BofA's View: Addressing Concerns About Elevated Stock Market Valuations

Table of Contents

BofA's Assessment of Current Market Conditions

BofA's overall view of the market is cautiously optimistic, leaning towards neutral. While acknowledging the elevated valuations, they don't foresee an imminent crash but warn of potential volatility. Their assessment is driven by a complex interplay of economic, geopolitical, and financial factors.

-

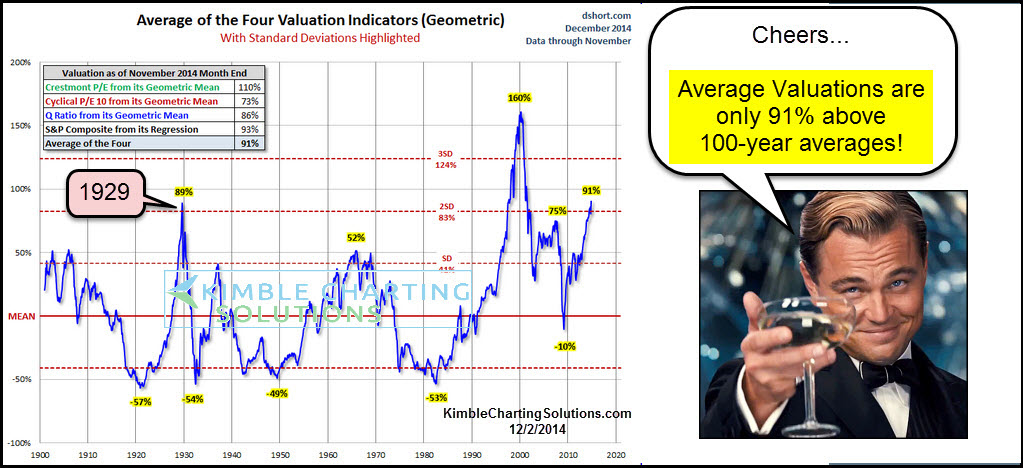

Current valuation metrics: BofA analysts closely monitor key metrics like the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE). While acknowledging these ratios are above historical averages, they emphasize the need to consider factors like interest rate environments and corporate earnings growth before drawing definitive conclusions. High P/E ratios alone do not necessarily signal an overvalued market, especially in a low-interest-rate environment where the cost of capital is relatively low.

-

Economic indicators: BofA tracks crucial economic indicators such as inflation, interest rates, and GDP growth. They analyze the trajectory of these metrics to assess the overall health of the economy and its potential impact on corporate profitability and stock valuations. Rising interest rates, for example, often lead to lower valuations as the cost of borrowing increases and future earnings are discounted more heavily. Conversely, strong GDP growth and controlled inflation can support higher valuations.

-

Geopolitical factors: Geopolitical risks, including the ongoing war in Ukraine and evolving US-China relations, significantly influence BofA's market outlook. These uncertainties contribute to market volatility and can impact investor sentiment, leading to shifts in stock prices. Uncertainty around these factors makes predicting market movement challenging.

Keywords: BofA Market Outlook, Stock Market Analysis, Economic Indicators, Valuation Metrics, Geopolitical Risk

Addressing Specific Concerns About Elevated Valuations

Investors are understandably concerned about the potential for a market correction or even a crash given the high valuations. BofA acknowledges these concerns but doesn't predict an immediate collapse.

-

Market correction/crash: While a correction (a 10-20% market decline) is always a possibility, BofA's analysis suggests that the likelihood of a significant crash depends on several factors including the pace of interest rate hikes, the resilience of corporate earnings, and the overall macroeconomic environment. A sharp increase in inflation, for instance, might trigger a more severe correction.

-

Monetary policy's role: The Federal Reserve's monetary policy, particularly interest rate hikes, plays a crucial role in influencing stock valuations. Higher interest rates make borrowing more expensive for companies, potentially slowing down economic growth and impacting corporate earnings. This can lead to lower stock prices. BofA closely monitors the Fed's actions and statements to gauge their potential impact on the market.

-

Corporate earnings growth: The ability of companies to sustain earnings growth is vital in justifying current valuations. BofA's analysts analyze corporate earnings reports and forecasts to determine whether current stock prices accurately reflect future profitability. Sustained earnings growth can support elevated valuations, but a slowdown in earnings could trigger a market correction.

Keywords: Market Correction, Stock Market Crash, Interest Rate Hikes, Corporate Earnings, Valuation Justification

BofA's Recommended Investment Strategies

Given the current market conditions and elevated valuations, BofA suggests a balanced and diversified investment approach.

-

Diversification: Diversifying across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to mitigate risk. This approach reduces the impact of any single asset's underperformance on the overall portfolio.

-

Sector-specific recommendations: BofA may favor value stocks (companies trading at lower valuations relative to their fundamentals) over growth stocks (companies with high growth potential but often higher valuations) in the current environment. Value stocks tend to be less susceptible to market corrections and volatility. However, their recommendations are always based on individual company research and market analysis.

-

Defensive investments: Incorporating defensive investments (assets that tend to hold their value during market downturns, such as high-quality bonds and gold) can help cushion the impact of market volatility. This is particularly true in a period of uncertainty and higher-than-normal risk.

-

Long-term investing: Maintaining a long-term investment horizon is essential. Short-term market fluctuations should not drive investment decisions. A long-term perspective allows investors to ride out market volatility and benefit from long-term growth.

Keywords: Investment Strategy, Portfolio Diversification, Value Stocks, Growth Stocks, Defensive Investments, Long-Term Investing

Understanding BofA's Methodology and Data Sources

BofA's market analysis relies on a robust methodology incorporating quantitative and qualitative factors. Their conclusions are based on extensive financial modeling, thorough data analysis from various sources, and insights from their experienced research team. They regularly publish reports and research papers detailing their analysis, which provide further insight into their findings.

Keywords: BofA Research, Financial Modeling, Data Analysis, Investment Research

Conclusion

BofA's analysis indicates that while stock market valuations are currently high, an immediate crash isn't their primary forecast. However, they advocate for a cautious approach, recommending diversified portfolios with a focus on value stocks and defensive investments, particularly given the current uncertainties. Investors should maintain a long-term perspective and adapt their strategies based on evolving economic and geopolitical conditions.

Investors should carefully consider BofA's perspective on elevated stock market valuations when formulating their investment strategies. Understanding these insights can help you navigate the current market environment and make informed decisions about your portfolio. For more in-depth analysis and up-to-date information, refer to BofA's latest research publications on stock market valuations. Keywords: BofA Stock Market Valuation, Investment Decisions, Portfolio Management, Market Analysis

Featured Posts

-

The Misrepresentation Of Mentally Ill Killers A Critical Analysis Of Academic Failures

May 09, 2025

The Misrepresentation Of Mentally Ill Killers A Critical Analysis Of Academic Failures

May 09, 2025 -

3e Ligne De Tramway A Dijon Le Conseil Metropolitain Approuve Le Projet

May 09, 2025

3e Ligne De Tramway A Dijon Le Conseil Metropolitain Approuve Le Projet

May 09, 2025 -

Stricter Uk Visa Policies Addressing Concerns Over Visa Abuse

May 09, 2025

Stricter Uk Visa Policies Addressing Concerns Over Visa Abuse

May 09, 2025 -

Elizabeth Hurleys Hottest Cleavage Moments A Revealing Look

May 09, 2025

Elizabeth Hurleys Hottest Cleavage Moments A Revealing Look

May 09, 2025 -

Travailler A Dijon Opportunites Au Rooftop Dauphine Et Restaurants

May 09, 2025

Travailler A Dijon Opportunites Au Rooftop Dauphine Et Restaurants

May 09, 2025