BofA's Take: Are High Stock Market Valuations A Cause For Concern?

Table of Contents

Understanding Current Stock Market Valuations

Assessing stock market valuations requires understanding key metrics. The Price-to-Earnings ratio (P/E ratio) is a commonly used indicator, comparing a company's stock price to its earnings per share. Another crucial metric is the Shiller PE ratio (CAPE), which considers inflation-adjusted earnings over a ten-year period, providing a more long-term perspective. These metrics, along with market capitalization, help gauge overall market valuation.

Currently, [cite source and provide data on current P/E ratio and Shiller PE ratio]. These figures can be compared to historical averages to determine whether current valuations are unusually high or low. [Cite source and provide comparison to historical averages]. The recent interest rate hikes by central banks have significantly impacted valuations, [explain the mechanism – e.g., increased borrowing costs reduce corporate profitability and investor appetite]. Inflation, too, plays a crucial role, as high inflation erodes purchasing power and affects future earnings projections.

- Current P/E ratio: [Insert current P/E ratio and context, e.g., "The current P/E ratio of the S&P 500 is X, significantly higher than the historical average of Y."]

- Impact of interest rate hikes: [Explain how interest rate hikes influence stock valuations. Example: "Higher interest rates increase the discount rate used to value future cash flows, leading to lower valuations."]

- Role of inflation: [Explain how inflation impacts stock valuations. Example: "High inflation reduces corporate profitability and increases uncertainty, potentially leading to lower stock valuations."]

BofA's Stance on High Valuations

BofA's analysts have [summarize BofA's official stance on current high valuations – cite specific reports and analysts if possible]. [Include direct quotes from BofA reports, properly cited]. The bank has identified [mention specific risks highlighted by BofA, e.g., potential for a market correction, impact on future returns]. These concerns are largely based on [explain the reasoning behind BofA's concerns].

- Specific concerns raised by BofA analysts: [List specific concerns, such as overvaluation in certain sectors or potential for a market downturn.]

- BofA's suggested investment strategies: [Summarize BofA's recommendations, e.g., a more cautious approach, increased diversification, focusing on value stocks.]

- BofA's forecast for future market performance: [Summarize BofA's predictions for future market trends, citing specific reports.]

Factors Contributing to High Valuations

Several factors contribute to the current high stock market valuations. Historically low interest rates [explain how this impacted market valuations], coupled with quantitative easing policies [explain the impact of QE], fueled a period of significant growth. Technological innovation [explain the effect of technological advancements on company valuations and market growth], and robust corporate earnings [explain the link between strong corporate earnings and high valuations] have also played a significant role.

- Influence of monetary policy: [Detail how monetary policy, like low interest rates and quantitative easing, impacted stock prices and valuations.]

- Role of technological advancements: [Explain how technological advancements in various sectors have contributed to higher stock prices and valuations.]

- Impact of strong corporate earnings: [Discuss the role of strong corporate earnings in supporting and driving up stock market valuations.]

Alternative Perspectives and Diversification

While BofA presents a cautious outlook, other financial institutions and experts offer contrasting viewpoints. [Present alternative perspectives and arguments for and against high valuations being a serious concern]. It is crucial to remember that no single perspective holds all the answers.

- Arguments for and against high valuations being a concern: [Present arguments from different perspectives, highlighting the nuances and uncertainties.]

- Importance of asset allocation and portfolio diversification: [Emphasize the importance of diversification in mitigating risk, regardless of market valuations.]

- Strategies for mitigating risk in a high-valuation market: [Suggest strategies for mitigating risks, such as value investing, defensive stocks, or alternative investments.]

Conclusion: Should You Be Concerned About High Stock Market Valuations?

BofA's concerns regarding high stock market valuations, while significant, are not universally shared. While some analysts see potential risks, others highlight factors supporting continued growth. The key takeaway is the importance of carefully considering market valuations when making investment decisions. Your risk tolerance and investment goals should guide your choices.

Investors should consider consulting with a qualified financial advisor to develop a personalized investment strategy that aligns with their risk profile. Conducting thorough research, including reviewing BofA's latest market reports and analyses on high stock market valuations, is crucial before making any investment choices. Understanding the complexities of market valuation and employing diversified investment strategies are vital steps in navigating today’s market.

Featured Posts

-

Antlaq Fealyat Fn Abwzby Fy 19 Nwfmbr Dlyl Shaml

Apr 29, 2025

Antlaq Fealyat Fn Abwzby Fy 19 Nwfmbr Dlyl Shaml

Apr 29, 2025 -

Hungarys Stand Against Us Pressure Preserving Economic Links With China

Apr 29, 2025

Hungarys Stand Against Us Pressure Preserving Economic Links With China

Apr 29, 2025 -

Attorney General Issues Transgender Athlete Ban Directive To Minnesota

Apr 29, 2025

Attorney General Issues Transgender Athlete Ban Directive To Minnesota

Apr 29, 2025 -

Get To Know Willie Nelson A Collection Of Fast Facts

Apr 29, 2025

Get To Know Willie Nelson A Collection Of Fast Facts

Apr 29, 2025 -

Regulatory Green Light For Hengrui Pharmas Hong Kong Share Offering

Apr 29, 2025

Regulatory Green Light For Hengrui Pharmas Hong Kong Share Offering

Apr 29, 2025

Latest Posts

-

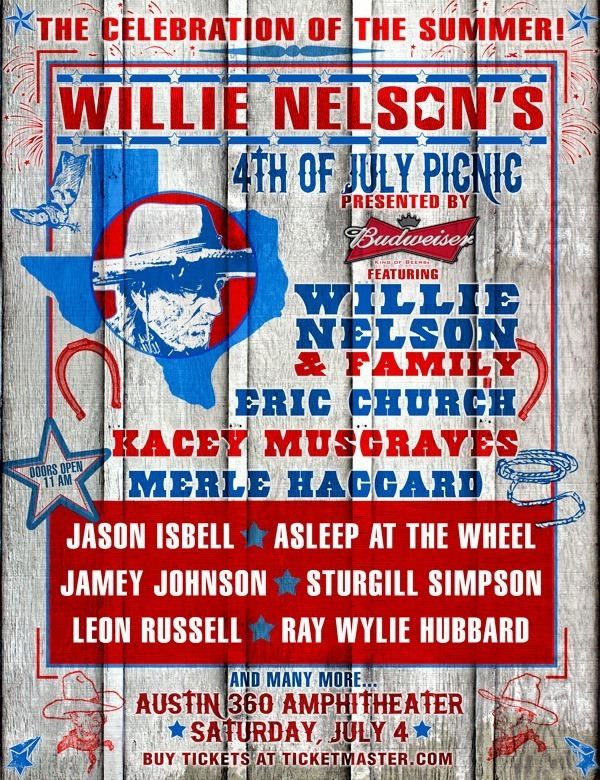

Willie Nelsons 4th Of July Picnic Texas Comeback

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Texas Comeback

Apr 29, 2025 -

New Documentary Willie Nelson Celebrates Legendary Roadie

Apr 29, 2025

New Documentary Willie Nelson Celebrates Legendary Roadie

Apr 29, 2025 -

Get To Know Willie Nelson A Collection Of Fast Facts

Apr 29, 2025

Get To Know Willie Nelson A Collection Of Fast Facts

Apr 29, 2025 -

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025

Willie Nelsons 4th Of July Picnic Returns To Texas

Apr 29, 2025 -

Willie Nelson Pays Tribute To His King Of The Road Crew In New Documentary

Apr 29, 2025

Willie Nelson Pays Tribute To His King Of The Road Crew In New Documentary

Apr 29, 2025