BofA's Take On Elevated Stock Market Valuations: An Investor's Guide

Table of Contents

BofA's Current Market Assessment and Concerns Regarding Elevated Valuations

BofA's recent reports express concerns about current stock market valuations, highlighting the potential for a correction. Their analysis uses various stock valuation metrics, primarily focusing on the price-to-earnings ratio (P/E ratio) and market capitalization to gauge the overall market health. A high P/E ratio, for example, generally indicates that investors are paying a premium for earnings, suggesting potentially overvalued stocks.

-

BofA's Concerns: BofA's analysts often point to historically high P/E ratios across various market sectors as a key indicator of elevated valuations. This, coupled with other economic factors, suggests a potential for increased market volatility and risk. Their market forecast often incorporates scenarios that account for various economic downturns.

-

Risk Assessment: The bank highlights the risks associated with these high valuations, emphasizing the potential for market corrections, declines in corporate earnings, and the impact of rising interest rates. BofA's risk assessment models consider various factors to determine potential downside scenarios.

-

Specific Sectors: BofA's research frequently identifies specific sectors or asset classes that appear particularly overvalued based on their valuation models. These sectors may be subject to greater volatility in the event of a market correction. (Note: Specific sectors mentioned would need to be sourced from current BofA reports for accuracy and ethical compliance).

-

Visual Representation: (Ideally, this section would include a chart or graph sourced from a legitimate BofA report visualizing their findings on P/E ratios or other relevant valuation metrics over time. This visual would significantly enhance the article's impact and SEO.)

Factors Contributing to Elevated Stock Market Valuations According to BofA

BofA's analysis attributes the elevated stock market valuations to a confluence of factors. These factors intertwine to create a complex market environment.

-

Low Interest Rates and Monetary Policy: BofA's experts often cite the prolonged period of low interest rates and quantitative easing (QE) as a major driver. These policies increase the availability of capital, pushing investors towards higher-risk assets like stocks in search of yield.

-

Strong Corporate Earnings (Historically): While recent trends might be shifting, periods of robust corporate earnings have historically supported higher stock valuations, justifying increased investor confidence.

-

Investor Sentiment and Market Liquidity: Positive investor sentiment and high market liquidity amplify the upward pressure on stock prices. BofA's analysts monitor sentiment indicators to assess market psychology.

-

Inflation and Economic Growth: BofA carefully considers the interplay between inflation and economic growth. High inflation erodes purchasing power, while strong economic growth can often bolster corporate earnings and drive stock prices higher. However, high inflation can also lead to interest rate hikes, potentially impacting stock valuations negatively.

-

Geopolitical Events: Geopolitical uncertainties and global events significantly influence market volatility and valuation levels. BofA continuously assesses the impact of such events on investor confidence and market dynamics.

BofA's Recommended Investment Strategies for Navigating Elevated Valuations

BofA typically advocates for a cautious approach to investing in a high-valuation environment. Their recommendations often emphasize risk management and prudent portfolio diversification.

-

Portfolio Diversification: BofA stresses the importance of a well-diversified portfolio across different asset classes (stocks, bonds, real estate, etc.) to mitigate risk.

-

Risk Management: Implementing robust risk management strategies is crucial. This might involve setting stop-loss orders or adjusting asset allocation based on market conditions.

-

Asset Allocation: In a high-valuation environment, BofA might suggest a more conservative asset allocation, potentially shifting towards less volatile assets or increasing allocations to defensive sectors.

-

Value vs. Growth Investing: BofA's stance on value versus growth investing can vary depending on market conditions. However, in periods of high valuations, value investing (focusing on undervalued companies) may be favored over growth investing (favoring high-growth companies).

-

Specific Sectors and Asset Classes: (Again, specific recommendations from BofA reports are needed here for accuracy and ethical considerations).

-

Alternative Investments: Depending on the specific BofA report, alternative investments (e.g., commodities, private equity) may be mentioned as diversification options within a well-structured portfolio.

The Importance of Long-Term Investment Strategies

Despite short-term market fluctuations and concerns about elevated valuations, BofA underscores the importance of long-term investment strategies.

-

Long-Term Perspective: Maintaining a long-term perspective is crucial for weathering market cycles and achieving long-term financial goals.

-

Market Cycles: Understanding the cyclical nature of the market is essential. Market corrections are a normal part of the investment cycle, and periods of high valuations are often followed by periods of lower valuations.

-

Financial Planning: Adhering to a well-defined financial plan, taking into account risk tolerance and long-term objectives, is vital for successful investing.

Conclusion

This guide summarizes BofA's assessment of elevated stock market valuations, including their concerns, contributing factors, and recommended investment strategies. Understanding BofA's perspective, while not financial advice, provides valuable insight for investors navigating today's market. Remember, market analysis is constantly evolving. Stay informed about BofA's ongoing market analysis to refine your investment strategy and navigate the complexities of elevated stock market valuations. Continue learning about BofA's perspective on market valuations and integrate it into your comprehensive financial planning.

Featured Posts

-

Mental Health And Transgender Individuals The Promise Of A Gender Euphoria Scale

May 15, 2025

Mental Health And Transgender Individuals The Promise Of A Gender Euphoria Scale

May 15, 2025 -

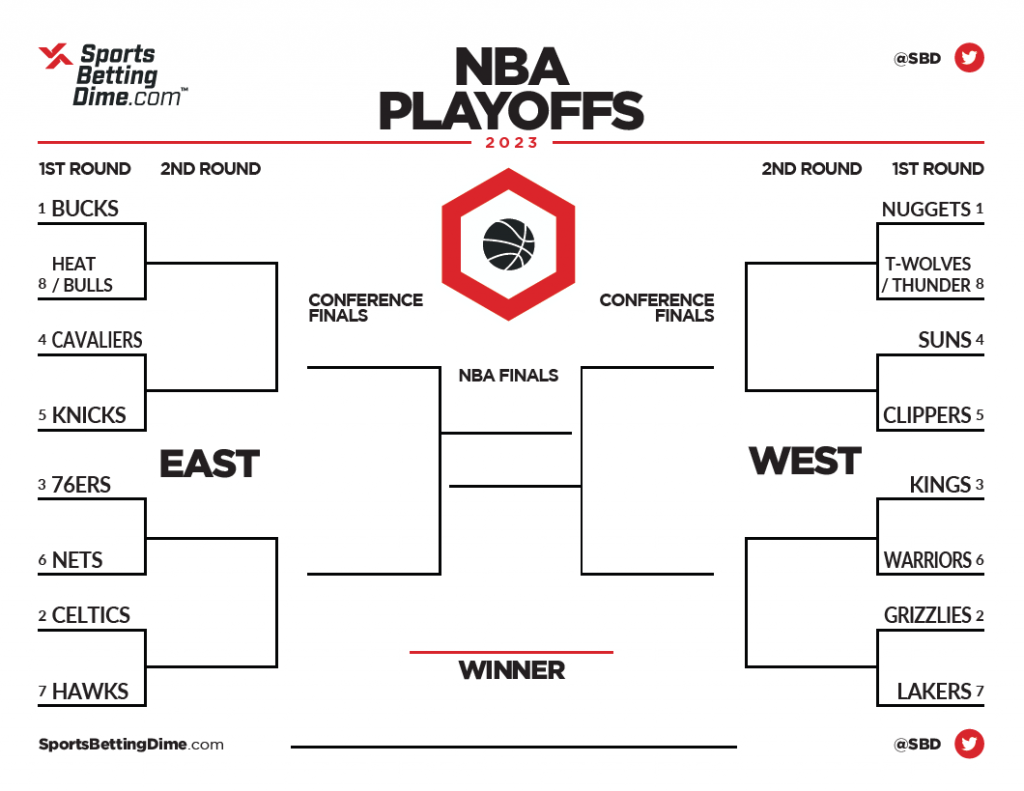

Winning Bets Nba And Nhl Round 2 Playoffs

May 15, 2025

Winning Bets Nba And Nhl Round 2 Playoffs

May 15, 2025 -

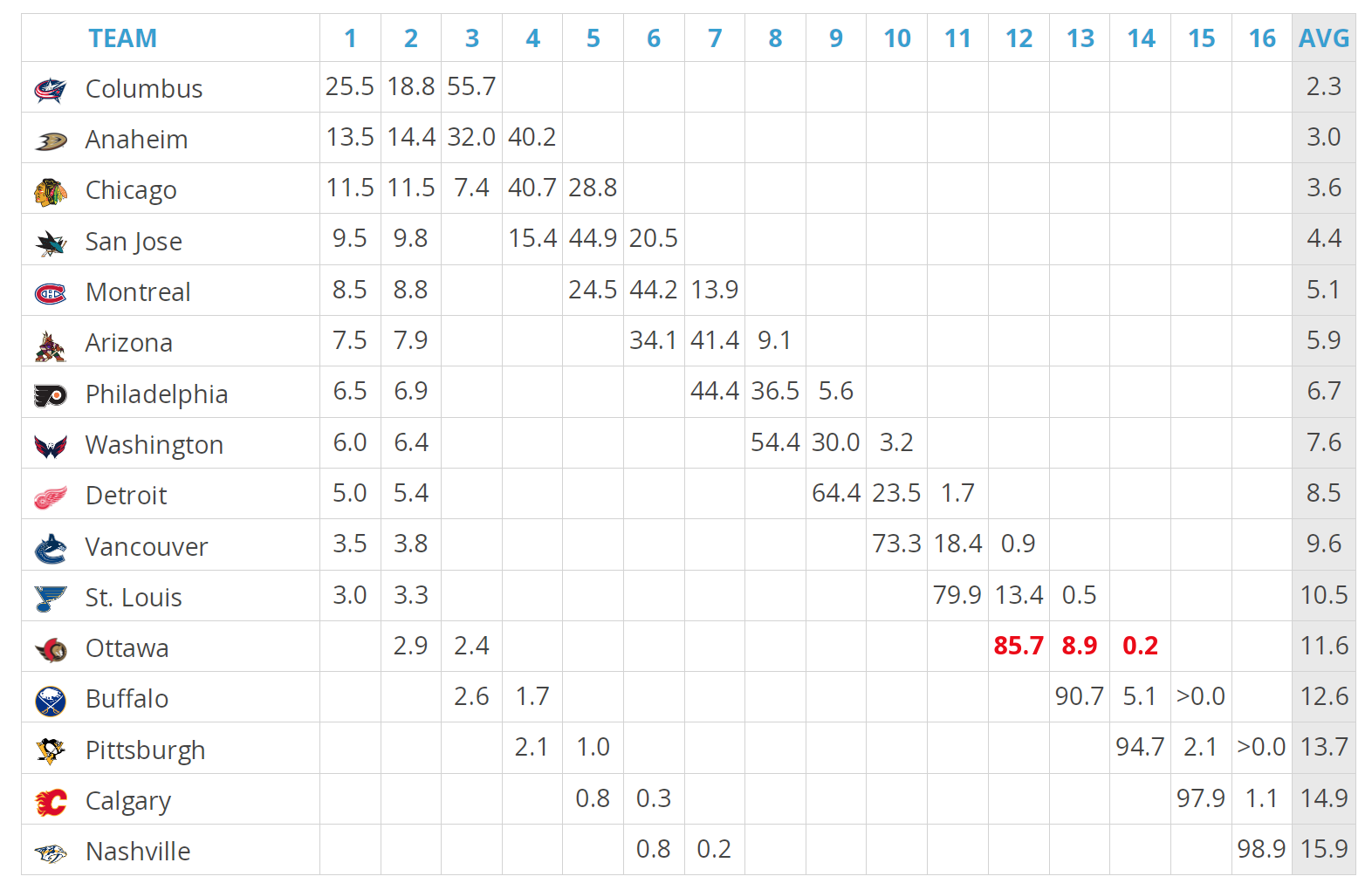

Nhl Draft Lottery Rules Explained Addressing Fan Frustration

May 15, 2025

Nhl Draft Lottery Rules Explained Addressing Fan Frustration

May 15, 2025 -

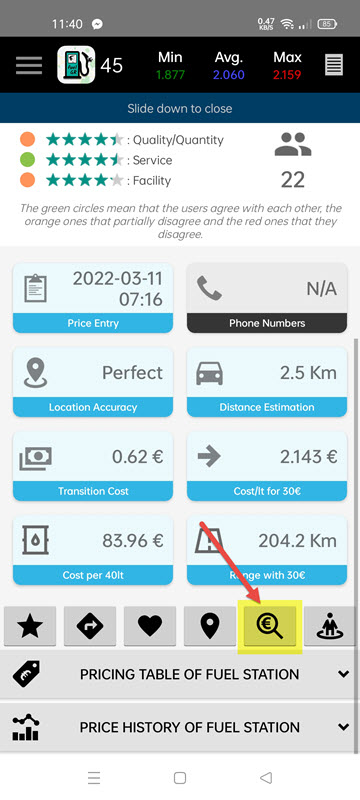

Sygkrisi Timon Kaysimon Fthina Pratiria Se Oli Tin Kypro

May 15, 2025

Sygkrisi Timon Kaysimon Fthina Pratiria Se Oli Tin Kypro

May 15, 2025 -

High Bids For Kid Cudis Personal Effects At Recent Auction

May 15, 2025

High Bids For Kid Cudis Personal Effects At Recent Auction

May 15, 2025