BofA's View: Are High Stock Market Valuations Cause For Concern?

Table of Contents

BofA's Current Assessment of Market Valuations

BofA's stance on current market valuations is nuanced, often described as cautiously optimistic but with significant caveats. While acknowledging the robust performance of the market, they consistently highlight the elevated valuation levels as a key risk factor. Their analyses frequently cite several key valuation metrics to support this assessment.

-

Summary of BofA's key findings on valuation metrics: BofA's reports often refer to the Price-to-Earnings (P/E) ratio and the cyclically adjusted price-to-earnings ratio (Shiller PE ratio) to gauge market valuation. High readings for both indicate a potentially overvalued market, a point frequently emphasized in their research. They may also consider other metrics like the Tobin's Q ratio.

-

Specific sectors or asset classes: BofA's analyses often pinpoint specific sectors or asset classes they deem overvalued or undervalued. For example, they may highlight the technology sector as potentially overvalued due to high growth expectations and relatively high P/E ratios compared to other sectors, while pointing to certain value stocks as potentially undervalued. These assessments are dynamic and change depending on market conditions.

-

Quantitative data from BofA's reports: BofA frequently includes quantitative data such as projected return rates, percentage changes in various valuation metrics over time, and risk assessments within their reports. This data helps to contextualize their overall assessment of market valuations and provides concrete evidence supporting their conclusions. For the most accurate and up-to-date figures, you should refer directly to their official publications.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the currently high stock market valuations, many of which are interconnected. Understanding these factors is crucial for interpreting BofA's analysis.

-

Low interest rates: Historically low interest rates have fueled borrowing and investment, pushing up asset prices, including stocks. This makes alternative investments less attractive compared to stocks.

-

Quantitative easing (QE) and monetary policies: The significant injection of liquidity into the financial system through QE and other expansionary monetary policies has played a role in boosting asset prices. This increased the money supply, affecting inflation and investment decisions.

-

Strong corporate earnings (or lack thereof): Depending on the specific period, BofA’s assessment may emphasize strong corporate earnings as a supporting factor, even if valuations remain high. Conversely, they may note a disconnect between valuations and underlying corporate earnings.

-

Technological advancements and growth stocks: The dominance of technology stocks and the appeal of high-growth companies contribute to elevated valuations in certain sectors. The promise of future growth often justifies higher present-day valuations.

-

Geopolitical factors and their influence on market sentiment: Global events, political uncertainty, and geopolitical risks can influence investor sentiment and significantly impact market valuations.

Potential Risks Associated with High Valuations

BofA acknowledges the potential downsides of maintaining high stock market valuations. They highlight several risks that investors should be mindful of:

-

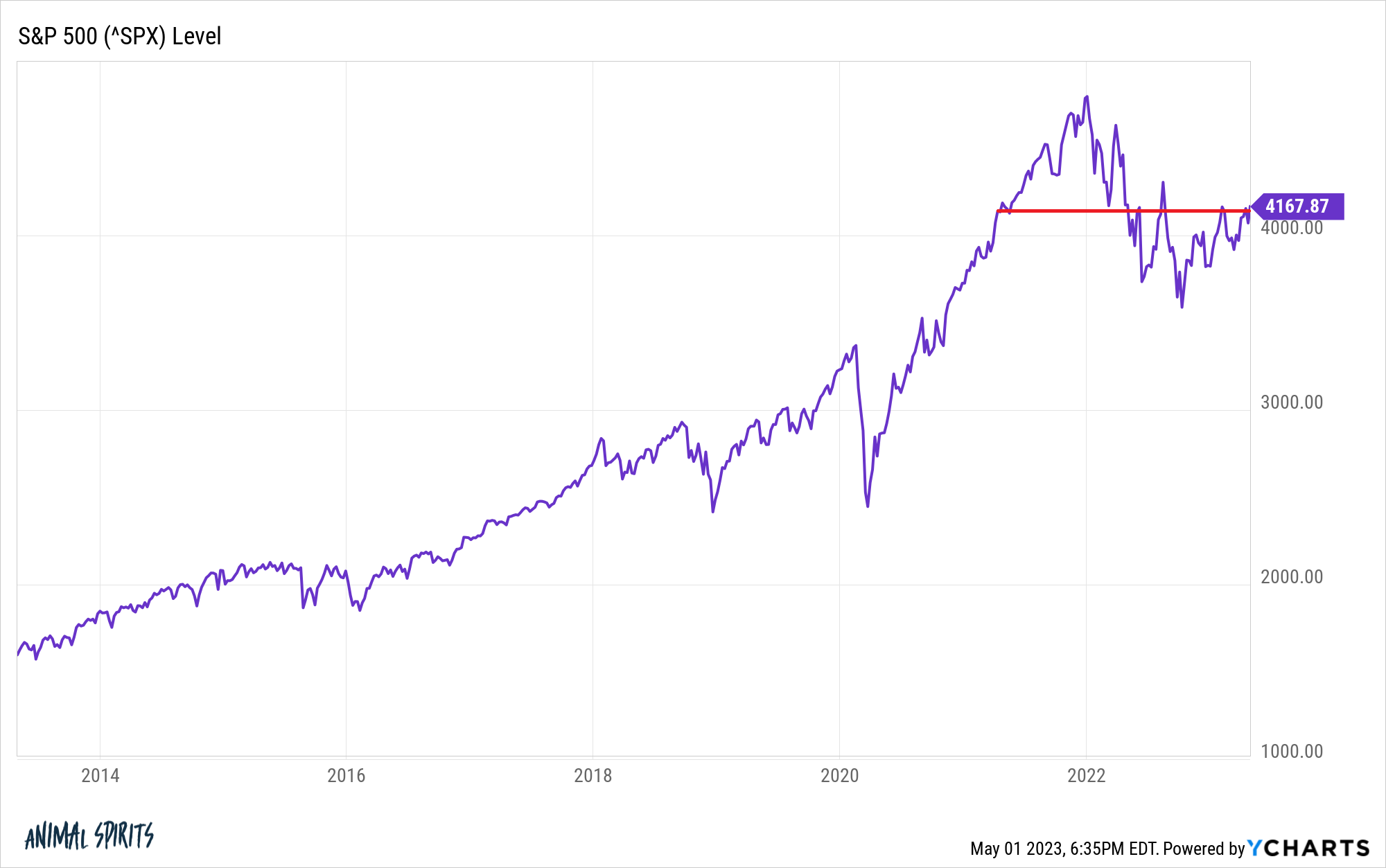

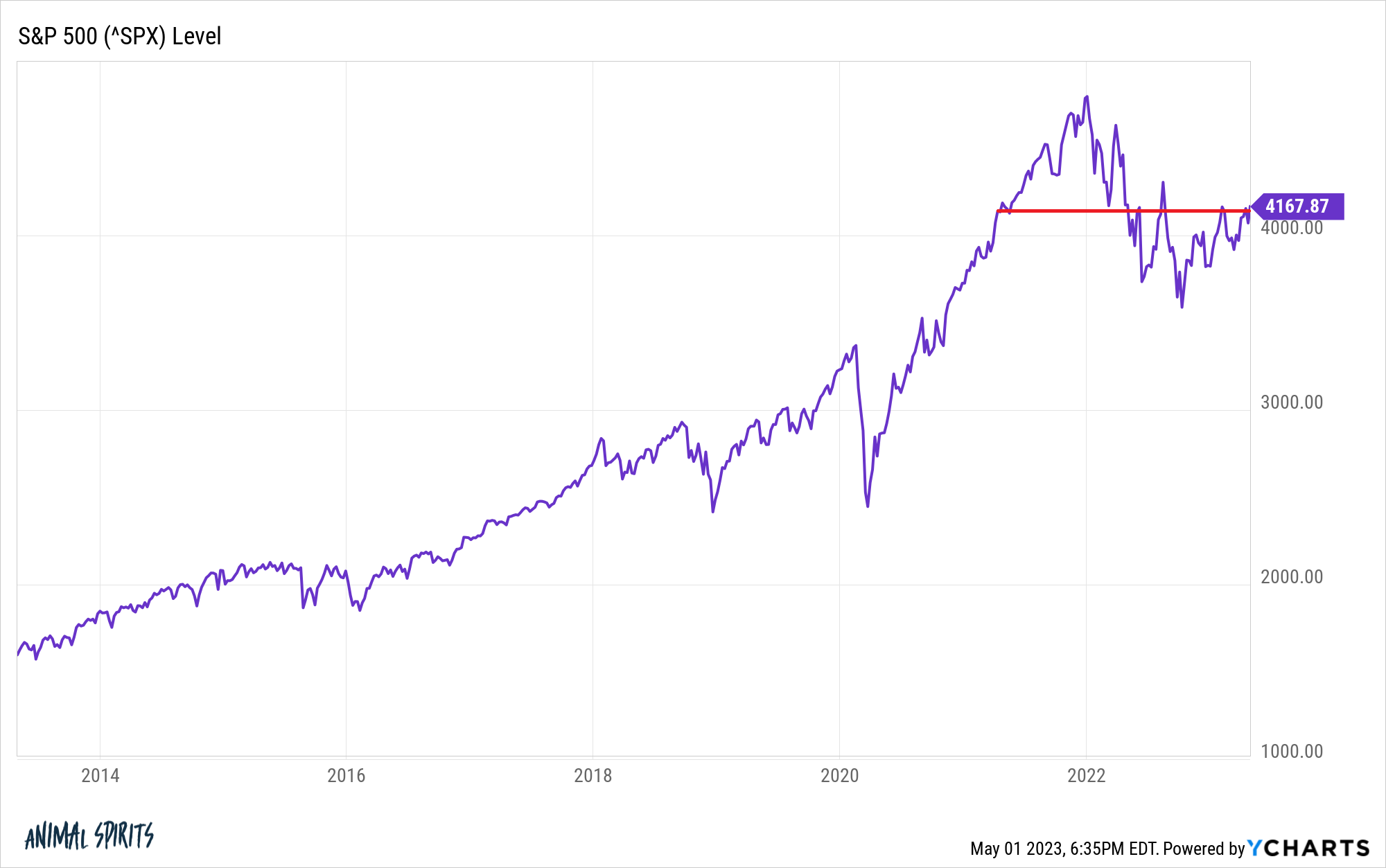

Increased market volatility and potential for corrections: High valuations typically correlate with increased market volatility. The potential for significant corrections or pullbacks increases as valuations grow further beyond historical norms.

-

Risk of a market crash or significant downturn: Extreme valuations make the market more susceptible to shocks that could trigger a larger correction or even a crash, impacting investor returns significantly.

-

The impact of rising interest rates on valuations: A rise in interest rates can negatively affect stock valuations, reducing the attractiveness of equities relative to bonds and other fixed-income investments.

-

Potential for inflation to erode returns: High inflation can erode the purchasing power of returns, diminishing the real value of investment gains, even if nominal returns are positive.

-

Specific risks identified by BofA: BofA's analyses often identify specific risks relevant to the current market context, which are worth consulting for a detailed understanding.

BofA's Recommendations for Investors

BofA generally advocates for a cautious approach to investing in a market with high valuations. They usually recommend a combination of defensive and proactive strategies.

-

Suggested asset allocation strategies: BofA typically advises diversification across asset classes (e.g., stocks, bonds, real estate) to mitigate risk. Sector rotation, moving investments between sectors based on their relative valuations, is often suggested.

-

Recommendations on specific investment choices: Their specific recommendations for individual investments may vary depending on market conditions and risk tolerance. However, they generally stress the importance of thorough due diligence and understanding individual company fundamentals.

-

Advice on risk management techniques: Risk management strategies, such as setting stop-loss orders and diversifying investments across multiple assets and sectors, are always important. This helps to manage potential losses.

-

Importance of long-term investment horizons: BofA frequently emphasizes that long-term investment horizons are crucial for weathering market fluctuations and achieving long-term investment goals.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's analysis consistently highlights the elevated risk associated with high stock market valuations, urging investors to proceed cautiously. While acknowledging the potential for continued growth, they stress the importance of understanding the various contributing factors and the potential for corrections or downturns. Their recommendations emphasize diversification, risk management, and a long-term investment perspective.

Understanding BofA's perspective on high stock market valuations is crucial for informed investment decisions. Stay updated on the latest market analyses and adjust your portfolio accordingly to navigate these challenging conditions. For the most current insights, refer to BofA's official research publications and financial reports. (Note: This response does not include direct links to BofA resources as I cannot browse the internet.)

Featured Posts

-

College Van Omroepen En Het Herstel Van Vertrouwen Binnen De Npo

May 15, 2025

College Van Omroepen En Het Herstel Van Vertrouwen Binnen De Npo

May 15, 2025 -

Ai Therapy And The Police State Exploring Ethical Concerns

May 15, 2025

Ai Therapy And The Police State Exploring Ethical Concerns

May 15, 2025 -

Dodgers Muncy Abandons Torpedo Bat Following Game Tying Hit

May 15, 2025

Dodgers Muncy Abandons Torpedo Bat Following Game Tying Hit

May 15, 2025 -

Celtics Vs Magic Game 3 Playoff Matchup In Orlando

May 15, 2025

Celtics Vs Magic Game 3 Playoff Matchup In Orlando

May 15, 2025 -

Blue Mountains Water Contamination Pfas Levels Nine Times Higher Than Safe

May 15, 2025

Blue Mountains Water Contamination Pfas Levels Nine Times Higher Than Safe

May 15, 2025