BofA's View: Are High Stock Market Valuations A Cause For Concern?

Table of Contents

BofA's Current Stance on Market Valuations

BofA's analysts continuously monitor various market indicators to gauge the overall health and potential risks within the market. Their assessment of high stock market valuations often incorporates several key metrics. Recent reports suggest a cautious optimism, acknowledging the historically high valuations but also pointing to certain mitigating factors.

- Key valuation metrics BofA is tracking: BofA utilizes several key metrics, including the price-to-earnings ratio (P/E ratio), the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE), and various sector-specific valuation ratios to assess market health and potential overvaluation. They also consider factors like dividend yields and interest rates when forming their outlook.

- BofA's assessment of current market risk: While acknowledging the elevated valuations, BofA's assessment of risk isn't uniformly negative. Their analysis typically considers the interplay between economic growth, inflation, and interest rate policies to determine the overall risk profile. This nuanced approach allows for a more comprehensive understanding of market conditions.

- BofA's outlook for future market performance: BofA's outlook for future market performance often incorporates a range of scenarios, acknowledging both the potential for continued growth and the possibility of corrections. Their forecasts generally include a discussion of the factors that could impact market direction, such as geopolitical events, changes in monetary policy, and unexpected economic shocks.

Factors Contributing to High Stock Market Valuations

Several interconnected factors contribute to the current environment of high stock market valuations. Understanding these factors is crucial for interpreting BofA's analysis and forming your own investment strategy.

- Impact of monetary policy on valuations: Years of low interest rates, particularly following the 2008 financial crisis and the COVID-19 pandemic, have fueled significant liquidity in the market, driving up asset prices, including stocks. This easy monetary policy has encouraged borrowing and investment, boosting demand and pushing up valuations.

- Role of technological innovation and disruption: The rapid pace of technological innovation across various sectors has contributed to high growth expectations for certain companies, resulting in higher valuations. Investors are often willing to pay a premium for companies perceived to be at the forefront of technological advancement.

- Influence of geopolitical events on market sentiment: Geopolitical uncertainty, such as trade wars or international conflicts, can impact investor sentiment and market volatility. These events can sometimes lead to a flight to safety, increasing the demand for perceived safe-haven assets, even if this comes at the cost of high valuations for certain assets.

Potential Risks Associated with High Valuations

While high valuations can signal robust economic growth, they also carry inherent risks. Understanding these risks is critical for responsible investment decision-making.

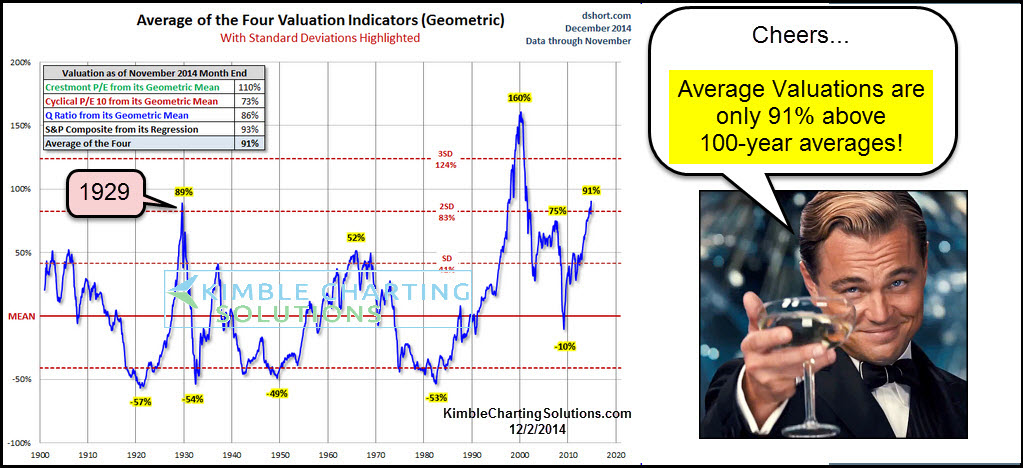

- Historical precedent for market corrections after high valuations: History shows that periods of high stock market valuations are often followed by market corrections or even crashes. This is not to say a crash is imminent, but the historical precedent warrants caution and careful risk management.

- The potential impact of rising interest rates on valuations: As central banks begin to raise interest rates to combat inflation, the cost of borrowing increases. This can impact company profitability and investor sentiment, potentially leading to a decline in stock prices, particularly for companies with high debt levels.

- Risks associated with specific investment strategies: Certain investment strategies, such as growth investing, become particularly vulnerable during periods of high valuations. These strategies often rely on high future growth expectations, making them sensitive to shifts in investor sentiment and interest rate changes.

BofA's Recommendations for Investors

Navigating the complexities of high stock market valuations requires a well-defined investment strategy that incorporates risk management techniques. BofA typically advises a balanced and diversified portfolio approach.

- Suggested asset allocation strategies: BofA often suggests a diversified approach, allocating assets across different asset classes such as stocks, bonds, and real estate to mitigate risk and potentially enhance returns. The exact allocation would depend on individual risk tolerance and investment goals.

- Recommendations for diversification: Diversification across sectors and geographies is crucial to reduce portfolio volatility and the impact of potential sector-specific downturns. A well-diversified portfolio is less susceptible to significant losses in a market correction.

- Advice on hedging against market risk: BofA might suggest hedging strategies, such as options or futures contracts, to protect against potential market downturns. These strategies can provide a buffer against losses, allowing investors to participate in market upside while limiting downside risk.

Conclusion: Navigating High Stock Market Valuations Based on BofA's Insights

BofA's analysis of high stock market valuations reflects a cautious but not overly pessimistic outlook. While acknowledging the elevated valuations and potential risks, they also highlight the influence of various economic and geopolitical factors. Their recommendations emphasize a balanced, diversified portfolio approach and careful risk management. Staying informed about BofA's ongoing analysis and considering their recommendations is crucial when making investment decisions in this environment of elevated valuations. We urge you to consult BofA's latest reports and research to further enhance your understanding of the current market dynamics and develop an informed investment strategy around high stock market valuations.

Featured Posts

-

Ticketmaster Y Virtual Venue Una Nueva Era En La Compra De Entradas

May 30, 2025

Ticketmaster Y Virtual Venue Una Nueva Era En La Compra De Entradas

May 30, 2025 -

Dana White Needs To Pay Up Ufc Veteran On Jon Joness 29 Million Demand

May 30, 2025

Dana White Needs To Pay Up Ufc Veteran On Jon Joness 29 Million Demand

May 30, 2025 -

Nissans Classic Nameplate Comeback Is It Really Happening

May 30, 2025

Nissans Classic Nameplate Comeback Is It Really Happening

May 30, 2025 -

Bladder Control For Women Discover The Power Of Primeras Natural Formula

May 30, 2025

Bladder Control For Women Discover The Power Of Primeras Natural Formula

May 30, 2025 -

Analysis The Trump Administrations 3 Billion Loan Rejection For Sunnova Energy

May 30, 2025

Analysis The Trump Administrations 3 Billion Loan Rejection For Sunnova Energy

May 30, 2025

Latest Posts

-

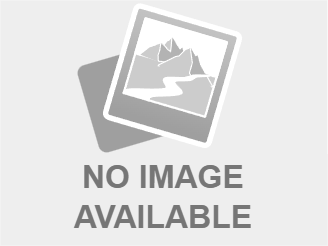

Tracking Power Outages Real Time Data For Northeast Ohio

May 31, 2025

Tracking Power Outages Real Time Data For Northeast Ohio

May 31, 2025 -

Meteorologist Tom Atkins Spring Skywarn Class Dates And Registration

May 31, 2025

Meteorologist Tom Atkins Spring Skywarn Class Dates And Registration

May 31, 2025 -

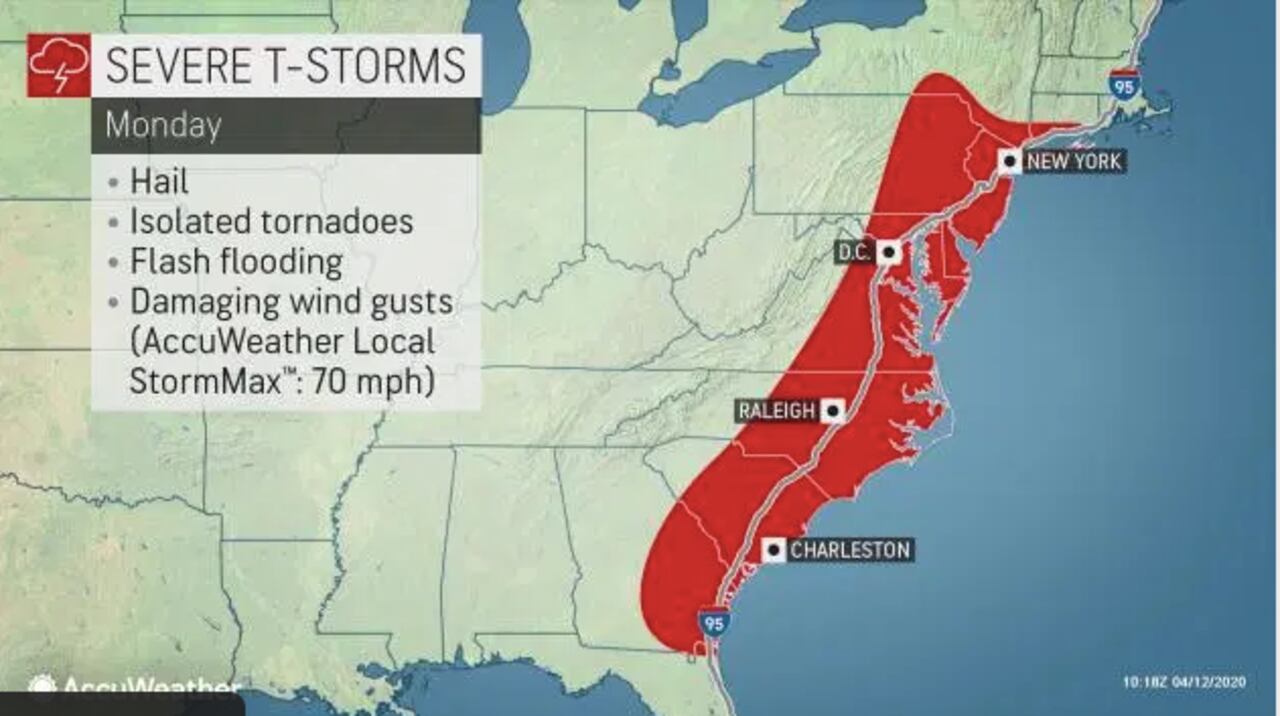

Northeast Ohio Braces For Severe Thunderstorms Safety Tips And Power Outage Preparedness

May 31, 2025

Northeast Ohio Braces For Severe Thunderstorms Safety Tips And Power Outage Preparedness

May 31, 2025 -

Northeast Ohio Power Outages Latest Statistics And Outage Map

May 31, 2025

Northeast Ohio Power Outages Latest Statistics And Outage Map

May 31, 2025 -

Thunderstorms Slam Northeast Ohio Latest Weather Updates And Power Outage Reports

May 31, 2025

Thunderstorms Slam Northeast Ohio Latest Weather Updates And Power Outage Reports

May 31, 2025