elevated stock market valuations.

-

Discussion of Potential Interest Rate Hikes and Their Predicted Impact: While the potential for interest rate hikes exists, BofA's assessment suggests that any increases are likely to be gradual, minimizing a sudden negative impact on the market. This gradual approach allows investors time to adapt to shifting market conditions. However, they also include considerations for how different scenarios impact stock market outlook.

Addressing Potential Risks and Counterarguments: A Balanced Perspective

While BofA presents a reassuring outlook, they acknowledge potential risks and concerns surrounding current valuations. A balanced perspective is crucial.

-

Addressing Inflation Concerns and Their Influence on Valuations: Inflationary pressure is a legitimate concern, potentially impacting corporate earnings and investor sentiment. BofA addresses this concern by analyzing the relative impact of inflation on different sectors.

-

Geopolitical Risks and Their Potential Impact on the Market: Geopolitical uncertainty remains a persistent risk, potentially impacting market stability. BofA assesses these risks and considers their potential influence on various sectors and valuations.

-

Potential for Market Corrections and How to Prepare: BofA acknowledges the possibility of market corrections, emphasizing the importance of risk management and portfolio diversification. Their recommendations on how to prepare for such an event showcase a pragmatic approach to investment.

BofA's Recommended Investment Strategies Based on Current Valuations

Based on their assessment, BofA offers investors several actionable recommendations:

-

Suggestions for Sector-Specific Investments: They suggest focusing on sectors demonstrating strong fundamentals and resilience, even amid market uncertainties.

-

Recommendations on Asset Allocation Strategies: BofA advocates for a well-diversified portfolio, balancing risk and return based on individual investor profiles.

-

Advice on Managing Risk Within a Portfolio: Their advice emphasizes proactive risk mitigation strategies tailored to different investment goals and risk tolerances. This includes suggestions for portfolio management techniques to weather potential market downturns.

BofA's Reassuring View on Stock Market Valuations: A Call to Action

BofA's analysis suggests that current stock market valuations, while perhaps high by some historical metrics, aren't inherently a threat to long-term investors. Strong corporate earnings, the influence of low interest rates, and a thoughtful consideration of potential risks paint a picture that is less alarming than some headlines might suggest. Remember, however, that maintaining a balanced perspective is key. While focusing on long-term opportunities, it's crucial to understand and manage the inherent risks. To learn more about BofA's detailed analysis and develop your own informed investment strategies, review their full report. Remember to always consult with a qualified financial advisor before making significant investment decisions based on any analysis of current stock market valuations.

Featured Posts

-

James Corden Returns Confirmed Collaboration With Sir Ian Mc Kellen And The Baby Reindeer Star

May 13, 2025

James Corden Returns Confirmed Collaboration With Sir Ian Mc Kellen And The Baby Reindeer Star

May 13, 2025 -

A Csillagok Ara Leonardo Di Caprio Es A Filmes Koeltsegvetesek

May 13, 2025

A Csillagok Ara Leonardo Di Caprio Es A Filmes Koeltsegvetesek

May 13, 2025 -

Dzherard Btlr I Negovoto Blgarsko Kuche 8 Godini Vyarna Druzhba

May 13, 2025

Dzherard Btlr I Negovoto Blgarsko Kuche 8 Godini Vyarna Druzhba

May 13, 2025 -

Prediksi Pertandingan Ac Milan Vs Atalanta Head To Head Susunan Pemain And Analisis

May 13, 2025

Prediksi Pertandingan Ac Milan Vs Atalanta Head To Head Susunan Pemain And Analisis

May 13, 2025 -

New Behind The Scenes Photos Show Ali Larter Back On Set For Landman Season 2

May 13, 2025

New Behind The Scenes Photos Show Ali Larter Back On Set For Landman Season 2

May 13, 2025