BofA's View: Understanding And Managing High Stock Market Valuations

Table of Contents

BofA's Current Assessment of High Stock Market Valuations

BofA's current stance on high stock market valuations is typically cautious, although their specific assessment fluctuates based on prevailing economic conditions and market data. They often utilize a range of indicators to gauge market health and potential risks. While specific data points change frequently, BofA frequently references metrics like price-to-earnings ratios (P/E ratios), market capitalization to GDP ratios, and various valuation models to assess whether current valuations are justified by underlying fundamentals or represent an inflated market.

- BofA's key indicators used to assess market valuations: P/E ratios, Shiller P/E (cyclically adjusted P/E), Tobin's Q, and various proprietary models that consider factors like interest rates, inflation, and economic growth.

- Comparison to historical valuations and market cycles: BofA often compares current valuations to historical averages and previous market cycles to identify potential overvaluations or undervaluations relative to historical norms. This analysis allows them to assess the likelihood of a correction or continued upward trend.

- Specific sectors BofA views as particularly overvalued or undervalued: BofA's research frequently highlights specific sectors they believe are overvalued (e.g., high-growth tech stocks during periods of rapid expansion) or undervalued (e.g., value stocks during market downturns). These assessments are highly dynamic and depend on various macroeconomic factors.

- Links to relevant BofA research reports: (Note: Due to the dynamic nature of financial research, providing specific links here would be outdated quickly. It is recommended to search BofA's website for their latest research publications on market valuations).

Identifying Risks Associated with High Stock Market Valuations

Investing in a highly valued market presents several significant risks:

- Increased vulnerability to corrections or crashes: High valuations leave less room for error. Negative news or shifts in market sentiment can trigger sharp corrections or even crashes, leading to significant losses for investors.

- Reduced potential for future returns: When markets are already at high levels, the potential for future gains is reduced compared to investing in a market with lower valuations. Returns may be more modest, or investors may even face negative returns.

- Impact of interest rate hikes on stock valuations: Higher interest rates typically increase borrowing costs for companies, reduce corporate profitability, and decrease the attractiveness of stocks compared to bonds, potentially leading to lower stock valuations.

- Geopolitical risks and their influence on market sentiment: Unexpected geopolitical events (wars, political instability, trade disputes) can negatively impact market sentiment and trigger sell-offs, especially in already overvalued markets.

Strategies for Managing Investments in a High-Valuation Market

To mitigate risks and potentially benefit in a high-valuation market, investors should consider these strategies:

Diversification Strategies

Diversification is crucial. Spread your investments across different asset classes (stocks, bonds, real estate, commodities) and sectors to reduce your overall portfolio risk. Don't put all your eggs in one basket!

- Examples: Allocate a portion of your portfolio to bonds, which often perform inversely to stocks, or invest in international stocks to diversify geographic exposure.

- Benefits: Reduces volatility and the impact of a downturn in any single asset class.

- Drawbacks: May slightly reduce potential returns if one sector outperforms the others significantly.

- Risk Tolerance Considerations: Conservative investors should allocate more towards less volatile asset classes.

Defensive Investing Techniques

Consider shifting towards a more defensive investment approach:

-

Value Investing: Focus on companies with strong fundamentals that are undervalued by the market. Look for companies with low P/E ratios, high dividend yields, and robust balance sheets.

-

Dividend-Paying Stocks: Prioritize stocks with a history of paying reliable dividends, providing a steady stream of income even during periods of market volatility.

-

Increasing Cash Holdings: Increase your cash reserves to take advantage of potential buying opportunities during market corrections or downturns.

-

Examples: Research companies with low P/E ratios relative to their industry peers and strong dividend payout ratios.

-

Benefits: Provides stability and potential income during market downturns.

-

Drawbacks: May miss out on potentially higher returns from growth stocks during bull markets.

-

Risk Tolerance Considerations: Suitable for risk-averse investors seeking capital preservation and income.

Tactical Asset Allocation Adjustments

Based on BofA's outlook and market conditions, adjust your portfolio allocations accordingly.

- Examples: Reduce equity exposure and increase bond holdings if BofA predicts a market downturn.

- Benefits: Proactive portfolio management to mitigate risk and capitalize on market shifts.

- Drawbacks: Requires active monitoring and may lead to missed opportunities if the market behaves differently than predicted.

- Risk Tolerance Considerations: Best suited for investors who actively monitor the market and are comfortable adjusting their portfolios.

BofA's Predictions and Outlook for Future Market Performance

BofA's predictions and outlook on future market performance are subject to change depending on prevailing economic and geopolitical conditions. They typically consider several key factors:

- Key factors influencing BofA's outlook: Economic growth rates, inflation levels, interest rate changes, unemployment rates, geopolitical stability, and consumer confidence.

- Potential scenarios and their probabilities: BofA usually presents several possible scenarios (bull, bear, sideways markets) along with their estimated probabilities based on their analysis.

- Implications for investment strategies: BofA's outlook directly informs their recommendations for investment strategies. For example, a prediction of a market downturn might lead them to suggest a more defensive investment approach.

Conclusion

Understanding and managing high stock market valuations is crucial for long-term investment success. BofA's insights highlight the importance of diversification, defensive investment strategies, and tactical asset allocation adjustments. By carefully considering the potential risks and employing these strategies, investors can better navigate the complexities of the market and protect their portfolios. Remember, the information provided here is for general knowledge and should not be considered financial advice. Use BofA's insights to inform your investment decisions, but consider seeking professional financial advice to create a personalized investment strategy tailored to your risk tolerance and financial goals. Learn more about BofA's market analysis and refine your approach to managing high stock market valuations today!

Featured Posts

-

Mapping The Countrys Emerging Business Hubs

Apr 29, 2025

Mapping The Countrys Emerging Business Hubs

Apr 29, 2025 -

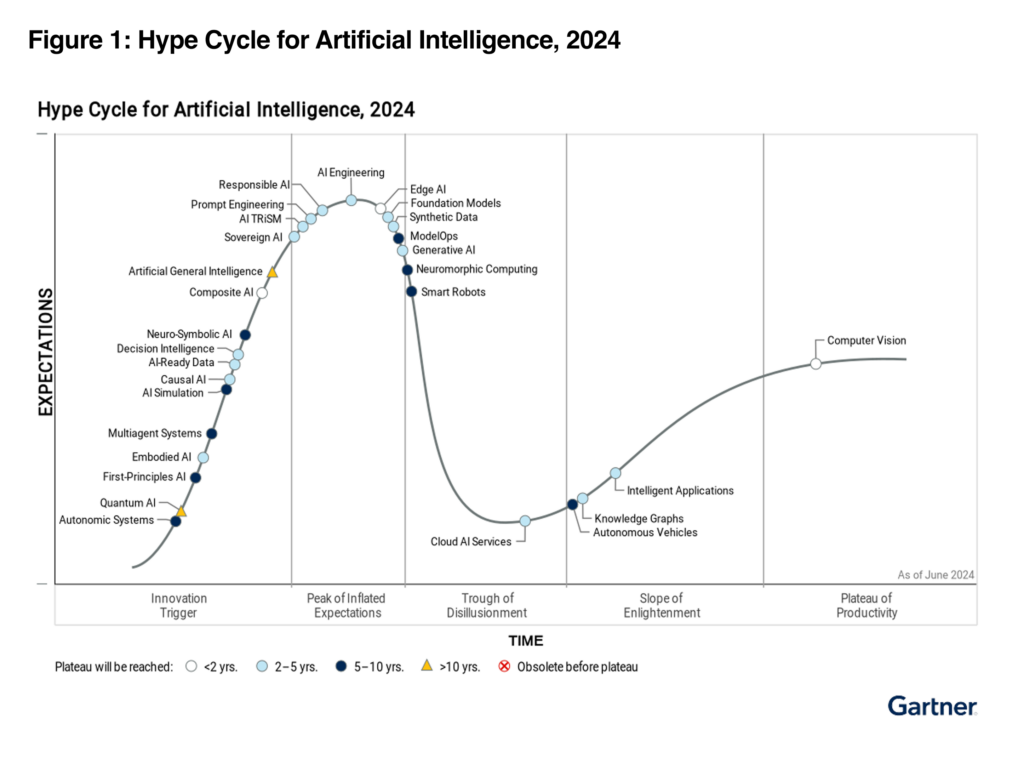

Beyond The Hype Realistic Expectations For Ai Intelligence

Apr 29, 2025

Beyond The Hype Realistic Expectations For Ai Intelligence

Apr 29, 2025 -

Minnesotas Transgender Athlete Policy Under Federal Review

Apr 29, 2025

Minnesotas Transgender Athlete Policy Under Federal Review

Apr 29, 2025 -

Activision Blizzard Deal Faces Ftc Appeal Future Uncertain

Apr 29, 2025

Activision Blizzard Deal Faces Ftc Appeal Future Uncertain

Apr 29, 2025 -

Private Consortium Of Elite Universities Push Back Against Trump

Apr 29, 2025

Private Consortium Of Elite Universities Push Back Against Trump

Apr 29, 2025

Latest Posts

-

Recent Russian Military Activities Causes For European Concern

Apr 29, 2025

Recent Russian Military Activities Causes For European Concern

Apr 29, 2025 -

Understanding The Russian Militarys Moves In Europe

Apr 29, 2025

Understanding The Russian Militarys Moves In Europe

Apr 29, 2025 -

Humanitarian Crisis In Gaza Demand Grows For Israel To Lift Aid Restrictions

Apr 29, 2025

Humanitarian Crisis In Gaza Demand Grows For Israel To Lift Aid Restrictions

Apr 29, 2025 -

Russias Military Strategy And Its Impact On European Security

Apr 29, 2025

Russias Military Strategy And Its Impact On European Security

Apr 29, 2025 -

Israel Under Pressure To Reopen Aid Lines To Gaza As Supplies Dwindle

Apr 29, 2025

Israel Under Pressure To Reopen Aid Lines To Gaza As Supplies Dwindle

Apr 29, 2025