Boston Celtics Sold For $6.1B: Fans React To Private Equity Buyout

Table of Contents

The $6.1 Billion Deal: Details and Implications

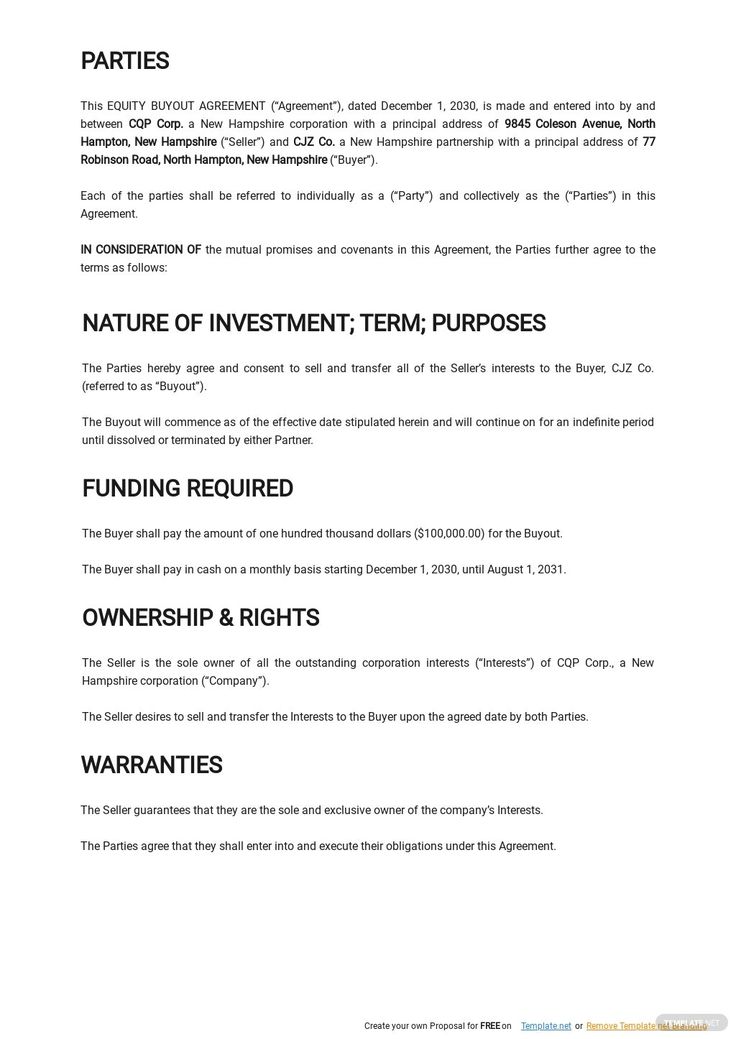

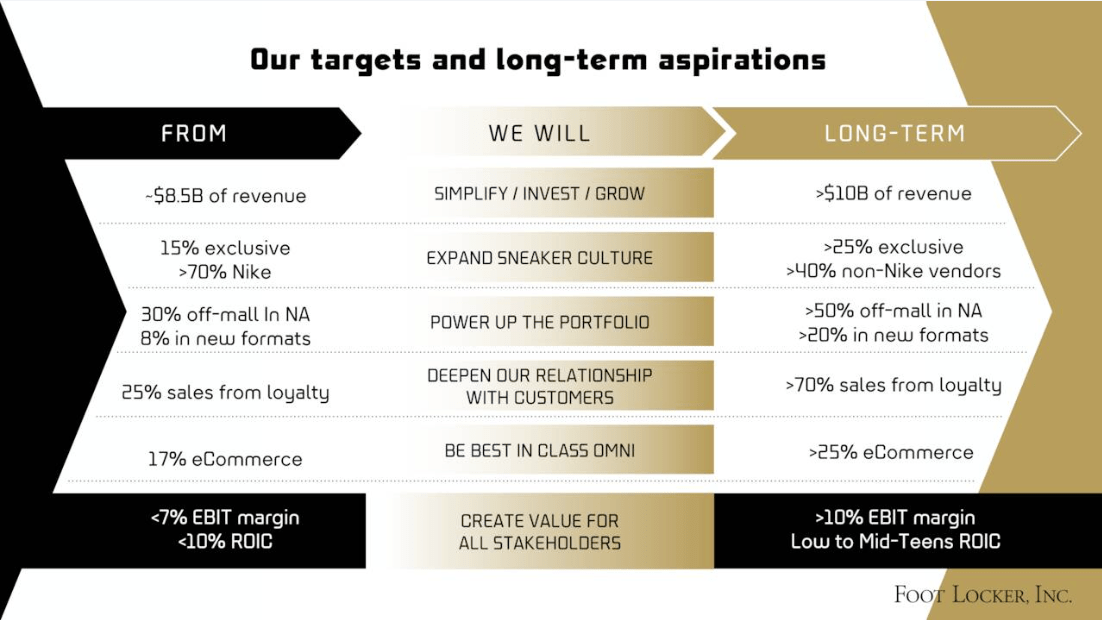

The Boston Celtics sale was finalized with a private equity group, [Insert Name of Private Equity Firm Here], acquiring the team for a record-breaking $6.1 billion. This firm boasts a history of significant investments, including [mention any relevant previous investments in sports or similar high-profile ventures]. This sale price represents a substantial leap in NBA franchise valuations, surpassing previous sales and highlighting the increasing financial power within professional basketball.

Several key financial aspects of this Celtics buyout deserve closer examination:

- Sale Price Comparison: This $6.1 billion price tag significantly exceeds previous NBA franchise sales, indicating the escalating value of successful franchises and their lucrative potential in the modern sporting landscape. For example, [mention a comparable sale and the price difference].

- Financing Breakdown: While the exact details remain undisclosed, the transaction likely involved a complex mix of debt and equity financing, reflecting the significant capital investment required for such a large acquisition. Further details about the financing structure are expected to emerge in coming weeks.

- Potential Return on Investment: For the private equity buyers, the potential for a substantial return on investment is considerable, given the Celtics' strong brand recognition, consistent performance, and access to lucrative revenue streams including ticket sales, merchandise, and broadcasting rights.

The impact on the Celtics' future is multifaceted. On the court, the influx of capital could lead to increased investment in player recruitment and development, potentially attracting top-tier free agents and enhancing the team's competitiveness. Off the court, improvements to TD Garden and enhanced marketing strategies are likely possibilities.

Fan Reactions to the Boston Celtics Buyout: Mixed Emotions and Concerns

The Boston Celtics buyout has generated a wide spectrum of reactions among Celtics fans, sparking lively discussions across social media platforms and online forums. These #CelticsFans reactions can be broadly categorized as follows:

- Positive Reactions: Many fans express optimism, hoping the new ownership will inject capital into the team, leading to improved facilities, better player acquisitions, and a stronger overall competitive edge. There is a clear sense of excitement and a "wait-and-see" attitude.

- Negative Reactions: Conversely, some fans harbor concerns about the potential downsides of private equity ownership, fearing increased ticket prices, a greater emphasis on profit maximization over on-court success, and a potential dilution of the team's unique identity and culture.

- Neutral Reactions: A significant segment of the fanbase adopts a more neutral stance, expressing a need for transparency and reassurance from the new owners regarding their long-term vision for the team and their commitment to maintaining the Celtics' cherished legacy.

Social media platforms are awash with comments reflecting these diverse sentiments. For instance, [Insert a quote from a fan on Twitter or another social media platform, citing the source properly], highlights concerns about ticket affordability, while [Insert another quote, citing the source] expresses hope for a more aggressive approach to player recruitment.

The Future of the Boston Celtics Under New Ownership: Challenges and Opportunities

The new owners of the Boston Celtics face a complex set of challenges and opportunities. Maintaining the team's rich history and unwavering fan loyalty will be paramount. Balancing financial goals with on-court success will require astute leadership and strategic decision-making. Cultivating positive relationships with players, coaches, and staff is crucial to ensuring smooth operations and fostering a productive environment.

However, significant opportunities exist for growth and improvement:

- Increased Investment: The substantial financial resources now available could lead to significantly enhanced player recruitment and development programs, boosting the team's competitive standing.

- Infrastructure Modernization: Upgrades to TD Garden and other team facilities could significantly improve the fan experience and create a more modern and engaging atmosphere.

- Brand Expansion: With a global fanbase, the potential for strategic brand expansion, both domestically and internationally, presents a clear path for increased revenue generation.

The impact on ticket pricing, merchandise costs, and the overall fan experience remains to be seen. Transparency and communication from the new ownership will be key to maintaining a positive relationship with the loyal Celtics faithful.

The Boston Celtics Sale: What's Next?

The $6.1 billion Boston Celtics sale signifies a monumental shift in the franchise's ownership structure, raising important questions about the balance between financial goals and on-court success. Fan reactions reveal a mix of hope, concern, and uncertainty, emphasizing the emotional connection between a storied franchise and its devoted fanbase. The challenges and opportunities facing the new owners are considerable, requiring a skillful blend of financial acumen and a deep understanding of the Celtics' unique place in the hearts of their fans. This private equity buyout of the Boston Celtics has set a new benchmark in NBA franchise valuations, and its long-term implications will continue to unfold in the coming years.

What are your thoughts on the Boston Celtics sale? Share your predictions for the Celtics' future and discuss the impact of this private equity buyout on the team in the comments section below!

Featured Posts

-

Ban Nen Xong Hoi Bao Lau Moi Lan De Co Hieu Qua Tot Nhat

May 16, 2025

Ban Nen Xong Hoi Bao Lau Moi Lan De Co Hieu Qua Tot Nhat

May 16, 2025 -

Psn Giant Sea Wall Penjelasan Menko Ahy Mengenai Dimulainya Pembangunan

May 16, 2025

Psn Giant Sea Wall Penjelasan Menko Ahy Mengenai Dimulainya Pembangunan

May 16, 2025 -

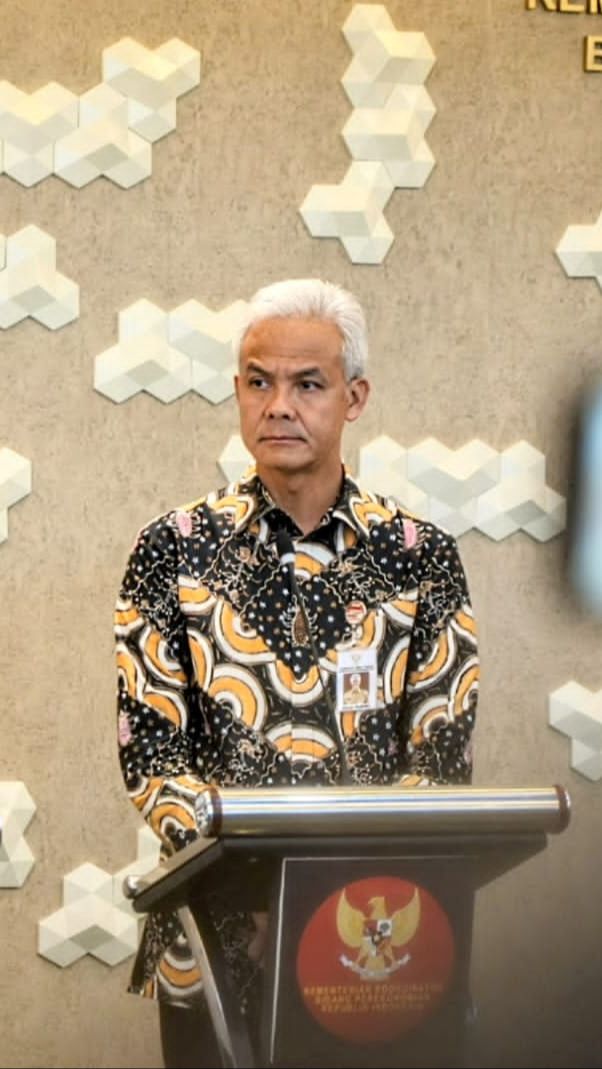

Up To 40 Off Nike Air Dunks Jordans Sale At Foot Locker

May 16, 2025

Up To 40 Off Nike Air Dunks Jordans Sale At Foot Locker

May 16, 2025 -

Is Foot Locker Facing Another Round Of Executive Changes

May 16, 2025

Is Foot Locker Facing Another Round Of Executive Changes

May 16, 2025 -

Watch 3 Free Star Wars Andor Episodes On You Tube

May 16, 2025

Watch 3 Free Star Wars Andor Episodes On You Tube

May 16, 2025