BofA's Take: Are High Stock Market Valuations A Reason To Worry?

Table of Contents

The stock market has experienced significant growth in recent years, leaving many investors wondering: are current high stock market valuations a cause for concern? Bank of America (BofA), a leading financial institution, offers valuable insights into this critical question. This article delves into BofA's perspective, analyzing the factors driving these valuations and assessing the potential risks and rewards for investors. We'll explore actionable information to help you navigate this complex market landscape.

BofA's Current Assessment of Stock Market Valuations

BofA's stance on current high stock market valuations is typically characterized by a blend of cautious optimism and measured concern. While acknowledging the impressive growth, their analysts consistently emphasize the need for careful consideration of various valuation metrics and underlying economic factors. They avoid outright pronouncements of a "bubble," but highlight the elevated risks associated with extended periods of high valuations.

Specific data points and quotes from BofA reports vary depending on the timing of publication, so consulting their latest research is crucial. However, their analyses often incorporate these key aspects:

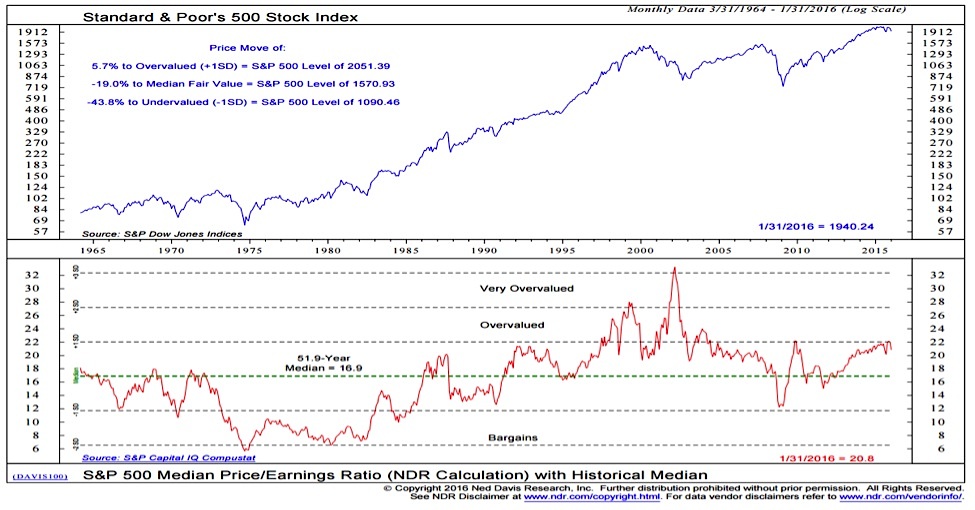

- Valuation Metrics: BofA utilizes a range of metrics, including the Price-to-Earnings ratio (P/E ratio), the Shiller PE (CAPE ratio), and other forward-looking valuation models, to gauge market valuations relative to historical trends and future earnings expectations.

- Sectoral Analysis: BofA's reports frequently dissect valuations across different sectors. Certain sectors, like technology, have historically shown higher valuations than others. They identify potential overvaluations and undervaluations based on their analysis of growth prospects, profitability, and risk factors within specific sectors.

- Economic Indicators: BofA closely monitors key economic indicators such as inflation rates, interest rates, GDP growth, unemployment levels, and consumer confidence to assess the overall macroeconomic environment and its impact on stock market valuations. These indicators are critical in predicting potential market shifts.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current elevated stock market valuations:

- Low Interest Rates: Historically low interest rates make bonds less attractive relative to stocks, driving capital into the equity markets, boosting demand, and subsequently increasing valuations.

- Strong Corporate Earnings: Sustained growth in corporate earnings and profits fuels investor confidence and supports higher stock prices. Many companies have reported record earnings, further contributing to the upward pressure on valuations.

- Investor Confidence (and Sentiment): While subject to fluctuations, a generally positive investor sentiment—driven by factors like technological advancements and economic optimism—contributes to higher stock prices. However, shifts in sentiment can quickly reverse this trend.

- Quantitative Easing and Monetary Policy: Central banks' monetary policies, including quantitative easing (QE) programs, have injected significant liquidity into financial markets, further stimulating demand for equities and inflating valuations.

- Technological Advancements and Innovation: The rapid pace of technological innovation and the emergence of high-growth technology companies have played a significant role in driving up market valuations, particularly in the tech sector.

Potential Risks Associated with High Valuations

Investing in a highly valued market presents several significant risks:

- Market Volatility and Corrections: High valuations often correlate with increased market volatility. Sharp corrections or market downturns become more probable when valuations are stretched.

- Market Bubble Risk: The potential for a market bubble bursting and a subsequent crash is a serious concern. History shows that periods of extended high valuations have often ended with significant market corrections.

- Inflation's Impact: Rising inflation erodes purchasing power and can negatively impact stock prices. Increased inflation often leads to central banks raising interest rates, which can further dampen market growth.

- Higher Interest Rates: An increase in interest rates by central banks aimed at curbing inflation can significantly impact stock valuations, as higher borrowing costs discourage investment and reduce corporate profitability.

- Geopolitical Risks: Global geopolitical events and uncertainties can drastically influence market sentiment and valuations, leading to significant market fluctuations.

Opportunities Despite High Valuations

Despite the risks, opportunities exist for savvy investors:

- Undervalued Sectors/Stocks: Even within a generally overvalued market, some sectors or individual stocks may remain undervalued. Thorough research and analysis are essential to identify these opportunities.

- Strong Fundamentals: Focusing on companies with solid fundamentals—consistent revenue growth, high profitability, strong balance sheets, and sustainable competitive advantages—can mitigate the risks associated with high valuations.

- Diversification: Employing a well-diversified investment portfolio across different asset classes and sectors helps reduce risk and improve overall portfolio resilience.

- Long-Term Investment: A long-term investment strategy allows investors to ride out short-term market fluctuations and benefit from the long-term growth potential of high-quality companies.

- Alternative Investment Strategies: Exploring alternative investment options, such as bonds, real estate, or commodities, can help diversify risk and achieve a balanced investment approach.

BofA's Recommended Investment Strategies

BofA's specific investment recommendations change frequently, so refer to their current research for the latest advice. However, their general strategies often include:

- Strategic Asset Allocation: They recommend a carefully constructed asset allocation strategy based on an investor's risk tolerance, investment goals, and time horizon.

- Diversification Across Asset Classes: Diversification remains central to BofA's recommendations, suggesting a balanced approach across stocks, bonds, and potentially other asset classes.

- Risk Management Techniques: Implementing risk management techniques like stop-loss orders and hedging strategies is crucial to protect against potential losses.

- Portfolio Adjustments: They advise regularly reviewing and adjusting investment portfolios based on changes in market conditions, economic indicators, and individual company performance.

- Regular Portfolio Reviews: BofA emphasizes the importance of periodic reviews to ensure your investment strategy remains aligned with your goals and risk tolerance.

Conclusion

BofA's assessment of high stock market valuations indicates a need for cautious optimism. While the market has shown significant growth, the elevated valuations present considerable risks. Factors such as low interest rates and strong corporate earnings have contributed to this, but risks including market volatility, inflation, and geopolitical uncertainty remain. Opportunities still exist for investors who identify undervalued sectors, focus on companies with strong fundamentals, and employ robust diversification and risk management strategies. BofA's suggested investment approaches emphasize careful asset allocation, regular portfolio reviews, and a long-term perspective.

Call to Action: Stay informed about BofA's ongoing analysis of high stock market valuations and adjust your investment strategy accordingly. Consider seeking professional financial advice to make informed decisions regarding your investment portfolio in this complex market environment. Learn more about managing risk in high-valuation markets by consulting reputable financial resources and experts.

Featured Posts

-

Months Long Lingering Of Toxic Chemicals After Ohio Train Derailment

May 03, 2025

Months Long Lingering Of Toxic Chemicals After Ohio Train Derailment

May 03, 2025 -

Find Out The Winning Lotto Numbers Saturday April 12th

May 03, 2025

Find Out The Winning Lotto Numbers Saturday April 12th

May 03, 2025 -

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Winning Numbers

May 03, 2025

Latest Lotto Lotto Plus 1 And Lotto Plus 2 Winning Numbers

May 03, 2025 -

Daisy May Coopers Sparkling New Engagement Ring Debuts

May 03, 2025

Daisy May Coopers Sparkling New Engagement Ring Debuts

May 03, 2025 -

Liverpools Contract Strategy For Salah Potential Jeopardy And Next Steps

May 03, 2025

Liverpools Contract Strategy For Salah Potential Jeopardy And Next Steps

May 03, 2025

Latest Posts

-

Rupert Lowe On X Examining The Effectiveness Of His Messaging For Uk Reform

May 03, 2025

Rupert Lowe On X Examining The Effectiveness Of His Messaging For Uk Reform

May 03, 2025 -

Souness Identifies The Missing Piece In Arsenals Title Challenge

May 03, 2025

Souness Identifies The Missing Piece In Arsenals Title Challenge

May 03, 2025 -

Arsenals Title Near Miss Souness Points To Crucial Role

May 03, 2025

Arsenals Title Near Miss Souness Points To Crucial Role

May 03, 2025 -

Concerns Over Mp Treatment Lead To Reform Uk Staff Walkout

May 03, 2025

Concerns Over Mp Treatment Lead To Reform Uk Staff Walkout

May 03, 2025 -

Charity Swim Graeme Souness Takes On The Channel For Isla

May 03, 2025

Charity Swim Graeme Souness Takes On The Channel For Isla

May 03, 2025